The federal government is a significant source of funding for states, contributing about $1 for every $3 of state spending nationally.1 Federal funds help more Minnesotans have affordable health care, sufficient food at a price they can pay, access to a public school education, drivable roads without too many potholes, and heat in their homes in the winter, even if they cannot keep up with their energy bills. Federal funds are deeply integrated into the state budget and have a substantial impact on the Minnesota economy and how much Minnesotans pay for everyday purchases like groceries, health care, education, transportation, housing, and more.

This issue brief takes a high level look at how federal funds flow to Minnesota, followed by a closer look at some of the ways federal and state governments work together so that Minnesotans have what they need to get by. It concludes with an overview of the potential harm from proposed federal cuts to basic needs services.

Exactly how much federal money flows to Minnesota ?

Money from the federal government generally passes into Minnesota in five main ways :

- federal grants to the state of Minnesota that help fund federal-state programs,

- direct benefits to individuals and families in Minnesota (through exclusively federal programs, such as Social Security and Medicare),

- federal grants to other entities besides the state,

- federal contracts with vendors located in Minnesota, and

- pay to federal employees living in Minnesota (of which there are approximately 31,500).2

While money from the federal government flows into Minnesota in other ways, this piece focuses on federal government grant funding for federal-state programs.

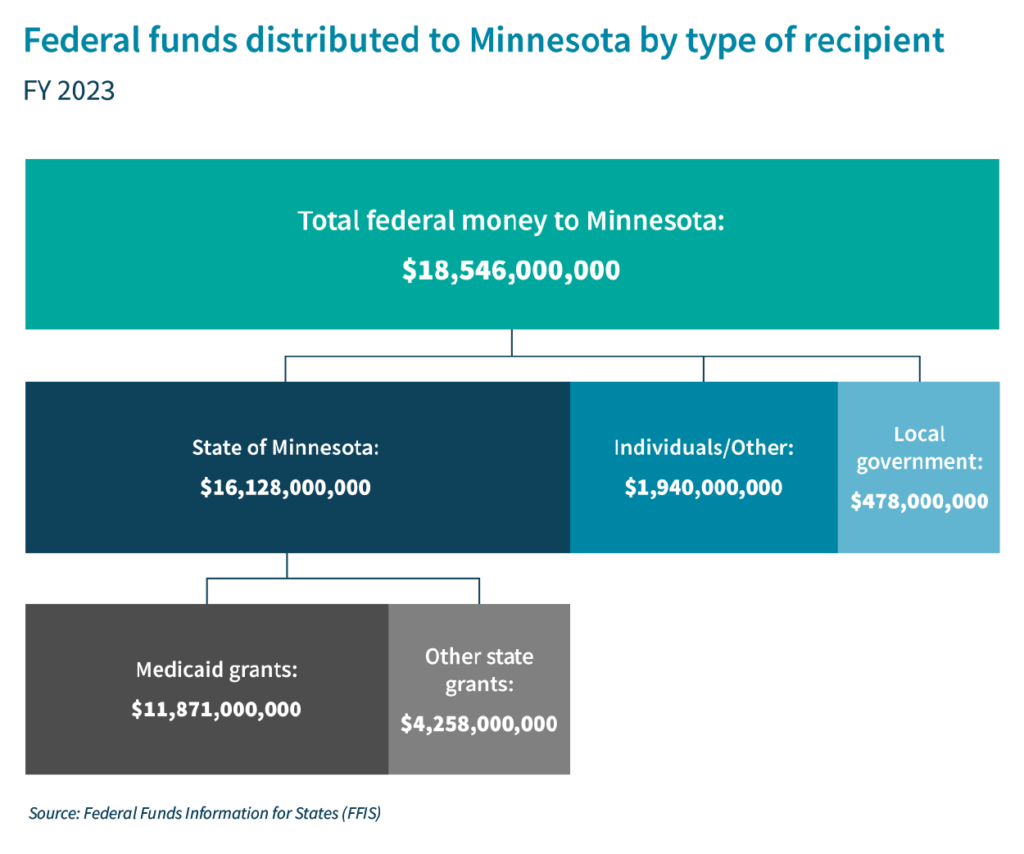

In federal fiscal year 2023,3 the federal government contributed a total of approximately $18.5 billion in funds for federal-state programs to Minnesota state and local governments and individual Minnesotans.4 Nearly 90 percent of that funding , more than $16 billion, went directly to the state through grants and can be located in the state budget. Another $478 million went to local governments, including school districts, and skipped the state budget. Some federal-state program funds are sent along directly to individuals and families, primarily through Supplemental Nutrition Assistance Program (SNAP) benefits and Pell Grants. In Minnesota, those recipients got about $1.9 billion in federal funds through federal-state programs.

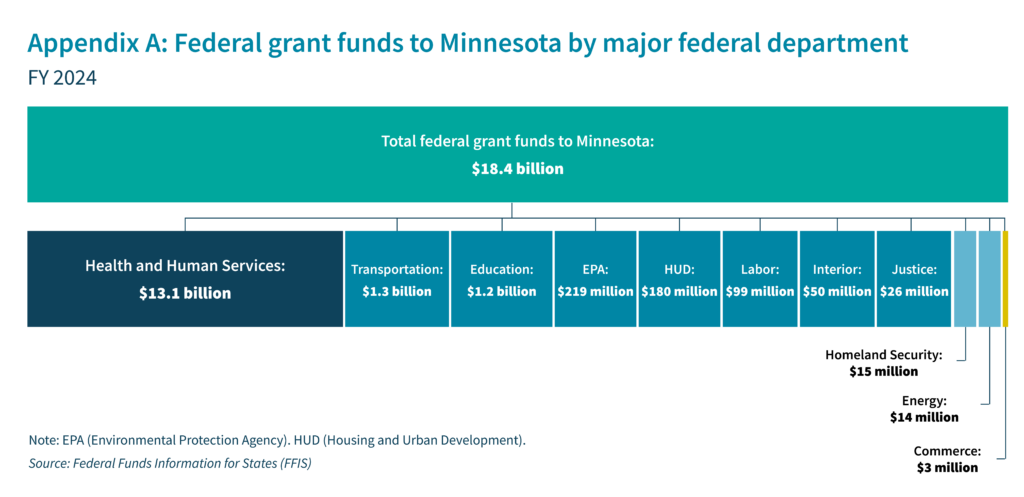

Appendix A of this document includes a breakdown of this same category of federal funds for federal-state programs in Minnesota, organized by federal government department.

What does the state of Minnesota do with federal funds?

Minnesota’s partnership and fiscal relationship with the federal government reaches across state budget areas. The state of Minnesota and Minnesotans rely on federal funding for vital, basic resources for families who have fallen on hard times, for contributions to transportation-related infrastructure projects, education for people of all ages, affordable child care, and more.

Listed below are just some of the joint state-federal programs that Minnesotans rely on to have enough food to eat, heat in the winter, access to health care, and receive an education that they can afford.

Federal funds that flow through the state budget

Medicaid, $11.9 billion in federal grant funding in federal FY 2023.5 Around 64 percent of all money that the state received from the federal government for state-federal programs in FY 2023 fun ds health care through Medicaid. Medicaid is the largest public health insurance program in the country , as well as the largest shared state-federal program.6 Medicaid – also called Medical Assistance, or MA, in Minnesota – served about 1.4 million people in Minnesota in 2023.7 Folks participating in Medicaid are babies, pregnant people, children, students receiving mental health supports, adults living on low incomes or who are between jobs, people with disabilities, and older adults in nursing homes or getting care supports at home.

In addition, the state’s health care sector – a group that includes public health departments, hospitals, mental health centers, home care, community clinics, nursing homes, physicians, dentists, and many other health professionals – needs Medicaid to cover the costs of staying in business. Particularly in rural Minnesota, Medicaid plays a significant role in keeping the doors open and preventing providers from being overwhelmed by the cost of providing uncompensated care . In calendar year 2023, MA (using both state and federal funding) paid nearly $18 billion in claims to health care providers in Minnesota.8

Special Education Basic State Grant, $234 million in federal FY 2023.9 About 5.5 percent of the federal money to Minnesota outside of Medicaid goes to pay for the Special Education Basic Grant.10 Most of this money is distributed by the state to Local Education Agencies (LEAs, which are primarily school districts ), but some is used for state-level activities.11

School Breakfast and Lunch, $292 million in federal FY 2023.12 Since 1946, under the Truman Administration, the federal government has operated the National School Lunch Program (NSLP).13 The NSLP contributes funds to provide nutritionally balanced lunches for no or low cost to children in public and nonprofit private schools, from pre-K to high school. The School Breakfast Program, made permanent by Congress in 1975, provides similar school-based nutrition support and reached 14.6 million children nationally in 2016.14

Low Income Home Energy Assistance Program, $164 million in federal FY 2023.15 LIHEAP is a joint state-federal program through the federal Department of Health and Human Services that supports families with their energy costs so that they can stay safely warm in the winter and cool in the summer.16 LIHEAP funding is one of the ways the state prevents energy shutoffs and reconnects services for families that may be behind on their utility bills.

Federal funds that go to people through programs jointly administered by states

Ninety-eight percent of federal-state program funds that go directly to Minnesotans come in the form of the Supplemental Nutrition Assistance Program (SNAP, formerly known as Food Stamps) and Pell Grants.17 Medicare and Social Security are federal programs (without joint administration by states), and so those significant federal transfers directly to people are excluded from this analysis.

Supplemental Nutrition Assistance Program, or SNAP, is the most important anti-hunger program in the United States.18 In federal FY 2024, it helped 453,900 Minnesota residents (8 percent of the population) to afford a basic diet.19 More than 63 percent of SNAP participants in Minnesota are in families with children . More than 50 percent of Minnesota SNAP participants are in working families still struggling to pay for food. In Minnesota, SNAP provides around $5 per day for food for each household member . Without access to SNAP benefits, hundreds of thousands of Minnesotans would go hungry. Minnesotans received about $1.4 billion in SNAP benefits in federal FY 2023.20

Pell Grants help more than 115,000 college and vocational school students from Minnesota and nearly 10 million students total in the U.S. afford their post-secondary education.21 Most Pell awards go to students from families with incomes below $30,000. In federal FY 2023, Minnesota families received $453 million in federal Pell Grants.22

How could Congress and the president implement harmful cuts to funding for states?

Federal policymakers are advancing budget plans that call for substantial cuts in Medicaid, SNAP, and other funding essential to Minnesotans’ health and well-being. Some of the harmful cuts to federal funding that have been proposed are:

- Capping and cutting program funding. For example, some Congressional Republicans have suggested implementing a per capita cap in Medicaid , which would be a cap on federal Medicaid funding at a fixed amount per participant.23

- Lowering reimbursement rates to states. For example, the federal government currently covers 90 percent of Medicaid costs for folks eligible through the Medicaid expansion made in the Affordable Care Act (ACA). Reducing or ending 90 percent federal reimbursement for the expansion population has been a prevailing idea among Congressional Republicans.24

- Imposing onerous state funding requirements. For example, SNAP benefits are currently covered 100 percent by the federal government; a recent proposal suggested shifting 22.5 percent of the cost of SNAP benefits to states.25 It’s estimated that this would shift more than $215 million in annual funding responsibility to Minnesota if was fully in effect in 2034.

- Adding administrative burdens and red tape that create additional costs to states and barriers to accessing services. For example, work reporting requirements for Medicaid would impose predictable administrative difficulties that would likely result in tens of thousands of working folks losing their health care coverage.26

- Reducing states’ flexibility in how they use their own funds. For example, U.S. House lawmakers have passed provisions in reconciliation legislation that would take away federal funding from states that are using their own funds to pay for health care for undocumented immigrants.27

How could these potential federal funding cuts hurt Minnesotans?

In some cases, like in the case of Medicaid and SNAP, the cuts being considered would dramatically reduce everyday Americans’ ability to meet their basic needs, especially when the economy gets worse. Because states have balanced budget requirements, they are not able to do the kind of recession-fighting spending that the federal government can do and does. When the economy is doing badly, states usually have less revenue to pay for services at exactly the same time that more folks need help to get by.

The federal government, however, is allowed to run deficits and to continue spending when jobs are scarce, unemployment is high, and more people need help to meet their basic needs. If the federal government shifts more responsibility for funding these recession-fighting programs to the states, hardship will increase among individuals and families negatively impacted by economic downturns through no fault of their own. If these cuts are made, more Minnesotans will go hungry, lose health care coverage, and run up debts paying for basic needs like food, heat, and housing, especially when the economy slows down.

Federal funding cuts threaten our collective well-being

Minnesotans and our state budget rely on federal lawmakers to prioritize our well-being. Strong federal funding for basic needs like health care, food, and heat for people’s homes in the winter help keep hundreds of thousands of Minnesotans from going cold and hungry, and getting sick. Federal investments in our economy, like fixing the roads and cleaning wastewater, also support Minnesotans in meeting their basic needs day-to-day.

When federal cuts are made, state, local, territorial, and tribal governments are expected to pick up the slack. Given the tough fiscal conditions states are already facing, it won’t be possible for state and local policymakers to fully fill in the gaps. They will have to make tough choices and when they do, they should prioritize the well-being of their residents – and raise revenues to support essential public services.

Even more troubling is that, under plans that President Donald Trump and the U.S. House and Senate are moving forward this year, cuts to these crucial services would be used to spend billions more on anti-immigrant actions and pay for trillions of dollars of tax cuts that give the biggest benefits to the wealthy.

Minnesota would be better served by a federal budget that puts everyday people first by protecting and strengthening essential public services that our families and neighbors count on to get by, and ensuring the country has the revenues needed to fund services that contribute to thriving communities in every corner of our state.

by Carly Eckstrom

[1] Center on Budget and Policy Priorities, President Trump, Congressional Republican Proposals Would Shift Large Costs to States, Inflict Widespread Harm, January 30, 2025.

[2] Grants.gov, How to Determine Eligibility for Federal Funding Opportunities, March 17, 2021; Analysis of 2023 American Community Survey and 2025 Current Employment Statistics data by Ben Zipperer, March 5, 2025.

[3] Federal fiscal year 2023 ran from October 1, 2022, to September 30, 2023. This is different from the Minnesota fiscal year 2023, which ran from July 1, 2022, to June 30, 2023.

[4] Data throughout this issue brief were retrieved from the Federal Funds Information for States (FFIS) service by the Center on Budget and Policy Priorities. Those instances are cited “Federal Funds Information for States (FFIS).”

[5] Federal Funds Information for States (FFIS).

[6] Center on Budget and Policy Priorities, President Trump, Congressional Republican Proposals Would Shift Large Costs to States, Inflict Widespread Harm, January 30, 2025.

[7] Minnesota Department of Human Services, Medicaid Matters: We’re all healthier when we’re all covered, February, 2025.

[8] Minnesota Department of Health, Investments in health care, 2025.

[9] Federal Funds Information for States (FFIS).

[10] Federal Funds Information for States (FFIS).

[11] U.S. Department of Education, Special Education — Grants to States, February 21, 2025.

[12] Federal Funds Information for States (FFIS).

[13] U.S. Department of Agriculture, National School Lunch Program Factsheet, June 11, 2024.

[14] U.S. Department of Agriculture, School Breakfast Program Factsheet, June 10, 2024.

[15] Federal Funds Information for States (FFIS).

[16] U.S. Department of Health and Human Services, Low Income Home Energy Assistance Program (LIHEAP), March 19, 2025.

[17] Federal Funds Information for States (FFIS).

[18] Minnesota Department of Children, Youth, and Families, Supplemental Nutrition Assistance Program (SNAP), 2025.

[19] Center on Budget and Policy Priorities, Minnesota – Supplemental Nutrition Assistance Program, January 21, 2025.

[20] Federal Funds Information for States (FFIS).

[21] Minnesota Office of Higher Education, Federal Pell Grant, 2025.

[22] Federal Funds Information for States (FFIS).

[23] Center on Budget and Policy Priorities, Medicaid Per Capita Cap Would Harm Millions of People by Forcing Deep Cuts and Shifting Costs to States, January 7, 2025.

[24] Center on Budget and Policy Priorities, House Republicans Won’t Let Go of Repealing ACA; Decimating Its Medicaid Expansion Would Harm Millions of Parents, Children, Disabled People, May 1, 2025.

[25] Center on Budget and Policy Priorities, House Republicans Reportedly Planning to Shift Billions in SNAP Costs to States, April 28, 2025.

[26] Minnesota Budget Project, Work reporting requirements could lead to large loss of health care coverage across Minnesota, March 7, 2025.

[27] Center on Budget and Policy Priorities, President Trump, Congressional Republican Proposals Would Shift Large Costs to States, Inflict Widespread Harm, January 30, 2025.