Please help us spread the word about the Minnesota Child Tax Credit

Nonprofits and other community organizations can share resources through their social media channels, websites, and newsletters, to help spread the word about this powerful tax credit that will boost the incomes and economic stability of families across Minnesota.

The Minnesota Budget Project, Children’s Defense Fund-Minnesota, and Prepare+Prosper partnered together to create resources and tools below, as well as a website MinnesotaTaxCredits.org, to help families across Minnesota learn whether they are eligible for the Child Tax Credit and where to file their taxes to claim it.

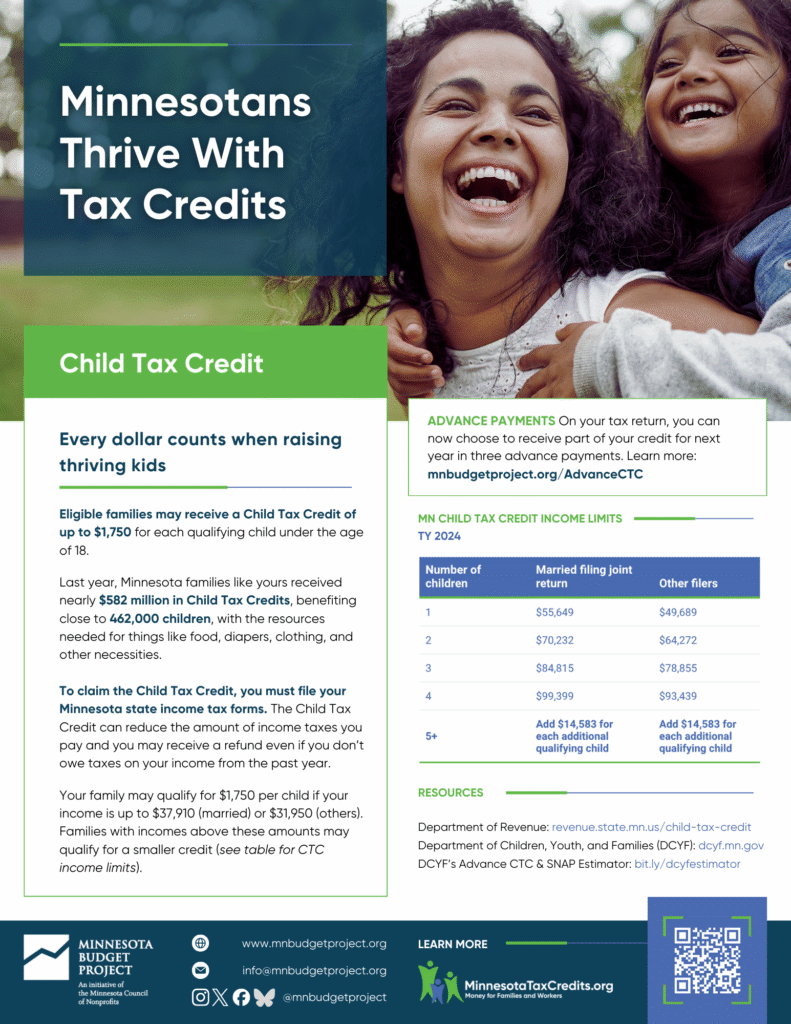

One-pager

Sample newsletter

Included below is sample content to use in your newsletters

Social media toolkit

- Download by clicking on image below and right-clicking to save on your device.

- Log in to your social media account (Facebook, Instagram, X, etc.).

- Copy and paste one of the sample messages below into your post’s caption.

- Upload the saved image onto your device to accompany your post.

- Post your content and encourage others to share the #MinnesotaTaxCredits resources.

- Tag @mnbudgetproject so we can repost and reshare your advocacy efforts.

Sample messages

Every dollar counts. With the MN Child Tax Credit, you can get up to $1,750 for every qualifying child. That means more money for groceries, school supplies, rent, and more. Visit: MinnesotaTaxCredits.org

Thanks to MN’s Child Tax Credit, parents who qualify can get up to $1,750 for every child when filing their 2025 tax return. Visit MinnesotaTaxCredits.org to learn more

The costs to raise healthy, thriving kids can be high. See if your family qualifies for the MN Child Tax Credit to help you cover some of the costs of basic necessities. Find out more: MinnesotaTaxCredits.org

You can claim MN’s Child Tax Credit when you file your MN income tax return. Need free help with filing? Visit MinnesotaTaxCredits.org to find free tax preparation sites before April 15

Hundreds of thousands of families qualify for the MN Child Tax Credit, worth up to $1,750 for each child. Find out if your family is eligible at: MinnesotaTaxCredits.org

No SSN? No problem. With the MN Child Tax Credit, families can qualify to get up to $1,750 per child by filing their 2025 tax return with an ITIN. See MinnesotaTaxCredits.org for more

Through the MN Child Tax Credit, some parents can receive up to $1,750 per child, but you must file a 2025 Minnesota income tax return this year! Learn more about eligibility at: MinnesotaTaxCredits.org

When you claim MN’s Child Tax Credit on your income tax return, you can choose if you want to receive part of your CTC for next year in three advance payments. Learn more: mnbudgetproject.org/AdvanceCTC

Did you know? You can choose to receive your future MN Child Tax Credit in 3 advance payments, but that could impact your SNAP benefits and eligibility. Learn more before you decide: mnbudgetproject.org/AdvanceCTC

Sample hashtags

#MinnesotaTaxCredits

#MNCTC

#EveryDollarCounts

Graphics for short slide show or carousel