How important is it for Minnesota to reform our tax system? According to an issue brief we recently released, it’s very important and we need to do it now.

The Facts Speak: It’s Time to Reform Minnesota’s Tax System finds our outdated tax system is not meeting the state’s needs.

Two key points about the state’s tax system:

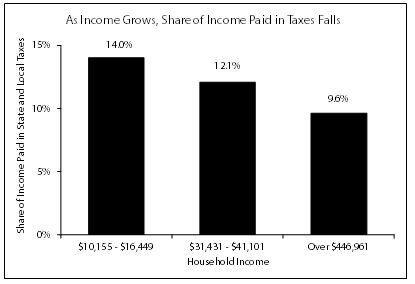

- As Minnesotans’ household incomes grow, the share of income paid for state and local taxes falls – and the difference between what the highest-income Minnesotans pay and what average Minnesotans pay has grown.

- Our tax system is not raising enough revenues to fund the state’s priorities and avoid persistent budget deficits.

The analysis points out that the wealthiest one percent of Minnesotans (those with household incomes over $429,354) pay 9.7 percent of their income in total state and local taxes. That’s significantly less than the 12.1 percent paid by middle-income households (incomes of $31,960 to $41,161).

Tax fairness in Minnesota has been declining since 1990, and two factors help explain that gap. One is growing income inequality – in other words, the benefits of economic growth have gone disproportionately to those with the highest incomes.

But policy choices matter too. The cuts in income taxes in the 1990s, followed by greater reliance on taxes like the property tax that are less based on the ability to pay, contribute to this trend.

Tax fairness has been a central part of the debate in recent years. What is less well known is that state and local taxes have become a smaller piece of Minnesotans’ budgets. The share of income Minnesotans pay for state and local taxes has dropped from 12.9 percent in 1996 to 11.5 percent in 2008.

Our conclusion: We need to reform Minnesota’s tax system so we can end the vicious cycle of budget deficits and gimmicks and instead invest in our future and our communities. And we need to reform the system so that all Minnesotans pay their fair share.

The data used to prepare our analysis come from the Minnesota Department of Revenue’s 2011 Tax Incidence Study. But that’s not the only analysis that finds a significant gap between what the highest-income Minnesotans pay in state and local taxes and what low- and middle-income families pay. Last week, the Institute on Taxation and Economic Policy’s latest Who Pays? report found the same trend.