There are two very different realities in Minnesota. Most Minnesotans enjoy the economic benefits that come from living in a state that does well in national measures of income, poverty and health insurance coverage. The median household income in Minnesota is much higher than the national average, so it’s not surprising that Minnesota’s poverty rate is lower than most other states. And Minnesota’s leadership in health care reform means that a smaller share of Minnesota’s households struggle without health insurance than in nearly every other state.

However, those figures disguise the fact that many Minnesotans live in a very different reality. Too many children live in low-income families who don’t have access to nutritious food and live in fear of a health crisis. In particular, people of color in Minnesota are less likely to have the same opportunities and economic success as white Minnesotans.

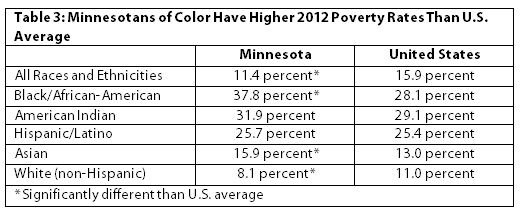

Minnesota’s proud claim of being an above-average state rings hollow when many of the state’s people of color are faring worse than their national counterparts.

Failing to address these disparities in opportunity will have serious implications for Minnesota’s future. The state’s workforce is shrinking as baby boomers retire. Minnesota can’t afford to leave anyone on the sidelines if we want to continue our economic success. Reversing these inequalities will take intentional efforts to promote opportunity in the state, support families to increase their earning potential and make ends meet, and improve job quality.

Minnesota Still Climbing out of the Recession

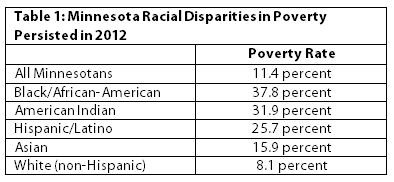

Economic well-being in the state is slowly improving. The poverty rate in Minnesota declined slightly from 2011, dropping to 11.4 percent in 2012.[1] Nationally, 15.9 percent of Americans were living in poverty in 2012.

However, too many Minnesota families can’t make ends meet on extremely low incomes. In 2012, almost 600,000 Minnesotans lived in households with incomes below the federal poverty threshold, which is $11,720 for an individual and $23,492 for a family of four.

An even higher proportion of children are off to a rough start. More than 14 percent of children in Minnesota lived in poverty in 2012. These children are starting off their lives with serious disadvantages, such as inadequate nutrition and housing. Child poverty can have serious long-term effects on health outcomes, academic success and adult earning potential.[2]

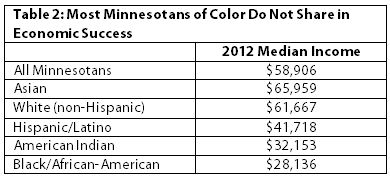

While poverty rates are improving, income growth in Minnesota stagnated from 2011 to 2012. The lack of income growth in Minnesota reflects the nation’s slow rise out of the last recession. Minnesota’s median household income in 2012 was $58,906, nearly $3,000 lower than the inflation-adjusted median income in 2007.[3] However, Minnesota is still outperforming most other states: the U.S. median income in 2012 was $51,371.

Many in the State Are Left Behind in the Recovery

While Minnesota is beating national averages, many racial and ethnic communities in Minnesotans are experiencing a very different reality, and are more likely to live in poverty and lack jobs with good wages and benefits.

African-American and American Indian Minnesotans have faced the greatest challenges in finding economic security. Only 8.1 percent of white Minnesotans lived in poverty in 2012. However, the percentage of African-American Minnesotans living in poverty was almost five times as high as for whites, and the rate for American Indians was four times as high. The median income for African-American and American Indian Minnesotans is only half that of white Minnesotans (around $30,000 for each community).

For many in the African-American and American Indian communities, a major obstacle to rising out of poverty is finding a job. In 2012, the unemployment rate was 19.2 percent for American Indians in Minnesota and 17.7 percent for African-Americans in the state. Meanwhile, the unemployment rate for white Minnesotans was 5.2 percent.

Hispanic Minnesotans are finding more success than some other racial and ethnic groups in the state. One quarter of Hispanic Minnesotans lived in poverty in 2012, and their median income was $41,718. While these numbers are better than for African-American and American Indian Minnesotans, they are still significantly below white Minnesotans.

Minnesota’s Asian community has a unique situation: they have both a high median income and a high poverty rate. The poverty rate for Asian Minnesotans is twice the rate for white Minnesotans. However, their median income is actually slightly higher than that of white Minnesotans. This indicates that some Asian Minnesotans are doing extremely well, but many others are being left far behind.

People of color in Minnesota are doing worse than their counterparts nationally. For many communities of color, poverty rates are higher and incomes are lower than the U.S. average for those communities. The median income for black Minnesotans is $5,628 less than the median income for all African-Americans in the U.S., and the poverty rate among African-American Minnesotans is ten percentage points higher than the U.S. average for African-Americans. Similarly, Asian Minnesotans earn $4,685 less than their national counterparts and have a poverty rate three percentage points higher than other Asian Americans.

The large gap in economic well-being between whites and people of color in Minnesota contradicts the state’s image as above average.

Young Minnesotans Gaining Health Insurance, But Racial Disparities Persist

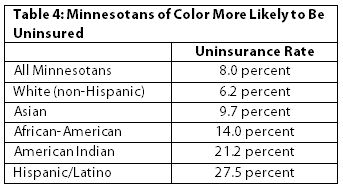

Thanks to an improving economy and new opportunities through the Affordable Care Act (ACA), more Minnesotans are securing health insurance coverage. In 2012, only 8.0 percent of the state’s population lacked health insurance, much lower than the U.S. average of 14.8 percent. But still almost 425,000 Minnesotans lacked health insurance in 2012.

Public health insurance played a very important role during the recession as employers pulled back on offering benefits, and it will continue to play a critical role moving forward. As a result of reforms passed in the 2013 Legislative Session, more than 235,000 additional Minnesotans will have access to affordable and comprehensive health insurance through Medicaid and MinnesotaCare.[4]

The Affordable Care Act has already improved insurance coverage for the state’s young adults. In 2009, 19.5 percent of 18- to 24-year-olds in Minnesota lacked health insurance. Thanks to a provision of the ACA that allows young adults to remain on their parents’ insurance policies until age 26, the share of 18- to 24-year-old Minnesotans with health insurance improved by six percentage points between 2009 and 2012.

Access to health insurance is another area where we see two Minnesotas. Although just 6.2 percent of all white (non-Hispanic) Minnesotans lacked health insurance in 2012, people of color were much more likely to be uninsured. Uninsurance rates for African-American and Hispanic Minnesotans were almost 3.5 and 4.5 times that of white Minnesotans, respectively.

These disparities in health insurance have real implications for Minnesota’s communities of color. Access to meaningful health insurance keeps families healthier, helps workers maintain stable employment, and makes it less likely that a health care crisis will become a personal financial crisis.

Policy Choices Can Make a Difference

Minnesota is a land of unequal opportunities. Many Minnesotans prosper, benefiting from access to an excellent education system and good-paying jobs. However, other Minnesotans are caught in a very different reality, where the opportunities to get a good education and find a job with a family-supporting wage are rare.

Policy choices that enable more Minnesotans to share in the state’s overall success include:

- Policies that increase workers’ earning potential and improve job quality, like the minimum wage, and access to affordable job training and higher education.

- Policies that help families make ends meet, like basic food assistance, child care assistance, Unemployment Insurance, and affordable and comprehensive health insurance.

It’s also critical that Minnesota funds its public services fairly. Low- and middle-income Minnesotans should not pay a larger share of their incomes in taxes than high-income Minnesotans.

Three policies that would make significant progress in promoting broader economic success in Minnesota include increasing the minimum wage, improving access to affordable health care, and improving the Working Family Tax Credit.

Increasing the minimum wage is an immediate and effective step to improve the economic security of Minnesota’s low-wage workers. The minimum wage is an important component of job quality, and sets a floor on wages. However, the minimum wage’s purchasing power has eroded over time. If it had kept up with inflation since 1968, the minimum wage would be $10.75 an hour. The federal minimum wage was last increased in 2009 to $7.25, and Minnesota’s minimum wage is even lower at $5.25 an hour. Many of those earning the minimum wage are adults working full time, and an increase in the minimum wage would significantly boost their purchasing power. Increasing the minimum wage to $9.50 by 2015 would raise wages for 357,000 workers and increase those workers’ annual spending power by $472 million. Additionally, an increase in the minimum wage would narrow racial gaps in economic well-being, as 29 percent of Hispanic workers and 22 percent of African-American workers would see increased earnings.[5]

During the 2013 Legislative Session, Minnesota made important strides in expanding health insurance for low-income Minnesotans and created MNsure, a state health insurance marketplace where Minnesotans can compare, shop for, and buy private and public health insurance. Minnesota should take additional steps to ensure there is an adequate health care safety net for all Minnesotans and to reverse the significant racial health disparities in our state.

The Working Family Credit (WFC) is the state’s version of the federal Earned Income Tax Credit. It makes the state’s tax system more fair by reducing the amount of taxes that working Minnesotans pay, and as a result, narrowing the gap between the share of income that low- and moderate-income Minnesotans pay in taxes and the smaller share that higher-income Minnesotans pay. The credit should be improved by adopting recent federal changes to avoid marriage penalties. An estimated 54,000 Minnesota families would benefit.[6]

Minnesota Can Become a Land of Equal Opportunity

While Minnesota does well on national measures, many in the state are not sharing in the state’s success. Minnesota’s future depends on the choices we’re making today. For Minnesota to build a future of broadly shared prosperity, all Minnesotans must have opportunities to reach their fullest potential. We can’t afford to leave significant parts of our workforce behind.

Building this future means investing so that all Minnesotans have access to education and training opportunities, quality jobs, and affordable health insurance. Schools succeed because children are better able to achieve. Local businesses can find the workers they need and have a stronger customer base. And the state will see greater economic growth thanks to a larger and more productive workforce.

By Clark Goldenrod

[1] Except where otherwise noted, the data in this analysis come from the U.S. Census Bureau, American Community Survey (years 2007, 2011 and 2012).

[2] American Psychological Association, Effects of Poverty, Hunger and Homelessness on Children and Youth, 2013.

[3] The median household income is the income at which 50 percent of households earn below and 50 percent of households earn above. Figures are inflation-adjusted.

[4] Minnesota Department of Human Services, Affordable Care Act (ACA) implementation, May 2013.

[5] JOBS NOW Coalition, A Raise for Minnesota: Statewide Demographic and Economic Effects of Raising the Minimum Wage to $9.50 an Hour, October 2013.

[6] Office of Governor Mark Dayton, Providing Tax Relief for Working and Middle Class Minnesotans, March 2013.