In 1969, days before leaving his post, U.S. Treasury Secretary Joseph Barr stunned the public when he presented Congress with evidence from the Internal Revenue Service that 155 people with incomes over $200,000 paid no federal income taxes, thanks to numerous tax deductions and loopholes.[1] Amid public outcry, Congress and the President enacted a number of changes aimed at closing loopholes in the federal tax code, including the Alternative Minimum Tax, or AMT.

The AMT operates as a stop-gap to the income tax, so that wealthy taxpayers can’t avoid paying income taxes by exploiting tax deductions, loopholes and exclusions.[2] AMT tax rates are generally much lower than the corresponding income tax rate, but these rates apply to more of the taxpayer’s income, since the AMT permits fewer deductions and exemptions than the income tax. Income below certain thresholds is exempt from the AMT. Taxpayers with incomes above that threshold pay the AMT only if that is a higher tax amount than under the standard income tax. The majority of AMT revenue comes from taxpayers with incomes over $200,000.

However, the AMT income exemption threshold is not indexed for inflation. In addition, tax cuts made in 2001 and 2003 substantially lowered the taxes owed under the regular income tax without changing the tax structure of the AMT. This means that the AMT affects a rapidly increasing number of taxpayers unless changes are made. To date, Congress has enacted temporary “fixes” or “patches” by indexing the AMT income exemption to inflation. In the absence of another patch this year, an estimated 26.5 million Americans will be subject to the AMT in 2008 – a seven-fold increase over the previous year in which a patch was in place.[3]

Fortunately, it is possible to fix the design flaw in the AMT so that it achieves its original purpose of ensuring everyone paying their fair share in federal income taxes without subjecting middle-income taxpayers to the AMT.

Fundamentals for Sound AMT Reform

Congress should enact changes to the AMT in a fiscally responsible and fair manner:

- AMT changes should be fully paid for. Any changes to the AMT should be revenue-neutral, meaning that it is paid for by other revenue sources. Our federal deficit is already sizable: in 2007, the federal deficit was $162 billion, and tax cuts made in 2001 and 2003 have been a big contributor to the growth in deficits.[4] The more money we borrow, the more we have to pay in interest on our debt, rather than on pressing national priorities, such as health care and energy independence.

- AMT changes should be well-targeted. The AMT can be improved so that it carries out its original purpose: ensuring everyone pays their fair share in taxes. The 2007 AMT patch that was enacted into law was not well-targeted, and went well beyond the concern of stemming the growth in the number of middle-income households who are subject to the AMT. Instead, a disproportionate amount of tax reductions went to high-income households.[5] Similarly, repeal of the AMT would provide sizable tax breaks to the highest-income households. Sound AMT policy would instead ensure that the AMT reaches only those it was originally intended to reach.

- AMT changes should be permanent. It is long past the time for Congress and the President to decide upon a permanent solution, rather than passing short-term AMT fixes that either add to the deficit or depend upon unsustainable revenue sources.

Changes to the AMT Should be Paid For

What’s worth doing is worth paying for. From 2001 to 2006, Congress did not pay for its temporary fixes of the AMT, adding over $100 billion to the deficit. In 2007, Congress added another $51 billion to the deficit by not paying for a one-year fix of the AMT. Saddling the next generation and the economy with that kind of debt is not good for long-term economic growth.

Some policymakers have argued that the growing reach of the AMT was unexpected or accidental, and thus changes to the AMT need not be deficit neutral or paid for. These claims are incorrect. In fact, the expanding reach of the AMT is largely a result of a budgeting device that hid the true cost of the 2001 and 2003 tax cuts.

The 2001 tax cuts lowered the regular income tax rates for the richest Americans, but not the AMT rate. Over time, this meant millions more taxpayers would have to pay the AMT – effectively taking back some or all of their tax cuts. Again, a person only pays the alternative minimum tax if their regular tax liability is less than their liability calculated under the AMT.

Most of the current AMT problem is the result of the 2001 and 2003 tax cuts. This was well understood and discussed at the time these changes were made. Congress chose to expand the reach of the AMT anyway, in order to lower the official cost of the 2001 tax cuts. The expanded reach of the AMT was entirely expected. It is simply the bill coming due on the true costs of the 2001 and 2003 tax cuts.

Changes to the AMT Should be Well-Targeted

Sound alternative minimum tax reform should be well-targeted, so that it fulfills its original purpose in ensuring everyone pays their fair share. The 2006 AMT patch was not well-targeted, and went beyond the concern of stemming the growth in the number of middle-income households who are subject to the AMT. Instead, about one-third of the benefits went to households with incomes above $200,000.

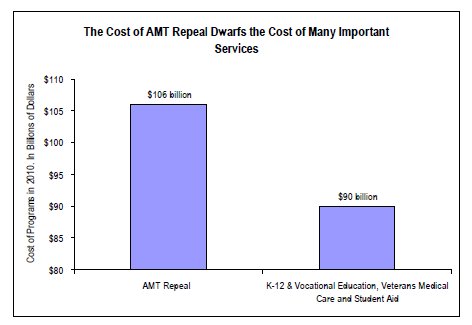

Some have proposed not just fixing but actually repealing the AMT. Repeal of the AMT is extremely costly and would give unwarranted tax breaks to high-income households. The lost revenue over the ten years would be at least $800 billion over ten years, adding to the federal debt or diverting money away from important national priorities. The cost of just one year of repealing the alternative minimum tax is more than the entire annual federal budget for K-12 and vocational education, veterans’ medical care and student aid.[6] The wealthy would benefit from repeal much more than middle-income taxpayers: more than half of the benefits of repeal of the AMT would go to households earning above $200,000.

A more targeted approach would be to permanently index the AMT exemption to inflation. This would prevent the AMT from effecting more middle-income households, while ensuring that the wealthiest households still cannot shield too much of their income from taxation. This approach would cost about $569 billion over the next decade, if the 2001 and 2003 tax cuts are allowed to expire. Another targeted option would be to simply exempt all households with income below a certain level from the AMT.

Changes Should Be Permanent

The Alternative Minimum Tax is an important part of a fair federal tax system. It solves a very real problem – stopping high-income taxpayers from using loopholes, deductions and exclusions to escape paying income taxes.

Sound AMT reform requires a permanent solution. Changes to the AMT should be targeted to stem the growth in the number of middle-income households who are subject to the AMT, while not giving unwarranted tax breaks to the wealthiest. AMT changes should also be revenue-neutral, meaning that the lost federal revenues are replaced.

[1] Jeffrey Birnbaum and Alan Murray, Showdown at Gucci Gulch, Random House, New York: 1987.

[2] Except where otherwise noted, data in this analysis comes from the Center on Budget and Policy Priorities, Myths and Realities about the Alternative Minimum Tax and Alternative Approaches to AMT Reform.

[3] Tax Policy Center, T08-0043: Aggregate AMT Projections.

[4] Center on Budget and Policy Priorities, Tax Cuts: Myths and Realities.

[5] Center on Budget and Policy Priorities, What Would it Say About Congress’s Priorities to Waive Paygo for the AMT Patch?

[6] Center on Budget and Policy Priorities calculations based on Congressional Budget Office and Urban-Brookings Tax Policy Center data. Costs are 2006 discretionary funding adjusted for inflation.