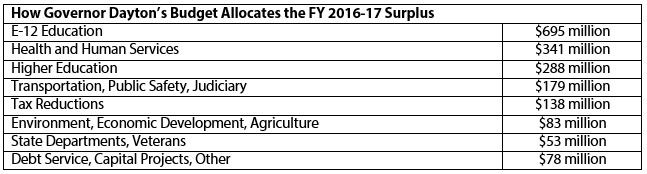

Governor Mark Dayton’s vision for the FY 2016-17 biennium is to increase economic opportunity for more Minnesotans. After a decade of frequent deficits and cuts to vital services, the most recent economic forecast projects a $1.9 billion surplus, which Dayton proposes to use to make much needed investments in high quality schools, affordable college tuition, a safe and modern transportation system and other building blocks of a prosperous state.

In FY 2014-15, Dayton invested in all-day kindergarten and tuition freezes for college students, and made tax reforms so that the way the state funds its public services is more sustainable and fair. For this upcoming FY 2016-17 biennium, Dayton continues to invest in our state, focusing particularly on Minnesota’s students. About half of the proposed new spending is in E-12 and higher education. Among his highest priorities are universal pre- kindergarten and continued tuition freezes at Minnesota’s public colleges and universities. He also proposes improvements to the state’s transportation infrastructure and increased tax credits for working families across the state.[1]

Early Childhood a Major Priority

Through pre-kindergarten, Head Start and Basic Sliding Fee Child Care Assistance, Dayton uses a multi-pronged approach to help children start off in stable environments and serve the diverse needs of Minnesota families. These proposals are found in both the E-12 Education and Health and Human Services areas of the governor’s budget proposal.

The centerpiece of the governor’s early education budget initiatives is to make voluntary pre-kindergarten programs available to all four-year-olds. Dayton’s budget proposes $3 million in FY 2016 for school districts to prepare, followed by $339 million in FY 2017 and $914 million in FY 2018-19 for implementation.

Dayton’s budget proposal also includes $19 million annually starting in FY 2017 so that 2,485 more three- to five-year-olds can participate in Head Start. Head Start helps kids develop emotionally, socially and physically, and connects parents with supportive services.

Dayton proposes an additional $12 million in FY 2016-17 and $19 million in FY 2018-19 so that more families can afford child care through Basic Sliding Fee Child Care Assistance. Basic Sliding Fee reaches children from infancy through age 12, but 5,638 families were on waiting lists as of January.[2] With Basic Sliding Fee, children can thrive in stable environments while their parents get to work or class. The administration estimates this proposal would result in a roughly 10 percent decrease in the waiting list.

About $1.6 million in FY 2016-17 is proposed to simplify the Child Care Assistance Program. Child Care Assistance includes Basic Sliding Fee and child care through the Minnesota Family Investment Program. Dayton’s proposal reduces administrative burdens around payment issues and allows children to stay in consistent care if their parent’s work schedule changes. These changes will help families as well as reduce administrative complexity and unpredictability for providers.

Many child care providers have asked for help identifying and addressing the mental health issues observed in the children and families they serve. Dayton’s budget includes $922,000 in FY 2017 and $3 million in FY 2018-19 for mental health consultations for children when they enter child care settings through public services like early childhood special education or the Minnesota Family Investment Program. In addition to improving health outcomes for children, the administration predicts that these consultations will reduce expulsions from child care and reduce turnover rates for child care staff.

Addressing the Achievement Gap in K-12 Education

Minnesota has long made education a top priority for state investment, but a significant achievement gap between white children and children of color remains. In his K-12 funding proposal, Dayton includes both broad-based funding as well as more direct funding to help narrow the state’s achievement gap.

A major component of the K-12 education budget is additional funding for school districts under the general formula. Dayton increases the general funding formula by 1 percent in both FY 2016 and 2017. This translates to a $58 increase per pupil in FY 2016 and a $59 increase per pupil in FY 2017. This helps Minnesota schools keep up with the rising costs of teaching Minnesota’s students.

The governor also makes additional investments to address the state’s achievement gap between white students and students of color; including:

- $4 million for the Northside Achievement Zone and the St. Paul Promise Neighborhood, two initiatives focused on reducing multigenerational poverty in North Minneapolis and the Frogtown and Summit-University neighborhoods in St. Paul.

- $7.9 million for the state’s English Learner program, to expand funding for students from six to seven years so that students can become proficient in English.

- $10 million for Minnesota Reading Corps, which helps students achieve reading proficiency standards at an early age so that they are not left behind.

- $29 million for free school breakfasts for students in pre-kindergarten to 3rd grade; full stomachs help students concentrate and perform their best.

- $20 million for American Indian education, including new funding for culturally appropriate tools to improve performance and lower the dropout rate for American Indian students.

Making Higher Education More Affordable

Making higher education more affordable is essential to build the skilled workforce the state needs for its future economic success. It’s also essential if all Minnesotans are to have access to the economic opportunities that higher education and training offer. However, since the recession, state funding for four-year public colleges and universities has fallen dramatically while the average tuition has risen by about $1,700.[3] Dayton’s budget seeks to make college more affordable through increased funding for financial aid and tuition freezes.

Dayton’s higher education budget proposal includes an additional $45 million for financial aid through the Minnesota State Grant program. He would increase the maximum amount of financial aid to meet the cost of Minnesota’s public colleges and universities. The grant program also has a living allowance, which the governor would increase to match the federal poverty level. This would help Minnesota students better access all of the state’s public colleges and universities and help students meet their basic needs while in school.

Dayton also proposes funding for the University of Minnesota and Minnesota State Colleges and Universities (MnSCU) to continue a tuition freeze for another two years. In the 2013 Legislative Session, policymakers froze tuition at the University of Minnesota and MnSCU for two years.

Health and Human Services Budget Includes Funding for Basic Needs

Dayton’s budget proposal for health and human services would improve access to vital services for some of Minnesota’s most vulnerable populations through improvements to the Minnesota Family Investment Program, and increased access to mental health supports and dental care. His proposal includes a net increase of $341 million over forecasted general fund expenditures for FY 2016-17.

Dayton’s proposal includes a long-overdue increase in Minnesota Family Investment Program (MFIP) cash assistance, which has not risen since 1986. Currently, a family of three participating in MFIP receives $532 each month, which isn’t enough to meet the costs of basic necessities. The governor proposes $68 million to increase the monthly grant by $100. This increase brings Minnesota families struggling in deep poverty closer to meeting basic needs like paying their rent and putting gas in their cars and food on the table each month. This increase would be funded in part with Federal Temporary Assistance for Needy Families (TANF) dollars currently used to fund part of the Working Family Tax Credit. Dayton’s proposal would fund the Working Family Credit entirely from the general fund.

People dealing with mental illness are also at a higher risk for problems with physical health, homelessness and chemical dependency. Dayton’s budget has several initiatives that recognize the interconnected nature of these issues. Most emblematic of this approach may be an investment in behavioral health homes. Behavioral health homes provide comprehensive care to improve patients’ overall health outcomes while also reducing the use of more expensive services, like emergency rooms. Dayton targets $6.9 million in FY 2016-17 and $24 million in FY 2018-19 to behavioral health homes. Dayton also proposes $4.7 million in FY 2016-17 to increase access to supportive services for Minnesotans dealing with mental illnesses.

Low-income Minnesota children are about three times as likely to have tooth decay go untreated compared to other kids. Visits to the emergency room for non-traumatic dental work cost the state $148 million over a three-year period. Dayton’s budget would spend $10 million in FY 2016-17 and $17 million in FY 2018-19 to address these issues by increasing Medical Assistance dental rates, thereby increasing access to dental services for low-income Minnesota families. Not all dental providers would be paid more under this plan. Currently, providers operating in areas where there aren’t many dental professionals receive a “critical access bonus” when they serve low-income patients. While Dayton’s proposal increases the base rate for dental services overall, it also decreases the critical access bonuses for Medical Assistance patients and community health clinics, and eliminates the bonus entirely for MinnesotaCare patients.

Dayton’s budget includes $12 million in FY 2016-17 and $13 million in FY 2018-19 for continued improvements and maintenance for the MNsure information technology system. This will improve the technology that connects consumers, insurance providers and the public sector in the health insurance marketplace.

The Minnesota Food Assistance Program helps low-income people over 50 who are ineligible for federal nutritional assistance to pay for food. Dayton proposes increased funding of $1.1 million in FY 2016-17, and $1.9 million in FY 2018-19 to meet the administration’s projections for increased demand.

Dayton’s budget includes $3.4 million in FY 2016-17 and $24 million in FY 2018-19 to better address the housing needs of Minnesotans with disabilities. The administration is also changing some of their supportive housing guidelines, aiming to continue providing access to group residential homes while also increasing the ability for people with disabilities to live in more affordable, community-based supportive housing.

Governor Seeks to Boost Economic Development, Housing Options

Dayton seeks to strengthen the state’s economy by increasing workforce training opportunities and improving housing options and employment for people with mental illness.

The governor invests in basic skills education and specialized training so that Minnesotans can enter high-demand fields. To do this, he proposes to refocus two existing grant programs to form Pathways to Prosperity, a new career pathways program. Between general and workforce development funds, Pathways to Prosperity would receive $12 million for the FY 2016-17 biennium.

Dayton also supports the Housing and Job Growth Initiative with $10 million in one-time FY 2016 funding to create additional workforce housing in Greater Minnesota. This funding would build more than 650 units.

The governor also proposes $2 million in FY 2016-17 to support Minnesotans with severe mental illness, who experience higher rates of unemployment and poverty than other Minnesotans, to find stable jobs through Individual Placement and Supports. Policymakers expanded these services in FY 2014-15 with one-time funding; Dayton’s proposed increase will maintain that expansion.

Dayton also seeks important investments in supportive housing. He proposes $2.5 million in FY 2016-17 in funding for Bridges, which provides rental assistance to those struggling with mental illness. Bridges currently has a waiting list of about 1,300 households, and the administration estimates that the increased funding will help 200 of those households.

Transit Investments in the Twin Cities and Greater Minnesota

Dayton proposes a broad plan to repair and improve our state’s transportation system. As part of this transportation proposal, the governor includes several investments in transit. Effective transit systems are critical to our state’s economic health and can provide access to good jobs.

To address the state’s transportation needs, Dayton seeks to raise an additional $2.3 billion in FY 2016-17 in revenues dedicated to transportation and transit. This includes:

- A 6.5 percent gross receipts tax on gasoline;

- An additional half-cent local sales tax in the 7-county metro area for transit; and

- An increase in vehicle registration fees (commonly called “tabs”).

These funding sources are all regressive taxes, which means that low- and moderate-income Minnesotans pay a higher share of their incomes on those taxes. Given this fact, and the role that transportation plays in access to jobs and economic opportunity, meeting the transportation needs of low-income persons and economically struggling communities should be an important factor in decisions about where to invest in transit and transportation.

Dayton proposes $10 million in FY 2016-17 to increase bus service in Greater Minnesota, including more morning and evening service hours and multi-county services. The $424 million of local sales taxes proposed in the governor’s budget would fund transit in the Twin Cities metro area, including expanding existing bus operations by 27 percent, funding additional rapid bus lines, improving transit shelters and meeting requirements for transitways like the Blue and Green light rail lines.

Tax Plan Focuses on Sustainability, Needs of Minnesota Families

Throughout his time in office, Dayton has made it a priority to make Minnesota’s tax system more equitable and sustainable. These values were reflected in a major tax reform bill passed in 2013 that raised new revenues to end a cycle of frequent budget deficits and fund investments in some of the building blocks of a successful economy, including education from pre-school through college.

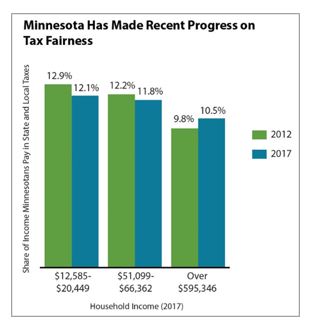

The 2013 tax law, combined with changes passed the following year, also made the tax system fairer. While the highest-income Minnesotans still pay a smaller share of their incomes in state and local taxes, the gap between them and other Minnesotans has closed considerably.[4]

Dayton seeks to build on this progress in the tax portion of his budget proposal, which continues to demonstrate the priorities of making the tax system work better for middle-class families and building ladders into the middle class, and raising adequate revenues to fund investments in the state’s economic future.

Dayton proposes increases in three tax credits for Minnesota families: the Child and Dependent Care Tax Credit, the Working Family Credit and the K-12 Education Credit.

The centerpiece of Dayton’s tax plan is a $103 million expansion in FY 2016-17 in the state’s Child and Dependent Care Tax Credit, which seeks to make affordable child care available to more Minnesota families. Child care can be one of the largest expenses that families with children face. The Dependent Care Credit is a refundable tax credit based on what a family pays for child care so that parents can work or look for work. However, it hasn’t kept up with the rising costs of child care. Under Dayton’s proposal:

- The maximum income at which a family can qualify for a credit would be increased to $112,000 for families with one dependent and up to $124,000 for families with two or more dependents. It’s currently at $39,000.

- The maximum amount of credit a family can receive would increase to $1,050 for families with one dependent and to $2,100 for families with two or more dependents.

An estimated 110,000 Minnesota families would benefit from this proposal by an average of $429, including 92,000 families who would become eligible for the credit. This tax credit can also be used for care for elders and people with disabilities, as long as they are claimed as dependents by the taxpayer and the care is so the taxpayer can work or look for work. That would continue to be true under Dayton’s proposal.

Dayton also proposes several important changes to the Working Family Credit. The Working Family Credit offsets a portion of the state and local taxes that low- and moderate- income Minnesotans pay. Half of all states have credits like the Working Family Credit that are based on the federal Earned Income Tax Credit, and build on the EITC’s proven success in supporting work, reducing poverty and improving the health and educational success of children. Dayton’s proposal increases the Working Family Credit for most currently eligible households. It also increases the income at which households can receive the credit, which makes an additional 30,000 households eligible. In all, around 310,000 Minnesota families would benefit from this proposal and receive an average tax benefit of $138.

Dayton would make two other changes to the Working Family Credit: making it entirely funded by the state’s general fund (instead of partially funded through federal welfare-to-work funds or TANF), and limiting eligibility for the Working Family Credit to full-year and part-year Minnesota residents.

Dayton’s proposal also expands the K-12 Education Credit, under which families can receive a credit for up to 75 percent of eligible educational expenses with a maximum credit amount of $1,000 per eligible child. Currently, 54,000 families qualify for the K-12 Education Credit. Dayton proposes increasing the income cap on the credit, which would make about 16,800 additional families eligible.[5] Dayton also proposes that eligibility levels would be adjusted each year for inflation, so that as incomes and the cost of goods rise over time, families can remain eligible for this credit.

A less prominent but also important piece of Dayton’s budget is a package of initiatives to close tax loopholes used by a relatively small number of corporations, and thereby create a more level playing field for all business taxpayers.

Dayton’s Budget Builds Opportunity for Minnesotans

While the state’s economic picture is looking much stronger than it has in several years, this prosperity is not yet reaching all Minnesotans. Dayton’s budget proposal takes some important steps so that more Minnesotans have the opportunity to share in our state’s economic success. He seeks to make sure that children start off in stable environments, young adults can afford college and get good jobs, and Minnesotans who have hit a rough patch have the support they need. He also seeks to maintain and build on recent progress toward a fair tax system that sustainably funds critical public services. As the state’s budget for FY 2016-17 takes shape, policymakers should keep these principles in mind.

By Clark Biegler, Ben Horowitz, and Nan Madden

[1] Governor Dayton originally presented his budget proposal in January, and released a supplemental budget proposal in mid-March to reflect the February forecast’s new state budget projections. This analysis reflects the supplemental budget proposal. Minnesota Management and Budget, Governor’s FY 16-17 Budget, March 2015.

[2] Minnesota Department of Human Services, Child Care Assistance Program: Number of Families on the Basic Sliding Fee Waiting List, January 2015.

[3] Center on Budget and Policy Priorities, Higher Education Cuts Jeopardize Students’ and Minnesota’s Economic Future, March 2015.

[4] Minnesota Department of Revenue, 2015 Minnesota Tax Incidence Study, March 2015.

[5] $37,500 is the income limit for the K-12 Education Credit for families with one or two children; the income ceiling rises for larger family sizes. Families who don’t qualify for the K-12 Education Credit can be eligible for the similar K-12 Education Subtraction.