Every day, hard-working Minnesota families struggle to make ends meet, often spending every dollar they earn to pay for the basics. Tight family budgets make it hard for Minnesotans to pay for child care, education and training to build their skills, reliable transportation, or other things they need to succeed in the workplace and get ahead. At the same time, Minnesota’s future economic success depends on more Minnesotans participating in the workforce.

Fortunately, there is a successful policy that focuses on working Minnesotans and their families: the Minnesota Working Family Tax Credit. The Working Family Credit encourages and supports work, makes Minnesota’s taxes more equitable, helps working people all across the state better meet their basic needs, and gets children off to a stronger start. Expanding the Working Family Credit is a smart investment in today’s workers and the children who will make up our future workforce. And it makes everyday Minnesotans a priority in the state’s tax decisions.

In 2015, more than 330,000 households received the Working Family Credit, which is more than 12 percent of all Minnesota households who file income taxes.[1] The Minnesota families who receive the credit live all across the state: 49 percent live in Greater Minnesota and 51 percent live in the seven-county Twin Cities metro area. The credit also is effective in reaching those communities where good jobs may be harder to find, including parts of Greater Minnesota and communities of color.

More than half of all states, including Minnesota, have credits like the Working Family Credit that are based on the federal Earned Income Tax Credit (EITC). They build on the EITC’s documented success in supporting work, reducing poverty, and improving the health and education of children.[2]

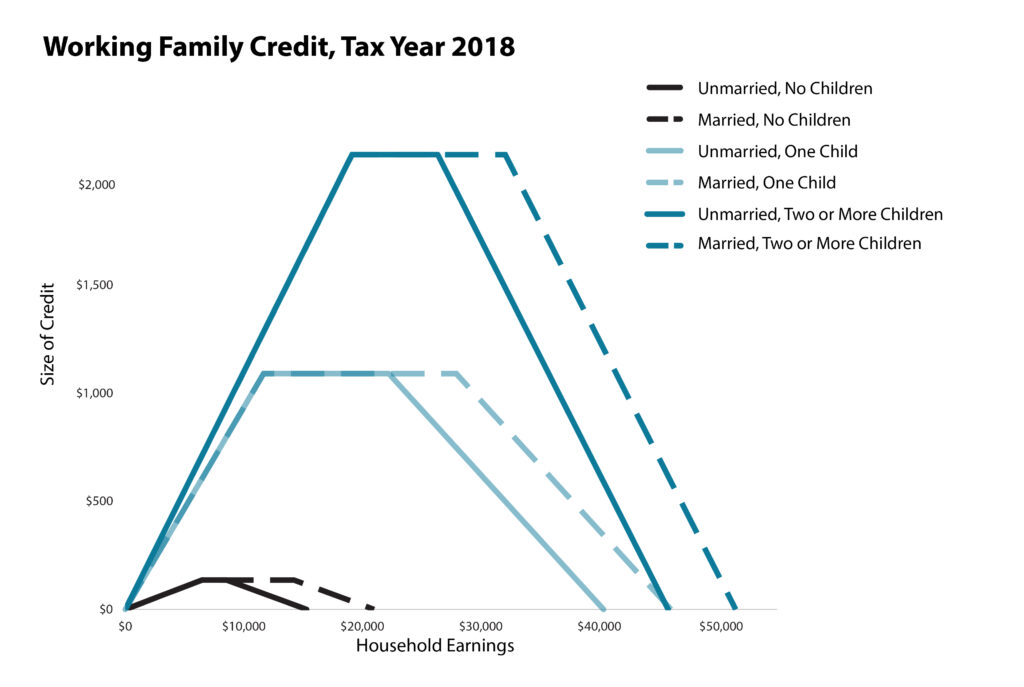

Minnesota’s Working Family Credit is calculated based on the amount of income earned during the year, the number of dependent children, and marital status. It can only be claimed by people with earnings from work. In 2015, the average Working Family Credit was $762.

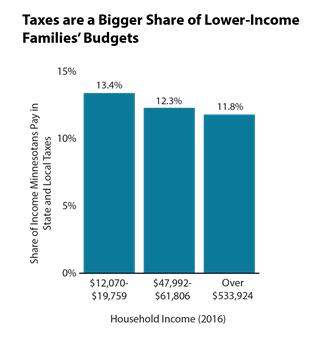

The Working Family Credit also contributes to a fairer tax system by offsetting a portion of the significant state and local taxes, such as sales taxes, that low- and moderate-income people pay. Even when including the Working Family Credit, on average, lower-income Minnesota households pay 11.5 percent or more of their incomes in state and local taxes.[3] And the lowest-income groups pay a higher share of their family income in Minnesota taxes than the highest-income one percent.

The Working Family Credit Contributes to the Success of Workers and Their Children

A strong and growing body of research on the federal Earned Income Tax Credit (EITC), on which the Working Family Credit is based, finds long-lasting positive effects for children and families,[4] including:

- Boosting school success and increasing future earnings: Children whose families receive these tax credits do better in school, are more likely to attend college, and earn more as adults.

- Improved health for children and mothers: Children in families who receive these tax credits are more likely to “avoid the early onset of disabilities and other illnesses associated with child poverty.”[5] Expansions of the EITC in the 1990s were shown to improve maternal health and the health of newborn children.

For people working at lower wages, the EITC and Working Family Credit make a real difference in their financial well-being, and building family wealth and the wealth of their communities. Because these credits are received once a year, after a family files their income taxes, many families use their credits to build a stronger financial future by increasing their savings or reducing debt. By being able to build their savings, these Minnesotans are in a better position to weather a financial setback — like a car breaking down — rather than having those challenges snowball into a worse situation. The financial impact of the credit extends to communities across the state, which get a boost when families spend their tax credits in their local economies.

In addition, these tax credits can play a role in making Minnesota a place where everyone can succeed, regardless of who they are or where they live. With a tightening labor market and worker shortages in some industries and parts of the state, Minnesota can’t afford to have potential workers sitting on the sidelines. The Working Family Credit especially reaches those Minnesotans who face geographic and structural barriers to economic stability.

- Households in Greater Minnesota are more likely to receive the Working Family Credit: 13.3 percent of tax-filing households in Greater Minnesota receive the Working Family Credit, compared to 11.4 percent in the seven-county metro area.[6]

- While people of color made up about 18 percent of the state’s population, in 2015 about 34 percent of Minnesota households eligible for the EITC (and therefore likely also the Working Family Credit) were people of color. Among EITC-eligible Minnesota households, 13.9 percent were black, 7.7 percent were Asian, and 6.5 percent were Hispanic.[7]

Time to Make the Working Family Credit Work for All Kinds of Families

The strong positive impact of the Working Family Credit and the federal EITC for many families with children is clear. Minnesota should make additional changes so that workers without children, larger families, and immigrant families are better included.

As they are currently structured, these tax credits do much less to support the work efforts of single people and married couples who aren’t raising children in their homes – sometimes referred to as “childless workers.” This group includes non-custodial parents and others who have children that they do not claim as dependents for tax purposes, as well as younger Minnesotans starting out their work lives. The Minnesota Tax Incidence Study shows that lower-income households without children pay a higher share of their incomes in Minnesota taxes than the state average.[8]

Two primary reasons to improve the Working Family Credit for workers without dependent children are:

- Their credits are small compared to what’s available to households with children. The maximum Working Family Credit a single worker without children can receive is $136, compared to $1,091 for a single parent with one child. The much smaller credit for workers without children is not proportionate to family size. To put the difference in perspective: for a single parent with one child receiving the maximum Working Family Credit, the combination of their earnings and the WFC can cover up to 43 percent of what it takes to support their family. For a single childless worker receiving the maximum Working Family Credit, the combination of their earnings and tax credit equals only 28 percent of what they need to support themselves.[9]

- Workers without dependent children lose eligibility at very low incomes. For example, single workers become ineligible for the Working Family Credit when their incomes reach $15,300 – so someone working full-time, year-round earning the state’s minimum wage will make too much to qualify.

There is growing interest in making the federal EITC and its state counterparts work better for households without dependent children. In 2017, Minnesota became the first state in the nation to pass legislation to address the arbitrary age requirement for households without dependent children. Younger workers who are economically independent and not claimed as dependents by another taxpayer have not been able to qualify for the credit unless they were at least age 25. Starting in 2019, Minnesota workers and couples without children can qualify for the Working Family Credit at age 21.

Minnesota should also make overdue changes to meet the needs of larger families, recognizing that these families have higher costs for basic expenses. In 2009, federal policymakers changed the Earned Income Tax Credit so that families with three or more children can qualify for a larger tax credit than families with two children, and they can qualify at a higher income level. Minnesota has not yet made a similar change to the Working Family Credit, and is one of only two states with state EITCs without a larger credit for families with three or more children.

A third change that Minnesota could make is to allow immigrant workers who file taxes using Individual Tax Identification Numbers (ITINs) to receive the Working Family Credit, as long as they meet the income and other eligibility requirements for the credit. These workers pay Minnesota taxes, but do not currently qualify for the Working Family Credit. Including these Minnesotans in the Working Family Credit would reduce poverty and economic hardship for these families and their children, and contribute to a more equitable tax system.

Expand the Working Family Credit to Support Minnesota Workers and Families

As policymakers consider tax policy changes this session, they should prioritize Minnesota workers and families striving for economic security. Minnesota should build on the Working Family Credit’s track record of making our taxes more equitable and supporting our workforce. Policymakers should pass an expansion of the Working Family Credit that increases the amount of tax credit that workers and their families can receive, and make more households eligible by increasing the amount that Minnesotans can earn and qualify for the credit. Special focus should be made on improving the credit for those workers and families who are less well served by the credit’s current structure and requirements.

A stronger Working Family Credit would make a real difference to hundreds of thousands of Minnesota workers and families striving toward economic security, and contribute to a stronger workforce and more equitable and prosperous state. It’s time to make that investment.

By Nan Madden

This research was funded in part by the Annie E. Casey Foundation and the Minneapolis Foundation. We thank them for their support but acknowledge that the findings and conclusions presented in this report are those of the authors alone, and do not necessarily reflect the opinions of the Foundations.

[1] Minnesota Department of Revenue, Tax Year 2015 Minnesota Income Tax Statistics by County. In this analysis, the term “households” refers to the number of tax returns.

[2] Center on Budget and Policy Priorities, Policy Basics: State Earned Income Tax Credits, August 2017.

[3] Minnesota Department of Revenue, 2019 Minnesota Tax Incidence Study, March 2019.

[4] Center on Budget and Policy Priorities, EITC and Child Tax Credit Promote Work, Reduce Poverty, and Support Children’s Development, Research Finds, October 2015.

[5] Center on Budget and Policy Priorities, EITC and Child Tax Credit Promote Work, Reduce Poverty, and Support Children’s Development, Research Finds.

[6] Minnesota Budget Project analysis of Minnesota Department of Revenue, Tax Year 2015 Minnesota Income Tax Statistics by County.

[7] Estimates by Brookings based on 2015 American Community Survey data.

[8] Minnesota Department of Revenue, 2019 Minnesota Tax Incidence Study.

[9] These examples use the Working Family Credit parameters for Tax Year 2018, assume the household has the maximum earnings to qualify for the maximum amount of Working Family Credit, and use the Basic Needs Budgets calculated by the Minnesota Department of Employment and Economic Development to describe what it takes to support a family in Minnesota.