Governor Dayton’s Budget Relies on Revenue Increases and Spending Cuts

On February 15, Governor Dayton released his proposal for resolving the state’s budget deficit for FY 2012-13, at the time projected to be $6.2 billion.[1] His proposal uses a combination of revenue increases and spending cuts to bring the budget back into balance. The Governor seeks to address the needs of Minnesotans struggling in tough times, restore balance to the state’s tax system and improve the state’s fiscal health over the long term.

Less than two weeks after the Governor released his budget proposal, the state’s February 2011 Economic Forecast revealed that the budget shortfall for FY 2012-13 had fallen by $1.2 billion to $5.0 billion. The Governor quickly responded with a preliminary list of changes to his initial budget proposal, withdrawing one of his revenue increases and several of his spending cuts, and adding a few new spending proposals. In late March, Minnesota Management and Budget released the formal supplemental budget that incorporated these changes. This analysis examines the Governor’s supplemental budget as released in March.[2]

Any balanced approach to solving the state’s budget crisis will include cuts to services, although years of budget cuts mean there are no easy choices left. The Governor’s supplemental budget proposal includes hundreds of millions in spending reductions, including $495 million in cuts to health and human services and another $171 million in cuts to higher education.

The service cuts in the Governor’s budget proposal will have real consequences for Minnesotans. Although the Governor seeks to protect some areas – such as K-12 education and vital safety net programs – there are many cuts that will impact Minnesota families still struggling in the wake of the recession. However, the state would face much deeper reductions to critical services under a cuts-only approach to solving the deficit.

To prevent those deeper reductions, Governor Dayton’s budget includes $2.7 billion in tax increases for resolving the state’s budget shortfall. In addition, the Governor places a high priority on reversing recent trends towards a more regressive tax system – one where low- and middle-income Minnesotans pay a higher share of their incomes in total state and local taxes than the wealthiest Minnesotans. His primary tax proposal is a new income tax rate on high-income Minnesotans. The Governor’s proposal also raises revenues by eliminating some corporate tax preferences.

Another significant source of revenue in the Governor’s proposal is a surcharge on a number of health care providers. The proposal will help draw down additional federal Medicaid dollars, but will mean increased costs for some providers. The surcharge proposal reduces the state’s deficit by $624 million in FY 2012-13.

The Governor’s budget continues the timing shift in school funding enacted last session for another two years, and then starts to buy back that shift beginning in FY 2014. This saves the state $1.4 billion in FY 2012-13.

Health and Human Services

In Governor Dayton’s supplemental budget proposal, health and human services contributes nearly $852 million to solving the state’s general fund budget deficit, or about 17 percent of the total solution. Elements of his proposal include $495 million in general fund spending reductions and $80 million in new investments. The Governor’s proposal also nets the state $624 million in revenue by increasing surcharges on health care providers. Although the Governor “protects health care services for Minnesota’s most vulnerable residents,” his budget does include proposals that will leave children, seniors, persons with disabilities and families recovering from the recession with less help.[3]

The Governor would increase surcharges that the state collects from all hospitals, nursing homes, Intermediate Care Facilities for persons with developmental disabilities (ICF/MRs) and managed care organizations, raising $875 million in revenue in FY 2012-13. To partially offset the increased costs to these health care providers, the state would increase their Medical Assistance and MinnesotaCare reimbursement rates, at a cost to the state general fund of $251 million. The federal government would match this additional state spending, with those federal dollars flowing to the health care providers. Some health care providers, particularly those that do not serve a large number of Medical Assistance clients, would not break even in this proposal. The result is $624 million in net revenue for the state’s general fund.

The Governor’s proposal provides additional funding for adoption assistance, but includes many cuts to services for vulnerable populations, including children, the elderly and those with disabilities.

- Funding for Adoption Assistance/Relative Custody Assistance is increased, ensuring that there are sufficient resources to cover the anticipated caseload of 9,700 children by FY 2013. This program provides financial assistance to families who have adopted or accepted permanent custody of children with special needs.

- Restrictions continue on the number of individuals with disabilities that can access home-based Medicaid services, which help them avoid entering a more expensive and confining institutional setting. With the Governor’s reduced level of funding, approximately 2,100 new individuals will be able to access these waivered services, but more than 80 individuals will have to enter an institutional setting.

- Funding for Children and Community Services Act (CCSA) grants to counties, which fund child protection and child and adult mental health services, are cut by $5 million in FY 2012-13. This represents a four percent reduction in state funding for these services. The Governor asks counties to focus the remaining resources “on protecting children and adults at risk of abuse and neglect.” However, this change in focus would leave mental health services for children and adults vulnerable to cuts.

- Funding for services for seniors and people with disabilities is reduced, impacting both individuals and the institutions and community-based providers that serve them. For example, there is a two percent rate reduction for all home and community-based service providers and a one percent reduction in nursing facility rates. However, providers and the people they serve may also be impacted by a variety of other changes in the Governor’s budget, such as cuts in funding for transportation services, a broadening of the definition of who qualifies as an individual with the lowest level of need and reducing reimbursement rates for this group, reducing or eliminating some types of payments to nursing facilities, and other rate reductions. These changes are in addition to any budgetary impacts from the surcharge proposal described above.

The Governor makes changes to the child care assistance system that will remove some flexibility for families, creating $7 million in savings in the FY 2012-13 biennium. The Governor’s proposal also captures $5 million in child care assistance funds that were not spent in calendar year 2010 that would normally carry-over and fund child care assistance in the next year, meaning nearly 500 fewer working families would be helped.

The Governor’s proposal reduces services and resources for low-income families, cutting the Minnesota Family Investment Program (MFIP) Consolidated Fund by $10 million in FY 2012-13. This cut could have several implications, including longer wait times for families trying to access assistance, less support in finding work, and fewer families getting emergency assistance when facing homelessness.

State funding for Family Assets for Independence in Minnesota (FAIM) grants is eliminated in the Governor’s budget. FAIM has helped several thousand low-wage workers improve their financial management skills, build assets and avoid predatory lending practices. Participants get their own savings matched with state and federal funds to help obtain post-secondary education, purchase a home or start a new business. To date, more than $2 million in individual savings has been deposited and more than 1,500 assets (homes, businesses and higher education degrees) have been acquired. The loss of $500,000 in state funds in FY 2012-13 will also mean the loss of a $500,000 matching grant from the federal government.

E-12 Education

The Governor’s supplemental budget proposes a net $36 million increase in E-12 Education funding in FY 2012-13, or less than a one percent increase from base funding.

The Governor’s budget continues the shift in school aid payments passed last year, saving the state more than $1.4 billion in FY 2012-13. Normally, the state pays school districts 90 percent of their annual aid in one fiscal year, and a 10 percent settling-up payment in the following fiscal year (allowing the state to adjust for enrollment or other changes that may have happened during the year). In the FY 2010-11 biennium, policymakers changed the formula to a 70/30 percent split to help reduce the state’s budget deficit by shifting $1.9 billion in school aid payments into the future. Under current law, the state is scheduled to “buy back” the shift, returning the payment schedule to the 90/10 split in FY 2012. The Governor’s proposal would delay buying back the shift until FY 2014, and then buy it back at a rate of two percentage points a year over a 10-year period.

The Governor’s budget proposal provides $32 million in additional funding for optional all-day kindergarten programs for school districts and charter schools in FY 2013 and $101 million in FY 2014-15. According to the Department of Education, all-day kindergarten has been shown to result in greater academic gains in language, literacy and math skills.

The Governor appropriates $2 million in one-time funds for a statewide early childhood quality rating and improvement system to assess program quality, support teacher improvement and to better inform parents about their choices.

Two other education proposals in the Governor’s budget would work on reducing the state’s achievement gap, which refers to the wide disparities in educational achievement that exist between white children and children of color. Minnesota’s achievement gap is one of the largest in the nation, according to the Minnesota Department of Education. The budget provides $5 million in FY 2012-13 to establish the Achievement Gap Innovation Fund, a competitive grant program to fund projects that develop innovative approaches for using technology to help close Minnesota’s achievement gap. The budget also creates a Governor’s Excellence in Education Award that would provide grants to schools with outstanding achievement growth ($12 million in FY 2012-13). Up to half of the grant could be used to maintain the school’s performance, with the remainder used to share their successful teaching techniques with other schools.

The Governor’s budget includes cuts to several education programs.

- Funding for Adult Basic Education (ABE) is cut by reducing the built-in growth rate for the program from three percent to two percent, resulting in a $1 million cut in FY 2012-13 compared to base funding. ABE helps adults access educational opportunities such as getting their GED or improving their English skills. The proposed cut may result in some waiting lists.

- Participation in Q Comp, a teacher performance pay program, is capped at current levels until there has been further evaluation of the effectiveness of the program ($5 million in FY 2012-13).

- Charter school start-up grants and magnet school grants are ended ($3 million).

- The Department of Education receives a five percent reduction to its administrative budget ($2 million in FY 2012-13).

The Governor’s budget also includes small changes to the Minnesota State Academies, which include the Minnesota Academy for the Deaf and the Minnesota Academy for the Blind. His budget allows students 60 to 90 days to attend one of the academies to determine if the school is an appropriate fit for them. The Governor also proposes to save $618,000 in FY 2012-13 by contracting for the schools’ nutrition services.

Although Governor Dayton made E-12 education one of the top priorities in his budget, his proposal will not completely protect local school districts from budget pressures. Rising costs for health insurance, utilities and other budget items are placing significant pressures on school budgets. In a recent survey of its members, the Association of Metropolitan School Districts found that a zero percent increase in state education funding would mean a $153 million shortfall for metropolitan school districts in FY 2012, a shortage ranging from one to four percent depending on the school district. The survey also found that the shift in school aid has cost metropolitan school districts more than $5 million in interest costs from loans or lost interest from using reserves.[4]

Higher Education

Governor Dayton’s supplemental budget includes $171 million in spending cuts for higher education, a six percent cut from base funding for FY 2012-13. As a result, the state’s level of investment in higher education would fall to FY 2002-03 funding levels (in actual dollars, not inflation-adjusted).

Minnesota’s current investments in higher education will play an important role in the future economic success of the state. According to the Department of Employment and Economic Development, “the state is continuing to shift towards a skill-based economy. National projections indicate that 70 percent of jobs in Minnesota will require a post-secondary degree by 2018, up from the current 40 percent.”[5]

The Governor’s budget proposal protects the State Grant program, but cuts other financial aid opportunities.

- There are no reductions to the State Grant program, which provides financial aid for approximately 84,000 low- and moderate-income Minnesota students every year. However, demand for financial aid is projected to exceed the available funding by $35 million in the next biennium. To ensure the available funds are able to stretch further, the Governor recommends that the student share of expenses be increased slightly and that families pay an additional surcharge on their share.

- There is a 32 percent reduction in funding for state-funded work study, which pays 75 percent of wages for qualifying campus and community jobs that allow students to earn money to pay for the costs of higher education. Approximately 2,600 fewer students would have a work study opportunity in FY 2012 as a result of the proposed cut.

- The Governor proposes a five percent reduction to the American Indian Scholarship program, resulting in 32 fewer students being able to access this financial assistance each year.

- There is a five percent reduction in child care assistance grants for low-income students. As a result of this cut, 150 fewer students a year would receive financial assistance to pay for child care, meaning that they would work more hours, incur more student loans or take longer to graduate.

- The Achieve Scholarship program is eliminated. This scholarship program was designed to help high-achieving, high-need students access higher education, with a maximum annual scholarship of $1,200. Approximately 130 students would lose access to this financial aid.

- The Governor phases out all general fund support for the Minnesota College Savings Program, which helps low-income families save for college expenses. In 2009, approximately 2,100 families received matching grants.

The Governor proposes a six percent reduction in base funding for the University of Minnesota, a $77 million cut in FY 2012-13. This would bring funding for the University of Minnesota below FY 2010-11 levels. Back in 1978, the University received 43 percent of its budget from state funding; that percentage has fallen to 18 percent today. University of Minnesota president Robert Bruininks testified before the House Higher Education committee that to absorb the proposed reductions, the University is likely to continue to freeze wages, reduce employee benefits and shed staff wherever possible to minimize increases in tuition.[6]

There is also a six percent cut to the Minnesota State Colleges and Universities (MnSCU), or $76 million in FY 2012-13. This would bring funding down to FY 2003 levels, even though the system is serving nearly 38,000 more students today than it did in 2003. As a result of years of budget cuts, state per student spending in the MnSCU system has fallen by more than 20 percent between 2001 and 2011, from $4,877 to $3,832 per student.[7]

Economic Development

Governor Dayton’s recommendations result in a net 10 percent increase from base funding in general fund spending for the Department of Employment and Economic Development (DEED), the agency primarily responsible for workforce development in the state. Although employment in Minnesota is beginning to recover, the state is not expected to reach pre-recession employment levels until mid-2013. Many Minnesotans are still struggling to find jobs that will support their families. According to the February forecast, “18 months after the recession officially ended nearly 1 out of 7 Minnesotans who prefer a full time job is still unable to find one.”[8]

The impact of the Governor’s budget proposal on workforce development services is mixed. The Governor proposes to increase funding for Vocational Rehabilitation, which provides employment services for people with significant disabilities, by $2 million per year. There is also a $150,000 per year increase for State Services for the Blind, which helps Minnesotans who are blind, visually impaired or Deafblind with their employment skills. This increased funding would allow the state to draw down additional federal matching funds.

The Governor’s budget includes cuts in workforce development services as well, including a $313,000 a year cut in grants to several nonprofits that provide employment services and small business assistance. There is also a $221,000 per year reduction to the Job Skills Partnership, which funds job training or retraining partnerships between educational institutions and businesses. In addition, the proposal would allow the Department of Employment and Economic Development (DEED) to withhold up to five percent (or $275,000 a year) from pass-through grants to nonprofits to cover DEED’s administrative costs.

The Governor also proposes to transfer over $6 million in FY 2012-13 from the Unemployment Insurance (UI) Contingent Account to the Workforce Development Fund to invest in additional help for dislocated workers, and another $6 million to the general fund to help reduce the state’s budget deficit.

The Governor’s supplemental budget proposal adds some investments for business development, including $3 million for the Minnesota Investment Fund and $2 million for grants to encourage the redevelopment of sites with particular challenges.

In affordable housing and housing development, Governor Dayton’s budget protects services for those who are homeless or at risk of being homeless, as well as rental assistance for those with mental illness. However, his budget includes a five percent reduction in base funding for the Minnesota Housing Finance Agency (MHFA). The programs hardest hit by these reductions include efforts to preserve and rehabilitate affordable housing units.

The Governor recommends a five percent cut to both the Minnesota Arts Board ($417,000 per year) and the Minnesota Historical Society ($804,000 per year), which will result in reductions in regional arts programming and historical preservation and education.

Another major source of funding for these cultural opportunities is the Legacy Amendment, a constitutional amendment approved in 2008 that increased the state sales tax to support the state’s outdoor heritage, clean water, parks and trails, and arts and cultural heritage. In FY 2010-11, $93 million from the Legacy Amendment was dedicated to arts and cultural programs, including $43 million for the State Arts Board and $22 million for the Historical Society. The Governor’s budget proposal did not indicate his priorities for how to spend the Arts and Cultural Heritage portion of the Legacy Amendment funds in FY 2012-13, leaving this question to be worked out during the legislative session.

Public Safety

Governor Dayton’s public safety budget boosts funding for prisons and public defenders and includes small increases for the courts, but holds public safety funding flat in other areas. The state’s public safety infrastructure – which includes the courts, the Department of Corrections and the Department of Public Safety – is under considerable strain. The Governor’s budget documents point out that the economic downturn has increased consumer-related court matters, cuts to public defenders have significantly reduced their capacity to provide adequate and timely representation, prisons are facing growth in costs for utilities and health care that exceeds the rate of inflation, and federal funds for homeland security and law enforcement have been declining.

In the Governor’s supplemental budget proposal, the Supreme Court, Court of Appeals and the Trial Courts would all get slight increases – about one percent – that would go towards inflationary increases in employee health insurance and pension contributions.

Within the criminal court system, the Governor’s plan includes a five percent increase to the Board of Public Defense’s budget to address the need for adequate staffing so that clients receive constitutionally-required representation. Past budget cuts have taken a significant toll on the board’s capacity. In half of the state’s counties, the board no longer has sufficient attorneys on staff to represent clients at their first appearances in court. Further, public defenders increasingly rely on help from volunteers and law students.

The Governor recommends funding civil legal services at existing levels. Civil legal services provide legal assistance in non-criminal matters to Minnesota’s most vulnerable populations: low-income families, the elderly, people with disabilities and children. State funding for civil legal services has fallen by 11 percent between 2008 to 2011 and is currently below 2006 levels. Other sources of funding for civil legal services are also on the decline. A $25 annual attorney registration fee the Supreme Court added in FY 2010-11 to support civil legal services is set to expire this July. In addition, interest from the Law Trust Accounts (IOLTA) Program is dedicated to providing grants to enhance the availability of civil legal services for low-income Minnesotans. Due to economic conditions and low interest rates, funding for these grants will drop by nearly $3 million in FY 2012-13.

The Governor’s budget does not recommend any reductions to the Department of Human Rights. The Department says that it is processing an increased number of human rights complaints, and faces legislative pressure to increase compliance audits on state bonding contracts.

The Governor’s budget proposes to increase funding for the Department of Corrections by nearly three percent over base funding in FY 2012-13. Changes in this area include:

- $27 million increase in core prison operations in FY 2012-13 to restore a cut made in the 2010 Legislative Session. The funding will prevent the loss of essential positions and maintain prison safety.

- $3 million reduction in offender supervision, with state and county corrections absorbing the reduction by implementing alternative strategies to supervise low-risk offenders. The three percent cut translates into 22 fewer supervising agents with a combined caseload of 1,500 to 2,000 offenders.

The Governor’s budget proposal does not include any major changes to the Department of Public Safety’s budget for FY 2012-13. However, general fund spending for this area would drop below FY 2010-11 spending levels, a budget cycle that included significant one-time spending on disaster relief. Some of the Governor’s minor changes in this area include:

- $3 million one-time appropriation for the Network for Better Futures to complete a pilot program that provides housing, employment and other supports to men at high risk of entry or re-entry into corrections, or chemical or mental health programs.

- Continuing the “technology surcharge,” a $1.75 driver’s license fee to pay for technology upgrades. The fee is set to expire in FY 2012; the Governor would extend it through FY 2015. This fee flows to a special revenue account and does not reduce the state’s budget deficit.

State Government

The state government budget area includes the agencies, offices and boards responsible for the basic operations of state government, such as offices established by the state constitution, the Department of Revenue, Minnesota Management and Budget (MMB), and the departments of Military and Veterans Affairs. His proposal for state government includes reductions for some state agencies, but also invests in initiatives to improve government efficiency and performance.

The Governor’s budget recommends a five percent reduction in base funding for some constitutionally-established offices, such as the Governor’s office, the legislature and the Attorney General. There are no reductions proposed for the State Auditor or the Secretary of State (which actually gets a small appropriation to pay for legal fees for a recent court case).

His budget also includes at least a five percent reduction in the operating budgets for the Department of Revenue, the Office of Enterprise Technology, the Department of Administration and MMB. (Reductions to other state agencies, such as the Department of Human Services or the Department of Education, are reported in other areas of the budget.) The state’s councils of color advise policymakers on the issues facing their particular community. The Governor does not propose any reductions for the Council on Black Minnesotans, the Chicano Latino Affairs Council, the Council on Asian-Pacific Minnesotans or the Minnesotan Indian Affairs Council.

Governor Dayton’s budget seeks to “transform how we provide residents with the best possible services, most efficiently, at the lowest cost.”[9] Towards that end, the Governor recommends $500,000 in FY 2012-13 for a Results Management Initiative to “ensure that state agencies clearly identify their performance objectives and are held accountable for achieving results on critical initiatives.”[10] There is also increased funding for the Small Agency Resource Team (SmART), which helps small agencies, boards and councils consolidate their human resource and financial management activities. The Governor also appropriates $50,000 to evaluate whether some of those small agencies, boards and commissions can be merged or abolished.

The Governor’s proposal would spend $11 million to increase tax compliance efforts. The additional oversight is estimated to result in collecting nearly $44 million in taxes, netting the state $32 million in additional revenue.

The Governor proposes a $3 million increase for tuition reimbursement in the Military Affairs Department. This additional funding enables the department to continue to provide 100 percent tuition reimbursement for members of the National Guard. The Governor also proposes nearly $2 million in additional funding for the Higher Education Veterans Program to help veterans access their educational benefits and make the difficult transition from the military to college.

Minnesota Management and Budget must manage the state’s cash flow – ensuring that on any given day, the state has sufficient funds to make all the required payments. Governor Dayton transfers $171 million of the $266 million in the cash flow account to help resolve the state’s budget deficit, saying the state should have sufficient resources to make payments through the end of FY 2011.

However, in recent years, the cash flow account has not had sufficient resources to manage cash flow issues and the state has had to resort to temporary measures, such as borrowing resources from other funds and delaying payments to school districts. The Governor leaves in place current statutory language that automatically directs any future budget surpluses to restoring the cash flow account to its target level of $350 million.

State Taxes and Local Aids and Credits

Governor Dayton’s budget includes tax changes intended to help close the state’s budget deficit and reverse recent trends towards a more regressive tax system – one where low- and middle-income Minnesotans pay a higher share of their incomes in total state and local taxes than the wealthiest Minnesotans. The Department of Revenue’s Tax Incidence Study finds that while on average Minnesotans pay 11.5 percent of their incomes in total state and local taxes, the wealthiest one percent of Minnesotans pay 9.7 percent.[11]

The Governor’s proposal also responds to the fact that Minnesota’s current tax revenues are a smaller share of the state’s economy than a decade ago and are inadequate to fund current needs. The average share of income that Minnesotans pay in state and local taxes dropped by 11 percent from 1996 to 2008.[12]

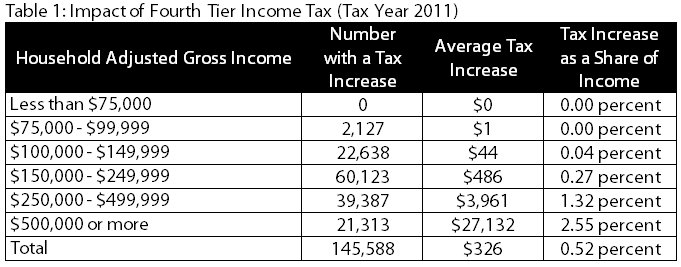

Governor Dayton’s budget raises $2.7 billion in taxes in the FY 2012-13 biennium. In keeping with his priority on addressing regressivity, his largest initiative is in the individual income tax, the only major tax based on ability to pay. His budget proposes a new fourth income tax bracket, which would raise $2.0 billion in FY 2012-13. This “fourth tier” proposal applies a tax rate of 10.95 percent on taxable income above $150,000 for married joint filers.[13] The Department of Revenue estimates that 5.8 percent of income tax filers would be impacted.

The Governor’s budget notes that, when the ability to deduct state taxes from one’s federal income tax is taken into account, the average tax increase and tax increase as a share of income is likely to decrease. For example, for households with incomes above $500,000, their average tax increase as a share of income drops from 2.55 percent to 2.0 percent when federal deductibility is taken into account.

Some have raised concerns about the potential impact that an income tax increase on high-income households would have on small business owners. It actually is difficult to know the impact on small businesses per se, but there is data on “pass-through” income, which is the kind of business income that shows up on the individual income tax. Department of Revenue analysis finds that only 11 percent of tax returns with pass-through income would be impacted by the Governor’s fourth tier proposal.

Concerns have also been raised that the Governor’s tax proposals will lead to high-income individuals leaving the state. Recent experiences in Maryland and Oregon demonstrate that while some may leave the state for tax reasons, the majority will stay. Those two states raised their income taxes on high-income earners recently. But tax rates were not the only thing changing. There was also a recession and a huge drop in the stock market. In the nation as a whole, there was an 18 percent reduction in the number of millionaires in 2008, for example.[14] A closer look at the data in Maryland and Oregon found that many of their “missing millionaires” were still there, but had moved into lower tax brackets due to the poor economy.

As originally introduced, the Governor’s budget also included a temporary additional three percent tax rate on taxable incomes above $500,000 (for all filing statuses). This proposal would raise $918 million in total during the three years it would be in effect (tax years 2011 to 2013). Less than one percent of all income tax filers would be impacted. The Governor withdrew this proposal in his supplemental budget.

Governor Dayton’s budget also anticipates raising $30 million in FY 2012-13 from requiring more part-year residents to pay income taxes on a portion of their income. Currently, part-year residents who maintain a home in Minnesota need to be in the state for 183 days or more to be subject to the income tax. The Governor’s budget would reduce that threshold to 60 days.

Governor Dayton puts a high priority on not raising local property taxes, and his budget does not include any cuts to state aids to local governments or to state-paid property tax refunds to Minnesota residents.

Property taxes are primarily a local revenue source, but there is a statewide property tax on businesses and cabins that is paid to the state. Governor Dayton proposes to add high-value homes to the statewide property tax, raising $63 million in FY 2012-13 and $85 million in FY 2014-15. The property tax would apply only to the amount of a home’s value over $1 million.

Governor Dayton’s budget would raise $316 million through changes to the corporate tax. His goals in this area are “to close corporate tax loopholes [and] ensure that corporations that profit from sales to Minnesota also pay tax in Minnesota.”[15] Major initiatives in the corporate tax area include:

- Ending the current Foreign Royalty exclusion, which exempts from taxation any royalty payments a multinational corporation receives from its foreign subsidiaries.

- Repealing the special tax treatment of Foreign Operating Corporations (FOCs). FOCs are parts of a multinational corporation that are incorporated in the U.S. but at least 80 percent of their income is from foreign sources. This foreign income currently is taxed at an 80 percent discount. The bill would treat this income the same as domestically-produced income.

- Indexing the minimum fees paid by businesses, raising $14 million in FY 2012-13. The brackets and fee amounts have not been adjusted since 1990. While the fees are increasing, the brackets are also becoming larger, so some businesses will pay lower fees while some will see higher fees. The maximum fee would rise from $5,000 to $8,890.

Governor Dayton’s budget would also raise $31 million from sales and use tax changes. These changes are often an instance of tax law keeping up with technology. One proposal would ensure that remote sellers collect sales taxes from Minnesota residents, just as retailers physically located in the state do. This “affiliate nexus” provision would impact remote retailers who sell their products to Minnesotans through referrals from businesses with a physical presence in Minnesota. In another example, under current law, Minnesotans pay sales tax on subscriptions to digital video recorder and other services when purchased from a cable TV provider, but not when purchased from a satellite service. The Governor’s budget would make these services taxable regardless of the means of delivery.

When the February forecast showed that the deficit had shrunk, the Governor also proposed paying corporate tax refunds and sales tax refunds that had been delayed as part of legislation to balance the budget in 2010. House File 79, which allows for faster payment of $152 million in refunds, has since passed the legislature and was signed by Governor Dayton on March 21.

Minnesota uses federal law as the starting point for both the individual income tax and the corporate franchise tax. When the federal government makes tax changes, the state must decide whether to conform to those changes. Governor Dayton’s budget conforms to many of the changes in four federal bills passed since the state’s last legislative session, with a resulting loss of $41 million in state revenues over three years (FY 2011 to FY 2013).

Where the Governor does not conform, his budget argues that doing so would be “too costly” or “would benefit only a limited number of high-income Minnesotans.” He continues the practice of not conforming to Section 179 expensing and bonus depreciation, both of which relate to how businesses deduct the amount of their assets on their tax returns. Governor Dayton’s budget also does not conform to the federal additional standard deduction for married couples, the repeal of the limit on itemized deductions, and the phase out of personal exemptions.

Because conformity decisions impact Minnesotans filing their income taxes this spring, decisions about federal conformity were made more quickly and separately from the overall budget discussion. House File 79, passed in late March, included federal conformity provisions negotiated by the Governor and the Legislature for the 2010 tax year only that reduce state revenues by $13 million in FY 2011.

The Governor and Legislature Must Resolve Competing Visions

The release of the February forecast marked the real start of the budget debate. Policymakers now have a final number for the state’s budget deficit – $5.0 billion for FY 2012-13 – and can begin the difficult work of resolving the problem.

The Governor has shared his vision: a balanced approach that includes a mix of revenues and cuts to services. The House and Senate have moved very quickly to reveal their alternative approaches to solving the deficit, each body completing a series of omnibus budget bills by March 25. In both the House and Senate, increased tax revenue is not part of their approach, meaning that their budgets rely heavily on cuts to services.

The national economic recession has hit Minnesota hard. It has meant that more Minnesotans are struggling to make ends meet, but it also brought about a big drop in state revenues. In the 2011 Legislative Session, legislators will need to respond to that state revenue shortfall in a way that still meets people’s needs during these tough times and makes the investments that will help us have a stronger economy in the future.

As policymakers consider how to approach the current deficit, they should acknowledge how past budget decisions have impacted Minnesota. Not so long ago, the state enjoyed budget surpluses and policymakers used those resources to cut taxes. Between 1997 and 2001, Minnesota lawmakers had the opportunity to allocate almost $13 billion in state surpluses. Just over half of those resources – $7 billion – were used for temporary tax rebates and permanent tax cuts.[16]

When the state’s fiscal situation took a dramatic turn for the worse in 2002, lawmakers did not revisit the tax cuts they had recently made. Instead, they turned to one-time fixes and deep spending reductions to bring the state budget back into balance. During those initial rounds of budget balancing, cuts were made in early childhood programs, higher education, housing, job training and health care. The impact of those cuts added up quickly.

- Minnesota’s per pupil spending on education, once 11 percent above the national average, had actually fallen to match the national average by FY 2006.

- Higher education became substantially more expensive for Minnesotans, as average tuition in the Minnesota State Colleges and Universities system (MnSCU) rose by 55 percent between 2000 and 2007, while the average state grant amount decreased by seven percent.

- 11,000 fewer Minnesota children accessed child care assistance in October 2005 than in June 2003 after deep cuts were made to child care funding.

- The number of households in Minnesota spending more than half of their income on housing more than doubled from one in 15 households in 2000 to one in eight households in 2006, as the need for affordable housing opportunities remained unmet.[17]

That was the state of the state on the eve of the 2009 Legislative Session. Since then, Minnesota has experienced two more legislative sessions with more than $1 billion in additional cuts to health and human services, higher education and other services.

When times were good, policymakers cut taxes and reduced state revenue. But for nearly a decade, policymakers have been solving budget deficits by making cuts to essential public services. If Minnesota continues down this path, the infrastructure that has supported a strong economy and healthy communities in the past will not be there to support the state in the future.

As the session unfolds, Governor Dayton and the legislature will need to negotiate a compromise solution to the state’s budget deficit. A balanced approach – one that includes revenue increases and service cuts – is vital, both to ensure that those Minnesotans most impacted by the recent recession are protected, as well as to position the state to succeed in the coming recovery.

[1] The Governor’s official budget proposal is released by Minnesota Management and Budget, which issues a document for each agency, board and commission that details their functions and any changes the Governor proposes for their budget. The complete budget is available at the Minnesota Management and Budget website.

[2] Except where otherwise noted, the analysis in this report is based on data from budget documents prepared by Minnesota Management and Budget and the applicable state agency, and legislative research and fiscal departments. The opinions expressed are those of the authors.

[3] Office of the Governor, Governor Dayton’s Fiscal Year 2012-13 Budget: Keeping our Promises for Protecting Minnesotans’ Health, February 2011.

[4] Association of Metropolitan School Districts, Budget Survey 2010-2011, January 4, 2011.

[5] Minnesota Management and Budget, Governor’s Budget, Department of Employment and Economic Development, March 2011.

[6] Testimony by Robert Bruininks, University of Minnesota President, House Higher Education Policy and Finance Committee, February 22, 2011.

[7] Testimony in House Higher Education Policy and Finance Committee, February 24, 2011.

[8] Minnesota Management and Budget, February 2011 Economic Forecast, February 2011.

[9] Office of the Governor, Governor Dayton’s Fiscal Year 2012-13 Budget: Providing the Best Value for Taxpayers’ Dollars, February 2011.

[10] Minnesota Management and Budget, Governor’s Budget, Minnesota Management and Budget, March 2011.

[11] Minnesota Department of Revenue, 2011 Minnesota Tax Incidence Study, March 2011.

[12] Minnesota Budget Project analysis of Minnesota Department of Revenue, 2011 Minnesota Tax Incidence Study.

[13] The new tax rate applies to $130,000 of taxable income for head-of-household filers and $85,000 for single filers.

[14] Jon Shure, Where Have All the Millionaires Gone?, Center on Budget and Policy Priorities Off the Charts blog, July 15, 2010.

[15] Minnesota Management and Budget, Governor’s Budget, State Taxes and Local Aids and Credits, March 2011.

[16] Children’s Defense Fund-Minnesota and Minnesota Budget Project, Wasted Opportunities: How We Used Our Surpluses 1997-2001, January 2002.

[17] The information in this paragraph comes from Minnesota Budget Project, The Lost Decade: Taking a Closer Look at Minnesota’s Public Investments in the 2000s, December 2008.