“At a time of crisis, it is much better to be generous and wide ranging than to be too targeted,” said Neel Kashkari, the Minneapolis Federal Reserve’s president CEO, in Twin Cities Business.

Referring to potential federal response to the emerging economic crisis caused by the COVID-19 pandemic, Mr. Kashkari further called on Congress and others to take bold action to aid individuals, businesses, and the overall economy, warning that Congress should not be looking for ways to exclude people from receiving benefits.

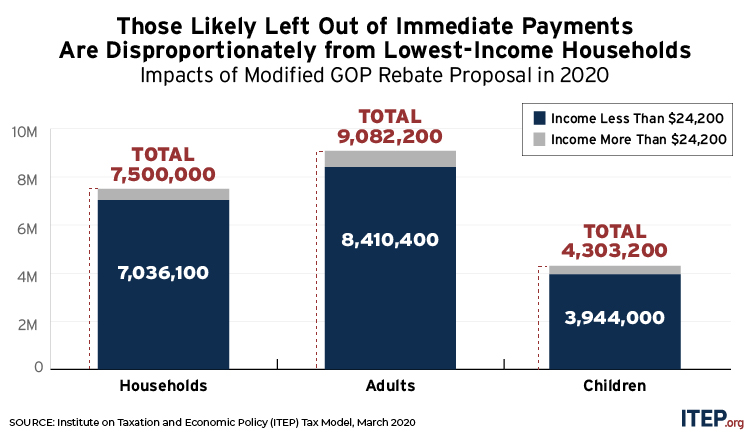

But unfortunately, we continue to see too many people left out of economic stimulus proposals coming from the U.S. Senate. New analysis from the Institute on Taxation and Economic Policy (ITEP) finds that those who are being excluded from immediate financial assistance include lower-income people, who have the least resources to get through this time of financial hardships.

With unprecedented jumps in unemployment and significant financial strain as the nation takes the necessary steps to slow the spread of the coronavirus, it makes sense to provide financial support for individuals and families across the nation so they can pay their bills and keep money circulating in their local economies. An inclusive cash payment is important to reach those who are losing income but are not fully helped by Unemployment Insurance, like the self-employed.

The proposal voted down by the Senate on March 22 failed to prioritize everyday people living paycheck to paycheck. While it improved on an earlier version that left millions of lower-income people ineligible or receiving smaller amounts of assistance, the modified Senate GOP proposal still would leave out 7.5 million Americans and their families from receiving quick financial support. This low-income group includes veterans, very low-income seniors, and others who are not required to file tax returns, as well as immigrant workers who file taxes using an Individual Taxpayer Identification Number (ITIN).

Why does the Senate GOP proposal work this way? It purports to provide $1,200 for each tax filer or spouse and $500 for each child, with households with higher incomes receiving less than the full amount (married couples with incomes above $150,000, single people with incomes above $75,000, and single parents with incomes above $112,500). But many lower-income people would have to wait for their assistance, because only households that filed a federal income tax return for 2019 or 2018, or have received Social Security benefits, would get immediate assistance.

Clearly there is more needed to provide economic stimulus to everyone struggling in the current public health and economic crisis.

This is just one area where improvements are needed in order to prioritize everyday people and families. The proposal also needs to get the balance right between assistance for businesses on the one hand and assistance for people on the other. The bill proposes to spend $500 million on assistance to corporations and businesses – nearly twice as much as the $278 billion that would go to individuals and families. Also troubling is that the assistance to businesses would have almost no strings attached – for example, there are no guarantees that the businesses will use those dollars to keep workers on the payroll.