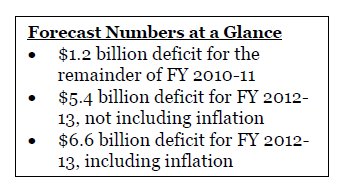

A drop in expected revenue has created a $1.2 billion budget deficit in Minnesota’s current two-year budget cycle, FY 2010-11, according to the state’s recently released November economic forecast. The forecast’s good news is that the national economy is improving. It grew in the third quarter after a record-setting four consecutive quarters of decline. The bad news is that the recovery is expected to be very slow. The labor market is weaker than projected, both locally and nationally. Significantly, that has led to a drop in expected state income tax revenue.

The slow economic recovery is contributing to ongoing deficit problems for the state. The November forecast projects a $5.4 billion shortfall for the next biennium, FY 2012-13.

Minnesota’s constitution requires the state to balance the budget by June 30, 2011, the end of the FY 2010-11 biennium. State policymakers already have begun preparing for quick action when the Legislature reconvenes in February. The November forecast will serve as the starting point for the budget debate. The forecast is the official measure of the state’s fiscal health, and serves as the benchmark against which budget and tax proposals are measured. It is prepared each February and November by Minnesota Management and Budget, which uses Global Insight as its economic consultant. The forecasts predict revenues and expenditures based on current laws and a model of how the economy is expected to perform. The forecast does not reflect any policy proposals that have not yet become law.

Job Losses and Revenue Shortfalls Pushes Deficit in Current Biennium

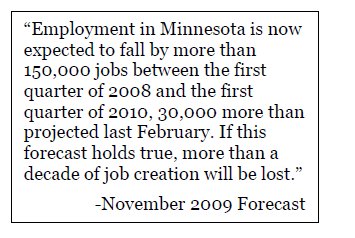

It is a record loss of jobs and decline in wages that is driving the current budget deficit in Minnesota, not increased spending. The November forecast predicts that “employment in Minnesota is now expected to fall by more than 150,000 jobs between the first quarter of 2008 and the first quarter of 2010, 30,000 more than projected last February. If this forecast holds true, more than a decade of job creation will be lost.” Minnesota is expected to have four percent fewer jobs in 2009 than 2008 and non-farm wages are predicted to drop nearly six percent. This is the first time that Minnesota wages and salaries have declined from one year to the next since the state began tracking data in 1970.

This drop in employment, wages and salaries has serious implications for Minnesota’s budget. Compared to 2009 end-of-session estimates, income tax revenues are now projected to drop an additional $827 million for this biennium (FY 2010-11). This fall in income tax revenue accounts for nearly 70 percent of the estimated $1.2 billion deficit. By contrast, general fund spending is actually projected to be slightly lower than end-of-session estimates.

Although the national economy appears to have turned the corner, unemployment continues to be a significant problem. National employment numbers are not expected to return to pre-recession levels until 2013. The nation’s 10.2 percent unemployment rate in October is well above the high predicted back in February. According to the forecast, “in October 17.5 percent of the potential workforce was either unemployed, working less than full time because a full time job is not available, or discouraged and not looking for work.” For those that still have work, average weekly hours have dropped to the lowest level since data was first collected more than 40 years ago.

Future Deficits Await the State

The slow climb out of the recession will have a long-term impact on the state’s finances. For the next biennium, FY 2012-13, the November forecast projects a $5.4 billion shortfall. However, changing the assumptions made by the forecast results in deficit projections ranging from $4.3 billion to $8.1 billion.

- The Governor partially delayed payments to school districts in order to help balance the budget. The forecast assumes that the bulk of that money will be repaid in FY 2012-13. Continuing to delay those payments would decrease the deficit by $1.2 billion.

- The forecast assumes that a portion of the delayed school payments (the property tax recognition shift) will not be repaid in FY 2012-13. Repaying the property tax recognition shift in FY 2012-13 would add $562 million to the deficit.

- The Governor line-item vetoed and unalloted General Assistance Medical Care (GAMC), a health insurance program for very low-income childless adults. Fully restoring GAMC would add $928 million to the deficit.

- A 2002 law prohibits Minnesota Management and Budget from factoring in inflation when calculating the state’s future spending needs. Including inflation would add $1.2 billion to the deficit.

National Outlook: Great Recession Ends, The “Not-So-Great” Recovery Begins

The forecast notes that the worst recession in more than 60 years has ended, but anyone expecting a quick economic rebound will be disappointed. Typically, the economy will surge after emerging from a recession. In contrast, this recovery is expected to be long, slow and bumpy. The national economy is not expected to hit the typical post-recession growth spurt until 2012. For Minnesota in particular, total wages are projected to increase in 2010, but the state is expected to continue to lose jobs in the coming year.

Some key points made in the forecast’s national economic outlook include the following:

- The economy is stabilizing: Job losses in the U.S. are slowing down as more firms report they will be hiring and fewer firms report that they will have lay-offs.

- Business will be slow to hire: Until they are convinced that the economic recovery is self-sustaining, firms are likely to restore hours to existing workers before making new hires.

- More saving means less spending: The recession wiped out wealth for many older Baby Boomers nearing retirement. They are now saving more and spending less, taking an estimated $400 billion annually out of consumer spending.

- Federal stimulus creates uncertainty: The extra influx of federal funds into the economy through the American Recovery and Reinvestment Act (ARRA) will begin to fade in late 2010. However, as long as credit conditions improve, and individuals and businesses are able to obtain favorable loans, the economy will continue to recover despite the loss of stimulus dollars.

The forecast is a prediction. Global Insight includes an assessment of risk, or how likely it is that the economy will perform differently than predicted. Global Insight gave its November forecast a 60 percent probability of happening. On the other hand, there is a 20 percent probability that the economy will worsen and go into a “double-dip” recession. There is also a 20 percent probability that the economy will actually do better than projected and recover more quickly.

Policy Changes Create a Shortfall in the Health Care Access Fund

The 2009 Legislative Session ended acrimoniously and the General Assistance Medical Care program (GAMC) is one symbol of the political breakdown. GAMC provides health insurance to approximately 39,000 very low-income adults. The recipients are mostly adults between the ages of 21 and 64 who do not have any dependent children, but often face significant mental health and chemical dependency issues. These individuals’ incomes must be below 75 percent of the poverty level, earning less than $677 per month.

Near the end of the session, the Governor signed the omnibus health and human services bill into law, but used his authority to line-item veto funds for GAMC, effectively eliminating the program in FY 2011. The Governor followed up by making further cuts to GAMC through the unallotment process, ending the program three months earlier than originally expected. In November, Minnesota’s Department of Human Services (DHS) announced that GAMC enrollees would be automatically enrolled in MinnesotaCare, another public health care program. Many argue that MinnesotaCare is not a feasible alternative for most GAMC enrollees, and legislators will likely seek to restore GAMC in a modified form during the 2010 Legislative Session.

These actions have important implications for Minnesota’s general fund and the state’s Health Care Access Fund (HCAF). The HCAF was created in 1992 and funds MinnesotaCare, a low-cost health insurance program for working Minnesotans. It receives revenue from health care provider taxes and premiums from enrollees in MinnesotaCare. GAMC is funded solely through the state’s general fund. Shifting the GAMC population into the MinnesotaCare program helped reduce the state’s general fund deficit for the FY 2010-11 biennium, but it also shifted significant costs to the HCAF.

If no changes are made during the 2010 Legislative Session, the November forecast projects that the enrollment of GAMC recipients in MinnesotaCare will cause the HCAF to begin running a deficit in FY 2011. Due to a law that is currently in place, the general fund will contribute $159 million to keep the HCAF solvent through the end of FY 2011. However, starting in FY 2012 (which begins July 1, 2011), the HCAF will start showing a deficit. By the end of the FY 2012-13 biennium, the HCAF is projected to face a $839 million deficit. If GAMC had not been eliminated, the HCAF would not have begun running a deficit until FY 2012, and the shortfall would only have risen to $223 million by the end of the FY 2012-13 biennium.

Once the HCAF runs a deficit, DHS is required by law to take actions to bring the fund back into balance. Under current conditions, DHS officials report that they will stop any new enrollments for adults without dependent children in MinnesotaCare starting July 1, 2011. In addition, by FY 2013 DHS estimates that it will need to disenroll 92,000 adults without children to eliminate the HCAF’s deficit, or about 99 percent of all childless adults on MinnesotaCare.[1]

What Happens Next?

Legislators have already started working at the Capitol to develop proposals in time for the start of the next legislative session on February 4. And the Governor is expected to release a supplemental budget proposal in February for addressing the state’s budget deficit.

One budget wild card is whether the federal government will approve another infusion of funds to states like what was done through the American Recovery and Reinvestment Act (ARRA). Minnesota received $816 million in “fiscal stabilization funds” that were used mainly to prevent cuts in E-12 education and reduce cuts in higher education, but also helped to avoid some smaller reductions in public safety and health and human services. The state also received $1.8 billion in increased federal funding for Medicaid, allowing the state to avoid cuts in health care and prevent people from losing coverage. If the federal government approved new stimulus funding through additional state fiscal stabilization funds, increased federal funds for Medicaid or some other mechanism – it would help ease Minnesota’s budget deficit and allow the state more time to address the long-term structural deficit issues.

The deficit will be a major topic of discussion for the coming session, with policymakers battling over whether increased revenues should be part of the solution. Governor Pawlenty has said he will not consider tax increases. DFL leaders say all options – including revenues – need to be on the table.

The economy has been a big part of Minnesota’s budget problems, but not the only part. Minnesota also has a long-term structural budget problem that has resulted from past policy decisions. Minnesota has now faced budget deficits in seven of the past nine legislative sessions. Federal stimulus money and one-time budget actions helped balance the budget in 2009. However, one-time options are dwindling while deficits keep looming.

After years of either cuts or relatively small increases in state investments, the choices get more difficult. Policymakers have the opportunity to leave a legacy and put the state on much stronger financial footing. It is possible to balance the budget in ways that ensure adequate revenues are raised, make the investments that Minnesotans expect for our economic well being and quality of life, and deal with structural problems to create a long-term, sustainable budget.

Unless otherwise noted, the information in this analysis comes from Minnesota Management and Budget’s November 2009 Economic Forecast.

[1] Health Care Access Commission hearing, December 16, 2009.