The 2016 Legislative Session seemed ripe for opportunity to invest in a more equitable and prosperous Minnesota. However, policymakers had vastly different priorities for the use of a projected budget surplus, and ultimately only one major piece of budget legislation was enacted into law. As a result, much of the surplus went unallocated. The final budget decisions made this session combine small but positive steps toward a broadly shared prosperity with some missed opportunities.

One area of progress was a higher level of attention to the state’s racial opportunity gaps. Expanding economic opportunity to all Minnesotans, regardless of their race or where they live, is critical for the state’s future. Minnesota is looking at its deep racial disparities to a greater degree than perhaps ever before. This was reflected in a new emphasis on equity by policymakers through the policy proposals they put forward and new legislative structures, such as the pre-session Legislative Working Group on Economic Disparities and the Senate’s Subcommittee on Equity.

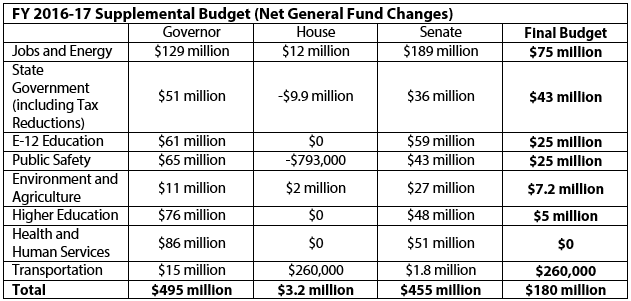

However, for the most part, policymakers struggled to reconcile their very different approaches to the use of the surplus. Governor Mark Dayton’s proposed supplemental budget included investments in education, supports for Minnesota’s workforce, and a safe and modern transportation system. He proposed a limited amount of tax cuts, with a strong focus on tax credits for working families. The Senate followed a similar strategy of investment in their budget targets for the session, allocating one-third of the surplus to tax cuts that again focused on working families, while proposing investments in education, a major paid family leave initiative, and better access to health care. The House of Representatives proposed a very different path that would use most of the surplus for tax cuts and new funding for transportation, with only very minimal investments in other areas of the budget.

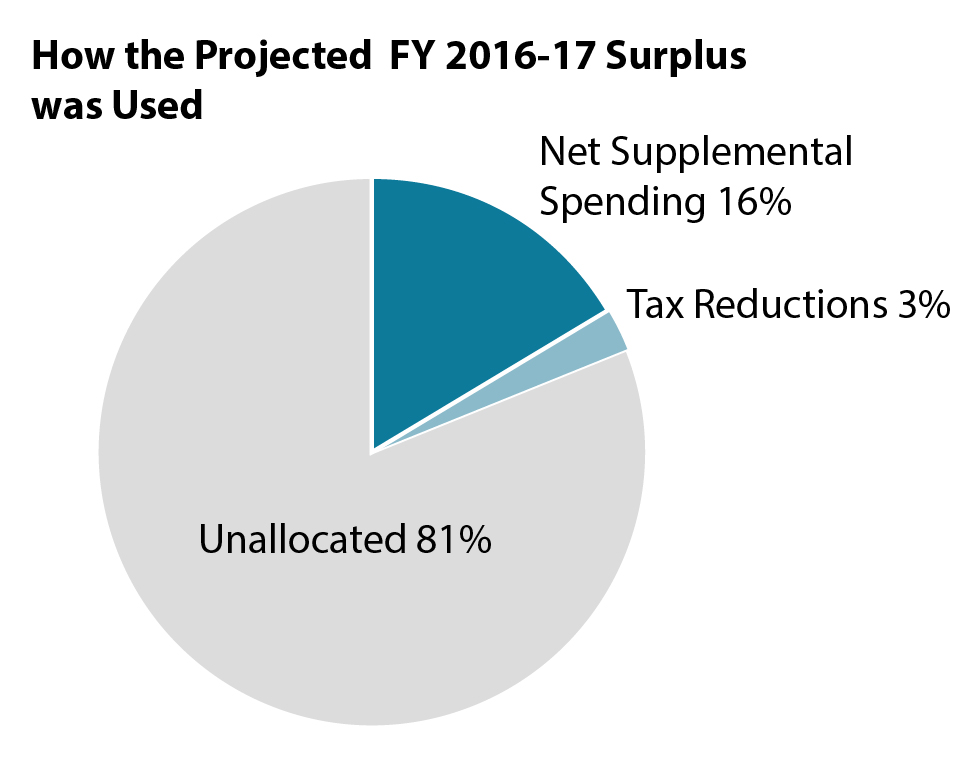

The session began with a $900 million projected surplus for the FY 2016-17 budget cycle already underway, and a $1.2 billion projected positive balance for FY 2018-19.[1] These dollars could be used for targeted initiatives that would build on the state’s two-year budget passed in 2015. The supplemental budget legislation passed by the Legislature and signed into law by Dayton allocated about one-sixth of the surplus – a net $156 million – for additional spending in FY 2016-17, including a package of racial equity initiatives, expanding voluntary pre-kindergarten, broadband access for Greater Minnesota, and provisions that make it easier for Minnesotans to access health care.

The Legislature also passed a tax bill containing $257 million in tax reductions and increased aids to local governments. This bill included several provisions that made working families its priority, including nation-leading improvements to the Working Family Tax Credit and expansions of the Child and Dependent Care Credit. However, a serious drafting error was found in the tax bill after the legislative session had ended, which would have resulted in an additional $100 million in lost revenues over a three-year period.[2] As a result, the governor did not sign the tax bill into law.

Policymakers were unable to reach agreement on two other major finance bills this session. For the second year in a row, they failed to pass a substantial transportation bill, due to disagreements on which transportation investments the state should make and how they should be funded. Legislative sessions in even-numbered calendar years like this one are also typically “bonding years” in which policymakers pass a capital budget bill to finance improvements in our state’s infrastructure, such as roads and public buildings. In the last days of the legislative session, policymakers tried but failed to reach a compromise between their different approaches to bonding and transportation, again disagreeing on the size of the bill and which projects it would contain.

Over the summer, legislative leaders and Dayton continued negotiations about a potential special session to pass legislation addressing bonding and transportation as well as a corrected tax bill. However, they were unable to reach an agreement by Labor Day so these unresolved issues will likely wait until next session.

With the supplemental budget bill being the only major finance bill enacted into law, that left $729 million of the projected surplus unspent, or “on the bottom line.” The remainder of this analysis takes an in-depth look at the supplemental budget bill and tax bill, evaluating proposals that made the final budget as well as important provisions that didn’t make it in.

Education Investments Support Students from Early Childhood through College

A strong education is crucial to a person’s economic success; making sure all of Minnesota’s children get a solid education is key to the state’s future success. Minnesota has long made education a priority, but significant achievement gaps between white students and students of color remain. The final budget includes provisions that affect students across the state, as well as more targeted funding intended to narrow the achievement gap. Policymakers invested $25 million in E-12 education in FY 2016-17, which climbs to $79 million in FY 2018-19. Much of the funding increases are made possible through savings to the state expected to result from a loan refinancing option for some school districts.

The Legislature agreed to fund one of the governor’s highest priorities, voluntary pre-kindergarten, allocating an additional $19 million in FY 2017. Priority for this funding is given to areas with higher poverty rates and a lack of high quality rated pre-school options. The final E-12 education budget also includes a House proposal for an additional $4.9 million in FY 2017 for equity aid funding and stipulates this equity aid be available to non-metro schools. In the past, this aid was only available to metro area schools.

The final bill also includes several initiatives to improve achievement gaps, such as:

- $1 million for the Minnesota Reading Corps, which helps students achieve reading proficiency standards at an early age so that they are not left behind;

- $1 million for Full Service Community Schools, which help kids thrive in and out of class by facilitating school and community resource partnerships;

- $2.8 million to support positive learning environments through Positive Behavior Interventions and Supports;

- $920,000 to improve access to Adult Basic Education; and

- $270,000 to help bring more Native American teachers into the workforce.

The education provisions also include funding to support development of teachers and proper placement of support staff to help improve students’ learning environments, as well as increased funding for early childhood education.

Policymakers also devoted $5 million of the surplus to higher education, with $2 million for the state grant program, which provides financial aid for low- and moderate-income students, and $500,000 for colleges and universities to narrow gaps in college education attainment between students of color and white students.

Some Families Will Better Access the Support They Need in Health and Human Services

Health and Human Services (HHS) is a broad budget area comprising critical services and resources to Minnesotans who might otherwise wind up in financial or physical danger. That includes our oldest and our youngest residents, and people with disabilities or mental illnesses. It also includes families who have fallen on tough times and people who work hard but for whom health insurance is out of reach.

The HHS portion of this year’s supplemental budget bill contains important investments that will maintain and strengthen Minnesota’s safety net for people with mental illnesses or disabilities. However, it missed several opportunities to help thousands of Minnesota families find a path to economic security.

The supplemental budget increases HHS expenditures by $79 million in FY 2016-17 and $154 million in FY 2018-19; however, the general fund resources devoted to HHS will remain the same. The additional investments are largely made possible by a $74 million transfer from the Health Care Access Fund, which is a funding source for affordable health care through Medical Assistance and MinnesotaCare. The change is intended to update an existing transfer for payments that cover services provided by health insurers and providers. The existing transfer was capped in 2005, but the value of the services have continued to increase over time. Prior to the passage of the supplemental spending bill, the Health Care Access Fund was projected to have a $1 billion surplus in FY 2019. As a result of the transfer and several other small expenditures and transfers, the Health Care Access Fund’s projected surplus in FY 2019 is now $936 million.

The bulk of the new HHS spending is devoted to direct care, treatment and support for Minnesotans with mental illnesses. Combined with investments in the state’s treatment system for people convicted of sex offenses, spending on direct services will increase by a total of $63 million in FY 2016-17 and $71 million in FY 2018-19. The state will also invest in certified community behavioral health clinics, spending $188,000 in FY 2017 and $8.4 million in FY 2018-19 on an innovative treatment model that may be matched by an additional $15 million in federal dollars.

The bill spends $7.3 million in FY 2017 and $33 million in FY 2018-19 to address changes resulting from the Affordable Care Act that were causing some people who get health insurance through Medical Assistance to be charged more for their care. The bill modifies provisions in law that place liens on some enrollees’ estates and require the partners of Minnesotans with a disability served through Medical Assistance to liquidate certain assets to pay for their loved one’s medical care.

In FY 2018-19, the state will spend an additional $29 million on some of the most vulnerable young Minnesotans through a higher payment rate to foster parents, and through increased funding for the Homeless Youth Act, school-linked mental health services and Safe Harbor for Sexually Exploited Youth. An additional $2.8 million in FY 2017 and $3.8 million in FY 2018-19 will go to tribal governments to support their efforts to provide culturally responsive human services.

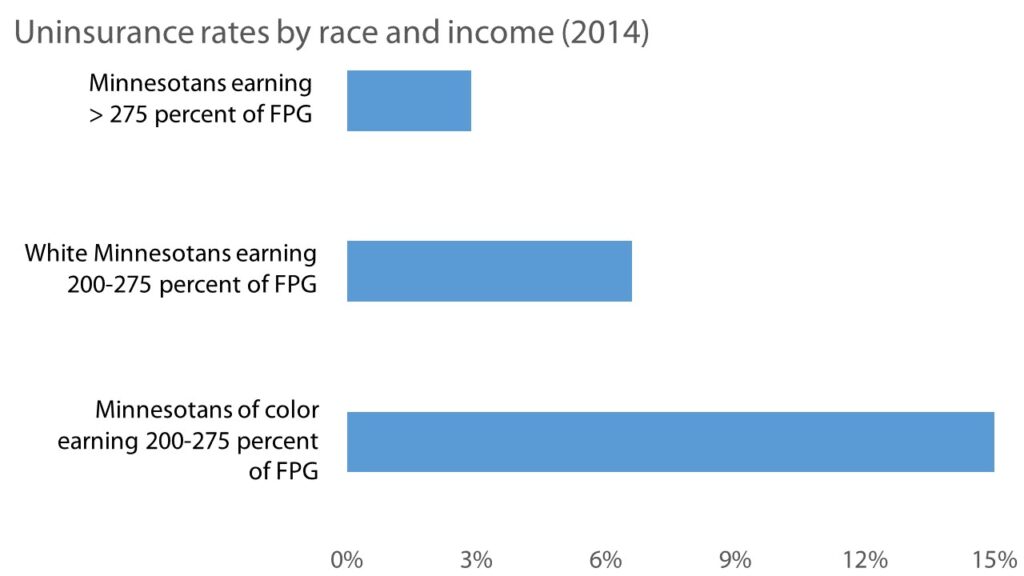

Unfortunately, the supplemental bill did not include proposals considered during the session that would have supported families across the state struggling to reach economic security. Among the disappointments was the failure to re-institute eligibility for MinnesotaCare for Minnesotans earning 200 to 275 percent of the federal poverty guideline (about $24,000 to $33,000 for a single adult). Minnesotans in that income range are about three times more likely to lack health insurance compared to their higher-income neighbors; the disparities are even worse for Minnesotans of color.[3] This proposal was one of the recommendations made earlier this year by the bipartisan Governor’s Health Care Finance Task Force, which found that the proposal could save the state money, depending on the result of negotiations with the federal government.

The bill also failed to strengthen the Child Care Assistance Program (CCAP), leaving 5,754 families on the waiting list. Updating state reimbursement rates paid to providers would have responded to the shrinking number of child care provider options for families who use CCAP. Child care can be a major obstacle to economic security for families who are struggling to pay their rent and other basic needs. When families have affordable child care, parents can go to work safe in the knowledge that their children are thriving in stable care environments, and a serious roadblock to success in the workplace is removed.

Another disappointment is that, for the 30th year in a row, the state will not increase cash assistance offered by the Minnesota Family Investment Program (MFIP), a crucial but cruelly out-of-date support for Minnesota families who fall on hard times. MFIP provides a cash grant that is intended to allow a family to meet their most basic needs until they land on their feet. But the MFIP monthly cash grant has not increased since 1986, when it was set at $532 for a family of three. That won’t cover fair-market rent on a two-bedroom apartment anywhere in the state. The longer that cash assistance stagnates, the longer 64,000 Minnesota children will live in families unable to afford the most essential necessities.

Another major proposal that failed to make it into the supplemental spending bill would have better maintained services for Minnesotans with disabilities. Due to a federal rule change, the home care workers who take care of people with disabilities will now be covered by federal laws regarding overtime and travel pay. The federal changes are meant to ensure that these workers – who are disproportionately women and people of color – are paid more adequate wages for this difficult but important work. However, it also means the services provided by these workers will become more expensive, particularly for people who live in hard-to-reach areas of the state. The governor and the Senate proposed spending about $20 million per year to cover the cost of the new rules and allow people with disabilities to continue their current level of service. This investment is not in the supplemental budget bill, likely leading to decreased services for people with disabilities served through Medical Assistance.

Fortunately, the supplemental budget also left out proposals that would have created problems for Minnesotans trying to obtain affordable health care. It did not incorporate a harmful proposal to add asset tests to MinnesotaCare, an already tried and failed approach that would have placed a bureaucratic wall between 100,000 Minnesotans and affordable health insurance. A provision that would have allowed MinnesotaCare enrollees to choose health insurance plans with higher cost-sharing and premiums also was left out of the bill.

Tackling Racial Disparities through Housing, Economic Development

A strong workforce has been one of the keys to Minnesota’s economic success. And a strong workforce relies on education, specialized training and stable housing. Minnesota workers also benefit when the state enacts policies that increase the quality of jobs in Minnesota. Jobs and Economic Development was the part of the supplemental budget bill where policymakers put the most additional resources, allocating $75 million in FY 2017 and $16 million in FY 2018-19. About $21 million of the investments in economic development are not paid for from the surplus but through cuts to the Minnesota Investment Fund and the Minnesota Job Creation Fund, which provide financing to create and retain jobs in the state.

Tackling racial disparities was a prominent issue of the session; both Dayton and the Senate released specific equity proposals, and the House included equity initiatives within their economic development budget proposal. These provisions seek to move the needle on the state’s economic disparities; and most of the equity funding included in the supplemental budget continues into the next biennium, rather than only providing a one-year infusion as was originally proposed for many of these initiatives. In the final budget agreement, policymakers dedicated $35 million in FY 2017 to address the state’s economic disparities, including:

- $6.9 million in grants for the Latino, Somali, Southeast Asian and American Indian communities to address educational, employment and workforce disparities, and to support youth;

- $1.5 million to promote high-wage, high-demand non-traditional jobs for women;

- $1 million for a Minnesota Youth at Work Competitive Grant Program that will connect at-risk youth with employment opportunities, targeted toward youth of color and others who face barriers in the job market;

- $1 million for Pathways to Prosperity, which helps prepare low-wage workers for high-demand jobs; and

- $500,000 for the Emerging Entrepreneurs Fund, which helps fund loans to businesses owned by disadvantaged groups, including people of color, women and people living with disabilities.

Providing access to broadband internet services for under- and unserved areas of Greater Minnesota was a priority expressed by the House, Senate and governor, and about half of the net new funding in economic development is for that purpose. Only $5 million of the $35 million in additional broadband funding can go to underserved areas, defined as areas where households and businesses have internet speeds slower than the state’s 2026 goals. Policymakers also set aside up to $500,000 for areas with significant low-income populations. The final funding for broadband is much closer to the House’s proposed figure of $15 million than the governor’s and Senate’s proposals of $100 million and $85 million, respectively.

The economic development portion of the supplemental budget bill also provided limited additional investments in housing, including $500,000 for rental assistance for exploited women and children, and $750,000 for a statewide workforce and affordable housing program.

A high profile issue that did not make it into the final bill was the Senate’s proposal to expand paid family and medical leave to more workers in Minnesota. This proposal would allow employees to better make ends meet because they would be able to continue to receive some income when they take time off of work after the birth or adoption of a child, or to care for a seriously ill family member. The paid family leave system would be funded through payroll taxes.

Tax Proposal Included Important Steps Forward for Working Families

The theme of missed opportunities applies also in the tax area. The tax bill that passed the Legislature this session but was not signed into law included a strong commitment to supporting the work efforts of Minnesotans trying hard to support themselves and their families, and build on the state’s recent progress toward a sustainable and equitable tax system.[4]

The tax bill that passed the Legislature would have used $257 million of the surplus for the remainder of FY 2016-17 and $544 million in the next two-year budget cycle (FY 2018-19). Those figures include both tax reductions, much of which focus on working families, and additional appropriations, primarily increased funding to local governments. However, a serious drafting error in the bill caused Dayton to “pocket veto” the bill.

Two highlights of the tax bill were expansions of the Working Family Tax Credit and Child and Dependent Care Credit, both of which support working Minnesotans to get by and get ahead. The Working Family Credit provisions provided $49 million in tax reductions to an estimated 386,000 Minnesota families and workers across the state by:

- Increasing the size of the tax credit for most currently eligible families and individual workers;

- Making some additional families and individual workers eligible by increasing the incomes that they can earn and still qualify for the credit; and

- Reaching younger workers without dependent children by lowering the age requirement to qualify for the credit from 25 years old to 21.

The Working Family Credit provisions for workers without dependent children are truly nation-leading, and would support younger workers and others to be successful as they start their working lives. Minnesota would become the first state, following Washington, D.C., to improve its state Earned Income Credit for workers without dependent children, building on bipartisan efforts to make similar improvements at the federal level.[5]

In addition to supporting work, expanding the Working Family Credit can narrow racial income disparities and is focused on those income groups who on average pay the largest share of their incomes in Minnesota taxes.

The tax bill also supported Minnesota’s working parents through a targeted expansion of the state’s Child and Dependent Care Credit. Child care can be one of the largest costs that families with younger children face, and expanding this credit is a strategy to make child care more affordable. The credit offsets a portion of what a family pays for child care while parents are working or looking for work, but it hasn’t kept up with the rising costs of child care. The $9.8 million expansion of the Child and Dependent Care Credit in the 2016 tax bill takes some important initial steps by:

- Increasing the maximum amount of credit that families can receive to $1,050 for families with one child and $2,100 for families with two or more children; and

- Increasing the income that families can earn and still qualify for the credit to $44,900 for families with one child and $51,800 for families with two or more children.

The bill included additional funding for free tax preparation and related financial capability services, which would have meant more Minnesotans could get the tax credits for which they qualify and use their tax refunds to build savings and a stronger economic future.

Some of the other larger provisions in the tax bill included:

- New tax provisions to address student loan debt and savings for college, which include: a refundable student loan debt credit of up to $1,000 for student loan payments that exceed 10 percent of the taxpayer’s adjusted gross income ($37 million in tax reductions in FY 2017); a refundable tax credit of up to $500 for contributions to Section 529 college savings plans ($8.4 million in FY 2017); and a similar subtraction for contributions to 529 plans or prepaid tuition plans ($7.4 million in FY 2017);

- Federal conformity provisions to update the state’s individual and corporate income taxes to match federal changes; these would reduce taxes by a net of $17 million in FY 2016-17 and raise revenues by $33 million in FY 2018-19;

- Increasing the tax credit for past military service from $750 to $1,000 and increasing the income limit to qualify for the credit ($4.5 million in FY 2017);

- Reducing tobacco taxes by $3.2 million in FY 2017 and $29 million in FY 2018-19 through repealing the annual inflation adjustment on tobacco tax rates and changing taxes on vapor products;

- Increasing Local Government Aid to cities by $20 million per year, increasing County Program Aid to counties by $10 million, and providing $10 million per year to counties implementing buffers to address agricultural run-off;

- Exempting the first $100,000 of a property’s value from the statewide property tax paid by commercial-industrial properties; this is a $31 million reduction for a partial year in FY 2017 and about $58 million per year starting in FY 2018; and

- A new tax credit on agricultural land and buildings equal to 40 percent of the property taxes related to voter-approved bonding by school districts. Proponents argue that this tax credit will help rural school districts that currently have difficulty passing local referenda to approve bonds to build or improve school facilities.

One of the real dangers posed in this session was that policymakers would pass large and unsustainable tax cuts, as happened during the surplus years of the late 1990s and early 2000s. The House tax proposal included $999 million in tax cuts and diversions of existing revenues in the current budget cycle, which would take all of the surplus and more. Its price tag grew to $2.7 billion for FY 2018-19, and it included “phased in” tax cuts that would grow substantially over time, disguising their true cost and threatening the state’s ability to fund schools, health care and other critical services.[6]

Fortunately, the 2016 tax bill left out the largest and most poorly targeted proposals that were on the table. It does not cut the estate tax, which would have benefited only a small number of the largest estates. It left out expensive proposals to exempt all Social Security income from the income tax, which would have had no benefit for the state’s most struggling seniors and had a high price tag that would put the services that seniors count on at risk. And it left out the House’s proposal to eliminate the statewide property tax paid by businesses and cabins, which would have ultimately cost about $1 billion a year when fully in effect and provide the largest tax cuts to the state’s highest valued properties.

There were a small number of tax provisions that did pass this session. The supplemental budget bill included $24 million in tax reductions in FY 2017 and $63 million in FY 2018-19 from the following:

- Exempting military service pension income from the income tax; about 16,400 taxpayers will receive $23 million in total tax cuts from this provision;

- Extending the Small Business Investment Tax Credit (also known as the “Angel Investor” tax credit) for another year and providing an additional $10 million in tax credits;

- Creating a new tax credit for parents of stillborn children; an estimated 400 tax returns are expected to receive tax credits totaling $800,000 per year; and

- Changes to sales tax treatment of modular homes.

Policymakers Make Some Good Investments, Leave Most of the Money on the Bottom Line

Considering the $900 million surplus, the state had an important opportunity to take positive steps toward more broadly shared prosperity. Policymakers delivered on this in some ways, especially through making an important down-payment on making the state’s economic opportunities available to everyone, regardless of race or place. But they missed many more opportunities to support Minnesotans struggling to move up the ladder toward economic security, like improving the cash grant for MFIP and increasing access to affordable child care. Additionally, the drafting error in the tax bill meant that critical supports for working people through the Working Family Credit and Child and Dependent Care Credit aren’t in place just yet.

The session ended with about 80 percent of the projected surplus unspent. This leaves a projected $729 million financial cushion. This figure will be updated when the November Economic Forecast comes out this fall to determine how much will be available when policymakers come back next year to put together the state’s FY 2018-19 budget. When they do so, key priorities should be continuing the state’s progress toward opening windows for economic opportunity to more Minnesotans and ensuring that Minnesotans who hit a rough patch have the support they need.

By Clark Biegler, Ben Horowitz, and Nan Madden

[1] Except where otherwise noted, the analysis in this report is based on data from budget documents prepared by Minnesota Management and Budget and the applicable state agencies, and legislative research and fiscal departments. The opinions expressed are those of the Minnesota Budget Project.

[2] Star Tribune, Gov. Dayton says he won’t sign tax cuts without a special session, June 2016.

[3] Minnesota Budget Project analysis of 2015 American Community Survey data.

[4] See Minnesota Budget Project, Minnesota Tax System Now Fairer, But There’s More to Do, September 2015.

[5] For more information on the federal discussion, see Center on Budget and Policy Priorities, Strengthening the EITC for Childless Workers Would Promote Work and Reduce Poverty, April 2016.

[6] These figures are the updated estimates by House and Senate Fiscal staff of the House 2015 tax bill, updated for the February 2016 Forecast and updated implementation dates.