We’re getting “back to normal”, but that isn’t enough

The state of Minnesota’s revenue and economic picture continues to improve, according to the July Revenue and Economic Update. Federal stimulus actions, progress in bringing the pandemic more under control, and economic re-opening are important contributing factors. But the pandemic and recession’s impact on Minnesotans won’t be eliminated overnight, and we’re not yet seeing an equitable recovery.

Some of the top takeaways from the Update include:

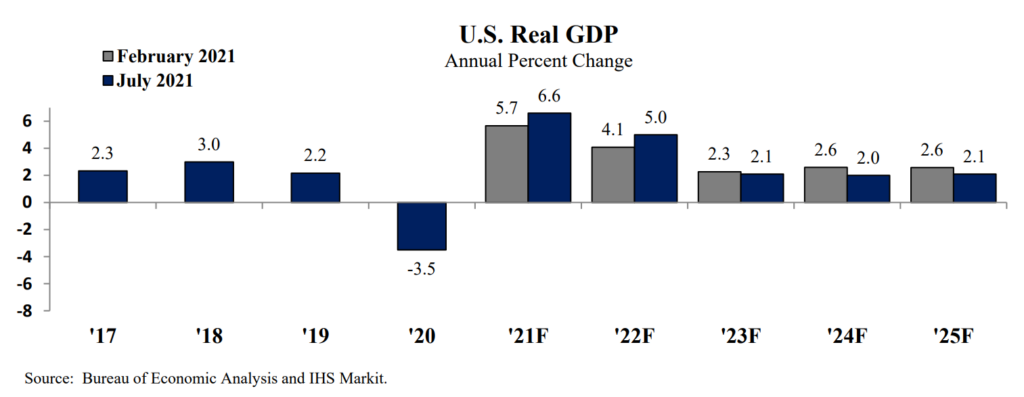

1. Near-term national economic expectations are improved. After a 3.5 percent reduction in the nation’s GDP last year, forecasters now predict 6.6 percent GDP growth in 2021 and 5.0 percent in 2022. That’s stronger than expected in the state’s February forecast. This good news is largely due to federal economic stimulus payments and other policies to jumpstart the economy, increasing vaccination rates, and the re-opening of many businesses and other indicators of economic rebounding.

2. State fiscal year 2021 revenues came in higher compared to the February forecast. Revenues for Minnesota’s FY 2021, which ended on June 30, came in $2.7 billion or 11.2 percent higher than February projections. Individual income tax and corporate tax revenues were the largest sources of this increase. The Update notes higher income tax collections in 2020 and 2021 compared to earlier estimates.

3. Unemployment has fallen, but many people are still out of work. In June, the national unemployment rate was 5.9 percent, down from the peak of 14.8 percent in April 2020. However, the unemployment rate is still 2.4 percentage points above the February 2020 pre-pandemic level. Furthermore, the official unemployment rate doesn’t measure people who stopped looking for work during the pandemic and haven’t yet reentered the labor force. Additionally, four million American workers have been unemployed for six months or more; that’s almost three million more people who are long-term unemployed compared to pre-pandemic.

4. Forecasters are only somewhat confident in their projections. The nation’s economic performance continues to be dependent on the severity of the pandemic and the effectiveness of efforts to bring it under control. The emergence of new, more contagious strains of the virus is adding uncertainty about the course of the pandemic; the slowing of vaccination rates is also reflected in forecasters’ uncertainty about their economic projections. Forecasters assign a 50 percent chance that their baseline economic scenario is correct. They give a 20 percent chance for a more pessimistic scenario in which the pandemic causes greater economic harm. They assign a 30 percent probability to a more optimistic scenario in which the impact of COVID-19 is less severe due to a stronger uptick in vaccination rates and greater adherence to mask-wearing and social distancing.

The state’s ledgers showing a positive balance doesn’t mean that all Minnesotans are thriving. Labor market participation is still down, and many workers have not yet received the vaccinations or access to reliable child care they need to return to work. After more than a year of economic distress, 1 in 10 Minnesota adults said they couldn’t afford for the children in their homes to get enough to eat, 93,000 Minnesotans are behind on rent, and nearly 800,000 are having trouble covering basic household expenses. Minnesota students, teachers, and families won’t recover overnight from the disruption to learning caused by the pandemic and the necessary efforts to contain COVID-19.

So we’re not yet back to normal, and getting back to normal should not be our goal. Hardship and inequality didn’t originate with the COVID-19 pandemic. Minnesota has long been home to deep divides in opportunity across lines of race, income, and geography. Our pre-pandemic state budget was not doing enough to make Minnesota a state where everyone can be healthy, safe, and financially secure. It left in place deep inequities baked into our current systems that disproportionately harm Black, Indigenous, and other People of Color (BIPOC) and lower-income Minnesotans.

There are clear needs in our communities and for a more equitable recovery. Policymakers must intentionally focus on those goals as they make budget decisions, including about federal funds coming from the American Rescue Plan (ARP).

The global budget agreement negotiated this May laid out the process for using flexible ARP funding coming to the state. Governor Tim Walz will determine how to allocate $500 million, state budget legislation passed in June allocated $633 million to be spent in FY 2022-23 and $550 million in FY 2024-25, and decisions about the remaining $1.2 billion will be made in the 2022 Legislative Session. In addition, the American Rescue Plan allocated billions of dollars to dedicated purposes (such as education, higher education, housing, and child care), and to local and tribal governments in Minnesota. These funds too should be used to contribute to a more equitable and prosperous Minnesota.

Federal stimulus legislation enacted over the past year including the CARES Act and the American Rescue Plan have shown how investments in people, communities, and state and local governments can buoy families, communities, and the economy. However, we were disappointed that the recently passed state budget largely does not make the transformative investments that this moment calls for.

State budget funds and federal stimulus dollars are significant resources that should be used to respond to the unique time we’re in, and to advance Minnesotans’ health and well-being through investments in things like our schools, affordable housing, health care, a more equitable justice system, and support for BIPOC-owned businesses.