If Congress does not act soon, Minnesotans across the state will see their health insurance costs spike for 2026. As open enrollment nears and the expiration of enhancements on premium tax credits loom, many across the state are seeing their health care premiums for next year increase by more than 50 percent.

Since 2021, enhanced premium tax credits (ePTCs) kept health insurance premium costs down for most people who buy their health insurance on the marketplace, known as MNsure in Minnesota. These Minnesotans include farmers, independent contractors, early retirees, and people who do not have affordable health insurance through their employer. In 2025, about 92,000 Minnesotans used premium tax credits to decrease their health insurance costs by roughly $360 a month.

Without congressional action, health insurance premiums will increase across Minnesota

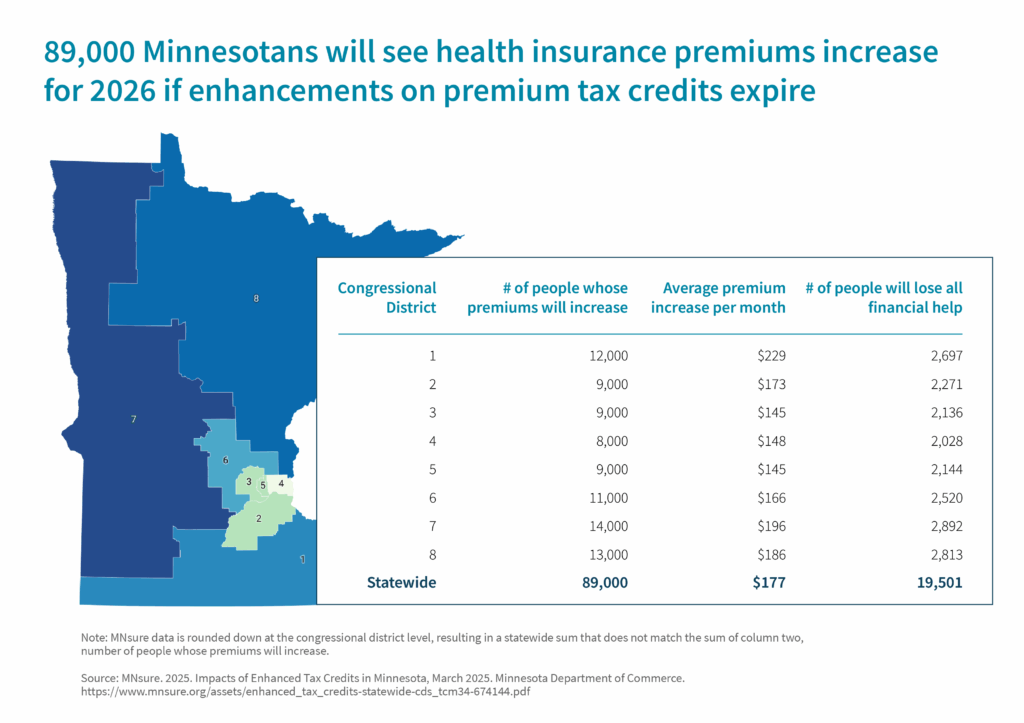

Enhanced premium tax credits have contributed to the record high levels of health insurance coverage in Minnesota. If they expire, the increased cost of health insurance will add stress to the household budgets of roughly 89,000 Minnesotans across the state. An estimated 19,500 people across the state would lose all financial help.

To help folks understand the significance of ePTCs expiring, KFF developed a tool where people can input their information and estimate how their premiums will be impacted.

In 2021, premium tax credits were enhanced to further bring down the cost of health insurance premiums and eligibility was expanded to include households with income levels above 400 percent of federal poverty guidelines. If this tax credit enhancement expires and income eligibility narrows, low- and moderate-income households could see dramatic increases in their health insurance costs.

- For example, a married couple in their 60s in Mankato, earning $89,000 a year, will see their net premiums increase from $500 a month to $2,000 a month in 2026. This is a startling 322 percent increase.

Spikes in costs for insurance premiums will put real pressure on household budgets and could force people to make tough choices about health coverage for them and their family.

If enhanced premium tax credits expire, people will be less healthy, hospitals will see increased costs, and the economy will be worse off

Without health insurance, people are less healthy, hospitals see increased costs, and the economy is worse off. Those without health insurance often delay care for conditions that could have been caught and treated early, and they often wait to see someone until these conditions are serious and possibly life-threatening. Hospitals see increased costs because of rises in uncompensated care, which happens when people without insurance cannot afford to pay the hospital for the health care they need.

With health insurance, employees generally take fewer sick days because they get sick less often and are more likely to recover and go back to work after an illness. Employers are then better able to maintain levels of service.

Congress should act soon to permanently extend enhancements on premium tax credits

Enhanced premium tax credits make health insurance more affordable for people buying marketplace coverage by lowering their monthly premiums. Because of the enhancements, more people across the state can afford health coverage and get the care they need, when they need it. When people have health insurance, communities are healthier, hospitals are more financially stable, and the economy is better off. If Congress lets enhancements on premium tax credits expire, some Minnesotans will be priced out of the market and forced to drop their health insurance, and tens of thousands will see sharp increases in premium prices.

Open enrollment for health insurance starts on November 1, and our representatives in Congress need to know how the expiring health care tax credits will make health insurance more expensive for Minnesotans across the state.

Tell your Minnesota representative in Congress to act now to make ePTCs permanent and put affordable health insurance back into the hands of our families and neighbors.