The State of Minnesota is projected to have dramatically more resources than previously expected, according to the November 2022 Budget and Economic Forecast released last week. These resources present an historic opportunity to make transformational changes to build a more equitable recovery in which all Minnesotans are healthy, safe, and economically secure.

Key data from the forecast

The forecast projects an $11.6 billion general fund surplus for the current FY 2022-23 budget cycle, which ends on June 30, 2023.

That makes up a big part of the $17.6 billion general fund surplus projected for the upcoming FY 2024-25 budget cycle. This number would be $16.1 billion if it included the funding needed for existing public services to keep up with inflation in that biennium. A substantial portion of the surplus represents the impact of additional resources and economic growth as result of federal COVID-response and economic stimulus legislation, but that policymakers did not allocate in past legislative sessions.

In both FY 2022-23 and FY 2024-25, revenues are higher than previously expected and state spending is lower, particularly in education and health and human services. One important example is that the extension of the federal public health emergency through January 2023 has kept many Minnesotans connected to their health care and increased federal funding for Medicaid. This reduced the amount of state dollars needed to fund Medicaid by $603 million in FY 2022-23 compared to prior estimates.

The forecast projections for FY 2026-27 demonstrate how much of the FY 2024-25 surplus is temporary, and what is predicted once that short-term bubble has ended. The forecast projects an $8.4 billion structural balance for FY 2026-27. The structural balance compares projected revenues to projected spending under the state’s current budget decisions, but does not include any balances carried forward from prior budget cycles. This figure would drop to $5.1 billion when including what would be needed for existing levels of state services to keep up with 4 years’ worth of inflationary pressures from FY 2024 through FY 2027.

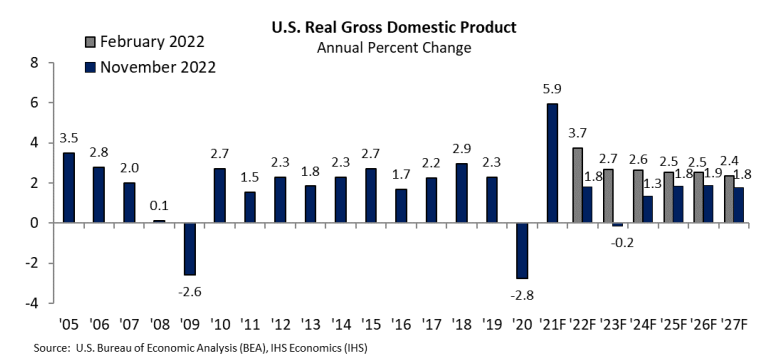

This forecast includes a worsening U.S. economy. Forecasters predict a mild recession beginning in the third quarter of 2022, lasting until mid-year 2023. In 2024 and beyond, the forecast predicts a return to economic growth, but at much lower rates than earlier projected. Several things have happened since the February forecast that have contributed to lower growth, including the Russian invasion of Ukraine, persistent high inflation, and the Federal Reserve’s increases in interest rates. Inflation is expected to be 4.3 percent in 2023, then taper off to 2.7 percent in 2024 and average a little over 2 percent from 2025 through 2027. While job numbers surpassed pre-pandemic levels in August 2022, forecasters expect a worsening job picture in the future, with the national unemployment rate increasing to 5.7 by late 2024.

Forecasters are somewhat confident in their economic projections. Forecasters assign a 55 percent chance that their baseline economic scenario is correct, which the forecast notes “hinges critically on the Fed’s ability to curb inflation.” They give a 30 percent chance for a more pessimistic scenario in which the ongoing Russian invasion of Ukraine intensifies and leads to higher prices and slower global economic growth, and supply-chain issues persist longer than anticipated. They assign a 15 percent probability to a more optimistic scenario in which there is a quicker resolution to the Russian invasion of Ukraine, and a stronger economic response to the federal Infrastructure Investment and Jobs Act (IIJA).

The projected FY 2022-23 surplus triggered an automatic allocation of $196 million to the state’s budget reserve, which brings the reserve to the full $2.9 billion recommended by Minnesota Management and Budget to best equip Minnesota to respond to an economic downturn.

Now that we know the numbers, what actions should policymakers take?

The state’s projected surpluses are not a measure of whether the state is successfully addressing the challenges Minnesotans face or investing in the future they want. The forecast simply compares projected revenues to the expected spending levels from continuing the status quo from prior budget decisions. The official surplus figures don’t include the funding needed for most of our current public services to keep up with the cost of inflation, changes in caseloads, or other measures of need.

The last few years have highlighted the need for stronger public investments in the things that Minnesotans, their families, and communities need to thrive.

Our state has the resources to make transformational investments to build a more equitable future, with a focus on those who face the greatest barriers to taking part in Minnesota’s prosperity, including lower-income and BIPOC Minnesotans. Policymakers should take steps to ensure all Minnesotans have affordable health care, child care, paid family and medical leave, housing, a quality education from the earliest years through college and training, clean air and water, and other building blocks of a high-quality standard of living. And they should build the fair tax system needed to sustain those essential investments into the future.

The ability to make those crucial investments will be squandered, however, if policymakers enact large tax cuts for those who are already doing very well. For example, some policymakers are proposing to replace our state’s existing targeted Social Security income tax exemption that prioritizes modest-income seniors. They instead would spend more than $1 billion in each two-year budget cycle to expand that exemption to all seniors, regardless of their income. The biggest tax cuts would go to high-income seniors, while threatening funding for the public services that struggling seniors count on. Those proposals need to be left behind. A better approach is for our tax policy to focus on everyday Minnesotans, such as by creating a state Child Tax Credit (CTC) that builds on the federal CTC’s historic success in reducing child poverty.

Policymakers should also act to restore a measure of inflation to the forecast to make it a better tool to inform budget decisions. The forecast currently considers the impact of inflation when projecting future taxes and other revenue sources, but a law passed in 2002 prevents Minnesota Management and Budget from including inflation for the most part in the forecast’s spending projections. This understates the amount of funding needed to maintain existing public services and gives policymakers and the public a mistaken impression of the state’s budget situation.

Each year, the amount of funding needed to provide the same level of public services generally increases as the cost of materials, rent, and personnel rises. While not included in calculating the surplus figures themselves, Minnesota Management and Budget estimates that it would take an additional $1.6 billion in funding to keep current services up with expected inflationary pressures in FY 2024-25, and $3.3 billion in FY 2026-27. With the high inflation we’re experiencing, it’s even more important to recognize the real harm that inflation does to the state’s ability to provide the public services that Minnesotans count on.