Minnesota policymakers could be less than two weeks away from enacting into law innovations and improvements in the Child Tax Credit and Minnesotans’ tax-filing experience.

The global budget targets that legislative leaders and Governor Tim Walz agreed to earlier in session allotted $53 million in FY 2024-25 and $5.2 million in FY 2026-27 for this year’s tax bill. That is the net amount of general fund changes that can happen from expanded tax credits, other tax reductions or increases, funding for local governments, and tax implementation.

I’m excited that all of our priorities are under consideration in the end-of-session negotiations, including Minnesota becoming the first state in the nation to implement Child Tax Credit advance payments, as well as provisions to expand funding for free tax preparation services and tax outreach, and create a free income tax-filing option.

Here’s a closer look at the issues we are watching and how they are treated in Walz’s tax plan, the House tax bill (House File 5247), and Senate tax bill (Senate File 5234).

Child Tax Credit advance periodic payments and other improvements

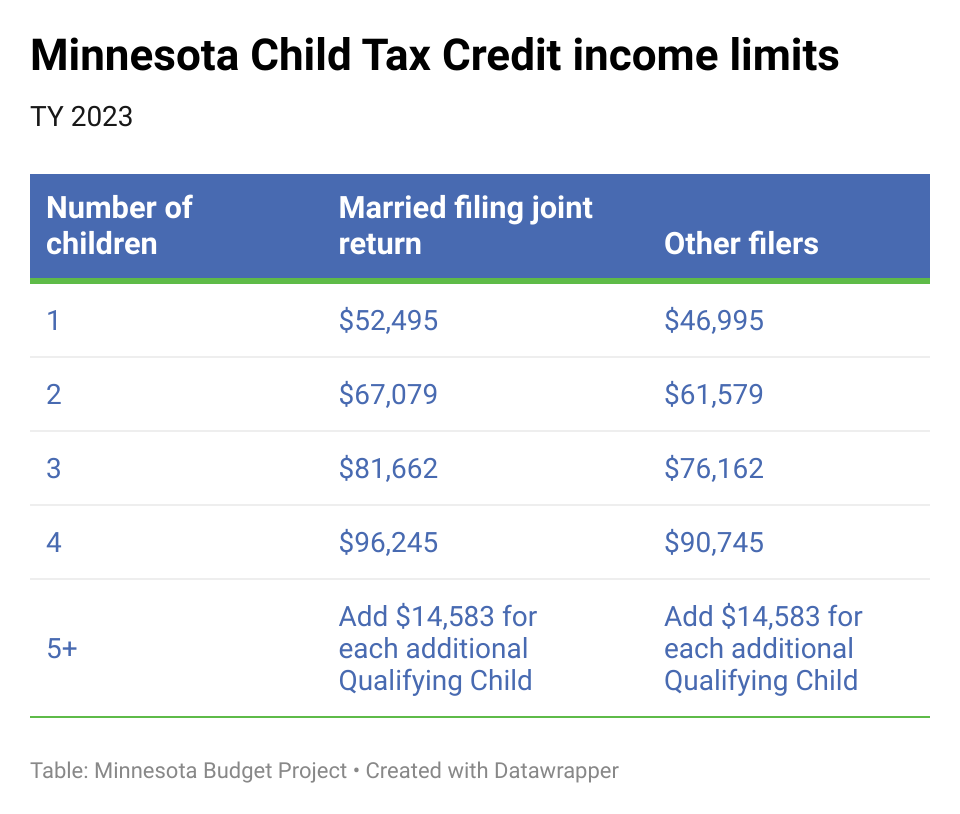

In 2023, Minnesota passed legislation that created a nation-leading Child Tax Credit. Families can qualify for up to $1,750 for each of their eligible children ages 17 or under, as long as their family incomes are below certain limits. (See table.)

The 2023 tax bill gave the Minnesota Department of Revenue (DOR) the option to implement advance periodic payments. Families could choose to receive a portion of their Child Tax Credit in advance through multiple payments, instead of waiting to receive the full amount after they have filed their state income taxes. Advance payments better match how families pay their bills and strengthen the CTC’s ability to reduce child poverty and hardship. (Learn more about CTC advance payments in our issue brief.)

DOR is developing plans to launch advance periodic payments in 2025. We’ve advocated for legislation to be passed in the 2024 Legislative Session in order to support a process that empowers families to choose what works for them and minimize potential negative consequences.

Tax plans from Walz, House, and Senate all include “minimum credit” provisions aimed at the important issue of protecting families from later having to pay back some or all of their advance payments. Without such provisions, families who experience significant unanticipated changes in their incomes over the course of the year could face such payback scenarios. While a relatively small number of families would likely be in this situation, there could be a strong “chilling effect” among families considering advance payments. In conversations with families, our colleagues at Children’s Defense Fund-Minnesota have frequently heard that payback concerns are a deterrent for families to choose advance payments. The main issue at play for tax bill negotiators is whether payback protections would apply to all families who choose periodic payments, or whether there would be an income level above which the protections would not apply. Walz’s tax plan and the Senate proposal have such an income cap; the House specifies that the family must have met the income requirements for the Child Tax Credit in the prior year. The plans also differ in their duration (the House’s minimum credit would be a permanent feature of the Child Tax Credit; it is temporary in the other plans), and how many years of funding is set aside for the minimum credit.

Periodic payments present pros and cons for families, including potential harm to families’ access to federal assistance they may also rely on to make ends meet. Another key element of successful implementation of advance CTC payments is making sure there is a strong infrastructure for families to get the information they need to decide whether advance payments is a good option for them, and to be able later to opt out if it doesn’t meet their needs. The governor included funding to implement advance payments in his tax proposal, but neither of the legislative tax bills contains funding specifically for that purpose. This issue will likely be a point of conversation in the conference committee.

The House also proposes expanding the Child Tax Credit to include eligible children who are age 18. Currently, eligible children must be 17 or under to qualify for the Child Tax Credit. Families with older children instead may qualify for a somewhat similar but smaller Credit for Older Children (older children include 18-year-olds, 19- to 23-year-olds who are full-time students, and older children who are permanently and totally disabled). An estimated 10,800 families with 18-year-olds would benefit from the House’s proposed expansion, and would receive an additional $716 on average.

Tax-filing improvements

Both House and Senate would put additional dollars into efforts to make sure Minnesotans learn about and apply for the tax credits for which they are eligible. Both House and Senate propose an additional $750,000 per year starting in FY 2025 for grants to organizations that do free tax preparation for lower-income Minnesotans. And both propose at least $1 million per year in additional funding for grants to nonprofits and tribal nations for outreach and education about tax credits; the House has the higher figure at $1.2 million for FY 2025.

The House would also substantially increase the number of Minnesotans with access to a free and easy method to file their income taxes, often called Direct File. Paying taxes is how we come together to fund public services that Minnesotans value and count on, but with our current system, the majority of folks pay to meet their tax-filing responsibilities. A free public income tax-filing option would be a better choice for many Minnesotans. Such a system should be connected to the successful federal Direct File system launched this year. (Learn more about Direct File on our blog.)

The House tax bill would create a free filing program and encourages integrating with the federal Direct File. The Senate tax bill does not include Direct File provisions.

What’s next

Tax negotiators will need to reach agreement and pass final tax legislation before the legislative session ends on May 20.

In addition to agreeing to final outcomes for the priorities we have outlined above, tax negotiators will tackle other issues ranging from expanding local governments’ authority to raise sales taxes, to corporate tax disclosure requirements. Readers interested in learning more about the tax conference committee and its work can learn more on the conference committee’s webpage.