On Monday, the nonpartisan Congressional Budget Office (CBO) released an analysis detailing how the American Health Care Act (AHCA) would cut $1.2 trillion in federal funding for affordable health care while giving the wealthiest Americans and insurance companies the bulk of $600 billion in tax cuts. The CBO’s report details several important ways these radical funding changes would result in lost health care coverage for 24 million Americans and high health care costs for many others.

The CBO predicts 24 million more people would lack health insurance in America by 2026, including 14 million by 2018. Notably, less than 10 percent of this decrease is explained by fewer individuals buying coverage on the individual market. There are several ways the bill would increase the ranks of the uninsured:

- Roughly 7 million fewer people would receive health insurance coverage through their employer.

- Roughly 14 million fewer people would be enrolled in Medicaid.

- Roughly 2 million fewer people would purchase coverage through the individual market.

The AHCA would also fail to curtail premium increases in a meaningful way, and would not address the high out-of-pocket costs for Americans shopping for health insurance on the individual market. In fact, under the AHCA, the federal government would provide much less assistance for either than is done under current law. By the CBO’s calculations, the federal assistance that helps people afford health insurance premiums and other out-of-pocket costs would be cut by $312 billion, or 46 percent, by 2026.

When discussing premiums, it is important to note the difference between the “sticker price” of premiums that shoppers see in the market and the out-of-pocket premium shoppers actually pay after taking any available premium assistance into account. At the same time that federal premium assistance decreases — causing out-of-pocket premium prices to increase — the CBO predicts that the sticker price of insurance premiums will also rise 15 to 20 percent in 2018 and 2019. It is important to note that this is a 15 to 20 percent increase on top of the sticker price premium increases that would already occur without any law changes.

Under the AHCA, the sticker price of premiums is predicted to start falling in 2020, but the out-of-pocket price that many Minnesotans pay will be higher because of cuts in assistance. These lower average sticker prices come at a high price for older Americans: the CBO writes that the reduction in average sticker price premiums will partially occur because so many shoppers aged 50-64 will drop out of the market altogether. That’s partially because under the AHCA, insurers will be allowed to charge these older people five times as much as their younger neighbors. That is a big change from today, when they are only allowed to charge them three times as much. In other words, one reason the average sticker price premium will be lower because many older Americans simply won’t have insurance.

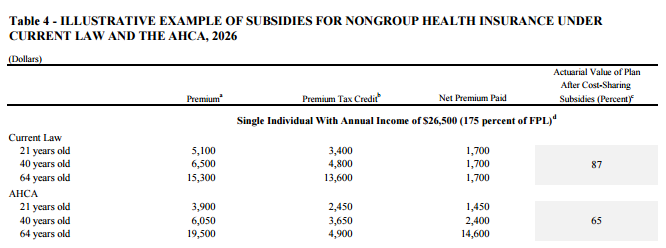

With the AHCA, many people will be paying more for less coverage. That’s because higher out-of-pocket premiums will pay for lower-quality insurance as measured by actuarial value. “Actuarial value” describes the share of medical costs covered by an insurance plan, as opposed to the share paid by patients. The CBO projects that typical plans under the AHCA will carry lower actuarial values. That’s bad news for the roughly 9 percent of Minnesotans under age 65 who find insurance on the individual marketplace. The following chart from the report lays out an illustrative example:

Source: Congressional Budget Office report on the American Health Care Act. See it in the report here.

In the example above, only the 21-year-old would actually pay less in out-of-pocket premiums relative to current law. The 64-year-old would see a staggering $12,900 increase in their out-of-pocket premium costs. Meanwhile, all three people would see a 22 percentage point decrease in their actuarial value, meaning that when they actually need to purchase health care, they’ll be paying even more out-of-pocket.

The damage that would be done by the AHCA becomes more clear with each new report analyzing its impact. Federal policymakers must put the brakes on this legislation and go back to the drawing board to find solutions that will help more Minnesota families afford health care, instead of increasing the number of uninsured and raising costs for many.

By Ben Horowitz