The federal Child Tax Credit (CTC) is an income tax credit that provides families with more resources to afford the costs of raising thriving children. It is a powerful tool for combating poverty and improving the well-being of children and families. The boost to household income the credit provides is associated with many positive outcomes for families like lower maternal stress, better childhood nutrition, and higher school enrollment and test scores.

However, the reconciliation bill (H.R. 1) signed into law on July 4, 2025, will continue to leave out low-income families who need the Child Tax Credit the most to get by. The reconciliation law makes the expansions to the CTC temporarily enacted under the 2017 Tax Cuts and Jobs Act (TCJA) permanent, rather than expiring at the end of 2025. The new law increases the credit but still fails to fix a flaw in the current CTC, which means the lowest-income families get smaller credits or none at all. The credit will also be taken away from even more families because of new citizenship restrictions added by the law.

These Child Tax Credit provisions are just a small portion of a massive reconciliation tax package that overwhelmingly benefits the wealthiest and highest-earning taxpayers.

The lowest-income families continue to be left out of the Child Tax Credit

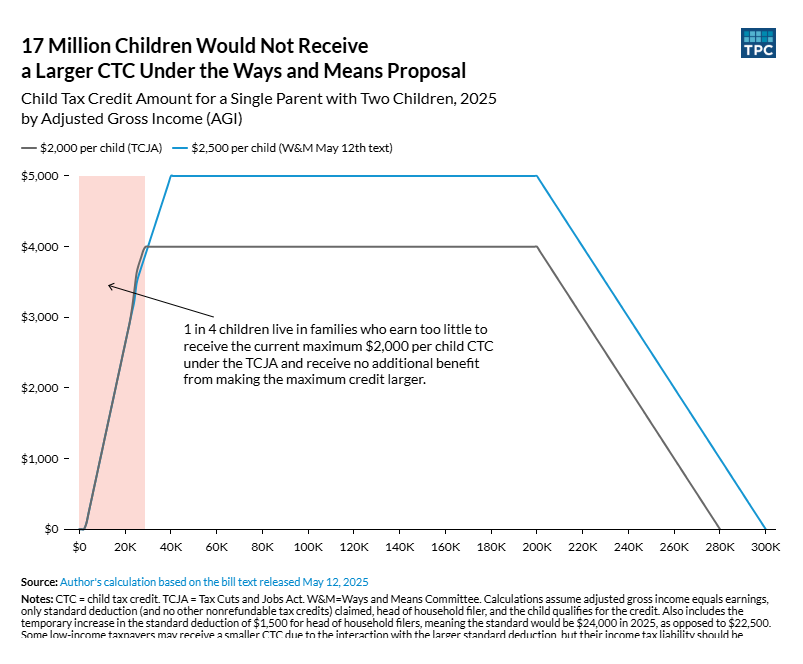

The current CTC leaves out 17 million children who receive less than the full Child Tax Credit or no credit at all primarily because their families’ earnings are too low. That’s because as the credit is currently structured, families need to have earnings of at least $2,500 to qualify for the Child Tax Credit. Many additional families are getting less than the full credit amount because the value of the credit rises slowly after earnings of $2,500 until the full credit amount is available.

According to the Brookings Institution, under current law, a family with two children has to earn over $29,000 – which would require working 40 hours a week, every week of the year, for $14 an hour (nearly twice the federal minimum wage) – before they can receive the full CTC of $2,000 per child. On the flip side, married families making as much as $400,000 a year receive the full credit for each of their children.

The graphic below displays a Child Tax Credit expansion proposal similar to that passed in the reconciliation law. This graphic shows how just increasing the credit amount without solutions to the structural issues with the CTC leave out families that earn too little to receive the full value of the credit.

The reconciliation law fails the families and children who could benefit most from the credit. For example, the expanded credit is not helping children with parents who work vital low-earnings jobs, like truck drivers, cooks and waiters, nursing assistants, home health aides, construction workers, cashiers, and others. These same families will also see increased hardship from drastic cuts to basic needs services like Medicaid and SNAP included in the reconciliation law.

The benefits of an expanded Child Tax Credit are reduced by the loss of other tax benefits for families with children

The reconciliation law will – like the TJCA before it – include some policies that could cut taxes for families with children as well as other policies that could raise taxes for families with children. Families could see benefits from an increased CTC and an increased standard deduction. However, both the TCJA and the reconciliation law repeal the personal and dependent exemptions, which could increase families’ taxes.

The Institute on Taxation and Economic Policy finds that, in total, the tax increases from repealing personal and dependent exemptions offsets almost 85 percent of the benefits families with children see from an increased Child Tax Credit and an increased standard deduction.

Tax cuts for everyday families are smaller

The maximum Child Tax Credit is permanently increased from $2,000 to $2,200 starting in 2025 and will adjust with inflation starting in 2026. This $200 increase continues to leave out 17 million children and their families because their incomes are too low. The wealthy and corporations in comparison will see massive tax benefits from the reconciliation law’s tax provisions while those who could use the CTC most are still left out.

Similarly to the 2017 TCJA, the attention to tax provisions like the CTC hides the fact that low- and moderate-income people will see modest tax cuts, if at all, while the most well off among us see the highest benefit. Just 14 percent of the tax cuts in 2026 would go to the 60 percent of working-class and middle-income households, who make $92,000 or less, while 22 percent of the tax cuts would go to the richest 1 percent, who make almost $1 million or more. The lowest-income households would see average tax cuts of $40 in 2026, while the top 1 percent would get a tax cut of nearly $70,000.

New anti-immigrant restrictions take away the CTC from citizen and legal resident children

This reconciliation law will also take the Child Tax Credit away entirely from 2 million previously eligible children. The new restrictions require at least one filing parent to have a Social Security Number in addition to the child, whereas previously only the child had to have a Social Security Number. Some 15,000 Minnesota children will become ineligible for the CTC under the new restrictions.

The Child Tax Credit is a key tool for addressing childhood poverty, increasing school achievement, health outcomes, and productivity. Taking this credit away from children with non-citizen parents harms the family, but also all of us by reducing the broader economic prosperity that results when all families and children have what they need to thrive.

Additionally, taking away the CTC from families with non-citizen parents is just another blow to immigrants who pay a lot into a system that offers them very little. Undocumented immigrants paid $96.7 billion in federal, state, and local taxes in 2022, but are ineligible for many of the benefits that their taxes fund, such as Social Security, Medicare, and unemployment insurance. These families will be worse off despite contributing greatly to our economies and communities.

A better tax bill would permanently expand the Child Tax Credit to all low- and moderate-income families

A better Child Tax Credit expansion would:

- Make the full value of the credit available to lower-income families: Treat low-income families the same as moderate- and high-income families by allowing them to receive the same maximum per child credit instead of having a lower maximum credit for families with lower earnings.

- Exclude immigration status from eligibility requirements: Ensure all income-eligible families and children have access to the benefits of the Child Tax Credit, regardless of their immigration status.

- Make increases to the Child Tax Credit larger: Help families afford more basic necessities with a larger CTC. For example, in 2021, the American Rescue Plan temporarily increased the maximum value of the credit to $3,600 for children younger than 6 and to $3,000 for children between the ages of 6 and 17.

The Child Tax Credit is a much more powerful tool against poverty and for economic prosperity when all families, regardless of lower earnings or immigration status, can benefit from it. Many of the CTC policies listed above were popular and even championed by Republican legislators in the House in 2024. The reconciliation bill that was signed into law on July 4, 2025, did not reflect that previous support from policymakers on both sides of the aisle. Further changes to the Child Tax Credit are still needed so that economic opportunity is in reach for all our neighbors, regardless of race, income, immigration status, or where they live.