Governor Mark Dayton released his FY 2018-19 supplemental budget proposal today, focused on making strategic investments to support Minnesota’s economic success, prioritizing working Minnesotans in responding to the federal tax bill, and leaving some of the state’s projected surplus unspent “to cushion against risk.”

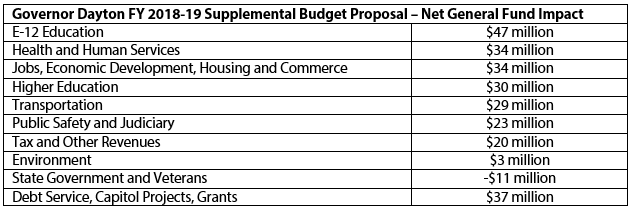

The supplemental budget describes Dayton’s proposed changes to the two-year state budget passed last year. Dayton proposes $227 million in net additional general fund spending and $20 million in net revenue increases in FY 2018-19, leaving $206 million of the projected surplus unspent, or “on the bottom line.”

Here’s our first look:

Education

Dayton’s largest new investments are for the education of Minnesotans at all ages. He recommends $21 million in FY 2019 for the Safe and Secure Schools Act to improve the security of students through building improvements and student supports. He also includes an additional $17 million in FY 2019 for special education. Dayton also proposes $57 million in FY 2020-21 to expand access to pre-kindergarten.

Dayton proposes improvements for Minnesotans pursuing higher education as well. He includes $10 million each to Minnesota State and the University of Minnesota to keep the cost of tuition down. He also includes an important improvement to financial aid. Minnesota Dreamers – young people who came to the country as children and do not have legal status – are ineligible to receive federal Pell Grants. However, the State Grant formula currently calculates financial aid assuming students receive this federal grant, meaning that Dreamers receive much less aid than they need to afford college. The proposal would increase the grant award for these students, making college education more in reach for all Minnesota’s young people.

Health and Human Services

Governor Dayton proposes an additional $2.5 million in FY 2019 and $15 million in FY 2020-21 in child care. These investments are intended to avoid disruptions in child care for families and better prepare children for school. These improvements are essential to making sure parents can join the workforce and kids can grow in stable and nurturing environments.

Dayton also maintains an essential funding source for affordable health care by repealing the sunset of the provider tax. The provider tax provides the majority of the revenues for the Health Care Access Fund but is currently set to expire on December 31, 2019. By ensuring this revenue continues for MinnesotaCare and Medical Assistance, Dayton is taking an important step to ensure low- and moderate-income Minnesotans can continue to get the health care they need.

Affordable health care is also expanded through the MinnesotaCare buy-in option, which would allow Minnesotans who don’t already qualify for MinnesotaCare or Medical Assistance to purchase health insurance through MinnesotaCare. After initial set-up costs of about $171 million, individual premiums are projected to sustain the program into the future.

Other important funding proposals include addressing opioid treatment and addiction, and strengthening consumer protections for seniors and other people living in care facilities.

Taxes

One the major challenges in this legislative session is responding to the recent federal tax bill. As in his past tax proposals, Governor Dayton prioritizes everyday Minnesotans and maintaining the revenues needed to fund essential services.

Dayton’s tax plan would protect seniors, people with disabilities, and families with dependents from seeing a cut in their Property Tax Refunds, which would occur from conforming to the federal tax code.

In addition, Governor Dayton continues his commitment to Minnesota workers and their families through an expansion of the state’s Working Family Credit, helping working families meet their basic needs and get children off to a stronger start. This proposal is similar to the expansions Dayton has proposed in the past, and would provide an average $160 tax cut for 329,000 Minnesota workers and families.

Simply conforming to all the federal tax changes that impact the state is estimated to raise $459 million in individual and corporate taxes in FY 2019 and more in future years. Preliminary analysis by the Institute on Taxation and Economic Policy estimates that about one-third of Minnesota taxfiling households would see a tax increase if Minnesota conformed to the major income tax changes.

Instead, Dayton proposes to keep Minnesota’s tax code as it was before the recent federal changes. It would prevent tax increases by allowing Minnesota families the same standard deductions and personal exemptions as before, and those who itemize would continue to be able to take the same deductions, such as for charitable giving and property taxes. In addition, it creates a new $60 per-person tax credit. Budget documents estimate that more than 1.9 million Minnesota families would receive an average tax cut of $117.

In addition, Dayton’s budget plan would reverse three tax cuts enacted in last year’s tax bill: on tobacco products, the commercial/industrial state property tax, and the estate tax.

Jobs and Economic Development

Governor Dayton continues to prioritize expanding broadband service in underserved areas so that Minnesota’s economic success reaches into every corner of the state. He proposes adding $30 million in additional one-time funding for grants that are expected to expand access to broadband for thousands of Minnesotans.

Preparing for Uncertain Future

The Governor leaves a significant portion of the projected surpluses for FY 2018-19 and FY 2020-21 on the bottom line – $206 million in this biennium and $182 million in the next. The state’s current projected budget surpluses are certainly good news, but they don’t guarantee a positive economic and budget outlook into the future. Forecasters had the tough job of predicting how people and businesses would response to the sweeping federal tax bill. Additionally, our state’s projected surplus could swiftly be cancelled out if federal policymakers follow through with any of several proposals to deeply cut federal funding to the state.

Considering increased uncertainty from federal policy changes, it is crucial for policymakers to set Minnesota up for success. Leaving a significant portion of projected surpluses on the bottom line while making targeted investments to support Minnesotans is a good way to do that.

By Clark Goldenrod, Sarah Orange, and Nan Madden