The state of Minnesota’s revenue picture continues to improve, but the national economy is growing at a weaker pace largely due to the pandemic and supply chain disruptions, according to the October Revenue and Economic Update from Minnesota Management and Budget.

While state revenues continue to out-perform earlier expectations, increased revenues do not yet point to a broad-based recovery. The pandemic and recession’s unequal impact on Minnesotans won’t be eliminated without further investment. Improving state revenues, combined with federal ARP dollars, should be used to begin to dismantle the barriers to truly feeling safe, healthy, and economically secure that many of our low-income and Black, Indigenous, and people of color (BIPOC) neighbors continue to face.

Some of the top takeaways from the Update include:

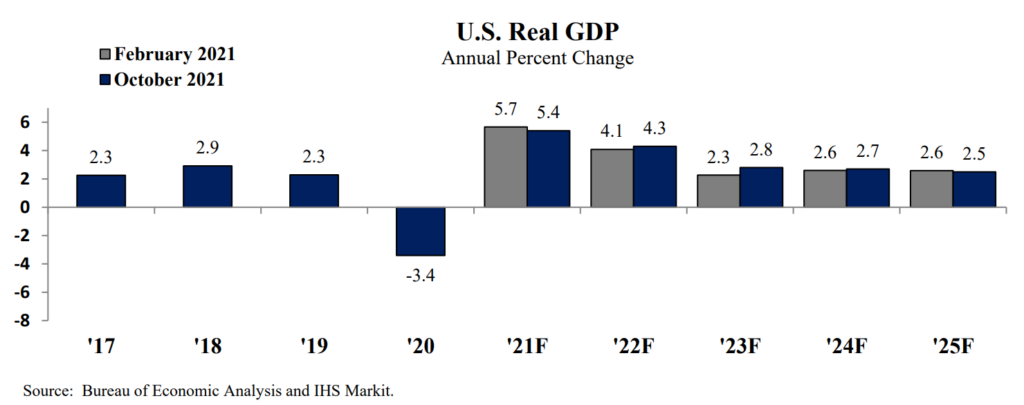

1. National economic expectations for 2021 have weakened slightly. Forecasters now predict 5.4 percent GDP growth in 2021, lower than the 5.7 percent predicted in February. This dialing back of economic growth expectations is largely due the spread of the delta variant of COVID-19, as well as supply chain disruptions. The Update’s growth projections include the predicted impact of the federal government passing an Infrastructure Investment and Jobs Act that will have its greatest impact in 2025, including increasing GDP growth by 0.5 percent and boosting employment by 750,000.

2. Recent state revenues came in higher compared to the February forecast. Revenues for July to September this year came in $657 million, or 12.4 percent, higher than February projections. Corporate tax revenues were 90.5 percent higher than expected in the February forecast and are the largest source of this increase.

3. Unemployment continues to fall, but many people are still out of work. In September, the national unemployment rate was 4.8 percent, down from the peak of 14.8 percent in April 2020. However, the unemployment rate is still 1.3 percentage points above the February 2020 pre-pandemic level. Additionally, 2.7 million Americans have been unemployed for six months or more; that’s 1.6 million more long-term unemployed people compared to before the pandemic. Furthermore, the official unemployment rate doesn’t reflect the 3.1 million people who have left the labor force during the pandemic.

Economic projections are only predictions, and actual economic performance can differ from what is outlined in the Update. The nation’s economic performance continues to be dependent on the severity of the pandemic and the effectiveness of efforts to bring it under control. Forecasters recognize the potential for both more pessimistic scenarios in which the pandemic causes greater economic harm, as well as more optimistic outcomes in which the impact of COVID-19 is less severe due to a stronger uptick in measures to control the virus’ spread, and in which the economy is further boosted by a stronger-than-expected federal stimulus package.

What does this all suggest for the budget and policy decisions ahead?

Earlier this year, state policymakers agreed to wait until the 2022 Legislative Session determine how to allocate the state’s remaining $1.2 billion in flexible American Rescue Plan funding. If the trends in this Update hold, it seems more certain that Minnesota can expect a state budget surplus at play in 2022 as well, potentially several billion.

It is imperative for policymakers to boldly respond to the unique times we’re in, and recognize that the state’s ledgers showing a positive balance doesn’t mean that all Minnesotans are thriving. Recently, 1 in 10 Minnesota adults said they couldn’t afford for the children in their homes to get enough to eat, 115,000 Minnesotans were behind on rent, and 651,000 were having trouble covering basic household expenses.

Addressing basic needs is not the only area where additional public investment is needed. For example, while Minnesota students, teachers, and families have largely returned to in-person classes, they won’t recover overnight from the disruption to learning caused by the pandemic and the necessary efforts to contain COVID-19.

So we’re not yet back to normal, and getting back to normal should not be our goal. Hardship and inequality didn’t originate with the COVID-19 pandemic. Minnesota has long been home to deep divides in opportunity across lines of race, income, and geography.

Right now, federal policymakers are considering Build Back Better recovery legislation that would build upon the progress made over the past year, fill in the holes in the safety net that the pandemic laid bare, and build a stronger, more equitable economy. They must use this opportunity to continue the Child Tax Credit expansion that’s bringing about a historic 40 percent reduction in child poverty, and further invest in child care, health care, unemployment insurance reform, and more, so that all of us can thrive.

Our communities deserve to have their needs met, and more of us are heeding the call for a more equitable recovery and economy. Federal and state policymakers must intentionally focus on those goals in their budget and policy decisions ahead.