Both the state of Minnesota’s revenues and the national economic forecast are slightly improved compared to the February forecast, according to the April Revenue and Economic Update from Minnesota Management and Budget.

The data in new Update suggest the state is on track with the large projected surpluses forecasted in February. As legislative budget plans continue to be released, they describe how policymakers envision using this historic opportunity to build a more equitable future in which all Minnesotans are healthy, safe, and economically secure.

Some of the top takeaways from the Update include:

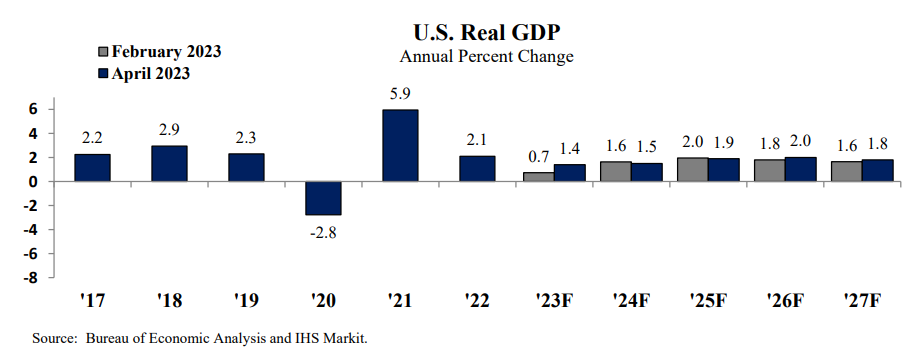

1. The national economy is expected to grow in 2023 and beyond. Forecasters now predict 1.4 percent GDP growth in 2023, stronger than the 0.7 percent growth projected in the February forecast. Looking further ahead, they expect yearly growth between 1.5 percent and 2.0 percent from 2024 to 2027, which is roughly consistent with what was projected in February. In contrast to the February Forecast, forecasters no longer expect a mild recession this year, largely due to stronger than expected growth in the first quarter of 2023.

2. Recent state revenues came in higher compared to the February forecast. Revenues for February to March 2023 came in $176 million, or 4.6 percent, higher than the forecast’s projections. Individual income taxes came in 8.2 percent higher than forecasted, and are the largest source of the increase.

3. The official unemployment rate remains low. In March, the national unemployment rate was 3.5 percent, which was roughly at pre-pandemic levels. However, the update notes that the official unemployment rate does not include folks who have left the workforce or who are not actively searching for employment. The national labor force participation rate was 62.6 percent in March, and has not yet returned to its pre-pandemic level.

What does this mean for budget and tax decisions this session?

The April Update provides more recent information about the state’s budget and economic landscape that are consistent with the positive outlook outlined in February. The February forecast remains the reference point as policymakers put together the state’s FY 2024-25 budget. The February forecast projected a $17.5 billion surplus for FY 2024-25, followed by a $5.4 billion structural balance in FY 2026-27. Policymakers will also make decisions about how to allocate the $1.4 billion in FY 2024-25 and $3.1 billion in FY 2026-27 that the forecast estimates would be needed to keep existing services up with inflation.

It’s important to remember that projected budget surpluses are not a measure of whether the state is successfully addressing the challenges Minnesotans face or investing in the future they want. The forecast and economic updates simply compare projected revenues to expected spending under prior budget decisions.

Policymakers have begun putting forward their more specific plans for use of the surplus, detailing the steps they would take to build a stronger, more equitable future for all of us through investments in things including affordable health care, child care, starting up a paid family and medical leave system, housing, a quality education from the earliest years through college and training, clean air and water, fighting child poverty through smart tax policy, and other building blocks of a high-quality standard of living.

Their budget plans have also taken into account that the majority of the FY 2024-25 surplus is temporary, and they have articulated ways to fund crucial investments out into the future.

But the opportunity to sustainably fund public services and important new investments will be squandered if policymakers enact large tax cuts for those who are already doing very well – such as by replacing our state’s existing targeted Social Security income tax exemption that prioritizes modest-income seniors with an unlimited exemption that would give the biggest tax cuts to high-income seniors.

Minnesotans and their families, children, and communities deserve to have their needs met, and have opportunities to thrive and contribute to our shared future. In their final budget and tax decisions, policymakers must focus on addressing the real challenges Minnesotans are facing and building an equitable future for all.