The state of Minnesota’s revenue picture to date is still solid, but the national economic recovery is now expected to be weaker, according to the April Revenue and Economic Update from Minnesota Management and Budget (MMB).

The Russian invasion of Ukraine is one of the factors keeping a broad-based recovery from taking hold. The figures in the Update underscore why it’s important to make bold policy changes this year so that Minnesotans are better equipped to weather current and future challenges. The pandemic clearly demonstrated the hardship that occurs as a result of barriers to being safe, healthy, and economically secure that too many of our lower-income and Black, Indigenous, and people of color (BIPOC) neighbors continue to face.

Some of the top takeaways from the Update include:

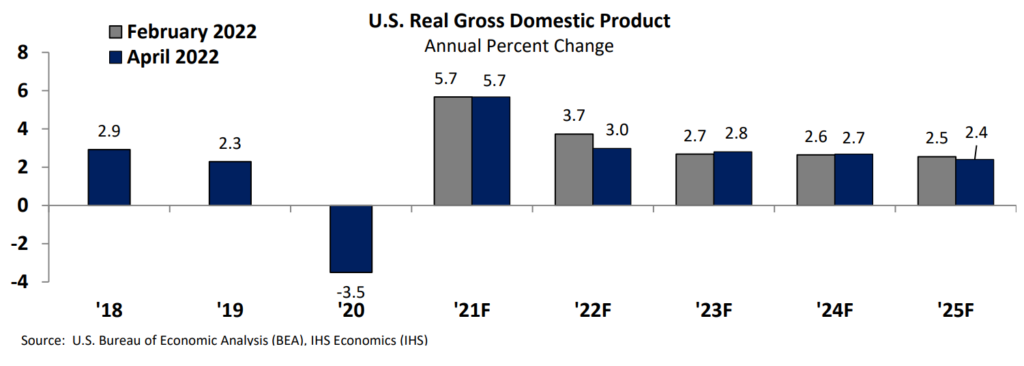

1. Nationally, economic growth is still expected in 2022 and beyond, but weaker than earlier predicted. Forecasters now predict 3.0 percent GDP growth in 2022, lower than the 3.7 percent predicted in the November forecast. This decrease is in part due to Russia’s invasion of Ukraine, which among other impacts, is expected to increase food and energy prices and slow global economic growth. It also reflects indications that growth in the beginning of this year was weaker than was forecasted.

2. Recent state revenues came in higher compared to the February forecast, but most of this is due to timing issues. Revenues for February and March 2022 came in $666 million, or 18.7 percent, higher than the forecast’s projections. Individual income tax revenues were $554 million higher than expected in the forecast and are the largest source of this increase. However, MMB estimates that 96 percent of the higher income tax revenues is likely due to the timing of tax payments and refunds for certain businesses, which they expect to be reversed by lower than forecast revenues in April to June. The higher recent revenues are not thought to reflect stronger economic fundamentals.

3. Official unemployment rate is low. In March, the national unemployment rate was 3.6 percent. This unemployment rate is now just 0.1 percentage points above the February 2020 pre-pandemic level. In addition, many workers who left the workforce earlier in the pandemic continue to re-enter the workforce, but the national labor force participation rate is still one percentage point lower than it was in February 2020.

The forecasters acknowledge that these economic projections are predictions, and that actual economic performance may differ depending on several variables, including how and when Russia’s invasion of Ukraine is resolved, as well as how quickly existing supply chain issues are solved.

Our take on what this means for budget and tax decisions this session

The April Update provides some more recent information about the state’s budget and economic landscape. However, the February Forecast remains the reference point as policymakers consider revenue and spending changes to the two-year budget passed last year.

Policymakers have an extraordinary opportunity to invest in Minnesotans’ well-being through wise deployment of substantial projected surpluses as well as federal funding. The latest economic update shows that, as we approach the halfway mark of the FY 2022-23 biennium, revenues to date are coming in as expected, but also that the February forecast figures are based on a more positive economic outlook than is currently predicted.

The state’s ledgers showing a positive balance doesn’t mean that all Minnesotans are thriving. Just this winter, 148,000 Minnesota adults said they couldn’t afford to give their kids enough to eat, 130,000 Minnesotans were behind on rent, and 920,000 were having trouble covering basic household expenses. And because of longstanding structural inequities, our Black and brown neighbors are disproportionately likely to be struggling to get by.

Policymakers should focus on BIPOC and lower-income Minnesotans who struggled disproportionately during the pandemic and under the unequal status quo that predated it. They should take bold steps to ensure all Minnesotans have health care, child care, paid family and medical leave, affordable housing, a quality education from the earliest years through college and training, clean air and water, and other building blocks of a high-quality standard of living.

Policymakers should not waste this opportunity by enacting large tax cuts for those already doing well, on top of the over $1 billion in tax cuts that were enacted last year. The Senate has proposed two large tax cuts: a first bracket income tax rate cut and an untargeted expansion of the state’s Social Security income tax exemption. In total, the Senate omnibus tax bill would reduce revenues by $8.4 billion over three years, a size that would prevent making needed investments today and potentially create budget challenges in the long run. These tax cuts also are poorly targeted. They leave out the lowest-income Minnesotans while providing the biggest tax cuts to higher-income Minnesotans. A better approach would be to make more targeted and fiscally responsible tax changes that focus on ensuring everyday Minnesotans have the resources to cover the costs of raising a family, succeeding in the workforce, and maintaining a home.

Our communities deserve to have their needs met. State policymakers must intentionally focus on supporting Minnesotans’ well-being and building an equitable recovery in their budget and policy decisions ahead.