The federal tax framework released last week fails to prioritize our nation’s working families. Instead, it would provide most of its tax benefits to the highest-income Americans and profitable corporations. And when we consider the deep cuts in health care, food assistance and other essential federal services that the tax plan would require, it’s clear this is a bad deal.

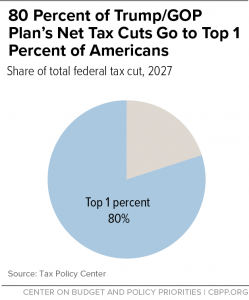

The large majority of the framework’s tax cuts would go to the highest-income Americans. Preliminary estimates from the experts at the nonpartisan Tax Policy Center are that, when the framework is fully in effect in 2027:

- 80 percent of the net tax cuts would go to the 1 percent of households with the highest incomes; and

- 40 percent of the net tax cuts would go to the 0.1 percent with the highest incomes. These households would get a tax cut of more than $1 million annually.

It’s not surprising the tax framework skews so heavily to the well-off; many of the plan’s centerpiece provisions provide the greatest benefit to those with high incomes. These provisions include:

- Reducing the top individual tax rate from 39.6 percent to 35 percent;

- Creating a new top rate of 25 percent for “pass-through income” – a type of business income that predominately goes to households with incomes over $1 million;

- Repealing the estate tax, which is paid by 0.2 percent of the highest-value estates nationally;

- Eliminating the Alternative Minimum Tax, which was designed to ensure that higher-income people with a large number of deductions and other tax benefits still pay a minimum level of tax; and

- Cutting the corporate rate — most mainstream economists believe investors and CEOs would receive the bulk of the benefit from this policy change, rather than workers.

In contrast, American families who live paycheck to paycheck would receive only a small sliver of the tax framework’s benefits. The 40 percent of American households with the lowest incomes would receive only 5.2 percent of the tax cuts in 2018, and less than 4 percent when the plan is fully in place in 2027, according to the Tax Policy Center.

The tax framework offers a number of changes in the individual income tax in the name of simplification. But the framework would make little real difference in the average working-class person’s tax-filing experience, and could even result in a tax increase. The tax framework’s proponents laud its increase in the standard deduction and Child Tax Credit, but some families will find that any benefits from those provisions are reduced or even outweighed by the loss of personal exemptions and increasing the tax rate in the lowest tax bracket from 10 percent to 12 percent. The Child Tax Credit expansion and new credit for other dependents are structured in a way that means they aren’t available to our country’s lowest-income families.

The tax framework proponents’ claim that this plan will unleash strong economic growth relies more on wishful thinking than on evidence. Let’s set aside the question of whether it is fair for the wealthy and profitable businesses to see immediate and certain tax cuts while everyone else crosses their fingers and hopes for some kind of trickle-down economic benefit. Past experience with federal tax cuts and in states like Kansas shows that tax cuts aren’t a silver bullet for creating economic growth, especially when those tax cuts are combined with increasing deficits or cuts in public investments that support working families and build the economy.

What is certain is that we all would be harmed by the budget choices that come along with this tax plan. The tax framework is estimated to cost $2.4 trillion over the next decade. In the House, the budget vehicle that is being used to advance the tax framework calls for cuts in federal services that help families afford the basic necessities — such as Medicaid, Medicare, and food assistance through SNAP. And under the Senate’s budget framework, $1.5 trillion of the tax plan’s costs would be added to the deficit, creating additional pressure down the road on anti-poverty programs as well as other federal priorities from transportation to scientific research.

This unbalanced and fiscally irresponsible tax plan isn’t the way to build more broadly shared prosperity. Instead it would increase hardship and inequality. Policymakers should go back to the drawing board and make strengthening working families and our communities a priority, instead of draining critical resources from public investments that build a stronger economy.

By Nan Madden