While new state budget figures are improved over earlier projections, the forecast also reminds us that many Minnesota workers and families are still struggling, and that this recession is hitting hardest those with the least resources to get through it.

For this budget cycle, the forecast projects a small state budget surplus, and structural budget shortfalls in the next two budget cycles.

Today’s forecast highlights that improved state revenue figures are not necessarily tied to better well-being for everyday Minnesotans. This fall, more than 230,000 Minnesota adults reported that their household didn’t have enough to eat; more than 140,000 said they were not caught up on paying their rent; and 1 in 4 Minnesotans said they had difficulty covering usual household expenses. And because of longstanding structural inequities, our Black and brown neighbors are being disproportionately harmed by the virus and its economic impact. In a year with many surprises, we received one more: Minnesota Management and Budget only released the executive summary of the forecast today. Here’s our initial take on the numbers, before we get the full forecast later this week.

1. The state is projecting a $636 million positive balance for the FY 2020-21 budget cycle, which ends on June 30, 2021. That’s largely measured against the budget passed in 2019, which does not include the costs of needed actions to respond to the pandemic and recession.

2. The forecast predicts a $1.3 billion shortfall for FY 2022-23, which grows to $2.6 billion when including what it would take for most current public services to keep up with inflation.

3. The forecast gives us our very first look at FY 2024-25. Here forecasters predict a structural deficit of $552 million, which is $3.5 billion when including inflation.

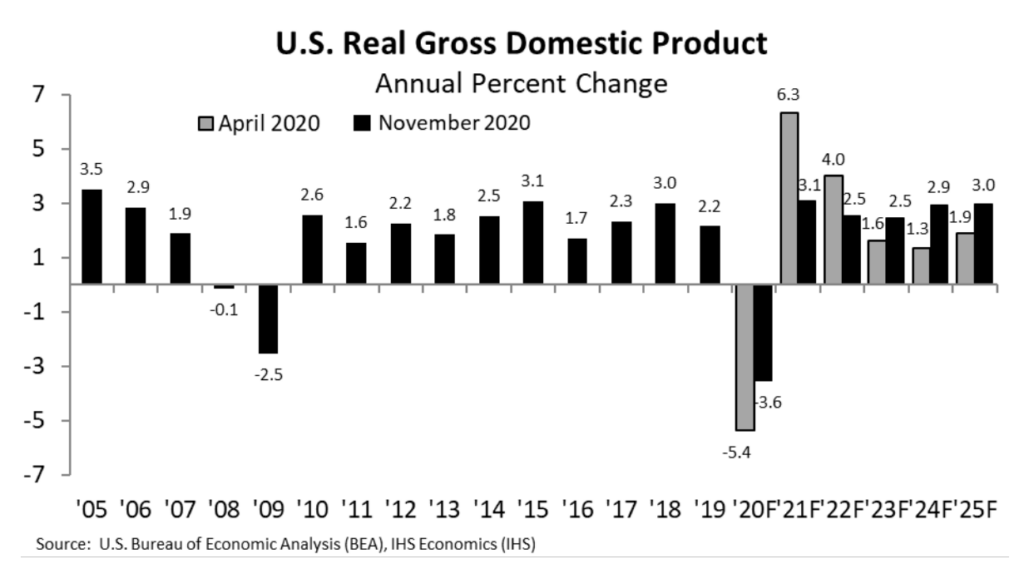

4. The national economy is still expected to see an overall 3.6 percent decline this year. Forecasters project that the economy will start to grow starting next year, with moderate annual growth ranging from 2.5 to 3.1 percent.

5. Unemployment during this economic downturn has disproportionately impacted lower-wage workers – more than half of all initial unemployment claims since mid-March were from workers in lower-paid occupations.

6. Minnesota Management and Budget acknowledges the substantial uncertainty inherent in this forecast. Several factors could impact the actual performance of the national economy and the state budget numbers, including the path of COVID-19; the timing of widespread availability of a vaccine; the survival of businesses; and any further action from the federal government to provide economic support to individuals and families, and states, local governments, and tribal governments.

One factor underlying today’s improved state budget numbers is the fact that smart federal and state policy decisions have blunted or delayed some of the worst economic impacts of the pandemic. But many of these actions have expired or will expire soon if additional steps aren’t taken.

State policymakers are considering taking action this month to address some of the economic disruptions due to the latest efforts to bring the coronavirus under control. Policymakers will also need to address the pandemic including vaccine rollout, reckon with the racial disparities the pandemic has laid bare, and build a stronger future for all us when they set the state’s next two-year budget in the 2021 Legislative Session. They will also need to address the substantial revenue shortfall as they do so.

Fortunately, Minnesota has resources at the federal and state levels that we can turn to address pressing needs in the weeks and months ahead.

- Congress should act quickly with another round of robust economic supports for everyday working people, and to states, local governments, and tribal governments.

- Minnesota’s budget reserve has given the state time to take thoughtful action, and could create a buffer against uncertainty as well as support further actions needed to meet Minnesotans’ needs and protect essential services.

- Policymakers could also raise revenues from those still doing well in this economy – wealthy Minnesotans and profitable corporations could shoulder more of the responsibility of funding essential services and building for a more equitable recovery.

Minnesota policymakers have a big job ahead of them, but thankfully we have tools that better ensure they’re up to the task.

Want to learn more? You can also check out our deep dive on the November budget and economic forecast.