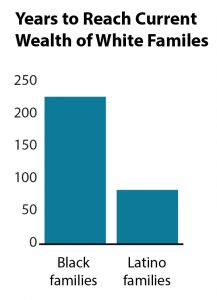

If black family wealth continues to grow at the same pace as the past three decades, it will take more than 200 years for black families in the U.S. to have the same amount of wealth that white families have today. It will take 84 years for Latino families to reach this milestone. That’s the upsetting news from a report by the Corporation for Enterprise Development (CFED) and the Institute for Policy Studies.

We’ve written before about the state of the racial wealth gap and how it’s bad for both families of color and our economy. With growing populations of color, the future economic success of Minnesota and the nation depends on everyone reaching their full economic potential. The report shows that over the past 30 years, the average wealth for white families in the U.S. has grown by 84 percent. By contrast, wealth for Latino families has grown by 69 percent and for black families only 27 percent. In other words, our country’s racial wealth gap has gotten even larger.

The report also demonstrates the enormity of the racial wealth gap and compares the wealth of black and Latino families against the richest people of the Forbes 400. The 100 wealthiest individuals in the U.S. have as much wealth as the entire black population in the United States. Similarly, the wealthiest 186 people have more wealth than the nation’s Latino population.

The report names several factors that impact the ability of black and Latino families to build wealth, including:

- Higher rates of unemployment. Without jobs, it’s difficult for many black and Latino families to build wealth and attain financial security.

- Income inequality and sluggish returns on earned income. Latino and black households earn 60 to 75 percent of what white households earn, and Latino and black households are less able to use their earnings to build wealth. This is due in part to the fact that black and Latino workers are less likely to have quality jobs that provide benefits (like health coverage, paid time off, or a retirement plan) that allow workers to save and invest. Instead they must use more of their current income to deal with daily needs and emergencies that come up.

- Fewer savings to get through an emergency. Over two-thirds of black and Latino households are “asset poor,” meaning they don’t have enough savings to live at the poverty level for three months if they suddenly lost their job. Meanwhile, just over a third of white households are asset poor. It becomes very difficult to build wealth when families must use any resources they have to get through an emergency.

- Increased reliance on alternative banking avenues. Black and Latino households are more likely to use alternative financial services, like check cashing services or prepaid cards, which often have much higher fees than traditional banks and can eat up a significant portion of a household’s income, leaving less for savings or wealth creation.

- Lack of retirement savings. Black and Latino households have much less saved for retirement. They are less likely to have access to employee-sponsored retirement plans and also carry high student loan debt, which makes it harder to save for the future.

But there are actions that can serve to accelerate progress on closing the wealth gap. The report recommends:

- Replacing the mortgage interest deduction with tax policies that support homeownership among low-wealth families. The mortgage interest deduction gives larger tax deductions to homeowners with higher incomes and more expensive houses. Instead, the tax code could have targeted provisions that better serve low-income and low-wealth families, which are much more likely to be families of color, and for whom the tax incentive would be more likely to make the difference in becoming homeowners.

- Strengthening the Earned Income Tax Credit (EITC). The EITC has a proven track record of giving working families a significant boost. By expanding eligibility for workers without dependent children, the EITC could allow more low-income workers to start building up savings. Here in Minnesota, an important part of the 2016 tax bill was to improve our state version of the EITC, the Working Family Credit, for families and workers. Given that a drafting error in the tax bill prevented it from becoming law this year, enacting the Working Family Credit expansion should be a top priority for 2017.

- Improving access to retirement savings for low-wealth families. Households of color are much less likely to have employer-sponsored retirement plans. The report suggests improving the federal myRA, which can help more families save for retirement.

- Creating savings accounts for children. Children’s Savings Accounts can be started for very young children and include matching funds so that when the child turns 18, they can use the money for higher education or other asset-building purposes.

Our country’s black and Latino families families can’t wait another century to reach financial security. Policymakers should act now to begin to create an environment in which all families can build wealth and stronger futures.

By Clark Biegler