As Minnesota policy-watchers get ready for the next legislative session, recent budget reports suggest that Minnesota will likely project a larger budget surplus. This in part reflects the fact that the national economy has performed more strongly this year than was previously anticipated.

In the 2023 Legislative Session earlier this year, policymakers agreed to a two-year state budget, which started this June. When the budget agreement was made, projections were that the FY 2024-25 budget cycle would end with a $1.6 billion general fund surplus.

Since then, we’ve seen several budget reports that show a more positive budget outlook to date, although some weakening of economic projections for the future.

FY 2022-23 budget ended $820 million stronger than prior estimates

In October, Minnesota Management and Budget (MMB) formally closed the books on the prior FY 2022-23 budget cycle, and determined that bienniums final general fund balance was $820 million higher than end-of-session estimates.

This was largely from revenues for the biennium coming in $739 million higher than was estimated at the end of the 2023 session, and spending coming in $81 million lower.

This $820 million from the end of FY 2022-23 will add to the $1.6 billion general fund FY 2024-25 surplus estimated at the end of the session.

FY 2024 starts stronger than projections

The pattern of revenues coming in higher than prior projections has continued into the start of FY 2024.

The states latest quarterly economic update reported that general fund revenues came in above prior projections. It predicts an improving national economic outlook in the near term, with some slower growth in 2025 and 2026.

Read on for highlights and takeaways from the October Revenue and Economic Update from Minnesota Management and Budget (MMB).

1. Minnesota’s net general fund revenues for the start of FY 2024 came in $400 million more than earlier predicted.

Total general fund revenues from July to September 2023 from individual income, sales, and corporate taxes, as well as other revenues, came in $400 million more than projected in the February 2023 Budget and Economic Forecast.

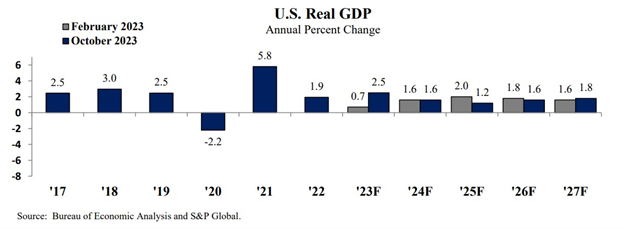

2. U.S. near term economic outlook improves, lower predictions after 2025

National real GDP is estimated to grow 2.5 percent in 2023 and 1.6 percent in 2024. These predictions come from Minnesota’s macroeconomic consultant, S&P Global (S&P), and are especially higher for 2023, compared to the 0.7 percent growth for 2023 estimated in February. National GDP growth predictions are lower for 2025 and 2026 than in February, and then improve slightly above February’s projections for 2027. The changes in economic projections reflect the national economy showing more resilience, with expectations for consumer spending, business investment, and employment for 2023 now being stronger than in February.

Actual economic growth could differ from these projections, resulting in changes in state budget and revenue estimates. Factors flagged that could result in slower economic growth than predicted include if tightening lending standards create a greater restraint on consumer and business activity, or higher energy prices.

3. U.S. unemployment rate stays relatively consistent; expected to increase starting next year

The Bureau of Labor Statistics (BLS) reports that in September 2023, the seasonally adjusted U.S. unemployment rate was 3.8 percent; this is the same as in August and 0.3 percentage points higher than in September 2022. (Keep in mind that the unemployment rate does not include individuals not in the labor force or who are in the labor force but are not looking for employment.)

The number of U.S. workers facing long-term unemployment – defined as being jobless for 27 weeks or more – totaled 1.2 million, which is similar to the average for the prior 12 months.

S&P predicts that the U.S. unemployment rate will be 3.7 percent through the first quarter of 2024, then increase gradually to reach 4.7 percent by early 2026.

More comprehensive budget projections to come in November Forecast

This figure gives good context as to the resources likely to be available in the upcoming 2024 Legislative Session. More comprehensive numbers will be provided in the November economic forecast to be released on December 6, in which both state revenues and expenditures are projected.

When the November forecast is released, we’re likely to see a small addition to the state’s budget reserve. Any time a November forecast projects a surplus, up to one-third of that surplus is added to the budget reserve as needed to reach the targeted dollar amount. MMB recently increased the target for the budget reserve; it’s likely that $21 million of projected surplus dollars will automatically go into the budget reserve. A strong reserve is a critical part of the state being prepared for the next economic downturn. The same way a family saves to withstand an unexpected serious illness or job loss, Minnesota builds this reserve so that when a recession hits and state revenues plummet, the state can maintain critical services and continue to serve Minnesotans’; needs and avoid further drag on the economy.