Budget Cuts Will Undermine Minnesota’s Recovery From the Recession

After a long legislative session, a nearly three-week state government shutdown and a special session, Minnesota finally emerged with a budget for the next two-year budget cycle, the FY 2012-13 biennium. Unfortunately, the decisions made will do little to shore up the state’s economy, invest in its people or help the state recover from a deep recession.

The 2011 Legislative Session centered around a clash between two very different visions for how to best secure a successful future for Minnesota. Governor Dayton’s budget took a balanced approach that combined spending reductions and revenue increases to address the needs of Minnesotans struggling in tough times. His plan restored fairness to the state’s tax system and improved the state’s long-term fiscal health. According to polls and editorials from around the state, it was also the approach favored by a majority of Minnesotans.[1]

The Legislature advanced a plan that relied heavily on cuts to services, including those that are vital to a strong future economy. Their plan dramatically reduced the state’s investments in the higher education and training that create a competitive workforce, transit that gets people to work, and health care and other services that create safe and vibrant communities. Further, it cut state aid to cities and counties, which would have resulted in higher property taxes for businesses and residents alike.

Governor Dayton and the Legislature were unable to arrive at a budget agreement before the end of the 2011 Legislative Session, leaving the state’s $5.0 billion revenue shortfall for FY 2012-13 unresolved. Negotiations failed to result in an agreement before June 30, resulting in a state government shutdown that lasted nearly three weeks.

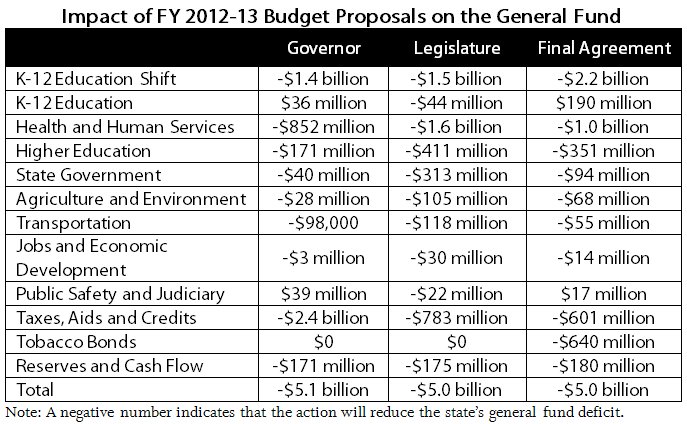

On July 14, the Governor and Legislature reached a compromise, relying on one-time fixes for more than half of the solution. The agreement delays $2.2 billion in payments to school districts, borrows $640 million from the future through tobacco bonds, and reduces funding for vital public services by more than $2 billion. This budget does not provide a permanent solution to the state’s ongoing budget problems, it cuts services that help Minnesotans who continue to struggle during the slow economic recovery, and it fails to invest in vital services that are essential to the state’s long-term economic success.

The details of the agreement were quickly negotiated behind closed doors and approved during a brief Special Session that began the afternoon of July 19 and stretched into the early morning hours of the next day. The Governor signed all the bills on July 20, officially ending the government shutdown.

This analysis examines many of the details included in the final agreement reached between Governor Dayton and the Legislature.[2] More information on the Governor’s and Legislature’s budget proposals can be found in our analysis, A Tale of Two Visions: Comparing Governor Dayton’s and the Legislature’s FY 2012-13 Budgets.

Schools Face More Delayed Payments in K-12 Education Bill

Minnesotans value a high-quality education system. A well-educated workforce is a critical building block for the economic success of our children and our state. Maintaining funding for K-12 education is typically a high priority for policymakers, and that was reflected in the budgets proposed by Governor Dayton and the Legislature. Although both proposals included delaying payments to school districts, the underlying level of funding for education remained relatively stable.

There were, however, some important differences between the two proposals. The Governor recommended a small increase in funding for K-12 education by expanding all-day kindergarten, adding a Quality Rating System to help parents assess early childhood programs, and making additional investments in overcoming Minnesota’s achievement gap. The Legislature rejected those ideas and instead proposed restructuring some specialized funding streams for schools and new evaluations for schools and teachers, while recommending a small overall budget cut.

Ultimately, the Governor and Legislature agreed to increase state funding for K-12 education by $190 million in FY 2012-13, or one percent, mostly by increasing funding for the basic education formula. However, the final K-12 education omnibus bill (House File 26) also delays more than $2 billion in payments to school districts and includes some important policy changes.

The most significant component of the final K-12 education bill is the decision to reduce FY 2012-13 state spending by shifting $2.2 billion in payments to school districts into the future. The bill continues to delay $1.4 billion in state aid payments that were shifted during the 2010 Legislative Session, and adds $772 million in new shifts. Normally, the state pays school districts 90 percent of their annual aid in one fiscal year, and a 10 percent settling-up payment in the following fiscal year. The bill changes that formula to 60 percent in one fiscal year and 40 percent in the next.

Payment delays create cash flow problems for many school districts, forcing them to use reserves or rely on short-term borrowing. As a way of helping defray borrowing costs, the K-12 education bill increases the basic education formula by $50 per pupil in each year of the next biennium, an increase of $118 million in FY 2012-13.

The bill does not specify when schools will receive the delayed payments. However, current law already includes an automatic provision for reversing the shift. When the state begins to have budget surpluses, the first roughly $900 million is slated to refill the state’s cash flow account and budget reserve. After that, any additional surplus will be used to reverse the school payment shifts. [3] Of course, policymakers can pass legislation to accelerate or delay this repayment process.

In addition to the increase in the basic education formula, the bill includes other investments, including:

- A new literacy incentive program to help meet the goal of ensuring that every child can read at or above grade level by the end of third grade. These funds will be distributed based on the number of students achieving reading proficiency and demonstrating improvement.

- Additional funding for the Minnesota Reading Corps, a statewide initiative that focuses on improving literacy among children up to third grade.

- A new early childhood scholarship program to help children from low-income families attend preschool.

- Scholarships for early high school graduates who go on to higher education and cash grants for early graduates who enter military service.

Not all areas of education fare as well. The bill:

- Reduces adult basic education (ABE) funding growth from a three percent increase to two percent in FY 2012-13. ABE helps individuals enter and advance in the workforce by providing high school equivalency degrees, workplace literacy training, and English language and citizenship classes.

- Phases out Integration Aid that goes to school districts with high concentrations of children of color to promote integration in and between school districts. A task force is created to make recommendations for how to repurpose those resources.

- Eliminates charter school start-up grants and metropolitan magnet school grants.

- Cuts the Department of Education and the Perpich Center for Arts Education by five percent for FY 2012-13.

The Legislature proposed reducing funding for special education by $48 million in FY 2012-13. The final agreement leaves funding for special education intact.

The K-12 education bill includes several policy changes, such as:

- Suspending the requirement that districts spend two percent of their revenue for staff development. Further, districts no longer have to set aside a portion of the Safe Schools Levy to pay for school counselors and other professionals.

- Creating a new evaluation process for principals, teachers and probationary teachers. And “inefficiency in teaching or in managing a school” is added as grounds for teacher termination.

- Allowing school boards to create “full-service school zones” for schools in high-crime neighborhoods, to provide education, health, human services and parent support in a collaborative manner.

- Eliminating the January 15 deadline for school districts to settle collective bargaining agreements. Districts had faced financial penalties for not meeting that deadline.

The final bill drops a number of high-profile proposals backed by either Governor Dayton or the Legislature. Not included are such things as the elimination of teacher tenure, a prohibition on strikes under some circumstances, and additional funding for all-day kindergarten and the early childhood Quality Rating System.

Cuts in Health and Human Services Fall on Vulnerable Populations

Many of Minnesota’s most vulnerable populations, including the elderly, persons with disabilities, and low-income families with children, are being asked to help balance the state’s budget through $1 billion in cuts in House File 25, the health and human services omnibus bill. This is an eight percent cut in FY 2012-13 compared to base funding, which means a reduction from current levels of service.

While some of the most troubling proposals, including those that would have caused more than 100,000 Minnesotans to lose their current health care coverage, did not make it into the final legislation, the health and human services bill still will make it harder for low-income families to work, the elderly and people with disabilities to stay in their homes, and Minnesotans to access health care.

In the Governor’s proposed budget, health and human services contributed $852 million to solving the state’s general fund budget deficit. His proposal included $495 million in general fund spending cuts and $80 million in new investments. The Governor’s proposal also netted the state $624 million in revenue by increasing surcharges paid by health care providers.

The Legislature’s proposal cut far deeper, reducing general fund spending for health and human services by $1.6 billion in FY 2012-13. The Legislature’s budget included not only spending cuts, but also dramatic changes to the state’s public health care programs that would have resulted in more than 100,000 Minnesotans losing health care coverage.

The final health and human services omnibus bill included elements from both budget proposals, as well as some new provisions that were not publicly discussed during the legislative session.

On the positive side, the bill increases funding for adoption and relative custody assistance, which provides financial assistance to families who have adopted or accepted permanent custody of children with special needs; and provides $700,000 in one-time funding to help address long-term homelessness.

However, there are many provisions that will harm families, children, the elderly, persons with disabilities and other vulnerable populations.

As a result of the final budget, working parents and other low-income Minnesotans face additional challenges in building a more secure economic future. Changes in the child care assistance system will remove some flexibility for families and create $7 million in state savings in the FY 2012-13 biennium. The bill also captures $5 million in child care assistance funds not spent in calendar year 2010 that would normally fund child care assistance in the next year, meaning nearly 500 fewer working families would be helped. The bill reduces rates paid to licensed child care facilities by 2.5 percent and legally non-licensed child care facilities by 14.5 percent. There will also be a cut to grants that provide information for parents and improve training and capacity within the child care system.

Other decisions will reduce the resources available to help families getting support through the Minnesota Family Investment Program (MFIP). The bill cuts the MFIP Consolidated Fund by $20 million in FY 2012-13, which could lead to longer wait times for families trying to access assistance, less support in finding work, and fewer families getting emergency assistance when facing homelessness. The bill also uses $38 million in federal funds for Temporary Assistance for Needy Families (TANF) to free up state dollars to help balance the state’s budget (commonly known as “refinancing”).

The Legislature had proposed very significant changes to General Assistance (GA), Emergency Minnesota Supplemental Aid (EMSA) and Emergency General Assistance (EGA). These changes would have dismantled a safety-net system for around 20,000 very low-income adult Minnesotans that provides them with a small monthly cash benefit, offers additional assistance for individuals who require a special medical diet for medical reasons or other special needs, and makes emergency funds available to help them maintain their housing and keep utilities running if they face a crisis. The final bill leaves the system largely intact, although it makes some eligibility changes that will make it more difficult for some to qualify for help.

Many low-income Minnesotans will find it harder to build assets as a result of the elimination of state funding for Family Assets for Independence in Minnesota (FAIM) grants. Low-income participants in FAIM get their own savings matched with state and federal funds to help obtain post-secondary education, purchase a home or start a new business. The loss of nearly $500,000 in state funds in FY 2012-13 will mean the loss of a matching grant from the federal government.

Support for children and adults with mental health issues will also be cut back as a result of decisions made during the special session. The final bill reduces funding for Children and Community Services Act (CSSA) grants to counties by $22 million in FY 2012-13, or 17 percent. The act is renamed the Vulnerable Children and Adults Act, and the remaining funds will be used only for child protection and to protect vulnerable adults. It will no longer fund mental health services for adults and children. At the same time, there are also other reductions in funding for mental health grants, including adult mental health and children’s mental health screening.

There are some small ways that the bill will increase barriers for individuals seeking affordable health care, such as reinstating some Medical Assistance copayments, creating a deductible for families on MinnesotaCare, and shifting some legal noncitizens from Medical Assistance to MinnesotaCare.

However, a more significant change to health care is the creation of the Healthy Minnesota Contribution program that takes away MinnesotaCare coverage for some adults without children. MinnesotaCare is premium-based health care insurance designed for working families who don’t have access to affordable health insurance through their employers. The change impacts individuals with incomes between 200 and 250 percent of poverty, or income between $21,780 and $27,225 for a single adult. These Minnesotans will be given a subsidy that they can use to help purchase health insurance in the private market, but it remains to be seen whether affordable coverage options will be available.

The budget cuts will make it more challenging for persons with disabilities to remain in their communities. As in previous legislative sessions, the bill places additional limits on the number of individuals who can enroll in waiver programs that enable the elderly and people with disabilities to access community-based care and avoid entering an institution. Cuts to these waiver programs total $64 million in FY 2012-13. The bill also reduces payments for relative personal care attendants by 20 percent. This cut particularly raises concerns for people with disabilities in rural areas, where relative caregivers are often the only option.

Some budget cuts do not fall on individuals directly, but will reduce funding for the providers that actually deliver health care and other critical services to individuals. These cuts could lead some providers to cut back on their level of services, and might force some to close their doors entirely. For example, there are more than $57 million in cuts to payment rates for a variety of community-based providers and continuing care facilities that serve the elderly and individuals with disabilities. The bill also eliminates a planned re-evaluation of payment rates intended to increase the rate to better represent the costs of providing care, known as “rebasing.” Hospitals face the loss of an anticipated $106 million increase in reimbursement rates in FY 2012-13 and another $491 million in FY 2014-15. Nursing homes lose $133 million in FY 2014-15.

A significant piece of the $1 billion in general fund cuts in the health and human services bill comes from managed care and fee-for-service reforms, including reducing payment rates, creating incentives to reduce hospital admissions/re-admissions and emergency room usage, instituting a new competitive bidding process for contracts, and shifting payments to state health plans forward by one month (which generates one-time savings in the FY 2012-13 biennium). The proposals generate $400 million in general fund savings in FY 2012-13 and $540 million in FY 2014-15.

One provision emerged in the final bill that was not included in either the Governor’s or the Legislature’s budget. The bill eliminates the MinnesotaCare provider tax beginning in 2020. This tax on health care services is one of the major funding sources for the Health Care Access Fund (HCAF), which in turn funds MinnesotaCare and other health-related grants and services. The federal Affordable Care Act is expected to begin paying for many of the health care services currently funded by the HCAF, but not all of them. There is no plan for how the state will continue to fund these other important public health functions once the provider tax is gone.

Some major proposals were left out of the final bill. For example, it does not include Governor Dayton’s plan to raise $624 million in revenue by increasing surcharges that the state collects from all hospitals, nursing homes, Intermediate Care Facilities for persons with developmental disabilities (ICF/MRs) and managed care organizations. This proposal would have drawn down federal funding and increased payment rates for some health care providers to partially offset the increase in surcharges.

Fortunately, the bill also does not include the Legislature’s proposal to repeal Medical Assistance for extremely low-income adults. One of Governor Dayton’s first actions in office was to take advantage of the opportunity to provide health care coverage for extremely low-income adults without children through Medicaid (known as Medical Assistance in Minnesota). This turned an all state funded program into a better health care option that is funded in part with federal funds. Reversing this action would have cut state general fund spending by $921 million in FY 2012-13, but the state would also have lost those federal matching dollars.

Higher Education Cuts Will Hurt Our Ability To Train Our Future Workforce

The state will need to produce more workers with degrees and credentials over the next decade to keep Minnesota’s economy competitive. However, the level of state investments in higher education agreed to by Governor Dayton and the Legislature will make it challenging for Minnesota to develop the workforce that is key to the state’s future economic success.

Higher education is cut by $351 million in House File 4, the higher education omnibus bill. That represents a 12 percent cut in general fund support in FY 2012-13, a slightly smaller cut than the Legislature proposed. Nevertheless, the state’s investment in higher education will fall below FY 2000-01 levels (and that’s in actual dollars, not inflation-adjusted), even though our higher education institutions are serving tens of thousands of additional students.

The higher education omnibus bill cuts funding for the University of Minnesota by $194 million in FY 2012-13, or 15 percent. The Legislature originally approved a 19 percent reduction and the Governor a six percent cut. The bill also includes language proposed by the Legislature that holds back $5 million, making the funds contingent on whether the University of Minnesota meets three of five goals:

- Increasing institutional financial aid;

- Producing at least 13,500 degrees;

- Increasing graduation rates on the Twin Cities campus;

- Maintaining spending on research and development;

- Maintaining sponsored research.

The bill does not include language encouraging caps on tuition increases that had been part of the Legislature’s proposal.

The Minnesota State Colleges and Universities (MnSCU) system is cut by $170 million in FY 2012-13, a 13 percent reduction from base funding, which is close to the 14 percent reduction approved by the Legislature. The Governor had recommended a six percent reduction. The bill also adopts language proposed by the Legislature that holds back $5 million and makes the money contingent on whether MnSCU meets three of five goals:

- Increasing the enrollment of students of color;

- Increasing the number of students taking online courses;

- Increasing the number of credentials earned;

- Increasing completion rates;

- Decreasing energy consumption.

The bill also caps tuition increases at state colleges at four percent in FY 2012. There are no caps on tuition increases at state universities or on fee increases, as there were in the Legislature’s proposal.

There is some limited good news for students as far as financial aid. The bill adopts the legislative proposal to increase funding for the State Grant program by $21 million in the FY 2012-13, or seven percent. While this was the higher of the two funding proposals on the table, the amount still falls short of the projected $35 million needed to fund financial aid for all qualifying students, so the Office of Higher Education will have to ration the existing funds by issuing smaller and/or fewer grants. The State Grant program provides financial aid for approximately 85,000 low- and moderate-income Minnesota students every year.

Other programs that help students afford higher education will see cutbacks as well.

- State funding for work study, which pays 75 percent of student wages for qualifying campus and community jobs, is cut by three percent in FY 2012-13.

- General fund support for the Minnesota College Savings Program, which provides approximately 2,500 low-income families with a state match when they save for college, is phased out.

- The Achieve Scholarship, which helps approximately 130 high-achieving, high-need students access higher education, is eliminated.

- The American Indian Scholarship program is cut by eight percent. At least 32 fewer students will be able to access this financial assistance.

- The Office of Higher Education, which provides administrative support for the state’s college and university system and manages the state’s financial aid programs, is cut by five percent in FY 2012-13.

These deep cuts to higher education institutions will create challenges for students seeking to improve their skills, and for employers counting on hiring an educated workforce. In response to these cuts, Minnesota’s public colleges and universities are likely to increase tuition, cut the number of courses offered and reduce support staff for students. With fewer classes and less guidance, it will take students longer to complete degrees and earn credentials, increasing the costs of higher education and reducing the supply of well-educated workers that employers need.

Few New Investments in Jobs and Economic Development

Many factors influence the state’s job and business environment, including a well-educated workforce. Funding for jobs and economic development represents just one percent of the state’s general fund budget, but those resources support business development and job training opportunities that help create jobs and get people back to work during these times of high unemployment.[4]

Governor Dayton proposed a $4 million increase in general fund support for jobs and economic development, while the Legislature proposed a $14 million cut. The final bill increases funding by $2 million, or one percent, for FY 2012-13. The bill also transfers $16 million from jobs and economic development special revenue accounts to help reduce the state’s budget deficit.

Senate File 2, the jobs and economic development omnibus bill, includes important new funding for some elements of workforce training, business development and affordable housing, but cuts to other areas. Some increases include:

- $4 million for Vocational Rehabilitation Services to secure federal matching dollars to provide employment services for people with significant disabilities.

- $300,000 for State Services for the Blind to secure federal matching dollars to help Minnesotans who are blind, visually impaired or Deafblind with their employment skills.

- $3 million in one-time funding for the Minnesota Investment Fund to encourage business expansion.

- $2 million in one-time funding for the Redevelopment Account to help develop sites with particular problems, such as environmental contamination.

- $500,000 for Enterprise Minnesota, a private consulting company that works with expanding businesses. (This provision was not in either the Governor’s budget or the bill passed by the Legislature.)

These limited new general fund investments are largely paid for by cuts in other job training and business development opportunities:

- A number of job training and business development grants that are currently awarded to specific nonprofits are consolidated into competitive grant pools beginning in FY 2013, with a reduced level of funding. One pool consolidates general fund grants for business and community development and cuts funding by 23 percent. Another pool consolidates general fund grants for adult workforce development and cuts funding by 10 percent. In addition to these cuts, the Department of Employment and Economic Development is authorized to withhold another five percent of the funds to administer the grant process.[5]

- The Job Skills Partnership, which supports job training and retraining opportunities to meet the needs of local business, is cut by five percent in FY 2012-13.

- Extended employment provides job support services to persons with disabilities and individuals with other barriers to employment. The budget cuts funding by three percent in FY 2012-13.

Affordable housing opportunities in Minnesota see increases and cuts. The bill increases the Housing Trust Fund by $2 million in FY 2012-13, which will preserve 150 rental assistance opportunities. However, there are $7 million in cuts to other parts of the Minnesota Housing Finance Agency budget, resulting in a six percent cut in overall funding. These reductions will particularly hurt the state’s efforts to preserve and rehabilitate affordable housing units and help first-time home buyers.

The final bill adopts the Legislature’s plan to use $16 million in transfers from other dedicated funds to reduce the state’s budget deficit, including a $13 million transfer from the Unemployment Insurance Contingency Account.

Public Safety Budget Protects Courts and Prisons, But Cuts Services for Vulnerable Populations

Many of the major differences between the public safety proposals advanced by Governor Dayton and Legislature reflected the differing priorities they placed on providing access to justice to low-income families and other vulnerable groups. The Governor proposed a $39 million increase in funding for public safety in FY 2012-13, a two percent increase, focusing additional funding on prisons, public defenders and civil legal services. The Legislature proposed $22 million in cuts to public safety in FY 2012-13, a one percent reduction, which will fall on services for some of society’s most vulnerable people: low-income families needing legal assistance, crime victims, women in abusive relationships and Minnesotans facing discrimination. More than the Governor, the Legislature relied on one-time money to balance the books.

Senate File 1, the public safety omnibus bill, increases the $1.8 billion public safety budget by $17 million, about one percent for the FY 2012-13 biennium. The slight increase supports additional funding for prisons, public defenders and the courts.

While the final cuts in public safety are not as deep as the Legislature proposed, the agreement still:

- Reduces funding for Legal Aid and other programs that provide free legal services to those who cannot afford an attorney to help resolve housing, credit, family matters and other civil issues. The bill cuts civil legal services by nearly $2 million in FY 2012-13, or seven percent. State funding for civil legal services had already fallen below 2006 levels, even before these new reductions.

- Reduces funding for the Office of Justice programs by nearly $3 million in FY 2012-13, which will impact funding for battered women programs, crime prevention services, crime victim assistance, and justice system improvements.

- Reduces funding for the Guardian ad Litem Board by $600,000 in FY 2012-13, or two percent. The Board provides advocacy services for abused or neglected children, minor parents, and incompetent adults in juvenile or family court cases.

- Reduces funding for the Department of Human Rights by $340,000 in FY 2012-13, or five percent. The agency works to end discrimination in Minnesota by investigating complaints, mediating disputes and educating the public about human rights issues. The cut is significantly less than the 65 percent reduction approved by the Legislature.

These funding cuts allow for spending increases in other areas of the public safety budget.

The Department of Corrections gets the largest increase – $27 million to make up for the loss of one-time federal economic recovery funds. Both the Governor and Legislature had included this increase in their budget proposals. The increase, however, is partially offset by $7 million in cuts in other areas, including reductions to agency operations and community corrections.

The bill provides a nearly $3 million increase, or two percent, to help address the public defender shortage. Public defenders represent low-income clients in criminal cases, and past budget cuts have taken a significant toll on staffing levels. In half of the state’s counties, there no longer is a sufficient number of attorneys to represent clients at their first court appearances.

As both the Governor and Legislature originally proposed, the bill includes a slight increase in base funding for the Supreme Court, Court of Appeals, District Courts and Tax Court, paying for inflationary increases in employee health insurance and pension contributions.

The public safety budget provides another example of the heavy reliance on one-time measures in the final agreement. The Legislature had proposed $18 million in one-time transfers from dedicated accounts within the public safety budget to the general fund to help balance the state’s budget. The final bill drops a proposed transfer from the 911 account and reduces the size of the transfer from the Fire Safety Account, but still includes $8 million in one-time transfers.

Cuts to Transportation Fall Almost Exclusively on Transit

The development and maintenance of the state’s road and bridge infrastructure is funded largely through dedicated revenue streams, state bonding and federal funding. Mass transit, however, gets a substantial portion of its funding from the state’s general fund. As a result, decisions to cut state general fund spending for transportation fall almost exclusively on mass transit.

Mass transit is an essential service that helps people get to and from work and school, and reduces traffic congestion and pollution. House File 2, the transportation omnibus bill, cuts state general fund support for mass transit by more than $54 million in FY 2012-13, a 33 percent reduction. The Legislature had proposed even deeper cuts – $118 million in FY 2012-13. Metro Transit, for example, would have lost 84 percent of its state support under the Legislature’s budget.

The final bill leaves a one-time hole in transit funding for both the metro area and Greater Minnesota. In the FY 2012-13 biennium, the bill:

- Makes a one-time cut of $52 million, or 40 percent, to state funding for the Metropolitan Council’s bus and rail operations.

- Makes a one-time cut of $3 million, or eight percent, to Greater Minnesota transit. While smaller than the metro area cuts, this reduction still will have an impact in areas where there are already few transportation options.

The final bill provides the Metropolitan Council with some resources to backfill this cut. Suburban transit providers that have opted-out of the Metro Transit system will be cut by $7 million, with those resources going to the Metropolitan Council. Also, the bill redirects revenues from a quarter-cent regional sales tax away from the construction and operation of rail and bus rapid transit projects. The Metropolitan Council also plans to use administrative reductions and operational reserves to fill the gap. As a result, there should be no immediate need to increase fares or reduce services.

The final bill makes no cuts to the Department of Transportation’s commuter and passenger rail funding. The Legislature eliminated this funding in its initial budget, which would have resulted in the loss of $1 million in FY 2012-13.

One new proposal appeared in the transportation bill – $127 million in additional funding from the trunk highway fund for the Better Roads for a Better Minnesota program, which is aimed at repairing roads in poor condition.

The cuts included in the final transportation bill will force transit authorities to divert resources from other projects to maintain current operations. If the state fails to make critical investments today in the transportation infrastructure, tens of thousands of Minnesotans – seniors, individuals with disabilities, working adults and students – are likely to find it a little harder to get where they need to go in the future.

Cuts Are Slowly Eroding State Government’s Ability to Serve the Public

The state government finance bill plays a key role in ensuring the wheels of government keep moving, providing funding for the state’s Constitutional officers, the Department of Revenue, Minnesota Management and Budget (MMB), the departments of Military and Veterans Affairs, and other boards and agencies. The budget also includes policy and budget decisions that affect all state agencies – such as proposals that impact all state employees and the way state government operates.

The Legislature’s initial budget targeted state government for deep cuts. Among its high-profile initiatives, the Legislature proposed reducing the state’s workforce by 15 percent by 2015 and freezing state employee salaries for two years.

In the end, the Governor and Legislature agreed to cut the state government finance budget by $8 million in FY 2012-13, a one percent reduction. The bill also anticipates $86 million in new revenue that will help reduce the state’s budget deficit.[6]

Some areas of state government are held harmless or will see an increase:

- The Secretary of State’s elections office sees no reductions because of a federal requirement to fund the Help America Vote Act.

- Much of the Department of Revenue budget is also protected because of requirements to maintain auditing and collections staff.

- The Department of Military Affairs and the Department of Veterans Affairs will see a $6 million increase in funding, mostly to support veterans who are pursuing higher education.

Protecting some areas of state government means deeper cuts to other agencies:

- Most offices and agencies receive a five percent permanent reduction in funding. These include the Governor’s office, Legislature, Attorney General, State Auditor, Minnesota Management and Budget, the Councils of Color, the Humanities Center, the Campaign Finance Board, Explore Minnesota, and portions of the Secretary of State and Department of Revenue.

- A few areas receive deeper cuts. The Science Museum of Minnesota and the Minnesota Arts Board both receive a 10 percent permanent reduction in their state funding. The Minnesota Historical Society receives a seven percent cut.

- Public television is cut by five percent, Minnesota Public Radio by 15 percent, and the Twin Cities Cable Channel loses all of its state funding.

The bill also includes new revenue. Two proposals in particular sparked controversy during the legislative session because the Legislature and Minnesota Management and Budget (MMB) disagreed on how much revenue each would raise. In both cases, the final bill relies on a more conservative dollar figure approved by MMB:

- The largest piece of revenue comes from adopting a legislative proposal to employ analytic and intelligence tools to identify businesses and individuals who are not paying taxes they owe. The bill estimates this will raise $82 million in the FY 2012-13 biennium (the Legislature estimated $133 million). After subtracting implementation costs, the bill anticipates a net $69 million in new state revenue.

- The state also will enter into an agreement with the federal government to pursue debt collections, raising $4 million in FY 2012-13 (the Legislature estimated $37 million).

The state government bill contains a few new policies that could have important future implications:

- It establishes a new Pay for Performance pilot program that sells state appropriations bonds to fund programs expected to generate increased revenues or reduced expenses for the state. Traditionally, bonds are used to pay for one-time capital projects. In this case, funding focuses on ongoing prevention and intervention services, like job training, that when successful save the state money down the road. Nonprofit providers of these services would be paid if they successfully meet performance goals, and the savings would be used to pay investors interest on their investment. The bill creates an oversight committee and authorizes up to $10 million in bonds for the pilot project.

- A Sunset Advisory Commission is created to review state agencies’ work and make recommendations on reorganization, continuation or abolition.

Although the final bill gives most agencies and programs smaller cuts than they would have received in the Legislature’s budget, the cuts still will have consequences. Most agencies have seen their bottom lines get smaller and smaller as policymakers chipped away at their budgets over the last several years. The cumulative effect is that agencies must cut back on their ability to serve the public – reducing office hours, increasing response time, or producing less information.

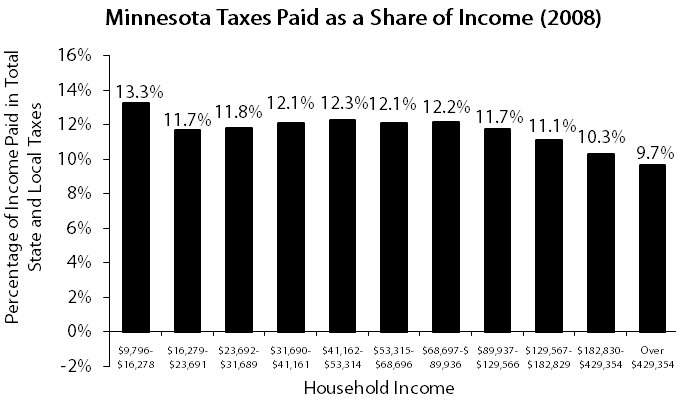

Tax Decisions Will Impact Renters, Local Governments and (Eventually) Property Taxes

Policymakers had the opportunity this session to take a balanced approach, including raising revenues, so that Minnesota’s tax system raises adequate revenues to sustainably fund the state’s priorities. They also had the opportunity to address the fact that low- and middle-income Minnesotans pay a larger share of their household incomes to fund those priorities than those with the highest incomes. On average, Minnesotans pay 11.5 percent of their household incomes in total state and local taxes, while the wealthiest one percent of Minnesotans – those with incomes over $429,000 – pay 9.7 percent.[7]

Unfortunately, the final tax bill did not make progress on either front. The tax bill, House File 20, does not include Governor Dayton’s proposal to raise revenues on the highest-income households, or any other significant state tax increases.

Fortunately, the tax bill doesn’t make our future revenue shortfalls worse. It does not include the Legislature’s proposals to eliminate the state property tax paid by businesses and cabins, to speed up the Single Sales Factor tax cut for multistate corporations, or the more costly components of conforming to federal tax law changes.[8] (The budget deal did include the future repeal of the health care provider tax, creating funding challenges for health care, as discussed in the health and human services section.)

Instead of any permanent and transparent state revenue increases, the tax bill includes tobacco bonds. The state would issue bonds to investors to move additional resources into this budget cycle, and use future payments from tobacco companies to pay the principal and interest on the bonds.[9]

By issuing up to $900 million in bonds, the state plans to raise $640 million in the current budget cycle. This means we are borrowing future revenues to pay for services today. And some of those future revenues will be used to pay interest to the bondholders and cover the costs of issuing the bonds, instead of funding services.

While there are no major changes in state taxes, the bill does contain provisions relating to property taxes.

Qualifying Minnesota households whose property taxes are high in relation to their income can receive a property tax refund from the state. The final tax bill cuts property tax refunds for renters but increases them for homeowners.

- The Renters’ Credit, which provides property tax refunds to low- and moderate-income renters, will be cut by $26 million, or 13 percent, starting with refunds filed in 2012. Nearly 300,000 Minnesota households will be harmed by this change, facing an average cut of $87. About 7,300 Minnesota households are expected to lose their entire credit. This is a substantially smaller reduction than the 46 percent cut to the Renters’ Credit that was included in the legislative tax bill.

- Property tax refunds for homeowners, commonly called the Circuit Breaker, are increased by $30 million, starting with applications filed in 2012. The maximum amount of credit is increased, and households with incomes of $10,880 to $93,240 will see larger refunds because of a change in how the refund is calculated.

The tax bill makes $642 million in cuts compared to base funding to the “property tax aids and credits” portion of the budget, which is made up primarily of state aids to cities and counties, and the Market Value Credit and its related reimbursement to local jurisdictions. This area faced $766 million in cuts in the Legislature’s budget. State aids to cities and counties have been cut significantly in recent years, but those cuts were not permanent. The tax bill essentially locks in the cuts to aids to cities and counties at their 2010 levels.

- Local Government Aid to cities is cut by $204 million compared to base funding in FY 2012-13. The bill does not include the Legislature’s proposal to end all aid for Duluth, Minneapolis and St. Paul.

- County Program Aid is cut by $73 million compared to base funding, as in the Legislature’s budget. In addition, counties face cuts to other specific funding streams in other budget bills.

- The Market Value Credit is eliminated and replaced with a different mechanism that is intended to provide a similar level of property tax reduction to homeowners but without a cost to the state, saving the state $365 million. The Market Value Credit directly reduces homeowners’ property taxes through a credit on their property tax statements. The state is supposed to reimburse local governments for the lost revenue, but has frequently not paid the full amount.

For the 2011 calendar year, cities and counties have already set their property tax levels, so these cuts will create pressure on local governments to make cuts in services or look to other revenue sources to make up the difference. For 2012, these cuts will put pressure on local property taxes.

The Minnesota Department of Revenue estimates that as a result of the combined impact of provisions in the tax bill, property taxes will increase by $377 million in FY 2013, $267 million in FY 2014, and $273 million in FY 2015.[10]

Governor Dayton proposed no cuts to local aids or property tax refunds, in order to avoid increases in property taxes.

Some of the other items in the tax bill include:

- Permanently reducing maintenance of effort (MOE) requirements on counties, allowing them to spend only 90 percent of the 2011 required amount on regional libraries, mental health services, child welfare targeted case management, and family service collaboratives. These reductions cannot result in a loss of federal dollars or an increase in costs for the state. There is a similar provision that sets city MOE spending on regional libraries at 90 percent of the 2011 amount.

- Suspending for another two years (through June 30, 2013) the Political Contribution Refund, a part of the state’s campaign finance system that reimburses Minnesotans for small contributions to candidates and political parties.

- A $9 million appropriation and tax provisions to assist in disaster relief and recovery to respond to spring floods in southwestern and western Minnesota, the May tornado that struck Minneapolis and Anoka County, and July storms and tornadoes.

- Increasing the estate tax exemption for qualifying small businesses and farms to $5 million, as under the federal estate tax, and calls for a study of ways to restructure or replace the estate tax while still raising the same amount of revenue.

- Approving new local sales taxes in six Minnesota cities and allowing changes to four existing local sales taxes. For any future local option sales tax to be considered by the Legislature, the city needs to hold a referendum on the issue first, but can only incur the cost of holding the referendum – the city cannot spend any money to encourage passage of the local sales tax.

- A $171 million transfer from the state’s Cash Flow Account and a $9 million transfer from the state’s budget reserve.

Policymakers Fail to Find a Sustainable Way to Fund Priorities

Failure to raise revenues means fewer investments and future deficits Minnesotans are proud of our quality of life – our highly skilled workforce, amazing outdoor spaces and vibrant culture are what attract people and businesses to this cold-weather state. However, maintaining this quality of life requires investments in our people, our communities and our infrastructure. Minnesota does not have a revenue system that raises enough to meet the state’s priorities, and the budget deal reached between Governor Dayton and the Legislature does not correct that current imbalance.

Instead, policymakers have once again turned to one-time solutions to bring the state’s budget back into balance. Shifting school payments and borrowing tobacco payments from the future account for 56 percent of the solution to balance the state’s budget in FY 2012-13. Policymakers continue to delay the tough decisions necessary to ensure long-term budget stability. After the decisions of the 2011 Special Session, the state is still projected to face a $1.9 billion deficit in the FY 2014-15 biennium. The size of that deficit could increase substantially if the national and global economies fall back into another recession.

The final agreement also relies on spending cuts. Unfortunately, many of those cuts will fall on Minnesotans still struggling during the slow economic recovery. Raising progressive revenues was not part of the final budget solution, even though additional revenues could have been used to avoid cuts to vital services that families depend on and to maintain critical investments that build our state’s economy. A majority of the public supported a balanced approach, including revenues, to solving the budget situation. However, instead of raising revenues fairly and transparently, the final budget agreement will result in property tax increases at the local level.

It’s time to face reality. We are no longer kicking a can down the road, it has become a 55-gallon drum. Minnesotans value healthy families, educated workers, vibrant communities, thriving outdoor spaces and a strong infrastructure – all of which are building blocks for our future economic growth – and we need to step up and pay for them. And that means ensuring that the revenues we collect match up with the investments we need to make to meet our expectations.

[1] Minnesota Budget Project, A balanced approach to state budget winning hearts, minds and positive editorials, June 8, 2011.

[2] Except where otherwise noted, the analysis in this report is based on data from budget documents prepared by Minnesota Management and Budget and the applicable state agency, and legislative research and fiscal departments. The opinions expressed are those of the authors.

[3] Minnesota Statutes 16A.152.

[4] Other major sources of non-general fund support for jobs and economic development come from special revenue accounts (such as the Workforce Development Fund) and federal funding. The state also pursues economic development strategies through the tax code; those efforts are not described in the jobs and economic development section of this analysis.

[5] The bill also consolidates Workforce Development Fund grants for business and community development, adults workforce development, and youth workforce development. Although these grants are combined into three competitive grant pools, the funding is not cut.

[6] Combining the $8 million in cuts with the $86 million in revenue results in the $94 million in net changes to state government that has been reported elsewhere.

[7] Minnesota Department of Revenue, 2011 Tax Incidence Study, March 2011.

[8] Minnesota uses federal law as the starting point for both the individual income tax and the corporate franchise tax, so the state must decide whether to conform when changes are made to the federal tax code. Some federal conformity provisions for Tax Year 2010 were passed in late March in House File 79.

[9] In 1998, the State of Minnesota was part of a settlement against tobacco companies to recover health care costs related to tobacco use. As part of the settlement, the state receives annual payments from tobacco companies. (Minnesota House of Representatives Research Department, Minnesota’s Tobacco Settlement, October 2002.) In FY 2012-13, these payments are expected to be $320 million.

[10] This estimate is a net change in property taxes. Minnesota Department of Revenue, Analysis of Laws 2011, 1st Special Session, Chapter 7, Articles 5-7.