What is the Child Tax Credit?

Enacted into law in 1997, the federal Child Tax Credit (CTC) is an income tax credit that offsets some of the costs of raising healthy and thriving children.

The Child Tax Credit has been a powerful tool to combat poverty since its inception. In 2018, the CTC lifted 4.3 million people (including 2.3 million children) out of poverty, and lessened poverty for another 12 million people (including 5.8 million children).[1] Its impact is amplified when combined with the federal Earned Income Tax Credit (EITC); together 28.1 million people were lifted out of poverty or made less poor from these two tax credits.[2] Further, research shows that boosting household incomes – which is what the CTC does – is associated with increasing healthy birthweights, lower maternal stress, better childhood nutrition, higher school enrollment and test scores, and higher rates of college entry.[3]

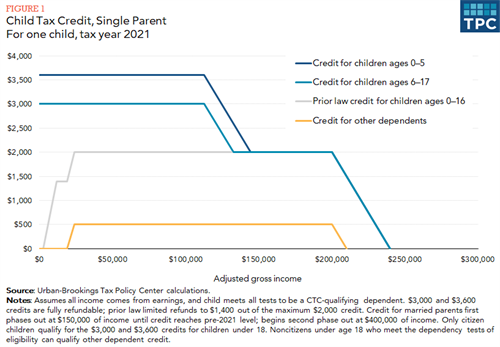

However, the lowest-income families – for whom the tax credit could make the most difference in their economic well-being – were prevented from receiving the full $2,000 per child value of the credit. When a credit is “refundable,” if the value of the credit exceeds a family’s income tax liability, then the family receives the difference as a tax refund. But the Child Tax Credit was only partially refundable. Until tax year 2020, the amount that could be refunded to families was capped at 15 percent of their earnings above $2,500, which works out to $1,400 or less per eligible child. Families with no or extremely low earnings could not receive any credit at all.[4] An estimated 1 in 5 households with an eligible child received less than $2,000 in Child Tax Credit.[5]

In contrast, high-income families could receive the maximum amount of the credit; for example, married couples with children making up to $400,000 could claim the full $2,000 per child.[6]

Historic increases to the Child Tax Credit reach more families, increase its impact

The American Rescue Plan Act (ARPA) of 2021 temporarily makes powerful changes to the Child Tax Credit that increase the credit amount and expand eligibility for the credit to include children and families who were previously left out.[7] The major changes include:

- Larger credit amounts: The ARPA increases the value of the credit to $3,600 for children younger than 6 and $3,000 for children between the ages of 6 and 17. Families with incomes up to $112,500 if headed by one adult or $150,000 headed by a married couple can receive the maximum amount of credit per child. Families with incomes above these limits may receive smaller credits.

- Including older children: Previously the maximum age for an eligible child was 16; under the ARPA, children aged 17 can also qualify.

- Making the full value of the credit available to lower-income families: this is the result of the ARPA making the credit fully refundable.

Thanks to these changes, an estimated 92 percent of households with children will receive a Child Tax Credit in 2021 according to the Tax Policy Center, which estimates the average amount of credit per family will be $4,380. That’s up from 89 percent of families receiving a Child Tax Credit, averaging $2,310 per family.[8] Among those who benefit from CTC expansion are folks whose work has always been essential, and we all have relied on even more during the pandemic, such as cashiers, nursing and home health aides, agricultural workers, and food preparation workers.[9]

Unfortunately, that still leaves more than one million children left out because of their immigration status – a situation that policymakers should rectify in future policy action.[10]

Expanded eligibility to more families further lowers poverty, advances racial equity

The Child Tax Credit improvements are expected to reduce child poverty by an estimated 40 percent: from 14.2 percent to 8.4 percent.[11] This would mean 4.3 million fewer children would be living in poverty in a typical year.

The expanded CTC provides the strongest economic boost to lower-income families. In 2022, the poorest 20 percent of households that benefit from the CTC expansion will receive a 35 percent income boost.[12] Children of color are disproportionately likely to be living in lower-income households, so the income boost from the increased CTC will also help reduce racial inequities in income. Before the CTC’s expansion, Black, Hispanic, and Asian American and Pacific Islander children experienced higher poverty rates, at 20.4, 24.2, and 14.9 percent, respectively.[13] With CTC expansion, these rates fall to 15.0 percent for Hispanic children, 10.1 percent for Black children, and 11.3 percent for AAPI children. This translates to 1 million fewer Black children, 1.7 million fewer Hispanic children, and 127,000 fewer AAPI children living in poverty.

New payment options allow families to budget on their own terms

An innovative aspect of the ARPA’s Child Tax Credit expansion is the introduction of monthly payments. Normally, families receive any refundable tax credits as a single lump sum after they file their income tax returns. However, this year families will receive half of the value of their Child Tax Credits divided into monthly payments starting on July 15. The remainder of the credit will be paid after families file their 2021 income taxes. This means families could receive up to $300 per month for each child under the age of 6, and $250 per child between the ages of 6 and 17.

Monthly payments help families meet their day-to-day living expenses, but it might not be the preference for every family. Families are also able to opt out of receiving periodic payments, and can choose instead to receive the full credit amount after filing their 2021 federal income taxes.[14] Giving families the option to receive periodic payments or one lump sum at tax time allows families to budget as they need for their unique circumstances.

Permanent expansion would narrow opportunity gaps by keeping more families and children out of poverty

While the CTC expansions provide a powerful new tool to fight child poverty, these improvements are temporary. To retain the substantial financial gains of the CTC expansion for families, especially BIPOC families, these changes to the credit should be made permanent. The change to full refundability is especially important to maintain the poverty-fighting impact. About 27 million children in families that did not previously receive the full value of the credit – particularly families of Black and Latino children, who are overrepresented among low-income families, and children living in rural areas – would be able to receive the full credit amount.[15] About 322,000 Minnesota children under the age of 17 who previously didn’t qualify for the full credit amount would benefit from making full refundability permanent, and more than 1.1 million Minnesota children would benefit from making all expansions permanent.[16]

The COVID-19 pandemic has demonstrated how policy choices that promote economic security, like a strengthened CTC, are crucial for families, especially low-wealth and BIPOC families, to stay safe, healthy, and make ends meet during periods of financial distress. Families are already putting this year’s expanded CTC to good use as they seek to recover from the pandemic’s effects. Making the expansion permanent would make a strong contribution to an equitable recovery by delivering on the credit’s demonstrated impact in improving outcomes in health care, education, and earnings. Policymakers should ensure that CTC expansion is made permanent in current budget discussions – and follow this up with further improvements – to ensure economic opportunity is shared by more of our neighbors regardless of race, income, immigration status, or where they live.

By Abimael Chavez-Hernandez

[1] Center on Budget and Policy Priorities, Policy Basics: The Child Tax Credit, December 2019.

[2] Center on Budget and Policy Priorities, Policy Basics: The Child Tax Credit.

[3] Center on Budget and Policy Priorities, Congress Should Adopt American Families Plan’s Permanent Expansions of Child Tax Credit and EITC, Make Additional Provisions Permanent, May 2021.

[4] Center on Budget and Policy Priorities, Policy Basics: The Child Tax Credit.

[5] Congressional Research Service, The Child Tax Credit: The Impact of the American Rescue Plan Act (ARPA; P.L. 117-2) Expansion on Income and Poverty, July 2021.

[6] Congressional Research Service, The Child Tax Credit: How it Works and Who Receives It, January 2021.

[7] Resources on the ARPA’s changes to the CTC include: Congressional Research Service, The Child Tax Credit: How it Works and Who Receives It, Center on Budget and Policy Priorities, Congress Should Adopt American Families Plan’s Permanent Expansions of Child Tax Credit and EITC, Make Additional Provisions Permanent, and Congressional Research Service, The Child Tax Credit: The Impact of the American Rescue Plan Act (ARPA; P.L. 117-2) Expansion on Income and Poverty, July 2021. See also Minnesota Budget Project, A brief rundown on the expanded Child Tax Credit, July 2021.

[8] Tax Policy Center, What is the child tax credit?, accessed August 2021.

[9] Center on Budget and Policy Priorities, Congress Should Adopt American Families Plan’s Permanent Expansions of Child Tax Credit and EITC, Make Additional Provisions Permanent.

[10] Institute on Taxation and Economic Policy, Child Tax Credit Is a Critical Component of Biden Administration’s Recovery Package, June 2021.

[11] 8.4 percent is the child poverty rate in 2018, which is used to represent a typical year. Urban Institute, How a Permanent Expansion of the Child Tax Credit Could Affect Poverty, August 2021.

[12] Institute on Taxation and Economic Policy, Child Tax Credit is a Critical Component of Biden Administration’s Recovery Package.

[13] Data in this paragraph about the impact of the CTC on poverty rates by race are from Urban Institute, How a Permanent Expansion of the Child Tax Credit Could Affect Poverty. This data source does not provide information for Native American children.

[14] The IRS allows eligible households to disenroll from monthly payments using their online Child Tax Credit Update Portal.

[15] Center on Budget and Policy Priorities, Congress Should Adopt American Families Plan’s Permanent Expansions of Child Tax Credit and EITC, Make Additional Provisions Permanent.

[16] Center on Budget and Policy Priorities, Congress Should Adopt American Families Plan’s Permanent Expansions of Child Tax Credit and EITC, Make Additional Provisions Permanent.