Governor Mark Dayton makes expanding economic opportunity to all Minnesotans a top priority in his supplemental budget for FY 2016-17.[1] The state’s workforce is shrinking as baby boomers retire, and Minnesota can’t afford to leave anyone on the sidelines if we want to continue our economic success. Expanding opportunity to more Minnesotans, regardless of their race or where they live, is critical for the state’s future. In the governor’s State of the State Address earlier this year, he made it clear that working to close our state’s shameful racial economic gaps was a primary focus. To build prosperity in the state, Dayton proposes investments in quality education, supports for Minnesota’s workforce, a safe and modern transportation system, and tax credits for working families.

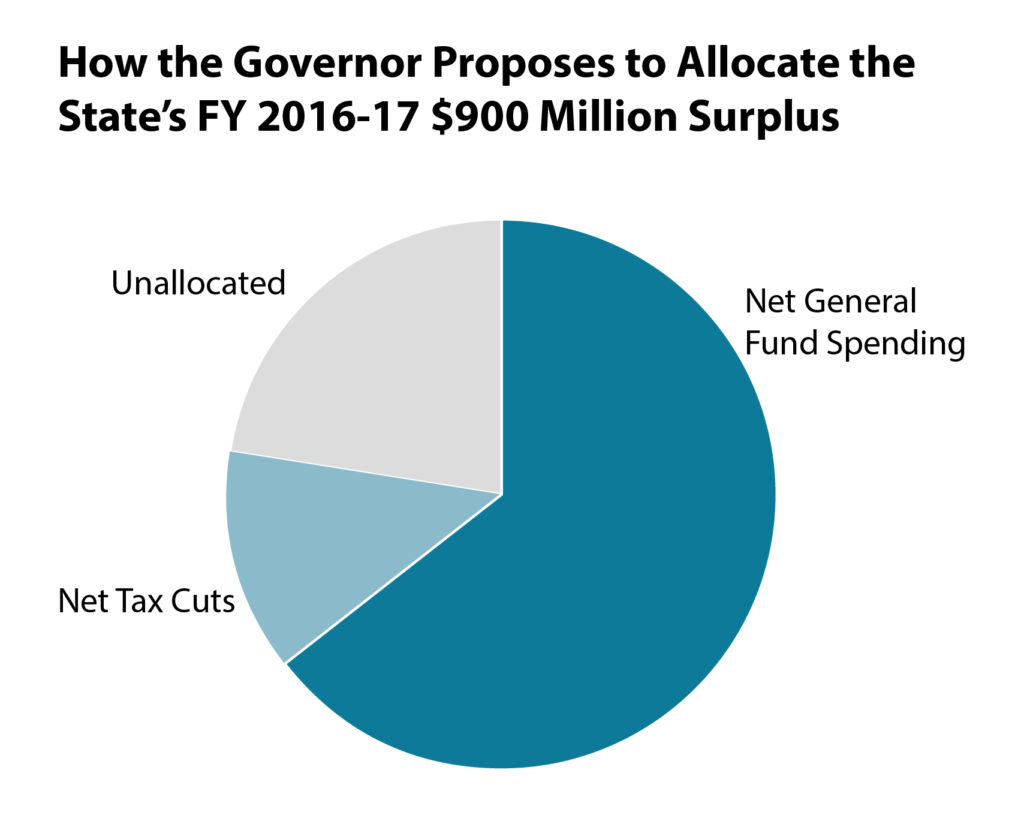

Given a $900 million projected surplus for FY 2016-17, Dayton proposes $581 million in net additional general fund spending and $117 million in net tax cuts in FY 2016-17, leaving $202 million of the projected surplus unspent, or “on the bottom line.”

Education Investments Support Students from Early Childhood Through College

Minnesota has long made education a top priority for state investment, but a substantial achievement gap between white students and students of color remains. Dayton’s education budget includes $137 million in provisions that provide both broad and targeted support for Minnesota’s students from early childhood to college.

One of Dayton’s priorities is expanded access to voluntary pre-kindergarten, concentrating funding in areas with higher poverty rates and a lack of high quality pre-school options. This is a $25 million proposal in FY 2017 that increases to $100 million in the FY 2018-19 biennium.

The governor recommends one-time funding to support students through Help Me Grow, which connects families to resources to serve children in their earliest years, and Full Service Community Schools, which help kids thrive in and out of class by facilitating school and community resource partnerships. Together they receive $3 million in FY 2017.

Dayton also recommends funding intended to expand and diversify Minnesota’s teacher workforce. His initiative requires $12 million in FY 2017 and $24 million in FY 2018-19.

In higher education, Dayton proposes a competitive grant program for colleges and universities to narrow the racial gaps in college education attainment in Minnesota. Graduation rates for students of color, especially for American Indian and black students, in our state’s colleges and universities are lower than their white counterparts.[2] Narrowing this gap is an important goal since making higher education accessible and affordable is essential to building the skilled workforce the state needs for its future economic success.

Families Can Better Access the Support They Need in Health and Human Services

The governor proposes an increase in general fund spending on health and human services of $143 million in FY 2016-17. These new investments improve access to affordable health insurance, support Minnesota’s most struggling families, and strengthen supports for families with young children and people with mental illness.

Two proposals would support working parents by strengthening the Child Care Assistance Program (CCAP), which includes Basic Sliding Fee. CCAP assists working families by bringing down the often-unaffordable cost of child care. One current challenge is that parent choices are limited because the rates paid to providers through CCAP are set far below market rates. The governor’s proposal would address this by raising CCAP provider rates to the 50th percentile of current market surveys, an investment of $17 million in FY 2017 and $171 million in FY 2018-19.

The budget also contains $11 million in FY 2017 and $60 million in FY 2018-19 to bring Minnesota into conformity with federal requirements and recommendations on child care assistance policy. Some of the policy updates are necessary to ensure that Minnesota continues to receive federal funding, which currently covers about half of CCAP expenditures. Many of the changes are aimed at streamlining CCAP so that it more effectively serves families, while others deal with health and safety issues in child care facilities.

The investments in CCAP dovetail with the governor’s focus on investments that address our state’s racial disparities. Nearly two-thirds of the children participating in CCAP are kids of color. However, the proposed changes will not greatly reduce the 7,200-family waiting list for Basic Sliding Fee, or prevent CCAP from serving fewer families over time, as is projected under current law.

The governor’s budget would update the cash grant available to extremely low-income families with children through the Minnesota Family Investment Program (MFIP) for the first time in 30 years. The budget would raise the grant by $100 a month through $4 million from the general fund and $24 million in TANF funding in FY 2017. When a family falls on hard times, MFIP is intended to allow parents to continue providing the most basic resources for their family. However, the maximum grant levels under MFIP haven’t changed since 1986. That means the maximum is still set at $532 for a family of three – an amount that doesn’t even cover fair market rent for a two-bedroom apartment anywhere in the state.

The budget proposal would begin the process to reopen access to affordable health care through MinnesotaCare to thousands of hard-working Minnesotans. Currently, people earning more than 200 percent of federal poverty guidelines are ineligible for MinnesotaCare; prior to 2014, that eligibility level was 275 percent. The governor’s budget spends $213,000 in FY 2017 to apply for a federal waiver that would reinstitute 275 percent of federal poverty guidelines as the income limit. Minnesotans earning 200 to 275 percent of federal poverty guidelines – or about $24,000 to $33,000 for a single adult – are nearly three times as likely to lack health care coverage compared to Minnesotans earning more.[3]

Restoring the MinnesotaCare eligibility level would likely open more doors to affordable, quality coverage for working people of color. Racial disparities in health care coverage shrank from 2013 to 2014, but they remain very high.[4]

In addition, the governor’s budget proposal would make other significant investments in mental health, health care services, and services for children in FY 2017. Those include:

- $11 million to eventually reach 4,100 additional families per year through family home visiting for pregnant and parenting teens;

- $52 million to increase services and staffing at the state’s community behavioral health facilities, Anoka Metro Regional Treatment Center and the Minnesota Security Hospital;

- $7 million for early learning and other facilities for families with children, including mental health services for children in homeless and at-risk families;

- $18 million to comply with federal regulations that will result in higher pay for personal care assistants and other home care workers;

- $19 million for a 5 percent increase in the payment rates to primary and mental health care providers through MinnesotaCare and Medical Assistance.

Dayton’s budget would transfer $135 million over the biennium from the Health Care Access Fund to the general fund largely to cover some existing health care expenditures related to medical care for low-income Minnesotans.

Tackling Racial Disparities Through Housing, Economic Development Policies

Tackling racial disparities is an overarching priority of the governor’s budget, and is certainly apparent in his housing and economic development proposals.

While 76 percent of white Minnesota households own a home, the rate for households of color is about half of that, or 41 percent.[5] To narrow this gap, the governor proposes down-payment and closing cost assistance, and homebuyer financial education for low- and moderate-income people, with a specific emphasis on households of color. This is one-time funding for FY 2017, totaling $6 million.

The governor proposes one-time funding for economic development initiatives, including $8 million for a Minnesota Youth at Work Competitive Grant Program that will connect at-risk youth with employment opportunities, targeted toward youth of color and others who face barriers in the job market. He also proposes $4.1 million for Pathways to Prosperity, which provides job training and education for high-demand jobs.

In addition, the governor recommends $33 million for other not yet specified actions to “expand economic opportunities and eliminate disparities for Minnesotans of color throughout the state.” As these initiatives are being determined, it is important for policymakers to hear from the communities who are most affected by these disparities.

Transportation Investments to Move Minnesota’s Roads and Transitways into the 21st Century

Dayton proposes a broad plan of additional transportation revenues to fund significant investments to repair and improve Minnesota’s transportation system and build effective transit systems.

In the Twin Cities metro area, Dayton proposes improving bus and light rail lines with new shelters, more routes and more frequent service. These would be funded by a half-cent local sales tax, expected to raise $171 million in FY 2017.

Statewide, the governor proposes improvements to roads and bridges, as well as to bicycle and pedestrian infrastructure. This would be funded primarily through a 6.5 percent gross receipts tax on gas and vehicle registration fee increases, which together are expected to raise $338 million in FY 2017, as well as $2 billion in additional trunk highway bonds over ten years.

Given the role that transportation plays in access to jobs and economic opportunity, meeting the transit and transportation needs of low-income persons and economically struggling communities should be an important factor in decisions about where to invest in transit and transportation.

Tax Proposal Focuses on Supporting Working Families

The tax portion of Dayton’s supplemental budget prioritizes sustainable tax choices that move Minnesota toward a tax system that is more equitable across income levels. It is especially focused on supporting working families, particularly those with children.

The governor’s proposal reduces taxes by a net of $117 million in FY 2016-17 and $154 million in FY 2018-19.[6] (These do not include the dedicated transportation revenues described above.) As no tax bill was passed in 2015, Dayton’s 2016 tax proposal is nearly identical to his proposal from the prior year, with two additions:

- One-time increases in aids to local governments in FY 2017 of $22 million to cities and $25 million to counties.

- Federal conformity provisions updating the state’s tax code to match some federal changes, which reduce taxes on net by $19 million in FY 2016-17.

Dayton’s proposal expands three tax credits for families: the Child and Dependent Care Credit, the Working Family Credit and the K-12 Education Credit. The largest piece of Dayton’s tax plan is the $47 million expansion in FY 2017 in the Child and Dependent Care Tax Credit, which seeks to make affordable child care available to more Minnesota families. Child care can be one of the largest expenses that families with children face. The Dependent Care Credit is a refundable tax credit based on what a family pays for child care so that parents can work or look for work.

However, it hasn’t kept up with the rising costs of child care. Under Dayton’s proposal:

- The maximum income at which a family can qualify for a credit would be increased to $112,000 for families with one dependent and up to $124,000 for families with two or more dependents. It’s currently at $39,400 for all families.

- The maximum amount of credit a family can receive would increase to $1,050 for families with one dependent and to $2,100 for families with two or more dependents.

An estimated 99,000 Minnesota families would benefit from this proposal by an average of $473, including 92,300 families who would become eligible for the credit. This tax credit can also be used for care for elders and people with disabilities, as long as they are claimed as dependents by the taxpayer and the care is so the taxpayer can work or look for work.

Dayton also proposes $39 million to strengthen the Working Family Credit. The Working Family Credit encourages and supports work, helps working people across the state to better make ends meet, and gets children off to a stronger start in life. Half of all states have credits like the Working Family Credit that are based on the federal Earned Income Tax Credit, and build on the EITC’s proven success in supporting work, reducing poverty and improving the health and educational success of children.

The governor’s proposal increases the Working Family Credit for most currently eligible households. As a result, 286,000 households would benefit by an average of $138. It also increases the maximum income that households can earn and receive the credit, which makes an additional 24,000 households eligible.

Expanding the Working Family Credit can also play a role in narrowing Minnesota’s stark racial income disparities. While people of color made up about 18 percent of the state’s population in 2013, about 30 percent of Minnesota households eligible for the EITC (and therefore also the Working Family Credit) were people of color.[7]

Dayton’s budget also proposes $5.7 million in additional tax benefits by expanding the K-12 Education Credit, under which families can receive a credit for up to 75 percent of eligible educational expenses with a maximum credit amount of $1,000 per eligible child. Dayton proposes increasing the income cap on the credit, which would make about 17,800 additional families eligible.[8] Dayton also proposes that eligibility levels would be adjusted each year for inflation, so that as incomes rise over time, families can remain eligible for this credit.

By providing tax reductions for struggling families, Dayton’s budget seeks to continue the state’s recent progress toward a tax system that is more equitable among income groups. While the highest-income Minnesotans still pay a smaller share of their incomes in state and local taxes, the gap between them and other Minnesotans has narrowed considerably as a result of tax changes passed in 2013 and 2014.[9]

The governor’s budget also includes a package of initiatives to close tax loopholes used by a relatively small number of corporations, and thereby create a more level playing field for all business taxpayers.

Governor Makes Smart Investments and Leaves Money on the Bottom Line

Considering the state’s $900 million surplus, the governor seized the opportunity to propose investments that seek to put more Minnesotans on a path to prosperity. And importantly, he seeks to ensure his budget is fiscally responsible. Since the projected surplus in the next biennium, FY 2018-19, is smaller annually than the FY 2017 balance, the governor wisely makes many of his initiatives one-time appropriations, rather than ongoing commitments. This means that the governor is not over committing the state’s resources in ways that create shortfalls in the future.

The governor also leaves about $200 million of the FY 2016-17 and $369 million of the FY 2018-19 surplus untouched. With any economic forecast, there is a certain amount of risk involved; leaving resources “on the bottom line” gives the state an additional financial cushion.

Dayton’s proposed supplemental budget seeks to make smart, responsible investments and expand economic opportunity to more Minnesotans regardless of where they live, what they earn, or their race or ethnicity. He prioritizes efforts so that children start off in stable environments and adults get the support they need for school or training for good jobs. Dayton’s budget also allows Minnesotans who have hit a rough patch to make ends meet until they are on firmer footing. The governor also seeks to build on the recent progress toward a fair tax system that sustainably funds critical public services. Policymakers should heed these priorities as they make tax and budget choices in 2016.

By Clark Biegler, Ben Horowitz, and Nan Madden

[1] Unless otherwise noted, this analysis uses information from Governor Mark Dayton’s FY 2016-17 Supplemental Budget.

[2] Minnesota Office of Higher Education, Graduation Rates, 2014.

[3] Minnesota Budget Project analysis of 2014 American Community Survey data.

[4] Minnesota Budget Project analysis of 2014 American Community Survey data.

[5] Corporation for Enterprise Development, Assets and Opportunity Scorecard, January 2016.

[6] These figures do not include the $47 million increase in local aids in FY 2017.

[7] Estimates by Brookings based on 2013 American Community Survey data. Among EITC-eligible Minnesota households, 10.9 percent were black, 6.6 percent were Hispanic and 6.4 percent were Asian.

[8] $37,500 is the current income limit for the K-12 Education Credit for families with one or two children; the income ceiling rises for larger family sizes. Families above the income limit for the K-12 Education Credit can be eligible for the similar K-12 Education Subtraction. Under Governor Mark Dayton’s proposal, some families would shift from using the K-12 Subtraction to the K-12 Credit.

[9] Minnesota Department of Revenue, 2015 Minnesota Tax Incidence Study, March 2015.