While Minnesota is recovering from the Great Recession, many working Minnesotans still struggle to reach economic security. Even though unemployment is back to pre-recession levels, workers have not seen substantial wage growth. Wages aren’t keeping up with the cost of living, and many families can’t meet their basic needs for child care, transportation, housing and health care.[1]

Even six years into the economic recovery, too many Minnesotans still lack the quality jobs that would allow them to support themselves and their families:

- Wages are lower than in 2000, when adjusted for the impact of inflation.

- Many Minnesota workers, including over half of Minnesota workers without a college degree, earn less than what it takes to support a family.

- Minnesota’s economic success is not reaching all communities; people of color are more likely than other Minnesotans to be underemployed or unemployed.

State policy choices play a role in building a future where all Minnesota workers benefit from the economic growth they help create. Policymakers can ensure that Minnesotans’ hard work pays off and build a strong economic future for us all by improving job quality standards, ensuring Minnesotans can get good jobs, and supporting low-wage workers as they climb into the middle class. Specific steps in this direction include expanding access to earned sick time, making child care affordable for more families, boosting family incomes through an increased Working Family Credit, and ensuring access to driver’s licenses, regardless of immigration status.

The Economic Recovery is Not Yet Bringing Strong Wage Growth

Minnesotans want to work and succeed. However, the benefits of Minnesota’s economic growth are not reaching all those who contribute to the state’s economic success.

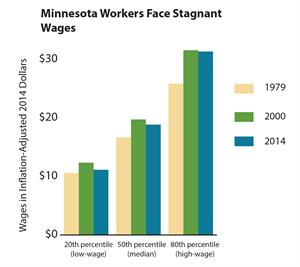

The recession took its toll on wages, and the recovery is not yet resulting in substantial wage growth in Minnesota.[2] Low-wage workers’ wages haven’t gotten back to 2007 levels, the year before the Great Recession hit. And wages for all wage groups are still hovering around 2000 levels, the year before the previous recession hit. In fact, in 2014 low-wage workers were still making less than they did in 1998 when inflation is taken into account, and median-wage workers’ wages were around the same as in 1999. High-wage workers are making about the same as they did in 2000.[3]

This lack of wage growth has occurred despite rising U.S. productivity, which has increased by 6.6 percent since the recession, and by 21.6 percent since 2000.

Over a longer time span, high-wage workers have seen the fastest wage growth. Their wages grew by 21.3 percent from 1979 to 2014, while median-wage workers’ wages grew by 13.0 percent and low-wage workers’ wages only increased by 5.4 percent, after adjusting for inflation. Again, wage growth has lagged substantially behind national productivity growth, which rose by 62.7 percent since 1979.

The fact that high-wage workers have seen much stronger wage growth has contributed to worsening wage inequality in Minnesota. In 1979, the median wage of high-wage workers was 2.4 times higher than the median wage of low-wage workers. That gap has increased, and in 2014, high-wage workers’ wages were 2.8 times higher than low-wage workers’. Hard work should pay off, but the benefits of economic growth haven’t been broadly shared.

Many Workers Can’t Afford the Basics

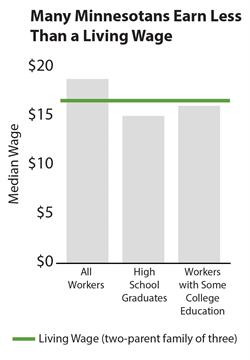

Stagnant wages mean that too many Minnesota families are unable to afford a basic standard of living. The Minnesota Department of Employment and Economic Development calculates that both parents in a family of three need to earn $16.34 per hour to afford their basic needs.[4] However, there are not enough jobs that pay these wages, especially for workers with less education. In 2014, more than half of all Minnesotans without a college degree made less than this wage.

This living wage only covers a basic needs budget that includes necessary expenses that Minnesota families face, such as the cost of food, child care, housing and health care. It does not include money for savings, entertainment, eating out or vacations. The living wage standard varies across the state, from $11.59 in Stevens County to $19.05 in Isanti County.

Low-wage workers are important to the state’s economy. They work at grocery stores and take care of Minnesota’s children, and they spend their paychecks at local businesses. These workers are integral to our state’s economy, yet today too many of them don’t earn enough to support a family.

People of Color Earn Lower Incomes, Are More Likely to be Unemployed or Underemployed

Minnesota is an above-average state in many ways. We have a high share of residents participating in the labor force, a higher median income than many other states and a lower unemployment rate. However, this disguises the fact that people of color in Minnesota lack the same opportunities that white Minnesotans enjoy.

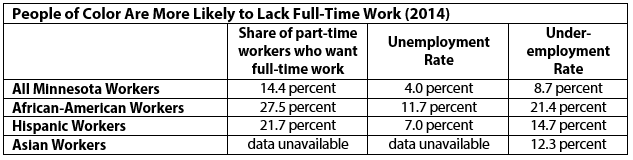

In Minnesota, people of color are more likely to be unemployed or underemployed than white Minnesotans. In 2014, while Minnesota’s overall unemployment rate was 4.0 percent, the unemployment rate was 11.7 percent for African-Americans and 7.0 percent for Hispanic Minnesotans.

Full-time work is an important path to economic security. About 1 in 7 part-time workers in Minnesota would prefer to work full-time, and this problem is much more prevalent among people of color. More than 1 in 4 African-American part-time workers and more than 1 in 5 Hispanic part-time workers want full-time work.

Workers of color are also more likely to be underemployed, a more comprehensive measure than unemployment that also includes other workers who are not able to find the work they need.[5] While overall 1 in 11 Minnesota workers are underemployed, 1 in 7 Hispanic workers, 1 in 5 African-American workers and 1 in 8 Asian workers are underemployed.

The finding that people of color are more likely to lack full-time work that meets their skills is reflected in the fact that people of color generally have lower incomes than white Minnesotans.[6] While the median income for Minnesota households was $61,500 in 2014, the median income for Hispanic or Latino Minnesotan households was only two-thirds of that. Black Minnesotan households had earnings less than half the state’s median income.

People of color are making up an ever larger share of our workforce, but our economy is not making full use of their skills and abilities. With a tightening labor market and a labor shortage on the horizon, it’s crucial for the state’s economic future that all Minnesotans have the opportunity to reach their fullest potential in the labor market.

Policy Choices Can Expand Access to Good Jobs and Economic Security

Workers need good jobs to meet their basic needs, but many Minnesota workers are struggling. Without a strong workforce, Minnesota’s future economic success is threatened. Lawmakers should adopt policies so that more Minnesotans can get and keep quality jobs to support themselves and their families. These include policies that:

- Improve job quality standards;

- Ensure Minnesotans can get the education and training they need, and can get to good jobs that make full use of their skills; and

- Help low-wage workers make ends meet and move into the middle class.

Specific steps policymakers can take toward more Minnesotans having good jobs and economic security include:

- Expanding access to earned sick leave;

- Making affordable child care available to more Minnesota families;

- Boosting family incomes by increasing the Working Family Credit; and

- Allowing all Minnesotans to have access to driver’s licenses.

Expanding access to earned sick leave. Over one million Minnesotans lose wages or maybe even their jobs if they take time off to care for themselves or a loved one. Making earned sick leave available to more workers would help families make ends meet, can reduce employee turnover, and contribute to healthier and more productive workplaces. Expanding access to earned sick leave would especially reach those who can least afford to lose wages, including low-income workers and people of color. Today 41 percent of workers in Minnesota lack earned sick leave, and the situation is more pronounced among communities of color. Almost half of black workers and 60 percent of Hispanic workers in Minnesota do not have earned sick leave. Expanding access to earned sick leave would also significantly help people with low incomes: 66 percent of Minnesota workers earning less than $15,000 a year lack earned sick leave.

Making affordable child care available to more Minnesota families. When Minnesota families have affordable child care that fits their needs, parents are able to go to work or school; children can thrive in stable, nurturing settings; and employers have the reliable workers they need. Child care can be one of the largest expenses that families with young children face, and for too many Minnesota families, the cost of child care is out of reach.

Two important strategies toward all Minnesota families being able to afford the child care they need are increasing funding for Basic Sliding Fee Child Care Assistance and a targeted expansion of the state’s Child and Dependent Care Tax Credit for low- and moderate-income families. In the 2015 Legislative Session, policymakers increased funding for Basic Sliding Fee, which will make a difference for hundreds of Minnesota families. But with around 5,300 Minnesota families currently on waiting lists for Basic Sliding Fee, there is still much more to do.[7] Policymakers should also improve the Child and Dependent Care Tax Credit by increasing the amount of credit families can receive and making more moderate-income families eligible for the credit. This tax credit specifically helps Minnesota families better afford the high cost of child care, but it hasn’t kept up with the growing cost of care.

Improving the Working Family Credit. The Working Family Tax Credit boosts the incomes of people working at lower wages, enabling them to better support their families. And its benefits go well beyond that. The Working Family Credit is based on the federal Earned Income Tax Credit (EITC), which has long-lasting positive effects for children who receive it, including that these children are healthier, do better in school and earn more as adults.

The Working Family Credit also makes the state’s tax system fairer by offsetting a portion of the substantial state and local taxes that lower-income working people pay. A boost in the Working Family Credit is needed, as even with the current credit, low- and moderate-income Minnesota households pay a larger share of their incomes in state and local taxes than high-income households.

Expanding access to driver’s licenses without regard to immigration status. Minnesota workers who don’t have driver’s licenses find their job opportunities are limited – there are some jobs they can’t get to, and they can only take shifts when public transportation is available. That’s the situation that thousands of Minnesotans in communities across the state are in, because they are unable to get driver’s licenses due to their immigration status. If these Minnesotans could get driver’s licenses, they could more readily fill jobs that match their skills and abilities. That’s likely to increase their earnings, which can have a positive ripple effect on the state’s economy as those higher earnings are spent on goods and services in our local communities.

Expanding access to driver’s licenses also helps businesses get the employees they need. With a large share of the population aging out of the workforce and a potential labor shortage, Minnesota can’t afford to leave qualified workers on the sidelines because they are unable to get to work. It’s also one important step in reducing racial disparities in unemployment and underemployment in Minnesota.

Our state needs a strong workforce to build a vibrant economy. But too many Minnesotans are being left out and left behind in the current economic recovery, especially low-wage workers and people of color. Wages haven’t kept up with the rising cost of living. And many workers of color are not able to use all of their skills in the workplace. Further policy steps should be taken to increase opportunities for Minnesotans to find and keep good jobs, and build an economy that works for all. A bright economic future for Minnesota depends on it.

By Clark Biegler

[1] Except where otherwise noted, data in this report come from analysis by the Economic Policy Institute of Current Population Survey and Bureau of Labor Statistics data. All wage calculations are inflation adjusted to 2014.

[2] This analysis defines low-wage workers as workers in the 20th percentile and high-wage workers as those in the 90th percentile. Median-wage workers are defined as those who earn the median wage, the wage at which 50 percent of workers earn wages below and 50 percent earn above.

[3] Economic Policy Institute, Understanding the Historical Divergence Between Productivity and a Typical Worker’s Pay: Why it Matters and Why it’s Real, September 2015.

[4] Minnesota Department of Employment and Economic Development, Cost of Living in Minnesota, 2015. The typical family is a family of three with one adult working full time and the other working part time.

[5] Underemployment includes workers who are unemployed, working part time when they prefer full-time work, and workers who are not in the labor force but are available for work and have searched for a job sometime in the past year.

[6] U.S. Census Bureau, American Community Survey, 2015.

[7] Minnesota Department of Human Services, Child Care Assistance Program: Number of Families on the Basic Sliding Fee Waiting List, July 2015.