Every day, hard-working Minnesota families struggle to make ends meet, often spending every dollar they earn to pay for the basics. Tight family budgets make it hard for Minnesotans to pay for child care, education and training to build their skills, reliable transportation or other things they need to succeed in the workplace and get ahead. At the same time, Minnesota’s future economic success depends on more Minnesotans participating in the workforce. Given that, supporting Minnesotans’ work efforts should be a priority for tax and budget decisions in the 2017 Legislative Session.

Fortunately, there is a successful policy that focuses on working Minnesotans and their families: the Minnesota Working Family Tax Credit. The Working Family Credit encourages and supports work, makes Minnesota’s taxes more equitable, helps working people all across the state better meet their basic needs, and gets children off to a stronger start.

In 2014, about 346,000 households received the Working Family Credit, which is more than 12 percent of all households who file Minnesota income taxes.[1] The Minnesota families who receive the credit live all across the state: 48 percent live in Greater Minnesota and 52 percent live in the seven-county Twin Cities metro area.

More than half of all states, including Minnesota, have credits like the Working Family Credit that are based on the federal Earned Income Tax Credit (EITC), and build on the EITC’s documented success in supporting work, reducing poverty, and improving the health and education of children.[2]

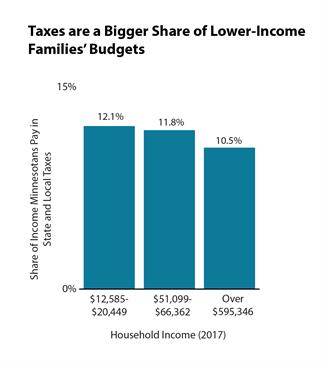

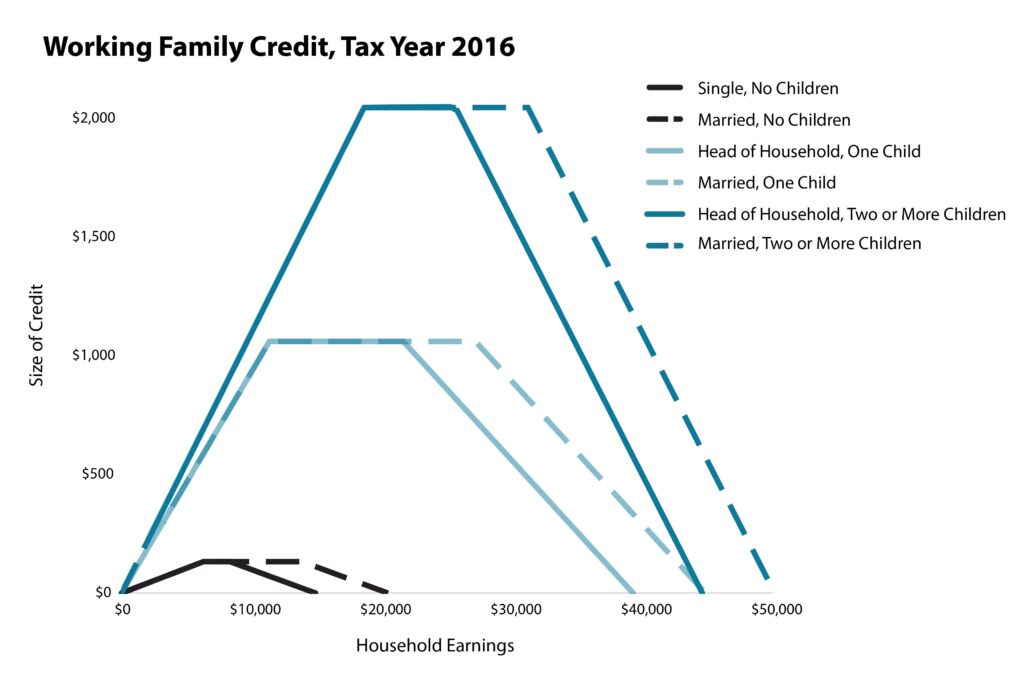

Minnesota’s Working Family Credit is calculated based on the amount of income earned during the year, the number of dependent children, and marital status. It can only be claimed by people with earnings from work. The Working Family Credit offsets a portion of the significant state and local taxes, such as sales taxes, that low- and moderate-income people pay. In 2014, the average Working Family Credit was $741. Even when including the Working Family Credit, on average, lower-income Minnesota households pay around 11 percent or more of their incomes in state and local taxes; that’s a larger percentage than what the highest-income Minnesotans pay.[3]

Increasing the Working Family Credit is a smart investment in today’s workers and the children who will make up our future workforce, and makes everyday Minnesotans a priority in the state’s tax decisions.

The Benefits of the Working Family Credit Go Beyond the Tax System

A strong and growing body of research on the federal Earned Income Tax Credit (EITC), on which the Working Family Credit is based, finds long-lasting positive effects for children and families,[4] including:

- Boosting school success and increasing future earnings: Children whose families receive these tax credits do better in school, are more likely to attend college and earn more as adults.

- Improved health for children and mothers: Children in families who receive these tax credits are more likely to “avoid the early onset of disabilities and other illnesses associated with child poverty.”[5] Expansions of the EITC in the 1990s were shown to improve maternal health and the health of newborn children.

For people working at lower wages, the EITC and Working Family Credit make a real difference in their ability to make ends meet. Because these credits are received once a year, after a family files their income taxes, many families use their credits to build a stronger financial future by increasing their savings or reducing debt. The financial impact of the credit extends to communities across the state, which get a boost when families spend their tax credits in their local economies.

In addition, these tax credits can play a role in making Minnesota a place where everyone can succeed, regardless of who they are or where they live. The Working Family Credit effectively reaches those communities where good jobs are harder to find, including parts of Greater Minnesota and communities of color.

- Households in Greater Minnesota are more likely to receive the Working Family Credit; 13.8 percent of tax-filing households in Greater Minnesota receive the Working Family Credit, compared to 11.8 percent in the seven-county metro area. And in 12 Greater Minnesota counties, at least one in six households receive the credit.[6]

- While people of color made up about 18 percent of the state’s population, in 2015 about 34 percent of Minnesota households eligible for the EITC (and therefore likely also the Working Family Credit) were people of color. Among EITC-eligible Minnesota households, 13.9 percent were black, 7.7 percent were Asian and 6.5 percent were Hispanic.[7]

Time to Make the Working Family Credit Work for All Kinds of Families

The strong positive impact of the Working Family Credit and the federal EITC for families with children is clear. However, as they are currently structured, these tax credits do much less to support the work efforts of single people and married couples without dependent children – sometimes referred to as “childless workers.” This group includes non-custodial parents and others who have children that they do not claim as dependents for tax purposes, as well as younger Minnesotans starting out their work lives. The Minnesota Tax Incidence Study shows that lower-income households without children pay a higher share of their incomes in state and local taxes than the state average.[8]

There are three primary reasons to improve the EITC and Working Family Credit for workers without dependent children:

- Their credits are small compared to what’s available to households with children. The maximum Working Family Credit a single worker without children can receive is $133, compared to $1,061 for a single parent with one child. The much smaller credit for workers without children is not proportionate to the difference in family size. To put the difference in perspective: for a single parent with one child receiving the maximum Working Family Credit, the combination of their earnings and the WFC equals 43 percent of what it takes to support their family. For a single childless worker receiving the maximum Working Family Credit, the combination of their earnings and tax credit equals only 28 percent of what they need to support themselves.[9]

- Workers lose eligibility at very low incomes. Single childless workers become ineligible for the Working Family Credit when their incomes reach $14,893 – so someone working full-time, year-round earning the state’s minimum wage will make too much to qualify.

- The credit has arbitrary age requirements for households without dependent children. Younger workers who are economically independent and not claimed as dependents by another taxpayer nonetheless cannot receive the credit if they are under age 25. This age requirement does not apply to workers with children.

There is growing interest in making the federal EITC and its state counterparts work better for households without dependent children. President Barack Obama and House Speaker Paul Ryan made similar proposals to improve the EITC for childless workers, and states don’t need to wait for federal action to improve their own credits.

Strengthen the Working Family Credit to Support Minnesota Workers

As policymakers consider tax policy changes this session, they should make struggling Minnesota families a high priority. Minnesota should build on the Working Family Credit’s track record of making Minnesota’s taxes more equitable and supporting work. Policymakers should pass an expansion of the Working Family Credit like what was included in the 2016 tax bill.[10] That proposal would have provided an additional $48.8 million in tax credits to 386,000 Minnesota workers and families by:

- Increasing the size of the credit that Minnesota households can receive; the 2016 tax bill would provide an average $135 additional tax benefit for currently eligible workers and families.

- Making more households eligible for the credit by increasing the amount that Minnesotans can earn and still receive the credit. For example, the 2016 tax bill would increase the income limit to $18,500 for single workers without children, $47,530 for a married couple with one child and $53,390 for a married couple with two or more children.

- Allowing younger workers without children to qualify by lowering the age requirement from 25 to 21 years old.

A stronger Working Family Credit would make a real difference to hundreds of thousands of struggling Minnesota families, and invest in a stronger workforce and more equitable and prosperous state. It’s time to make that investment.

By Nan Madden and Ben Horowitz

[1] Minnesota Department of Revenue, Tax Year 2014 Minnesota Income Tax Statistics by County. In this analysis, the term “households” refers to the number of tax returns.

[2] Center on Budget and Policy Priorities, Policy Basics: State Earned Income Tax Credits, June 2016.

[3] Projected data for 2017; Minnesota Department of Revenue, 2015 Minnesota Tax Incidence Study, March 2015

[4] Center on Budget and Policy Priorities, EITC and Child Tax Credit Promote Work, Reduce Poverty, and Support Children’s Development, Research Finds, October 2015.

[5] Center on Budget and Policy Priorities, EITC and Child Tax Credit Promote Work, Reduce Poverty, and Support Children’s Development, Research Finds.

[6] Minnesota Department of Revenue, Tax Year 2014 Minnesota Income Tax Statistics by County.

[7] Estimates by Brookings based on 2015 American Community Survey data.

[8] Minnesota Department of Revenue, 2015 Minnesota Tax Incidence Study.

[9] This example uses the Basic Needs Budgets calculated by the Minnesota Department of Employment and Economic Development to describe what it takes to support a family in Minnesota.

[10] This bill was not signed into law due to a serious, unrelated drafting error discovered after the end of the 2016 Legislative Session.