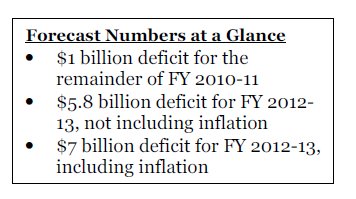

Minnesota’s short-term budget problems have eased slightly, according to the state’s February economic forecast. Last November, the forecast described a $1.2 billion deficit for the remainder of the FY 2010-11 biennium. That number got revised downward to $1 billion in the February forecast.

The new forecast paints a good news/bad news picture. The good news is that economic forecasters are slightly less concerned about the economy slipping into a double-dip recession. Compared to the last forecast, the February forecast is expecting slightly stronger growth in the nation’s Gross Domestic Product.

Yet the economy is far from a clean bill of health. While the national economy appears to be improving, that isn’t translating into more Minnesota jobs and higher wages. “Total wages paid in Minnesota are not expected to return to pre-recession levels until late in 2011, and Minnesota employment does not return to its pre-recession level until 2013,” the forecast said.

Looking ahead to the FY 2012-13 biennium, the February forecast lowers expectations for state revenues, notably in state income taxes. Compared to last November, the estimated FY 2012-13 deficit has grown from $5.4 billion to $5.8 billion. Adding in the cost of inflation, the deficit reaches $7 billion.

The Purpose of the Forecast

Minnesota’s constitution requires the state to have a balanced biennial budget. The state is now nine months into the FY 2010-11 biennial budget cycle, which ends on June 30, 2011. The forecast is the official measure of the state’s fiscal health, and serves as the benchmark against which budget and tax proposals are measured. Economic forecasts are prepared each February and November by Minnesota Management and Budget, which uses Global Insight as its economic consultant. The forecast estimates future revenues and expenditures based on current laws and economic assumptions. It does not include the impact of any budget changes policymakers are considering this legislative session.

The FY 2010-11 Forecast: Small Changes, With Spending Down Slightly

The February economic forecast’s projected revenues and spending changed only slightly compared to the November 2009 forecast. Overall, the state’s financial picture improved by $209 million, and most of that came from reduced spending. According to the forecast:

- Estimated spending is down a total of $184 million since the last forecast. The largest decline in projected spending is in Health and Human Services, which is down $150 million due to reductions in expected spending and an $83 million increase in federal health care reimbursements.

- Forecasted revenues increased $25 million, but changes varied among taxes. Estimates of corporate income tax revenues are higher than in November but income tax estimates have been reduced.

FY 2012-2013: A Slightly Larger Budget Hole

While the state economy is turning the corner, the forecast’s introductory paragraph on Minnesota’s Outlook leaves plenty to worry about.

“Business confidence continues to be suppressed by weak sales, a lack of credit, policy uncertainty, and a clouded economic outlook. … Minnesotans will remain stressed by stubbornly high concentrations of home foreclosures, difficult lending conditions, high debt burdens, depleted wealth, and severe unemployment and underemployment in the job market through much of 2010. Slow job creation is likely to limit the income growth necessary to support a robust consumer led recovery.”

The February forecast now assumes that the state’s revenues for the next biennium will not grow as fast as predicted in the November forecast. As a result, the projected budget deficit for FY 2012-13 has grown by $363 million since the November forecast, and now measures $5.8 billion. The growth in the deficit is a combination of a $312 million drop in projected revenues and a $51 million net increase in projected spending.

A closer look at the trends for FY 2012-13 reveals:

- Approximately two-thirds of the $312 revenue drop is due to lower projected individual income tax collections than in the previous forecast. Income tax revenue is expected to grow, but not as fast as projected in November.

- K-12 education spending accounts for all of the estimated spending increases, with projected spending for FY 2012-13 growing by $110 million since the November forecast.

- Spending in other areas of the budget is expected to be less than in the November forecast, including a slight decline in projected expenses in health and human services (down $39 million) and property tax aids and credits (down $11 million).

Assumptions in the Forecast: Unallotments to School Funding

The 2009 Legislative Session ended before the legislature and Governor agreed to a full solution to resolve the state’s $6.4 billion budget deficit. The Governor chose to act unilaterally to solve the remaining $2.7 billion deficit, using his unallotment authority to balance the state’s budget. His unallotment actions included cuts to higher education, health and human services and aids to local governments.

In general, the spending reductions made through unallotment are not permanent and the forecast only counts those cuts as savings in the FY 2010-11 biennium. However, the two pieces of the $1.8 billion shift in school funding made under unallotment are treated differently by the forecast in terms of their impact on the future deficit. These assumptions are based on an interpretation of what is “current law” – what would occur if no legislative changes are made; they are not based on any assumptions about what decisions are likely to be made during the legislative session.

The $1.8 billion in changes to education funding has two parts. First, the Governor partially delayed aid payments to school districts, saving $1.2 billion in FY 2010-11. Normally, the state staggers its school aid payments for any given year over a two-year period, paying 90 percent of the aid in the first year and the remaining 10 percent in the following year. The Governor’s unallotment action changed the formula to a 73/27 percent split, delaying $1.2 billion in payments to the following year. The forecast assumes that this was a one-time delay and the $1.2 billion will be repaid to schools in FY 2012-13. Any action made this legislative session to delay that repayment and continue the shift will reduce the FY 2012-13 deficit.

The second component of unallotment related to school funding is a change to the way school districts account for property tax revenue. Under unallotment, the state now requires districts to count a portion of their property taxes earlier than they used to. This accounting change inflates school district budgets in FY 2011, allowing the state to reduce its aid payments to schools for that year. The shift saved the state $600 million in FY 2011. The forecast assumes the property tax recognition shift is ongoing. Taking action to reverse this shift would increase the FY 2012-13 deficit.

Economic Outlook: Improvement with Some Uncertainty

Forecasting is part art and part science, and as a result, a key question is how likely is it that the economy will perform in the way predicted by the forecast. Global Insight assigns a 65 percent chance that the economy will experience the slow U-shaped recovery that underlies the February forecast.

The forecast, however, identifies several wild cards that could result in worse economic performance, chief among them consumer behavior. Although consumer spending is increasing, another wave of home foreclosures, further decline in home values, or just weak household finances could end this positive trend. The forecast assigns a 15 percent chance that the nation could fall into a double-dip recession, which would result in larger state budget deficits than currently predicted.

Still, despite a sluggish 2009, there are also positive signs, like a slowdown in the number of job cuts in Minnesota and fewer first-time claims for unemployment benefits. The forecast predicts a 20 percent chance of a quicker V-shaped recovery, which would improve the state’s financial situation.

What Happens Next?

The February forecast did not show significant changes in Minnesota’s budget picture. A long and slow economic recovery contributes to our current budget problems, yet over-reliance on short-term fixes to past budget challenges have also added to the large future budget shortfall.

These are not easy economic times and policymakers don’t have easy choices. The challenge at hand this legislative session is to balance the budget while still positioning Minnesota well for when prosperity returns. Policymakers can take a balanced approach to the state’s budget shortfall that includes both raising revenues and reducing spending. This approach will put Minnesota in the best possible position to compete in the global marketplace once the national economy recovers.

The information in this analysis comes from Minnesota Management and Budget’s February 2009 Economic Forecast. The opinions expressed are solely those of the authors.