2010 Legislative Session Starts Under Veil of Tension

The 2010 Legislative Session began in a context full of tension. Although even-numbered sessions are traditionally focused on passing a capital investment bill, several factors transformed 2010 into an important budgeting year as well. Setting the scene for this session were Governor Pawlenty’s unallotment actions of last year and a subsequent court challenge, a new budget deficit for the current biennium, and the politics of elections in the fall.

The drama began in 2009, when policymakers learned the state was facing a $6.4 billion deficit for the FY 2010-11 biennium. Through a combination of state budget cuts and federal stimulus resources, policymakers had reduced the size of the state deficit to $2.7 billion when the 2009 Legislative Session ended. However, instead of calling the legislature back into session to work out an agreement to resolve the remainder of the deficit, Governor Pawlenty made an unprecedented use of his unallotment power to unilaterally balance the budget. Many in the legislature felt the Governor overstepped his authority, and citizens who were impacted by the unallotment decisions are challenging the Governor in court. The case now sits with the state Supreme Court, which has the power to overturn some or all of the Governor’s unallotments, potentially opening up a $2.7 billion budget hole.

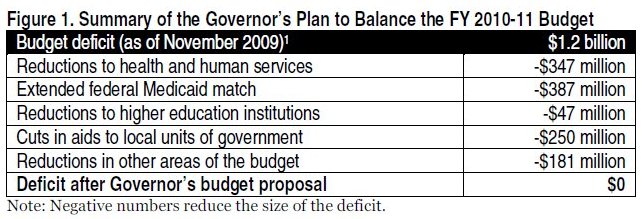

The 2009 November forecast also brought news of a new $1.2 billion deficit for the FY 2010-11 biennium – or about five percent of the remaining general fund spending for the biennium. A record loss of jobs and a decline in wages created the new deficit. This new gap must be fixed before the biennium ends on June 30, 2011. Although policymakers could wait until next session to balance the budget, acting quickly gives policymakers more options.

Adding to the drama of the session is the November election. In addition to all legislators being up for reelection, several prominent members of the House and Senate are running for governor now that Governor Pawlenty has announced he is vacating the seat. The 2010 Legislative Session represents a major opportunity for candidates to lay out their policy agenda for voters.

It is in this context that in mid-February, Governor Pawlenty released his budget proposal for resolving the state’s $1.2 billion deficit. Governor Pawlenty’s priorities are to not raise taxes and to maintain funding for military and veterans services, core public safety programs and K-12 education classrooms. In order to balance the budget, the Governor’s proposal relies on a combination of federal funding, a three percent cut to nearly every state agency’s operating budget and other reductions in services. The result is an unbalanced proposal that cuts health care, job training and services for people with disabilities at a time that these services are needed most.

The largest component of the Governor’s proposal is a placeholder for $387 million from enhanced federal Medicaid funding.[2] Medicaid is a health care program for low-income people that is jointly funded by the federal government and the states. Under the stimulus bill Congress passed last year, the federal government increased its share of Medicaid funding so that struggling people would not lose their health care during this recession and states would not have to cut services as severely. This enhanced match was a substantial part of solving the state budget deficit last year. Currently, that funding would end in December 2010, even though the tough economy and state budget deficits are expected to persist. While Congress has been discussing extending the increase for another six months, the extension has not yet been approved.

The rest of the solution to the $1.2 billion deficit includes funding reductions to most areas of the budget, including $347 million in cuts to health and human services, $250 million in cuts to local units of government and $47 million in reductions to higher education.

The Governor’s budget would balance the state’s budget in FY 2010-11 and reduce the forecasted deficit for FY 2012-13 by nearly $3 billion. He accomplishes this mostly by proposing to turn the majority of his unallotments for the FY 2010-11 biennium (which have only a short-term impact) into permanent spending reductions.

This report highlights the major components of the Governor’s supplemental budget proposal and takes a deeper look at how it would impact low- and moderate-income families and other vulnerable Minnesotans.

Health Care

The Governor’s budget would cut health and human services by about $350 million in the FY 2010-11 biennium. In addition, the Governor proposes to make his unallotment cuts permanent, which would increase the level of cuts to more than $1 billion in FY 2012-13. While a solution to the state’s budget deficit will require some cuts, significant reductions to services that help families survive this economic downturn are counter-productive.

The Governor’s budget would cut access to health care. His proposal would eliminate health care coverage under MinnesotaCare for childless adults with income between 75 and 250 percent of the federal poverty guidelines (for an individual, that’s income between $8,123 and $27,075 per year). MinnesotaCare is the state’s subsidized health insurance program for working Minnesotans. An average of 21,500 fewer Minnesotans per month would have health care coverage as a result of the proposal. The Governor also recommends increasing the maximum MinnesotaCare premium from 7.2 percent of household income to 8.8 percent of household income beginning July 1, 2011. The extra cost of premiums would result in more than 1,000 families dropping from the program and losing their health care coverage.

For adults on MinnesotaCare or Medical Assistance (Minnesota’s Medicaid program), the Governor’s proposal would eliminate coverage for rehabilitative services like physical therapy, occupational therapy and speech therapy.

For individuals struggling with mental health issues, the Governor’s budget would reduce the services available, stopping implementation of several new mental health programs for children and adults that were passed as part of a major mental health reform initiative in 2007.

Access to affordable health care, particularly preventative care, can be a significant challenge for low-income families. Years of budget deficits have led to frequent cuts in payment rates to a range of health care providers, including hospitals, pharmacies, community clinics and nursing homes. Reductions in payment rates can have significant implications for the health care system as a whole. Facing their own budget challenges, health care providers may make the difficult decision to refuse to take care of individuals on public health care programs, cut back on staff, reduce their level of services to all clients, or sometimes even close their doors. These choices make it more difficult for all Minnesotans to access health care services.

There are several examples of cuts proposed by the Governor that would have system-wide implications. For example, the Governor proposes to reduce reimbursement rates for continuing care providers by 2.5 percent. This reduction would impact home, community-based and residential programs that provide the elderly and disabled with supportive care that helps them live more independently. This reduction would come on top of a 2.58 percent reduction in rates implemented last session. To help nursing homes make up for the lost of state funding, the Governor also proposes to phase out the requirement that prevents nursing facilities from charging private pay residents higher rates than the rates set by Medical Assistance (MA). Some legislators have raised concerns about the rising costs for families with loved ones in nursing homes, but also about creating a two-tier nursing home system in which some patients receive a lower quality of care than others.

The Governor would also cut fee-for-service rates for inpatient hospital care for MA and MinnesotaCare by three percent beginning in FY 2011. Reimbursement rates for the managed care programs that provide medical assistance coverage would also be reduced by a proportional amount, although not until January 1, 2011.

The Governor also eliminates a special enhanced payment that provides a higher level of health and psychiatric care for the most difficult to reach homeless population – those with serious mental illness. This in-depth program helps these chronically homeless individuals attain and maintain stable housing.

Also of concern are proposed cuts to State Operated Services, which offer state residential and community-based programs for people with mental illness, developmental disabilities and traumatic brain injury. The Governor’s budget would permanently reduce funding for these services, creating a need for a complete redesign of the delivery system. The cut would result in a reduction in staffing and services to clients, as well as the closure or downsizing of several adult mental health facilities.

The Governor includes several proposals that would particularly reduce access to health care in Greater Minnesota. The Governor would eliminate a special payment to hospitals in Greater Minnesota that ensures their reimbursement rates for certain procedures are closer to metro area reimbursement rates. The Governor would also make it more difficult for providers to qualify for a higher reimbursement rate for dental care. This is likely to add to the severe shortage of dental providers in Greater Minnesota.

Many of these reductions will have an impact on the resources available in the state’s Health Care Access Fund (HCAF). The HCAF pays for MinnesotaCare, the subsidized health insurance program for working Minnesotans. The HCAF is funded by a tax on health care providers and the premiums paid by MinnesotaCare participants. The Governor proposes reductions in HCAF expenditures, then transfers $159 million of these savings from the HCAF to the general fund to help balance the state’s budget. In FY 2012-13, spending reductions in the HCAF would grow to $572 million.

It’s important to note that some cuts in state funding for health care also result in the loss of federal matching dollars. The federal government is currently matching the state’s spending on Medical Assistance (MA) at about 61 percent. In other words, for every dollar spent on MA, the state pays 39 cents and the federal government pays 61 cents. When the state cuts MA spending, it loses those federal dollars. For example, the cuts in health care made during the 2009 Legislative Session and through the Governor’s unallotment decisions resulted in a loss of $437 million in federal matching dollars.[3]

Services for Families and Individuals

During the current economic downturn, there are many Minnesotans living on the edge of poverty and struggling to maintain self-sufficiency. The Governor’s budget proposal includes several reductions that would impact these vulnerable Minnesotans. Individuals who are seriously ill or disabled and have very little income are particularly targeted by the Governor’s proposals.

The Governor proposes to eliminate General Assistance, which helps meet the basic needs of about 19,000 low-income adults every month who are disabled, ill or otherwise unable to maintain employment. Under the Governor’s proposal, most of these Minnesotans would lose their monthly assistance of up to $203 per month (or $260 for a married couple). Some funds would be used to create a short-term emergency cash assistance program to help at-risk adults facing a crisis situation pay for housing, utilities or other basic needs.

Another proposal would impact Minnesota families where at least one member of the household has been determined by the federal government to have a severe disability. For example, a household may have a parent with serious and persistent mental illness, or a child with severe physical disabilities. The Governor proposes to count all the Supplemental Security Income (SSI) received by the disabled household members as income when determining eligibility for the Minnesota Family Investment Program (MFIP), Minnesota’s welfare-to-work program. Under the Governor’s proposal, at least 4,500 families with disabled parents or children on MFIP would lose all their state assistance. They would be left to live on their SSI income – for many households that would be less than $700 a month.

In addition, the Governor also proposes using $28 million in extra federal welfare-to-work funds that came to Minnesota under the federal stimulus bill and are intended to prevent cuts to services for very poor children and their families to help balance the state’s budget deficit, rather than to provide additional services to struggling families during the recession.

The Minnesota Food Assistance Program (MFAP) supplements the federal food assistance program, providing food assistance for low-income families that are legal residents, but are a category of non-citizens that are not eligible for federal food assistance. The Governor would eliminate this program, impacting 200 to 250 individuals.

The Governor also proposes to make permanent his 25 percent unallotment in funding for the Children and Community Services block grant. This grant provides resources to counties to fund social service programs for children, adolescents and other individuals.

Early Childhood Education

Access to programs that serve young children has multiple benefits for the community. Enrollment in a quality early childhood program can positively impact a child’s social development and properly prepare the child for entering kindergarten, helping to close the achievement gap. For many low- and moderate-income parents, access to safe and affordable child care also is critical to their ability to get and keep jobs. In total, the Governor’s budget proposes $12 million in cuts to child care assistance.

The Governor’s budget proposes to reduce reimbursement rates to child care providers in the Child Care Assistance Programs (CCAP) for low- and moderate- income families by five percent. This is a $1.9 million reduction in FY 2010-11, but grows to an $18 million cut in FY 2012-13.

Under Minnesota’s child care assistance programs, the state pays a capped reimbursement rate to providers, and many parents pay a copayment (those parents with incomes over 75 percent of the federal poverty guideline – about $13,733 annually for a family of three). If the state’s reimbursement rate doesn’t cover the full cost of care, parents must either pay the difference themselves (in addition to their copayment), or find a lower-cost provider. With the state’s current maximum reimbursement rate, only 40 percent of family child care providers and 32 percent of child care centers are available to families receiving child care assistance. The Governor’s proposed five percent reduction in the reimbursement rate would mean more out-of-pocket costs for families. Unable to afford the additional costs, some families are expected to lose access to child care assistance.

The Governor also proposes two other reductions that would specifically impact the Basic Sliding Fee child care assistance program. Basic Sliding Fee offers child care assistance to families with income under 67 percent of the State Median Income, or less than $46,962 per year for a family of three.

- The Governor would reduce funding for Basic Sliding Fee child care by five percent (a $4.6 million reduction in FY 2010-11). As a result of the reduced resources, the Basic Sliding Fee program would serve fewer low- and moderate-income families. This cut is in addition to the five percent reduction in reimbursement rates mentioned above.

- The Governor would also transfer $5 million of unspent Basic Sliding Fee funds that could be used to provide child care for eligible families to the general fund.[4] Although funded by the state, the Basic Sliding Fee child care assistance is administered by counties. Counties often budget their child care funds conservatively and the state may end up with unspent funds at the end of the year. Under normal circumstances, the state redistributes these unspent funds to counties in the next calendar year, enabling more families to access child care assistance. As a result of the Governor’s proposal, hundreds of eligible families will not be able to access child care assistance.

The Governor proposes tightening income eligibility for child care assistance for families receiving disability payments. As discussed above, under the Governor’s budget proposal, families who have at least one severely disabled person in their household that qualifies for Supplemental Security Income (SSI) would start to have that SSI income count as part of the household’s income when determining eligibility for child care assistance. As a result, about 800 families that receive child care assistance would pay higher child care copayments and up to 100 families would lose child care assistance entirely. These changes would create one more financial challenge for families struggling to raise young children at the same time that they are handling a severe disability in the household.

In addition to the child care cuts in the DHS budget, the Governor also proposes cutting $500,000 in child care grants from the Office of Higher Education budget in FY 2010-11. These grants help low-income students pay for child care while attending classes.

Services for Minnesotans with Unique Needs

There are many Minnesotans that are in need of a higher level of care and attention in order to secure their health and general welfare. This may be for a variety of reasons, including age, disability or some other life situation. The Governor’s budget proposal includes cuts to many services that help to maintain the quality of life for these vulnerable Minnesotans.

The Governor proposes to place restrictions on the number of “waivers” available for individuals with disabilities. These waivers permit people to access home-based Medicaid services, allowing them to avoid a more expensive and confining institutionalized setting. These waiver opportunities have been reduced nearly every year since 2002. The Governor’s proposal will mean 600 persons will remain on a waiting list to access these services.

In his unallotment decisions last year, the Governor eliminated funding for Minnesota Supplemental Assistance – Special Diets (MSA-SD), which helps very low-income elderly and disabled adults pay for special diets required by a medical condition. The Governor proposes to make this unallotment permanent, as well as eliminate funding for the other element of MSA, which provides special needs payments for some meals, housing repairs and fees for guardianship. Each month, more than 4,300 individuals would lose one or more of these allowances.

The Governor’s actions to make his unallotment decisions permanent would also impact services for individuals with disabilities. The Governor would permanently reduce the number of hours a Personal Care Attendant (PCA) can work. PCAs are individuals that help persons with disabilities meet physical, social and emotional needs and allow them to live independently.

K-12 Education

The Governor’s supplemental budget does not propose any cuts in state aid to school districts. However, it does ask the legislature to ratify the Governor’s unallotment decision to shift $1.8 billion in payments to schools.

The Governor’s school payment shift actually consists of two components: a school aid payment deferral and a property tax recognition shift.

First, the Governor partially delays aid payments to school districts, saving $1.2 billion in FY 2010-11. Normally, the state staggers school aid payments for any given year over two fiscal years, paying 90 percent of aid in the first fiscal year and the remaining 10 percent in the following year. The Governor’s unallotment action changed the formula to a 73/27 percent split, delaying $1.2 billion in payments to the following fiscal year.

The state’s economic forecast assumes that this was a one-time delay and the $1.2 billion will be repaid to schools in FY 2012-13. The Governor’s budget proposes leaving the 73/27 formula in place and continuing the shift. This would reduce the projected FY 2012-13 deficit by $1.2 billion.

The second component of unallotment related to school funding is a change in the way school districts account for property tax revenue. Under unallotment, the state now requires school districts to count a portion of their property taxes earlier than they used to. This accounting change inflates school district budgets in FY 2011, allowing the state to reduce its aid payments to schools for that year. The shift saved the state $600 million in FY 2011. The Governor’s budget proposal would leave this property tax recognition shift in place.

The Governor’s budget cuts both the Department of Education and the Perpich Center for the Arts by three percent. The Governor also proposes to make permanent the $471,000 per year unallotment to the Department of Education budget. The Governor does propose $360,000 in new education spending, primarily for data collection and rulemaking related to academic standards and teacher and administrator preparation.

Economic Development and Affordable Housing

The Governor’s budget cuts $50 million from economic development spending, which includes reductions in job training and affordable housing initiatives. The bulk of the savings comes from one-time measures, which help fix the FY 2010-11 deficit but do nothing to solve the state’s long-term budget deficits.

The Governor’s proposal includes nearly $36 million in one-time transfers, which make up more than 70 percent of all the savings in economic development. The transfers include $30 million from the Douglas J. Johnson Economic Protection Fund (funded by a taconite tax on mining companies) and $5 million from the 21st Century Minerals Fund. Both of these funds target economic development assistance in northern Minnesota. The Governor’s proposal includes another $1 million in smaller transfers from other funds.

The Governor’s budget cuts nearly $1 million already appropriated to help businesses establish “Section 125 plans.” These plans allow workers to pay for health insurance with pre-tax dollars.

Despite the fact that they are needed more than ever in a tough economy, the Governor’s proposal cuts worker training, including services that support some of society’s most vulnerable adults. The Governor’s budget would cut:

- $388,000 from State Services for the Blind, which helps Minnesotans who are blind, visually impaired or Deafblind with their employment skills,

- $1 million from the extended employment, which helps people with significant disabilities keep and advance in their jobs,

- $320,000 from the Independent Living Program, which teaches skills and provides services that enable individuals with disabilities to live independently, and

- $290,000 from the Jobs Skills Partnership, which funds job training and retraining partnerships between educational institutions and businesses.

The Governor proposes reducing general fund resources for the Minnesota Housing Finance Agency (MHFA) by six percent. The largest cut ($3.7 million) is to resources for the Preservation of Affordable Rental Investment Fund (PARIF) that helps preserve affordable rental housing. The Supplemental Budget also cuts $1 million from MHFA’s rehabilitation loan program, which finances improvements to smaller rental properties occupied by low-income renters.

The Governor also eliminates all state funding for public broadcasting and the Minnesota Humanities Commission and begins to phase out funding for the Minnesota State Arts Board.

Higher Education

The American Recovery and Relief (ARRA) act passed by Congress last February has had a significant impact on the higher education budget. In the 2009 Legislative Session, federal fiscal stabilization funds were used to limit cuts to higher education to $63 million. However, use of the federal funds came with restrictions: Minnesota cannot cut state funding for higher education levels below 2006 levels until the federal funds expire at the end of 2010.

In his budget, the Governor proposes to reduce funding for higher education down to 2006 spending levels, the maximum level of cuts allowed by the federal restrictions. For the University of Minnesota, this would be a permanent reduction of $36 million per year beginning in FY 2011, or a six percent reduction. The Minnesota State Colleges and Universities (MnSCU) system would see a nearly $11 million a year permanent reduction in funding beginning in FY 2011 (a two percent cut).

The Governor also proposes to make his unallotment cuts permanent, an additional reduction of $50 million per year for both the University of Minnesota and MnSCU in FY 2012-13, or another eight percent cut.

The Office of Higher Education (OHE) would receive a three percent reduction to its administrative budget under the Governor’s proposal, and most program areas within OHE would experience a six percent reduction, including library resources, the Minnesota Indian Scholarship and the Minnesota Minority Education Partnership.

Some areas of the OHE would receive a higher reduction. The Governor proposes to cut the State Work Study program by $2.5 million per year (a 17 percent cut), eliminating new funding that was added during the 2009 Legislative Session. Also, postsecondary child care grants would be cut by $500,000 (an eight percent reduction), once again eliminating new funds that were added last session.

The Governor is also proposing cuts to the Minnesota State Grant program, the need-based financial aid program that last year served one out of every three residents enrolled in an undergraduate program in Minnesota.

The State Grant Program’s current level of funding is $42 million less than what is needed in the current biennium, due to higher than expected increases in enrollment and tuition and other factors that have fueled demand for financial aid.

Instead of proposing a way to meet the need in financial aid, the Governor instead proposes a series of cuts to the State Grant program. The Governor’s budget permanently eliminates two new financial aid benefits that were added in the 2009 Legislative Session: a Summer Transition Grant that helps students pay for summer courses to improve academic skills before they enter college and a 9th semester of eligibility for the State Grant Program (for a savings of $9 million in FY 2010-11). The Governor also proposes to temporarily increase the amount students and their families are required to pay towards tuition (for a savings of $35 million in FY 2011).

The total impact of these cuts is $44 million, $2.3 million more than is needed to make up for the current funding shortfall. The additional $2.3 million is applied towards the state’s budget deficit. As a result of these changes, it is expected that in FY 2011 the average grant award would decrease by $253 and 12,000 fewer students will receive financial aid through the State Grant Program.

Public Safety

The Governor listed maintaining funding for core public safety programs as one of his priorities, narrowly defining public safety to include the Department of Public Safety and certain elements within the Department of Corrections. For example, the Governor preserves funding for Office of Justice programs, which support victims of crime and domestic abuse. Other areas of public safety, including the state’s court system and public defenders, are not protected from cuts under the Governor’s budget.

The Governor’s proposal has a total of $36 million in savings in the public safety area. Two-thirds of that total comes from one-time transfers from dedicated funds. The largest transfer ($9.9 million) comes from the surplus in the Fire Safety Account. The funds come from a 0.65 percent surcharge on homeowner and commercial insurance policies and are used to support the State Fire Marshall and fire safety training. Other smaller transfers come from MinnCorr, the state’s prison industries program, and several dedicated funds within the Department of Corrections.

Under the Governor’s budget proposal, all the elements of the state’s court system – including the Supreme Court, Court of Appeals and district courts – would be cut by three percent, for a total of $15 million in FY 2010-11. A statement from the Minnesota Judicial Branch said the constitutionally-guaranteed right to speedy, public trial is at serious risk. The proposed cuts would mean backlogs and delays will grow; many locations have already seen the number of delays in scheduling hearings and trials double.[5]

The Governor also proposes cutting civil legal services by $1 million. Included in the Supreme Court’s budget, these grants help assure that all Minnesotans have access to justice regardless of whether they can afford an attorney. These grants support Legal Aid and pro bono legal programs to help low-income residents pursue employment, housing, disability and other civil cases. As a result of these cuts, hundreds of low-income Minnesotans will be denied legal representation.

In another cut that will increase barriers to adequate representation, the Governor’s budget proposal cuts the Board of Public Defense by $3.3 million in the FY 2010-11 biennium. The Board provides attorneys to people accused of crimes who cannot afford representation. Public defenders handle approximately 60 percent of all misdemeanor cases and between 85 and 90 percent of all felonies, gross misdemeanor and juvenile cases.[6] Facing deficits in 2008, the Board has already cut 53 public defenders, or approximately 12 percent of its total. A February 2010 Minnesota Legislative Auditor report said: “Public defender workloads are too high, resulting in public defenders spending limited time with clients, difficulties preparing cases, and scheduling problems that hinder the efficient operation of criminal courts.”[7]

The Governor’s budget cuts the Department of Corrections by $9.5 million, or roughly one percent of its general fund support. Cuts include eliminating the popular Sentencing to Service program and reducing funding for prisoner reentry services.

The Governor’s proposal includes a few requests for new funding for public safety, including $1.6 million to match federal aid for the 2009 Red River floods.

Taxes and Aids to Local Governments

In the tax area, Governor Pawlenty’s supplemental budget proposal has two main components: a package of tax cuts and a set of cuts to aids to local governments and property tax credits (particularly the Renters’ Credit).

The Governor’s budget includes a package of business tax cuts. Most of the fiscal impact of the proposed tax cuts is in future years, since many of the provisions phase in over time or don’t have a fiscal impact until future biennia. The tax cuts total $20 million in FY 2010-11, $333 million in FY 2012-13, and an estimated $800 million in FY 2014-15, according to a preliminary estimate by House Fiscal staff. Some of the tax cuts include:

- A 20 percent cut in the corporate tax rate. The cut is phased in over four years; the impact is a $10 million tax cut in FY 2011, $150 million in the next biennium, and an estimated $359 million impact in FY 2014-15.

- A 100 percent capital gains exemption for equity investments in small businesses with a five-year holding period. There is no fiscal impact until FY 2016, and no cost estimate is available yet.

- An exclusion for Business Non-Passive Income – a 20 percent exclusion for non-passive business income that flows through to shareholders, partners and members of S corporations and partnerships. This credit phases in over four years.

- An Angel Investment Credit – a 25 percent tax credit for investments in new and emerging small businesses (defined as having fewer than 100 employees and less than $2 million in gross sales).

- A Minnesota Business Investment Company Credit – an 80 percent tax credit for insurance companies investing in a Minnesota Business Investment Company (this is sometimes called a certified capital company or CAPCO), which will invest in small, emerging businesses.

- Changes to the Research and Development Credit, including increasing the amount of credit for large R&D expenditures, making it refundable and allowing pass-through entities to take the credit (in other words, the credit can be taken on the individual income tax form by those with income from partnerships, S corporations, and LLCs).

- Targeted Economic Development Incentives (TECH Z) – provides tax free zones in both the metro area and Greater Minnesota for qualified businesses engaged in certain activities such as manufacturing, architecture, engineering, scientific research and development, and software or internet publishing. The provision would provide tax benefits including a two year sales tax exemption on purchases, five years of refundable job creation tax credits for new employees hired, exemptions from property taxes for property improvements (five years in the metro area and ten years outside of the metro), and income and corporate tax exemptions for income attributed to new employees (five years in the metro and ten years outside of the metro).

The other major component of the tax portion of the Governor’s budget is cuts to “aids and credits”, which includes aids to local governments as well as the state’s Property Tax Refund, which provides refunds to Minnesotans whose property taxes are high in relation to their incomes.

As in the past, the Governor proposes significant cuts to state aids to cities and counties. The state provides aids to local governments with the goals of keeping property taxes lower than they otherwise would be and so that all local governments can provide a certain level of services, regardless of their level of property tax wealth. All cities and counties will see a reduction in aids under the Governor’s proposal and the cuts will come in each of the three primary methods that the state uses to provide general aid to local governments. The Governor’s budget proposes $250 million per year in cuts to aids to local governments, distributed as follows:

- County Program Aid, which provides general aid to counties, is cut by $107 million in FY 2011 and $215 million in FY 2012-13.

- Local Government Aid, which provides similar aid to cities, is cut by $118 million in FY 2011 and $236 million in FY 2012-13.

- Residential Market Value Credit reimbursements for counties are cut by $18 million in FY 2011 and for cities by $7 million. The Market Value Credit directly reduces a homeowner’s property taxes through a credit on the property tax bill. The state normally reimburses the locality for the lost revenue.

The Governor already cut local aids for FY 2010-11 by $300 million under unallotment this summer and his budget proposes making these cuts permanent, which reduces them by an additional $400 million in the next biennium, for a total cut of $900 million in FY 2012-13. The total impact when combining the unallotments already made in 2009, the proposed new cuts and making the unallotments permanent is significant:

- County Program Aid is cut by $207 million, or a 45 percent reduction from base funding, in FY 2010-11, and $349 million in FY 2012-13.

- Local Government Aid is cut by $265 million, or 25 percent, and by $441 million in FY 2012-13.

- Market Value Credit reimbursements are cut by $77 million in FY 2012-13, an 18 percent reduction, and $110 million in FY 2012-13.

The Governor’s budget assumes that the reduction in local aids will result in higher property taxes, even though he does propose that levy limits be made permanent, which would limit how much local property taxes would grow. His budget also proposes that local governments would only be able to raise 50 percent of the lost aids back in increased property taxes. Even with these limits, an increase in property taxes is expected to impact the state’s budget in two ways: a projected $14 million increase in property tax refunds to be paid in FY 2012-13, and a $14 million reduction in income and corporate taxes (because of an increase in the amount of property taxes that can deducted when calculating those taxes). However, some organizations representing local units of government have testified to the legislature that they would be unlikely to raise property taxes as much as they would be allowed.

Under unallotment, the Governor implemented a 27 percent reduction in the Renters’ Credit for FY 2011. The Renters’ Credit is a property tax refund for low- and moderate-income renters whose property taxes are high in relation to their income. More than 80 percent of recipients have household incomes of $30,000 or less, and more than one-quarter are households that include seniors or people with disabilities.

As a result of the unallotment, most Renters’ Credit recipients – 280,900 households – will see a significant cut in their Renters’ Credit this year. More than 18,000 Minnesota households will no longer qualify for the credit. The average credit will drop by $129. During an economic slowdown, financial assistance to low-income households is one of the most effective stimulus tools the government has, because these families are likely to spend those dollars quickly in their local communities. The Governor’s cuts to the Renters’ Credit take $51 million out of Minnesota’s still-struggling economy.

The Governor’s unallotment could only apply to FY 2011, and his budget proposes to make the cuts to the Renters’ Credit permanent, a $106 million reduction in FY 2012-13.

The Governor would also permanently eliminate the Political Contribution Refund (PCR). The PCR is a component of the state’s campaign finance system that provides refunds for small donations to candidates or political parties. The Governor eliminated the Political Contribution Refund (PCR) for the FY 2010-11 biennium under unallotment, saving the state $10 million.

The Governor’s budget cuts to aids and credits (including the Renters’ Credit and PCR) are only partially used to reduce the deficit. About a third of the cuts in aids and credits in FY 2012-13 are used to pay for the package of business tax cuts. In the following biennium, the cost of the tax cuts rises to approximately $800 million, and then the large majority of the cuts in aids and credits will be simply making up for the lost revenue, rather than balancing the budget.

Minnesota Would Benefit from a Balanced Approach

The Governor’s supplemental budget proposal relies on one-time federal resources and deep cuts to health care, job training, services for people with disabilities and other budget cuts to resolve the state’s budget deficit. It is not, however, a balanced approach to solving the problem. The Governor has continually opposed the use of revenue increases in times of significant budget deficits. Unfortunately, that forces cuts in critical services needed most by families struggling in tough economic times.

A balanced approach to solving the deficit – one that includes increases in revenues – would enable the state to maintain critical investments in our human capital and physical infrastructure. A balanced approach would allow us to maintain the vital services that are critical for the long-term health of our families and communities. This is the approach that a majority of states have taken to respond to the budget challenges created by the economic crisis.[8]

Except where otherwise noted, the analysis in this report is based on data from budget documents prepared by Minnesota Management and Budget and the applicable state agency, and legislative research and fiscal departments. The opinions expressed are those of the authors.

However, special thanks to the Affirmative Options Coalition, Child Care WORKS, Legal Services Advocacy Project, Minnesota Disability Law Center, Minnesota Housing Partnership and the Minnesota Social Services Association for their invaluable contributions to this analysis.

[1] This analysis focuses on the Governor’s supplemental budget as presented on February 15, 2010. The February forecast, released on March 2, revealed that the state’s budget deficit had decreased to $1 billion.

[2] Since the Governor released his budget proposal in mid-February, the estimated amount Minnesota would receive from an extension of enhanced federal Medicaid funding has increased to $408 million.

[3] Minnesota Management and Budget, June 25 Letter to Legislative Advisory Commission.

[4] The estimated amount of unspent Basic Sliding Fee funds has increased from $5 million to $7.5 million since the Governor released his initial supplemental budget proposal.

[5] Minnesota Judicial Branch, FY 2010-11 Budget Reduction Impact.

[6] Minnesota Bench & Bar, “Public Defenders: A Weakened but Indispensable Link,” February 2009.

[7] Minnesota Legislative Auditor’s Evaluation Report: Public Defender System

[8] Center on Budget and Policy Priorities, State Tax Changes in Response to the Recession, March 2010