Higher education is a steppingstone for many Minnesotans to further their career goals, gain advanced qualifications in their field of choice, and improve their quality of life. It is also an important component of a robust state economy, a strong workforce, and thriving communities. However, many Minnesotans face significant struggles to afford higher education because of rising tuition costs. Decreasing state funding to public higher education institutions over the years has dramatically increased costs for students and their families. Cuts to higher education funding reinforce long-standing disparities by limiting access to higher education for many low-income and Black, Indigenous, People of Color (BIPOC) students.

With rising costs of higher education and families still struggling to recover from the pandemic, Minnesota should invest in affordable and accessible higher education by significantly increasing higher education funding, including for financial aid for those who face the greatest cost barriers.

The cost burden of public colleges and universities has increasingly shifted towards students and their families

States’ disinvestment in higher education over the past few decades has led to public colleges and universities increasingly relying on the tuition students pay. A report by State Higher Education Finance (SHEF) indicated that nationally, the percentage of total higher education revenue that comes from tuition increased by 23 percent between 1980 and 2020.[1]

State funding cuts led public institutions to rely even more heavily on tuition paid by students. Nationally, students now provide close to half of the revenue of public higher ed institutions. According to a report by the Center on Budget and Policy Priorities (CBPP), 37 states, including Minnesota, cut funding per student between 2008 and 2019. Minnesota’s funding per student decreased by 6.7 percent.[2]

In response to the inadequate public investment, average tuition and fees have increased at Minnesota institutions. Minnesota public four-year colleges and universities saw a 19 percent increase in average tuition when adjusted for inflation between 2008 and 2019. Since the 2009–2010 academic year, the University of Minnesota increased tuition and fees by 23 percent, and Minnesota State four-year universities and two-year colleges increased tuition by 28 percent and 13 percent respectively.[3] In addition to tuition costs, students must also pay for other expenses such as housing, food, transportation, and supplies, but federal and state financial aid has not kept up with cost increases in those areas either.

Rising tuition costs disproportionately harm low-income and BIPOC students

Inadequate state funding translates into rising tuition and higher student debt, all of which compound historical and current barriers to affording and attending college that BIPOC and low-income communities face.

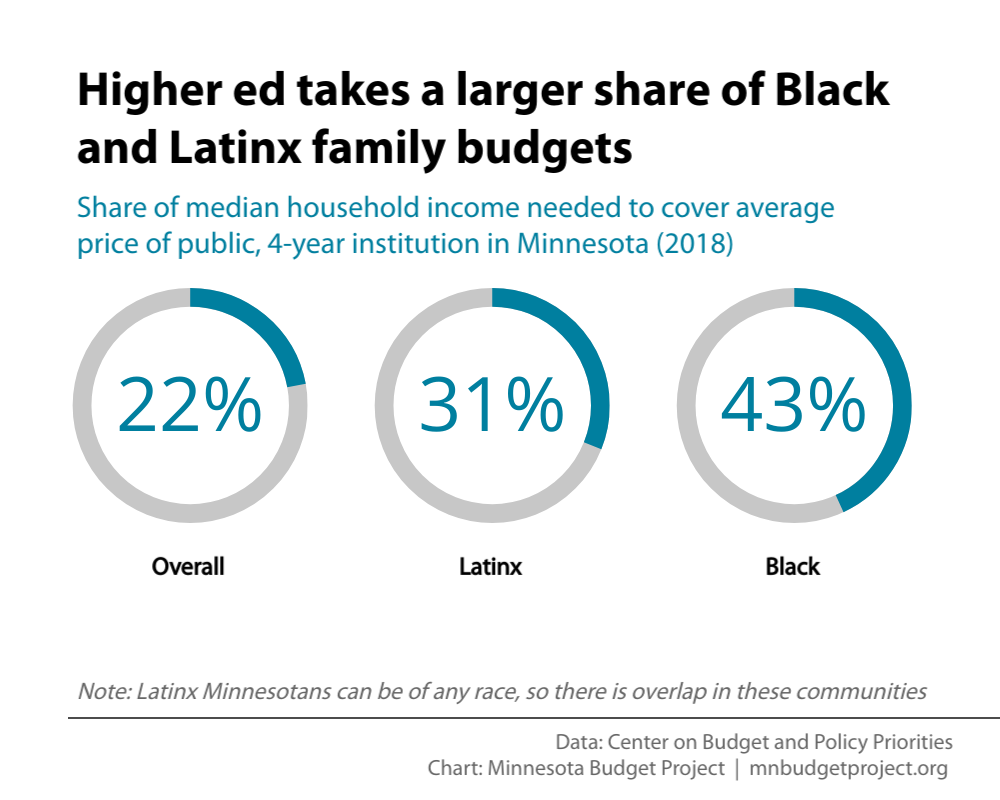

CBPP also reported that in 2018, the typical Black and Hispanic family would have to pay a much larger share of their income to afford the cost of higher education. Looking at all Minnesotans, a typical family would spend 22 percent of their household income to cover the average price of attendance at a public, four-year institution in Minnesota. The same tuition would require 43 percent of the median household income for Black households and 31 percent for Latinx households.[4]

These higher cost burdens have a negative effect on students’ ability to attend and complete college. CBPP’s research shows that tuition increases can deter lower-income students from enrolling and even narrow their higher education choices based on affordability. We all are harmed by the effects of inadequate state funding, which can result in declining enrollment, widened achievement gaps, reduced campus diversity, and a weaker workforce.

Federal emergency aid provided during the pandemic

In March 2021, Congress recognized the crisis in higher education as a result of the COVID-19 pandemic and provided emergency aid to students and institutions through the American Rescue Plan (ARP)’s Higher Education Emergency Relief Fund (HEERF III). The federal government distributed $39.6 billion to public and private institutions to be used for emergency financial aid to students and COVID-19 related expenses.[5] Minnesota received over $565 million through the HEERF to help students remain enrolled and complete their education.

While it was extremely important that federal and state governments act to address financial barriers to attendance and the additional pressures presented by COVID, this federal aid was only temporary and does not make up for decades of disinvestment.

Policymakers should address rising tuition costs and ease the burden of students most in need

Dismantling financial barriers to accessing higher education is part of making Minnesota’s prosperity open to everyone. It benefits those individuals who gain degrees and credentials, and it benefits us all by building a robust workforce. Minnesota policymakers should increase investments in higher education to ensure that every student has the means to enroll and complete their education at their institution of choice.

Policies targeted at eliminating financial barriers to higher education include stronger need-based financial aid and other measures to reduce the cost of attendance, which can have a profound impact on a student’s ability to complete their education. It also should include other economic supports for the students and families who are most in need, such as food assistance and other resources on campus that allow students to cover their basic needs. By making higher education affordable for all Minnesotans, policymakers would invest in building an equitable economy and future in which every person can thrive.

By Joo Ning Lim

[1] State Higher Education Finance, State Higher Education Finance Report: FY 2020, 2020.

[2] Center on Budget and Policy Priorities, States Can Choose Better Path for Higher Education Funding in COVID-19 Recession, February 2021.

[3] Minnesota Office of Higher Education, Minnesota System-Level Undergraduate Tuition & Fee Trends, accessed August 2022. This data is adjusted for inflation.

[4] Center on Budget and Policy Priorities, States Can Choose Better Path for Higher Education Funding in COVID-19 Recession, February 2021.

[5] U.S. Department of Education, ARP: American Rescue Plan (HEERF III), June 2022.