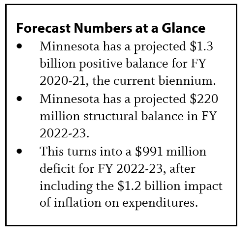

The November 2019 Economic Forecast brought some positive news for now, but predicts a more challenging budget situation in the future. Minnesota is in positive budget territory with a $1.3 billion balance projected for the current two-year budget cycle, FY 2020-21.[1] However, that good news is short-lived. In the FY 2022-23 biennium, Minnesota has a $220 million structural balance that becomes a $991 million negative balance once inflation is more fully accounted for.

Thanks to the automatic increase to the state’s rainy day fund, the state has a stronger budget reserve. The budget reserve is now at its recommended level of $2.4 billion, which puts the state in a good place to more adequately meet the needs of Minnesotans in the next economic downturn.

Faced with a short-term surplus, policymakers have an opportunity to make some one-time investments. But to build thriving communities for years to come, Minnesota needs to raise additional revenues to invest in quality schools, affordable health care, and other building blocks of lasting and shared prosperity for all Minnesotans.

Budget numbers show positive balance now, negative balance later

The forecast projects a $1.3 billion positive balance for FY 2020-21. The forecast outlines several changes in revenues and spending, compared to what was expected at the end of the 2019 Legislative Session. Tax revenues are expected to be higher, primarily from a combination of higher income and sales taxes being partially offset by lower corporate taxes. FY 2019 ended with a higher positive balance than previously estimated, which both contributes to the FY 2020-21 surplus and triggers additional appropriations that policymakers agreed to in 2019 contingent on this outcome. This includes $30 million for safe schools supplemental aid. Increases in some spending areas are largely offset by reductions in other areas – such as lower spending in health and human services in part due to lower enrollment in Medicaid. The combination of changes leaves total spending in FY 2020-21 about the same as prior projections.

The FY 2022-23 estimate shows a small structural balance of $220 million. However, that doesn’t take into account what it would take for most current public services to keep up with inflation. When the impact of inflation is accounted for, the balance in FY 2022-23 turns into a deficit of $991 million. This figure provides a more accurate picture of the state’s budget situation.

For more than 15 years, the official forecast figures have left out the impact of inflation on the majority of future spending. This can lead policymakers and the public to support tax and budget decisions that are not sustainable. The state’s Council of Economic Advisors recommends that Minnesota include inflation in its planning estimates so that they provide a more useful guide to policymaking.

The state’s economic forecasts are critical tools to measure the state’s fiscal health and form the baseline against which spending and tax proposals are assessed. Minnesota Management and Budget prepares forecasts each November and February. State, national, and global economic trends are used to estimate Minnesota’s future revenues and expenditures under current laws on taxes and spending.

The November forecast also shows good news for the Health Care Access Fund (HCAF), which funds affordable health care options like Medicaid and MinnesotaCare, as well as health promotion activities across the state. The November forecast shows HCAF revenues coming in higher than projected back in May, largely due to a strong economy. In FY 2022-23, projections also clock in better. HCAF revenues primarily come from a tax on health care providers – the subject of much intense debate at the Capitol last session. Funding for affordable health care and other services funded by the HCAF were threatened due to the scheduled expiration of the provider tax at the end of 2019. Fortunately, legislators took action in the 2019 Legislative Session that largely maintains this essential revenue source, albeit at a lower rate than previously. This forecast shows the crucial role the provider tax plays, on average raising about $700 million annually for health care for Minnesotans.

Slow economic growth expected nationally, which comes with risks

The forecast shows that Minnesota’s economy is still doing fairly well. Low unemployment combined with a high demand for workers mean the state continues to have a tight labor market, which has supported wage and income growth. The state has also recently experienced an increase of people moving to Minnesota from other states, reversing a long-term trend of Minnesota experiencing a net loss of residents to other states.

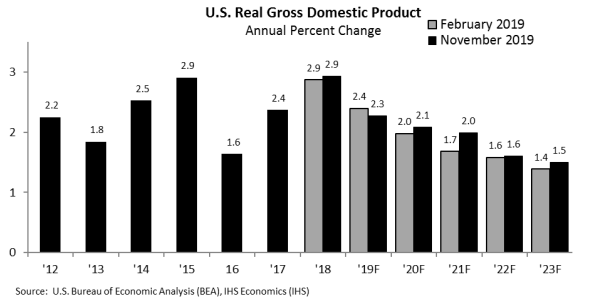

The national economy is expected to grow for the next several years, but start to slow down. The economy is expected to grow by 2.1 percent in 2020, and then decrease to 1.5 percent by 2023. This predicted continued economic growth throughout 2023 is a cause for caution. The U.S. is currently experiencing its longest economic expansion on record, and this forecast predicts what would amount to 14 years of economic growth since the last recession. Such sustained economic growth would be fairly unprecedented, and would be well beyond the average length of economic expansions in the United States.[2] In the past 50 years, the U.S. has experienced a recession every five or six years on average. Recessions of course don’t happen on a timer, but the longer the economic growth, the less likely it is that we will continue to avoid a recession.

Like any prediction of the future, this economic forecast is subject to risk. IHS Markit, the state’s macroeconomic consultant, assigns a 55 percent probability to their baseline economic forecast scenario. They assign a 35 percent probability to their more pessimistic scenario in which there is a recession starting late 2020, and a 10 percent probability to a more optimistic scenario. This confidence in the baseline scenario is the lowest since February 2012, and the forecast notes that the slow growth in the upcoming years makes the economy less resilient.

Keep the state’s budget reserve strong

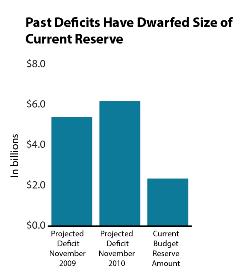

During an economic recession, the needs of Minnesotans grow – just at the time that the resources our state relies on to meet those needs shrink. The state’s budget reserve is one important way to better position the state to respond to an uncertain future. In the same way a family might save to be able to make it through a long illness or job loss, Minnesota keeps this reserve so when a recession hits, the state can avoid drastic cuts in essential services and continue to serve Minnesotans’ needs. During the last recession, deficits were much larger than the much smaller budget reserve the state had at the time, and Minnesota policymakers made painful service cuts. A healthy level of reserves also gives state policymakers the time they need to make responsible and thoughtful budget choices instead of having to make hasty decisions to balance the state’s budget.

Unfortunately, in the 2019 Legislative Session, policymakers slated $491 million to be withdrawn from the budget reserve in July 2021. This would weaken the budget reserve significantly, and could hurt Minnesotans during the next recession. Policymakers will need to undo this scheduled withdrawal.

Policymakers should prepare for the future

The November forecast is our first glance at the state’s budget and economic picture in advance of the upcoming legislative session. Policymakers will use the February forecast to inform their decisions in the 2020 Legislative Session.

This forecast gave Minnesota one-time good news, but with a shrinking balance in FY 2022-23, policymakers will need to raise additional revenues to sustainably fund priorities so that all Minnesotans can thrive. After decades of wage stagnation for many workers and years of under-investment in our communities, there’s still more work to do to invest in great schools, thriving communities, and other building blocks of lasting and shared prosperity for all Minnesotans, no matter who they are or where they live.

By Clark Goldenrod

[1] Data in this analysis come from Minnesota Management and Budget, November 2019 Budget and Economic Forecast, December 2019. Conclusions are those of the author.

[2] Minnesota Budget Project analysis of National Bureau of Economic Research data.