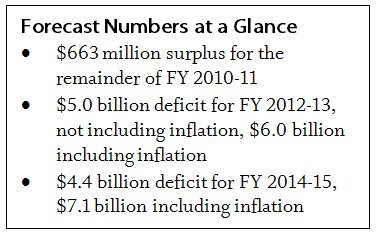

Minnesota continues to faces significant budget deficits, although the situation has improved. The state’s latest economic forecast projects a deficit of $5.0 billion for the upcoming FY 2012-13 biennium, or 13 percent of the general fund budget.[1] Taking into account the impact of inflation on expenditures increases the size of the deficit, requiring another $1 billion to maintain services at their current level in the next biennium. While still a significant deficit, it is an improvement from the November forecast, which projected a $6.2 billion deficit for FY 2012-13.

The February forecast also gives Minnesotans an updated look at the state’s FY 2014-15 biennium, which begins July 1, 2013. It projects a FY 2014-15 deficit of $4.4 billion. That deficit grows to $7.1 billion if the impact of inflation on spending is included.

Minnesota will finish the current biennium on June 30, 2011 in better financial shape than originally expected. The forecast projects a $663 million surplus, $264 million more than projected in November. Most of the additional surplus comes from lower spending in health care. The surplus means that policymakers will not need to change the current biennium’s budget, and the $663 million carries forward and reduces the FY 2012-13 deficit.

The Purpose of the Forecast

Minnesota’s constitution requires the state to have a balanced biennial budget, and the forecast is a critical tool to meet that goal. The forecast is the official measure of the state’s fiscal health. It serves as the yardstick against which the Governor and legislature will assess their budget and tax proposals for FY 2012-13. Economic forecasts are prepared each February and November by Minnesota Management and Budget. The forecast estimates future revenues and expenditures based on current laws and economic assumptions. It does not include the impact of any budget changes policymakers are considering this legislative session.

Slow Economic Growth Expected

The state’s ongoing revenue shortfalls are connected to slow economic growth that is expected to continue. According to the February forecast, there is discouraging news: “U.S. payroll employment will not recover to pre-recession levels until 2013 and…the unemployment rate will remain above 7.5 percent through mid-2014.”

In Minnesota, this slow recovery has meant that job growth in the state has not been sufficient to keep pace with population growth and new workers entering the labor force. According to the forecast, “18 months after the recession officially ended nearly 1 out of 7 Minnesotans who prefer a full time job is still unable to find one.” The slow job growth will make it difficult to reduce Minnesota’s unemployment rate from the current historically high levels.

According to Global Insight, Minnesota’s economic consultant, there is a 65 percent probability that the economy will follow the slow economic recovery predicted in the forecast. However, there is a 20 percent chance that the economy will follow a more optimistic, fast growth path, and a 15 percent chance of a more pessimistic scenario, with GDP growth hovering near zero for two quarters. The economic model underlying the February forecast was completed before the Middle Eastern turmoil hit. If the unrest continues for a prolonged period, the unexpectedly high oil prices could dampen the economic recovery. However, if tensions ease and oil prices fall below $100 per barrel once again, the economy is more likely to keep pace with projections.

What Next? A Prescription for Budget Bifocals

State leaders face difficult decisions. Minnesota is in a painfully slow economic recovery and residents face immediate needs for jobs, health care and basic services. Minnesota also needs to best position itself for long-term growth by making critical investments in education and workforce development. State leaders need to put on their budget bifocals, looking both at near-term needs while not losing focus on long-term prosperity.

The state’s leaders can meet both our short-term and long-term goals by including revenues as part of the solution to the state’s budget shortfall. In the short term, investments in education, health care and job training will help those hit hardest by the recession while preserving jobs during the economic recovery. In the long term, these investments in healthy citizens, vibrant communities and an educated workforce will position Minnesota for future prosperity.

[1] The data in this analysis comes from Minnesota Management and Budget’s February 2011 Economic Forecast.