Minnesota Must Balance its FY 2010-11 Budget

A weaker economy than previously predicted has meant less revenue than predicted, resulting in a state revenue shortfall. Minnesota faces a considerable budget deficit of $6.4 billion for the FY 2010-11 biennium, or about 17 percent of the state’s general fund budget. When the impact of a portion of federal economic recovery money is included, the deficit is $4.6 billion.[1]

The Legislature and Governor Pawlenty will have to make tough decisions in order to achieve a balanced budget. They have three major budget-balancing tools available: raising revenues, cutting spending, and using one-time actions, such as drawing on reserve funds.

This document focuses on the raising-revenue side of the equation, and describes various revenue-raising options that have been proposed in recent years, including the estimated amount of revenue that could be raised and the impact on tax fairness. This document is not intended to endorse any particular proposal, but to present a range of revenue-raising possibilities.

The Case for Raising Revenues

It makes sense to include revenue increases as part of the budget deficit solution. Resolving the deficit only through cutting state spending would do greater harm to our economy.

While both spending cuts and tax increases remove demand from the economy, Nobel Prize-winning economist Joseph Stiglitz and Office of Management and Budget director Peter Orszag have written that state spending cuts can hurt the economy more during an economic downturn than tax increases.[3] When government spending is cut, money is taken out of the state’s economy as the state spends less on employee wages and the purchase of goods and services.

In contrast, a tax increase on high-income households is likely to have less of a drag on the state’s economy, because those Minnesotans are likely to maintain their levels of consumption, but compensate for the tax increase by saving less. Less money is taken out of the state’s economy by a targeted tax increase than by cutting state spending. Thus tax increases are a reasonable part of the response to a large state budget deficit.

The Current Budget and Tax Environment

As policymakers and the public consider revenue-raising options, they should do so remembering the current state budget and tax environment. Minnesota faces this budget deficit with a considerably less fair tax system than in the previous decade. In particular, the wealthiest one percent of Minnesota households — those with incomes over $448,000 — pay a far smaller share of their income in state and local taxes than what the average Minnesota taxpayer pays. The wealthiest individuals pay 8.9 percent of their incomes in taxes, compared to the overall average of 11.2 percent.[4]

Total state and local taxes in Minnesota are lower today than in 1996, measured as a share of income, which is not surprising considering that Minnesota made the largest tax cuts in the country in 1997, 1999 and 2001.[5]

Revenue-Raising Options

Potential revenue-raising options are described below, grouped into the following categories:

- Income tax changes

- Business tax changes

- Sales tax modernization

- Federal fiscal relief to the states

Income Tax Changes

The income tax is the state tax that relates the most to the ability to pay. Unlike the tax system overall, the income tax in Minnesota is progressive – that is, higher-income households pay more in taxes as a share of their income than lower-income households.

Recent proposals to increase the income tax would increase the degree of fairness of Minnesota’s state and local tax system. These proposals include:

- Create a new income tax bracket for high-income Minnesotans.

- Enact a temporary income tax surcharge.

- Return income tax rates to 1998 levels.

Create a New Income Tax Bracket

There have been several recent proposals to create a new income tax bracket for high-income Minnesotans – often referred to as a “fourth tier”, as it would be added on top of the state’s three existing income tax brackets. Two examples from the 2007 Legislative Session are:

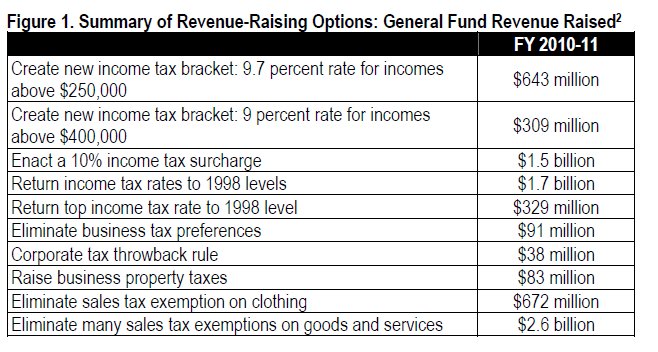

- A bill passed by the Senate would create a new 9.7 percent tax rate on taxable income over $250,000 for a married couple.[6] Enacting such a proposal today would raise $643 million in FY 2010-11.[7]

- The House passed a narrower proposal that would create a 9.0 percent tax rate on taxable income over $400,000 for a married couple.[8] This would raise $309 million in FY 2010-11.[9]

A relatively small number of Minnesota households would be impacted by such proposals. About 50,000 households, or 2.1 percent of all taxfilers would pay more taxes under the Senate proposal. About 26,000 households, or about 1.1 percent of all taxfilers, would see tax increases under the House proposal.[10]

Enact a Temporary Income Tax Surcharge

A second possible approach to raise revenue through the income tax is to institute an income tax surcharge. This is a fairly simple and flexible way to raise revenue. The state last implemented a surcharge in response to deficits in the early 1980s. When a surcharge is in place, taxpayers calculate their income taxes following the existing tax laws, but then add an additional surcharge amount. A surcharge could also be removed, or “blinked off”, when the additional revenue is no longer needed. A 10 percent income tax surcharge would raise $1.5 billion in FY 2010-11.[11]

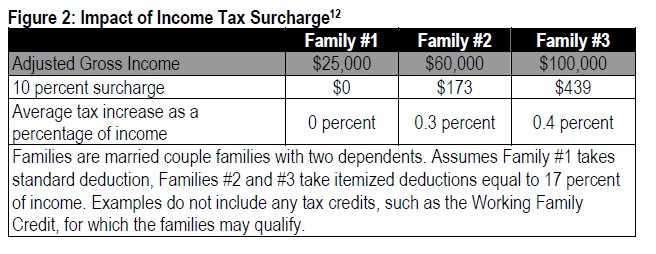

Because Minnesota’s existing income tax is based on ability to pay, so is an income tax surcharge, as shown in Figure 2. High-income households will see larger tax increases, while the impact on low- to moderate-income Minnesotans will be relatively modest or even zero.

Return Income Tax Rates to 1998 Levels

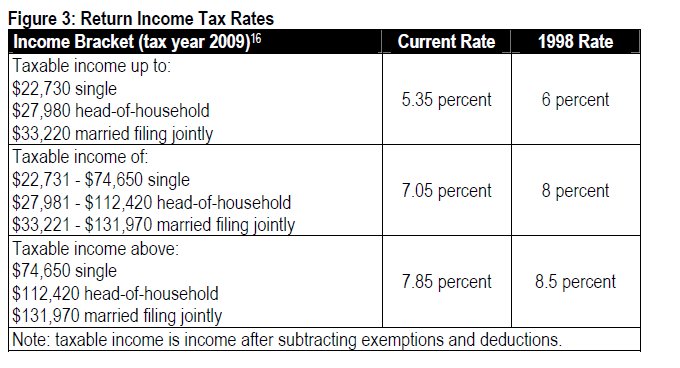

Another revenue-raiser that policymakers could consider is returning income tax rates to their 1998 levels, before the income tax rate cuts passed in the 1999 and 2000 Legislative Sessions. Figure 3 shows how rates would change.[13] This option would raise approximately $1.7 billion in FY 2010-11.[14]

Some have suggested only returning the top rate to 1998 levels. This is a more targeted proposal, and would raise a smaller $329 million for FY 2010-11.[15]

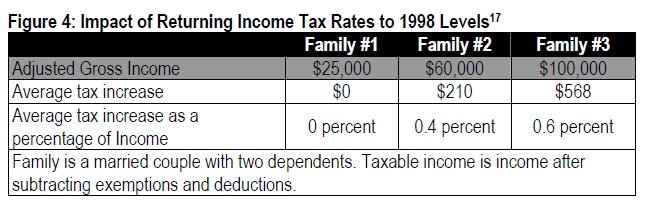

The amount of the average tax increase from this proposal rises as income rises, as Figure 4 demonstrates. A married couple with two children with an adjusted gross income of $25,000 could expect to see no tax increase. A family with an adjusted gross income of $100,000 would see an average tax increase of $568. In all cases, the average tax increase is quite small, and makes up less than one percent of the household’s income.

Business Tax Changes

In recent years, there have been several proposed changes to businesses taxes in ways that raise revenues. These include:

- Eliminate business tax preferences.

- Institute a “throwback rule” on corporate profits not currently taxed.

- Raise business property taxes.

Business taxes, including corporate taxes and property taxes paid by businesses, are regressive. That is, lower-income households pay a larger share of their income in these taxes than those with high incomes. This is because a portion of business taxes are assumed to be passed on to customers in the form of higher prices and on to workers in the form of lower compensation.

Proposals to raise business taxes would likely increase the regressivity of the tax system. However, the proposed changes to business taxes discussed in this analysis are relatively modest and would have a small impact on the overall fairness of the state tax system. In addition, any negative impacts can be offset by combining these proposals with income tax proposals such as those described above to create a tax package that is fair overall.

Eliminate Business Tax Preferences

Some legislators have advocated for ending incentives that provide special tax preferences to one type of business over another, arguing that this would level the playing field for all businesses.

HF 4103, introduced in 2008, proposed eliminating many tax provisions that provide tax benefits to certain types of businesses, such as special apportionment rules for mail order corporations, research and development tax credits, tax incentives under JOBZ and a state property tax exemption for airport property. These proposals raise $91 million in FY 2010-11.[18]

Institute a Throwback Rule

Overall, Minnesota has done a good job of limiting unintended tax loopholes that corporations can use to avoid taxes. An additional policy that Minnesota could adopt is a “throwback rule.” Corporations that sell their products in more than one state must meet a certain threshold of presence in Minnesota before their profits are subject to the state’s corporate income tax. Because of this threshold, some corporate income becomes “nowhere income,” or profit that is not taxed in any of the fifty states.[19]

A throwback rule would allow Minnesota to tax corporate profits that otherwise would not be taxed in any state. Sales made in a state in which a corporation is not taxable would be treated as if they were made to customers in the state from which it was shipped. Of the 45 states with corporate income taxes, 25 have a throwback rule. Instituting a throwback rule could raise an estimated $38 million in FY 2010-11.[20]

Raise Business Property Taxes

Property taxes in Minnesota are primarily paid to local governments. However, the state does levy a state property tax on commercial and industrial property, most public utilities, unmined iron ore properties and cabins.

In the 2008 Legislative Session, the Senate omnibus tax bill (SF 2869) proposed to raise the state property tax levy in 2009 and keep it at that higher level in FY 2010 and FY 2011. The bill also added public utility electric generating machinery and taxable property at the Minneapolis and St. Paul airports to the types of properties subject to the tax, but removed cabins. The net impact is an additional $83 million in FY 2010-11.[21]

Sales Tax Modernization

Currently most products in Minnesota are subject to the state sales tax, but few services are, even as services have become an ever larger share of the total economy.[22] There has been some discussion of expanding the sales tax base to include more services, but also to some of the goods that are currently exempt.

Two of many options for sales tax base broadening are described below, along with their potential fiscal impact in FY 2010-11.[23]

- Option 1: Eliminate exemption on clothing: $672 million

- Option 2: Eliminate exemptions on range of products and services purchased by consumers (not including clothing): $2.6 billion

The two options above illustrate the range of revenue that could be raised through base expansions. Option 1 simply applies the sales tax to one exempt category: clothing. Typically, legislation to tax clothing exempts used clothing and sewing materials.

Option 2 takes a different approach and would tax a wide range of goods and services that are primarily purchased by consumers. Some of the items that would become subject to the state sales tax include personal care services (such as hair styling and body piercing), legal services, car repair, residential heating fuels, motor fuels and funeral services. Exemptions would remain on essentials including food and medicines, and this option does not include the impact of taxing clothing. By primarily including services purchased by consumers, this option takes into account the argument that the sales tax should only be paid on final consumption, not on business inputs.

Option 2 helps to illustrate the magnitude of the revenue increase that could be raised through a broad expansion of the sales tax base, although it is not clear that there would be agreement on extending the sales tax to all of these items. While there is widespread support for the idea of not taxing “essentials”, it may be difficult to find agreement on what is essential and what is not. And extending the sales tax to other items — such as motor fuels, which are already subject to a separate gas tax — would likely generate controversy. Policymakers should be sure to understand the impact of expanding the sales tax to each particular item or service.

The sales tax is a regressive tax. Making the sales tax a larger portion of total taxes paid is likely to make the overall tax system more regressive. Fortunately, there are strategies that can be used to ensure that sales tax modernization would not unduly impact the state’s low-income taxpayers:

- Reduce the sales tax rate. Some base-broadening options bring in a large amount of revenue at the current rate, and therefore the rate could be lowered while still having a net increase in sales taxes.

- Provide a sales tax credit to low- and moderate-income taxpayers to offset sales tax base broadening. One possible mechanism would be an automatic sales tax credit, similar to the sales tax rebate used during the surplus years, but targeted to specific income groups. Existing credits, such as the Working Family Credit, could also be increased to soften the impact of the increase.

- Combine with income tax options to make a tax package that is fair overall.

Tax Increases Should Not Hit Low-Income Minnesotans the Hardest

Whatever revenue increases may be implemented, attention must be paid to the effect on tax fairness. The way we pay taxes differs among income levels: low-income people pay more of their tax obligation as sales taxes, and middle- and upper-income people pay more of their taxes as income taxes.

The cuts in the progressive income tax at the end of the 1990s, combined with economic trends and more recent increases in regressive property, tobacco and sales taxes, have led to a less fair tax system in Minnesota. Many of the options discussed above would hit low-income taxpayers the hardest.

Fortunately, there are strategies that can be used in combination with the options listed above to ensure that revenue-raising options do not ask for a disproportionate contribution from the state’s low-income taxpayers:

- Ensure that a fair income tax increase is part of the overall tax package, and that it is large enough so that the total tax package is not regressive.

- Expand and maintain existing refundable tax credits for low-income families, such as the Working Family Credit or Property Tax Refund, or create new tax refunds or credits that target assistance based on income.

Conclusion

Clearly, with such a large budget deficit, policymakers will have to draw upon all of the tools in their budget-balancing toolbox: raising revenues, cutting spending, and using one-time actions. However, raising revenue must be done with an eye towards improving the fairness of our tax system.

[1] Minnesota Management and Budget, February 2009 Economic Forecast.

[2] Estimates are the most current available at the time of publication. Fiscal estimates done by the Minnesota Department of Revenue on proposals similar to those discussed in this analysis may differ because they will be based on the Minnesota Department of Revenue’s more complete tax model and/or more current data. Income tax estimates are from House Research, based on the February 2009 Economic Forecast. Other estimates are based on fiscal notes and analysis prepared in previous legislative sessions or from the Minnesota Department of Revenue, Tax Expenditure Budget: Fiscal Years 2008-2011, February 2008, and adjusted for current economic conditions and recent law changes.

[3] Peter Orszag and Joseph Stiglitz, Center on Budget and Policy Priorities, Budget Cuts vs. Tax Increases at the State Level: Is One More Counter-Productive than the Other During a Recession?

[4] As of 2006, the latest date for which data is available. Minnesota Department of Revenue, 2009 Minnesota Tax Incidence Study, March 2009.

[5] National Conference of State Legislatures, measured as a percentage of the previous year’s collections.

[6] SF 1611, 2007 session. It is important to note that state income taxes apply to “taxable income,” which is different from gross income. For example, a typical married couple with two children and a gross income of $55,000 may have taxable income of $30,700. A married couple with two dependents and gross income of $281,000 may have taxable income of $250,000.

[7] House Research.

[8] HF 2362, 2nd engrossment, also in HF 2294, 1st engrossment, 2007 session.

[9] House Research.

[10] House Research.

[11] House Research. Estimate assumes a July 2009 implementation date, a 5 percent income tax surcharge in place for the second half of the 2009 tax year, and a 10 percent income tax surcharge in place for 2010 and 2011.

[12] House Research. Figures shown are the impact in 2009 as if fully phased in; however, the surcharge would not be fully phased in until 2010.

[13] Income tax brackets are normally adjusted each year for inflation. This proposal would not roll back the size of the brackets to where they were in 1998, but would keep them the same as under current law. This proposal assumes a 7.0 percent AMT tax rate.

[14] House Research.

[15] House Research.

[16] Minnesota Department of Revenue, Minnesota income tax rates.

[17] House Research.

[18] Minnesota Department of Revenue, Analysis of H.F. 4103. HF 4103 also included some corporate tax reductions and an appropriation for grants to replace JOBZ tax incentives, the impact of which is not included in this total. HF 4103 also included provisions related to Foreign Operating Corporations (FOC); since the laws regarding FOCs were changed in the 2008 Legislative Session, those proposals are not included in the estimate here. The revenue estimates have been deflated to reflect economic and policy changes.

[19] Center on Budget and Policy Priorities, Closing Three Common Corporate Income Tax Loopholes Could Raise Additional Revenues for Many States, November 2003.

[20] Minnesota Department of Revenue, Tax Expenditure Budget: Fiscal Years 2008-2011. The revenue estimates have been deflated to reflect economic and policy changes.

[21] Minnesota Department of Revenue, Analysis of SF 2869, 2nd Engrossment, April 10, 2008. The revenue estimates have been deflated to reflect economic and policy changes.

[22] Services already subject to the sales tax include, but are not limited to, serving and preparing meals, parking, laundry and dry cleaning, pet grooming, lawn and garden services and most telecommunication services. Minnesota Department of Revenue, Tax Expenditure Budget: Fiscal Years 2008-2011.

[23] These revenue estimates should be considered “ballpark figures” rather than precise estimates. Option 2 is based on, but not identical to, HF 2163, introduced in the 2008 Legislative Session. Both options use data from Minnesota Department of Revenue, Analysis of H.F. 2163, February 27, 2008, which have been deflated to reflect economic and policy changes.