First Phase Focuses on Budget Cuts

The recent recession struck Minnesota hard. Many workers have lost their jobs, the number of Minnesotans without health insurance has increased, and there has been a dramatic jump in the number of families using food stamps. As the market fails them, many Minnesotans turn to public supports to help them make ends meet until they can get back on their feet again.

The economic downturn has also contributed to large state budget deficits. Policymakers in Minnesota have been using spending reductions to respond to shortfalls – cutting the very services that help families during a recession. A balanced approach to solving the deficit – one that also includes raising revenues – would maintain investments in education, health care, job training and other vital services that are needed today and contribute to our future prosperity. Governor Pawlenty, however, has opposed revenue increases in the past and the 2010 Legislative Session is no different.

Policymakers began the 2010 Legislative Session in early February with the challenge of solving a $1.2 billion state budget deficit for the FY 2010-11 biennium. The Governor introduced a budget proposal in mid-February, offering a solution for solving the deficit through a combination of federal resources and spending reductions.

A few weeks later, the February forecast revealed that the size of the deficit had shrunk slightly to $1 billion. The state is nearly half-way through the biennium, making it challenging to solve a deficit of any size. And this new deficit comes after policymakers already filled a $6.4 billion deficit hole last session through a combination of federal resources, budget cuts and the Governor’s unallotment decisions.

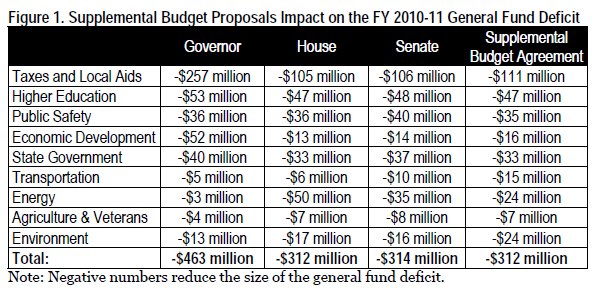

The House and Senate have outlined plans to address the budget shortfall in steps. The first step was completed on March 29, when the House and Senate passed a compromise supplemental budget agreement that had been negotiated with the Governor, reducing the state’s FY 2010-11 deficit by $312 million and the FY 2012-13 deficit by $419 million. The agreed-upon solution recommends changes to nearly every area of the state budget, except for the two largest areas: K-12 education and health and human services. The bill uses both one-time and permanent budget reductions, as well as some significant transfers from special revenue accounts.

This report highlights the major components of this supplemental budget bill and the impact on Minnesota families, and then discusses the next steps for this legislative session.

Taxes and Aid to Local Governments

The tax committee’s contribution to the supplemental budget agreement comes in the form of cuts to state aids to local governments, which the state funds with two goals: so that all areas of the state have the resources to provide basic levels of service, and so that property taxes are lower than they otherwise would be.

Under the supplemental budget agreement, aids to local governments are cut by $105 million in FY 2011 and $210 million in FY 2012-13. In FY 2011, aid to counties and cities are both cut by nearly $53 million. This solves 11 percent of the FY 2010-11 budget deficit. These cuts come on top of the $200 million that local aids have already been unalloted in the 2010 calendar year, and together represent about a 31 percent cut in total county and city aids and credits.[1] In the next biennium, counties are cut by $88 million, cities by $113 million and towns by $9 million.

In the 2010 calendar year, there will be no increases in property taxes as a result of these reductions – those levies have already been finalized. However, in the next biennium, it is assumed that these aid cuts will result in higher property taxes. The impact on the state budget in FY 2012-13 is a projected $8.9 million increase in state-paid property tax refunds to homeowners and a $9.2 million loss in revenues (from higher property tax deductions on the income tax). The aid cuts are significantly smaller than proposed by the Governor, yet still raise serious concerns about the impact on local services.

The combined impact of the aid cuts, the offsetting impact on property tax revenues and tax revenues, and a timing shift relating to a special revenue account add up to a $111 million net reduction in FY 2010-11 from this portion of the bill, and a $186 million reduction in FY 2012-13.

The legislature rejected the Governor’s proposals for a $106 million cut to the Renters’ Credit, a property tax refund for low- and moderate-income renters whose property taxes are high in relation to their income. More than 80 percent of recipients have household incomes of $30,000 or less, and more than one-quarter are households that include seniors or people with disabilities. The Governor already has cut the Renters’ Credit by 27 percent in FY 2011 under unallotment, and as a result, 280,900 households will see a cut in their credits at a time when they are struggling to make ends meet. During an economic downturn, financial assistance to low-income households is one of the most effective economic stimulus tools the government has, because these families are likely to spend those dollars quickly in their local communities.

The legislature also did not include the Governor’s proposal to eliminate the Political Contribution Refund (part of the state’s public financing of elections) in the next biennium.

The supplemental budget agreement does not include any provisions that raise revenues as part of a more balanced approach to the state’s budget deficit.

Higher Education

The House, Senate and Governor agreed to a total of $47 million in reductions to higher education, solving five percent of the immediate budget shortfall. The changes in this budget area will have a very direct impact on the ability of Minnesota families to afford higher education.

Almost all of the $47 million in cuts are made to the University of Minnesota and the Minnesota State Colleges and Universities (MnSCU) system. The University of Minnesota will be cut by $36 million in FY 2011 and by $22 million per year starting in FY 2012. The MnSCU system will see a nearly $11 million a year reduction in funding in FY 2011, and a $22 million per year reduction beginning in FY 2012. This is on top of the Governor’s unallotments that cut an additional $50 million each to the University of Minnesota and MnSCU in FY 2011. Altogether, theses cuts reduce funding for higher education down to 2006 spending levels, the maximum level of cuts allowed by the federal government.[2]

The Office of Higher Education will receive a three percent reduction to its administrative budget and three program areas (State Work Study, library services and community college emergency grants) receive one-time reductions. The supplemental budget agreement also caps funding for the Achieve Scholarship in the FY 2012-13 biennium. This scholarship provides high achieving low-income students with a one-time award for their first year of college.

The State Grant Program’s current level of funding is $42 million less than what is needed in the current biennium, due to higher than expected increases in enrollment and tuition and other factors that have fueled demand for financial aid. This is a need-based financial aid program that last year served one out of every three residents enrolled in an undergraduate program in Minnesota. To address the shortfall, the bill caps the Summer Transition Grant program, eliminates the ninth semester of financial aid and asks students and families to contribute more to the cost of college. As a result of these changes, approximately 9,400 students will completely lose their grant and the remaining students will likely see a 19 percent drop in the size of their financial aid grant.

Public Safety

The supplemental budget agreement reduces public safety general fund spending by $35 million in FY 2010-11, solving four percent of the budget shortfall. These numbers do not include the cuts to local government aids, which could affect public safety by reducing cities’ ability to support police and fire services.

Minnesota’s court system fared slightly better under the supplemental budget agreement than it did under the Governor’s proposal. The Judicial Branch warned that the Governor’s proposal to cut $15 million from the court system in FY 2010-11 would lead to staff shortages, creating more backlogs and delays. The supplemental budget agreement makes the following reductions:

- Supreme Court operations, the Court of Appeals and District Courts are cut by $12 million in FY 2010-11.

- Grants to legal services and alternative dispute resolution programs serving low-income clients are cut by $424,000, less than half of the $1.1 million cut proposed by the Governor. These grants support Legal Aid and pro bono legal programs to help low-income residents pursue employment, housing, disability and other civil cases.

- The Board of Public Defense takes a $1.9 million cut, significantly less than the $4.8 million cut proposed by the Governor.

The legislature also preserved the Department of Correction’s popular Sentencing to Service program, which puts low-risk offenders to work on civic projects. The Governor had proposed eliminating this program, but the supplemental budget agreement bill cut its funding in half to $2.3 million in FY 2010-11. New language allows counties to require offenders to pay a fee to participate and/or to assess fees to entities that benefit from Sentencing to Service work crews.

The supplemental budget agreement makes deeper cuts than the Governor proposed in other areas of public safety.

- The Department of Corrections takes an $8.9 million cut, $1.5 million more than the Governor proposed. The supplemental budget agreement includes some restrictions, specifying that the cuts cannot come from correctional officers, offender reentry programs or discharge planning for mentally ill inmates. However, the agreement allows cuts to inmate education programs, chemical dependency programs and treatment beds, cuts that were formerly prohibited in statute.

- The Bureau of Criminal Apprehension is cut by $1.6 million. The Governor had proposed a $200,000 increase.

- The Office of Justice Programs is cut by $1.3 million. The Office focuses on crime reduction and crime victim assistance. The Governor had proposed no cuts. There is language minimizing reductions to services for battered women’s shelters and domestic violence programs, general crime victim programs, sexual assault victim programs, and youth intervention programs.

The supplemental budget agreement relies heavily on one-time fixes, transferring money from special revenue accounts to the general fund. These do not help balance the budget in the long term. The largest example is an $11 million transfer from the Fire Safety Account to the general fund. The Fire Safety Account is funded by a tax on homeowner and commercial insurance policies and is intended to pay for firefighter education and training and other programs. State officials said the account had a surplus, which allowed for a one-time, $2 million increase in fire safety spending, plus the one-time transfer to the general fund to address the deficit.

Economic Development and Housing

The supplemental budget agreement reduces general fund spending for economic development by $16 million in FY 2010-11, or two percent of the current budget deficit.

The supplemental budget agreement makes $1.3 million in permanent reductions to workforce development services. Cuts include:

- $119,000 from State Services for the Blind, which helps Minnesotans who are blind, visually impaired or Deafblind with their employment skills,

- $397,000 from extended employment, which helps people with significant disabilities keep and advance in their jobs,

- $190,000 from Independent Living Services, which teach skills and provide services that enable individuals with disabilities to live independently, and

- $500,000 from the Jobs Skills Partnership, which funds job training and retraining partnerships between educational institutions and businesses.

The Minnesota Housing Finance Agency (MHFA) is cut by $4.2 million this biennium, including $3.2 million from the Preservation Affordable Rental Investment Fund, a fund created to prevent the loss of federally-assisted rental housing. Another $1 million was cut from MHFA’s Rental Rehabilitation Loan program, which helps maintain rental properties for low-income families.

The supplemental budget agreement reduces funding for public broadcasting by $149,000 in FY 2010-11 and cuts the State Arts Board by $543,000. The Governor had recommended eliminating all state funding for public broadcasting and proposed phasing out state funding for the State Arts Board. The Governor also proposed eliminating funding for the Minnesota Humanities Center. The supplemental budget agreement leaves the Center’s funding intact.

The supplemental budget agreement makes a few one-time transfers from special revenue accounts, including:

- $5 million from the Petroleum Tank Release Cleanup Fund (or “Petro Fund”) to the general fund. The Petro Fund pays for contamination clean-up grants for underground petroleum storage tanks.

- $1.4 million from the Assigned Risk Safety Account to the general fund. The funds in this account are used to promote workforce health and safety.

The supplemental budget agreement does not include two significant transfers proposed by the Governor: $30 million from the Douglas J. Johnson Economic Protection Trust Fund and $5 million from the Minnesota Minerals 21st Century Fund. Both of these funds target economic development assistance in northern Minnesota.

State Government

The supplemental budget agreement reduces general fund spending for state government by $33 million in FY 2010-11, solving three percent of the current budget deficit. The bill has across-the-board cuts for constitutional offices, including the legislature, the Governor and the Attorney General, as well as cuts to small agencies such as the Council on Indian Affairs.

The single biggest budget impact in this area comes from increased tax compliance, projected to net $20 million in additional revenues for the state. Past budgets have relied on increased tax compliance to provide more general fund resources. However, the Department of Revenue has raised serious concerns about the diminishing return on investment from more enforcement.

Transportation

The supplemental budget agreement cuts transportation funding by almost $15 million – significantly more than the level of cuts proposed by the Governor, House and Senate in their original budget proposals. This size reduction solves two percent of the state budget shortfall. Virtually the entire reduction is to transit, including a $1.7 million cut to Greater Minnesota transit and a $13 million cut to metro area transit (through the Met Council). Policymakers said these transit reductions will be offset by higher than expected revenues from the Motor Vehicle Sales Tax (MVST), which is partially dedicated to transit funding.

Energy (Commerce)

This area essentially comprises the Department of Commerce and numerous special revenue accounts. Almost all of the $24 million in reductions in this area in FY 2010-11 come from one-time transfers from these special revenue accounts (solving two percent of the current budget shortfall). As a result, there is less than $1 million in permanent reductions in this area that continue into FY 2012-13.

The two largest one-time transfers include $14 million from the Assigned Risk Plan (which helps businesses purchase workers’ compensation coverage) and $3 million from the Petro Fund (which provides partial reimbursement for cleaning up petroleum tank leaks). This is in addition to the $5 million transfer from the Petro Fund included in the economic development budget area. Not included in the supplemental budget agreement is a proposal to remove the cap on a mutual fund registration fee recommended by the both the House and Senate. This fee, which the Governor objected to, would have raised between $25 and $28 million in FY 2010-11.

Agriculture and Veterans Affairs

There are no reductions to the Departments of Military Affairs and Veterans Affairs in the supplemental budget agreement. Instead, the bill includes $100,000 in one-time funding for military honor guard reimbursements and another $100,000 in one-time funding for services for homeless veterans.

The supplemental budget agreement does include reductions to the Department of Agriculture. Overall, there is an eight percent cut – or $5.7 million – to department operations, grants and programs. Most of the reduction comes from a provision to delay $4.4 million in subsidy payments to ethanol providers. In addition to the cuts to the Department of Agriculture, the bill also includes a $1 million transfer from the Agriculture Fund and small reductions to two boards, for a total of $7 million in reductions in this area in FY 2010-11.

Environment and Natural Resources

The supplemental budget agreement reduces general fund spending for the environment by $24 million in FY 2010-11, solving two percent of the current budget deficit. The bill includes reductions to the Department of Natural Resources and Pollution Control Agency, affecting spending on forestry, water protection, parks and trails and other services. Spared from reductions are the Science Museum and the Minnesota Conservation Corps, which employs young people to help manage the state’s natural resources.

The general fund budget reductions include several one-time transfers from special revenue accounts. The most significant is an $8 million transfer from the Closed Landfill Investment Fund to the general fund. (This transfer was not included in any of the original proposals from the House, Senate and Governor.) The move solves the budget problem in the short term. However, the supplemental budget agreement says the state has to repay the transfer with interest in FY 2013 and FY 2014. The Closed Landfill Fund was created in 1994 to protect the public and the environment from closed solid waste landfills in Minnesota.

The Next Steps

The supplemental budget agreement is just the first step in solving the state’s $1 billion deficit, leaving two-thirds of the shortfall still remaining.

Policymakers have already taken another step to fill the deficit. In late March, legislators and the Governor agreed to a bill to continue the General Assistance Medical Care (GAMC) program for extremely low-income Minnesotans without children, saving the state’s general fund $147 million in FY 2010-11.

There are two other avenues policymakers are likely to pursue to resolve the remaining deficit.

- Last year, as part of the American Recovery and Reinvestment Act (ARRA), Congress temporarily increased its share of funding for Medicaid, allowing Minnesota to decrease its share of spending. Congress may act to extend this “enhanced match,” potentially saving the state $408 million in FY 2010-11.

- The remainder of the deficit is likely to be solved through cuts to health and human services and possible cuts to K-12 education. These are the two budget areas that were not included in this first supplemental budget bill.

There remain some very significant uncertainties. If Congress fails to extend the enhanced Medicaid payments before the legislative session ends, the state will continue to face a $408 million budget hole. In addition, there is a case currently pending with the Supreme Court over the Governor’s actions to unallot $2.7 billion in spending last year. The ruling could potentially overturn some or all of the Governor’s unallotments, creating another hole in the state’s budget. In the face of these challenges, it also remains to be seen if the legislature will propose revenue increases to help resolve the budget shortfall.

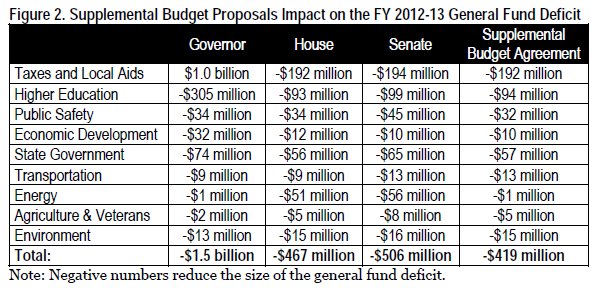

As policymakers pass the remaining bills to solve the deficit this biennium, they must also consider that the state faces a $7 billion deficit in the FY 2012-13 biennium (including inflation). It is important that this year’s budget solutions make a significant dent in the deficit that awaits us. The supplemental budget agreement makes a small step, reducing next biennium’s deficit by $419 million, slightly less than what the House and Senate initially proposed (see Figure 2). The Governor’s budget proposal would have reduced the future deficit by $1.5 billion, but at a very high cost to higher education and services provided by local governments.

Given the size of the deficit in the next biennium and the serious consequences from resolving that deficit entirely through cuts in services, policymakers must consider a more balanced approach to solving the state’s fiscal shortfalls. Although budget cuts will be a necessary component of any budget solution, raising revenues allows the state to protect investments in health care, job training, services for the elderly and people with disabilities, and other services that help Minnesotans during these tough economic times and position the state for when prosperity returns.

Except where otherwise noted, the analysis in this report is based on data from budget documents prepared by Minnesota Management and Budget and legislative research and fiscal departments. The opinions expressed are those of the authors.

[1] Jeff Van Wychen, “Preliminary Aid Cut Compromise at Capitol,” Hindsight 2020, March 26, 1010.

[2] The state utilized resources from the American Recovery and Relief (ARRA) act passed by Congress last February to limit cuts to higher education in the 2009 Legislative Session. As a result, the federal government stipulates that Minnesota cannot cut state funding for higher education levels below 2006 levels until the federal funds expire at the end of 2010.