Governor Makes Unprecedented Use of Unallotment Authority

The primary challenge of the 2009 Legislative Session was to address Minnesota’s considerable $6.4 billion budget deficit for the upcoming two-year budget cycle (the FY 2010-11 biennium). After taking into account federal stimulus dollars, the size of the deficit was reduced to $4.6 billion.[1] This exceptionally large deficit can partially be attributed to the declining national economy. However, policymakers also failed to fully address prior state budget deficits, allowing those budget problems to carryover into the current biennium.

The Legislature and Governor Pawlenty had a strong difference of opinion on whether to include tax increases as part of the budget-balancing solution. Ultimately, they did not come to agreement before the legislative session ended on May 18, leaving $2.7 billion of the FY 2010-11 deficit unresolved.

The usual way of resolving this is to continue negotiations and for the Governor to call the legislature back into special session. Governor Pawlenty, however, chose instead to exercise his unallotment authority to balance the budget. Unallotment refers to the power of the governor to reduce state spending independent of the legislature to bring the state budget into balance.

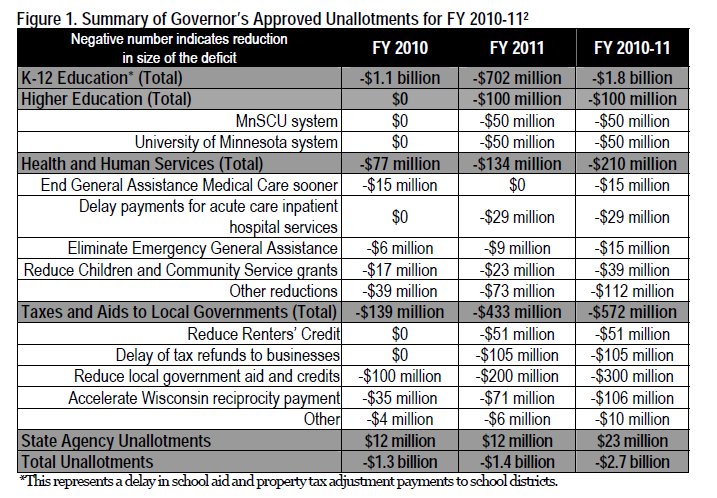

The $2.7 billion in unallotments, as detailed in Figure 1, started to go into effect on July 1, 2009, the first day of FY 2010. The unallotments impact a range of Minnesotans, including K-12 students, college students, low-income families, senior citizens and people with disabilities. This analysis examines the major unallotment decisions in more detail and provides a background on the unallotment process.

Health and Human Service Unallotments Touch Vulnerable Populations and Cost Federal Dollars

The Governor’s plan includes 27 separate unallotments for health and human services, totaling $210 million for FY 2010-11. Most of the Governor’s unallotment decisions in health and human services take effect at some point during the first year of the biennium, which began on July 1, 2009, giving the legislature little flexibility to reverse any unallotments when they reconvene in February 2010.

Examples of the major health and human service unallotment decisions made by the Governor include:

- Ending General Assistance Medical Care (GAMC) on March 1, 2010, one and one-half months sooner than under current law. With the elimination of GAMC, about 34,000 extremely low-income adults without children may lose access to health care coverage.[3]

- Eliminating emergency assistance grants to counties to help low-income and disabled families meet basic needs.

- Changes to chemical dependency programs, including capping payment rates and eliminating two special project grants.

- Reducing the Group Residential Housing supplementary service payment rate by five percent. This impacts homeless shelters, homes that provide special services, and housing for long-term homeless individuals and families.

- Reducing funding by 25 percent for the Children and Community Services block grant, which provides resources for social service programs for children, adolescents and other individuals.

- Reducing fee-for-service payments for non-primary care and specialist services by 1.5 percent.

- Eliminating general fund spending for the Outreach Incentive program which provides resources to community agencies that assist people in applying for Minnesota’s public health care programs.

- Suspending the add-on payment for critical access dental providers in Medical Assistance.

- Suspending rebasing (a reevaluation of payment rates) for nursing facilities.

- Reducing the number of hours a Personal Care Attendant (PCA) can work. PCAs are individuals that help persons with disabilities meet physical, social and emotional needs.

- Delaying payments for inpatient hospital stays and acute care services from FY 2011 to FY 2012.

These unallotment actions are on top of $918 million in cuts made to health care and human services during the 2009 Legislative Session through a combination of legislative reductions and the Governor’s line-item veto of funding for General Assistance Medical Care.[4] The budget changes made during the legislative session included limits on disability waivers, reductions in PCA services that will impact thousands, a reduction in the personal needs allowance for individuals living in group residential housing, and cuts in state reimbursements to health care providers.

The budget cuts and unallotment decisions will also cost the state federal dollars. Normally, the federal government matches state spending on Medicaid at a rate of one dollar in federal funding for every one dollar in state spending – in other words, the federal government pays 50 percent of the total cost. The federal stimulus package, however, has temporarily increased that percentage to 60 percent. Because the state and federal government share funding responsibility, any cuts in state spending on Medicaid results in a loss of in federal matching funds.

The cuts in health care made during the 2009 Legislative Session will cost the state $365 million in federal matching funds for the FY 2010-11 biennium. The Governor’s unallotment decisions result in the loss of an additional $72 million in federal funds for the biennium, for a combined total of $437 million in federal dollars lost.[5]

Unallotment Cuts Renters’ Credit and Delays Business Tax Credits

The Governor’s unallotment proposal also makes significant changes in the tax area. Under unallotment, the Renters’ Credit will be reduced by $51 million in FY 2010, a 27 percent cut. Nearly 281,000 Minnesota households will see a cut in their Renters’ Credit, and the average Renters’ Credit will be reduced by $163. An estimated 18,200 households will lose their Renters’ Credit completely.[6] Twenty-eight percent of households receiving the Renters’ Credit include seniors and/or people with severe disabilities.

During a recession, financial assistance to low-income families is one of the most effective economic stimulus tools the government has because these individuals are likely to spend those dollars quickly and locally. The Renters’ Credit is one of these tools. In addition, the Renters’ Credit also helps minimize the impact of rental property taxes – among the most regressive taxes in Minnesota – on low-income families, seniors and persons with disabilities.

The Governor’s unallotment plan also delays paying corporate tax refunds and refunds on sales taxes paid on business purchases of capital equipment by up to three months, shifting a total of $105 million in business tax refunds from FY 2011 into FY 2012.

Aid to Local Governments Reduced Under Unallotment

The Governor’s unallotment plan includes $300 million in reductions to aids to counties, cities and towns. The state provides aid to local governments in order to reduce local property taxes and to ensure that all local governments — regardless of their level of local property tax wealth — have sufficient revenues to provide adequate services, such as police and fire protection.

Under unallotment, state aid to counties, in the form of County Program Aid, will be reduced by $100 million in FY 2010-11. State aid going to cities, in the form of Local Government Aid and Market Value Homestead Credit reimbursements, will be cut by $200 million in FY 2010-11. These cuts to counties, cities and towns come on top of $110 million in reductions to aid to local governments already made during the Governor’s December 2009 unallotment actions.

Minnesota Management and Budget assumes that the cuts in state aids to local governments will cause local property taxes to increase. As a result, the state estimates an increased cost of $6 million to the state in FY 2011 from higher property tax refunds paid by the state and lower corporate and individual income taxes collected (because there will be higher deductions for property taxes paid).

Unallotment Seeks $106 Million from Wisconsin

The Governor’s unallotment plan includes an additional $106 million in tax revenues in FY 2010-11 by asking the State of Wisconsin to reimburse the State of Minnesota sooner under an existing reciprocity agreement. Under the current reciprocity agreement, Wisconsin residents who work in Minnesota file their state income taxes in Wisconsin, and Wisconsin remits those taxes to Minnesota after a 17 month delay, and visa versa. The State of Wisconsin has not at this time agreed to accelerate the payment schedule.

Higher Education Cut by $100 Million Under Unallotment

During the 2009 Legislative Session, after accounting for one-time federal dollars, funding for the University of Minnesota was cut by $30 million in FY 2010-11, and the MnSCU system was cut by $19 million.

Under unallotment, the Governor further reduced state funding for higher education by a total of $100 million in FY 2011. The Minnesota State Colleges and Universities (MnSCU) system and the University of Minnesota system each were cut by $50 million.[7]

Governor Uses Unallotment Powers to Delay Payments to School Districts

The Governor used his unallotment power to implement a $1.8 billion delay in payments to school districts.[8] Normally, schools get 90 percent of state aid in one fiscal year and a 10 percent settle-up payment in the following fiscal year. Under unallotment, school districts will receive 73 percent of their state aid in one year and 27 percent in the next year. This action is a one-time accounting action that artificially lowers the current budget deficit by shifting when school districts receive aid. The Governor and House of Representatives both proposed similar shifts in state payments to schools during the 2009 Legislative Session and policymakers agreed to such a shift when Minnesota last faced significant budget deficits in 2003.

This delay in payments could force some districts into drawing down cash reserves or resorting to short-term borrowing.

It is also possible that the delay in payments could turn into an actual cut in funding to school districts, rather than just an accounting shift. First, there is some debate over whether the Governor has the authority to settle up with school districts in FY 2012-13, or whether repayment requires legislative action. Secondly, there is already a large projected deficit for the FY 2012-13 biennium, so in order to repay school districts, the state would need to raise additional revenues or cut spending significantly in other areas.

The Governor’s budget planning estimates assume that a portion of the shift will not be paid off, resulting in a $600 million cut to schools in FY 2012.[9]

State Agencies Also Cut Under Unallotment

Finally, most state agencies will undergo 2.25 percent operating budget reduction for the biennium, or nearly $25 million in total.[10] Some examples of agency unallotments include:[11]

- $5.3 million to the Department of Human Services, mostly to administrative operations

- $3.4 million to mass transit operations and parks within the Metropolitan Council

- $3.0 million to a range of services within the Department of Natural Resources

- $512,000 to the rehab loan program within the Housing Finance Agency

- $336,000 to education, outreach, preservation and access within the Historical Society

- $162,000 to the Governor’s Office

Some agencies were exempted from any unallotments, including Public Safety, Corrections, Military and Veterans Affairs, State Operated Services, and the Minnesota Sex Offender Program within the Department of Human Services.[12]

The History, Process and Powers of Unallotment

The Governor’s unexpected unallotment actions raised many questions about the history and restrictions surrounding this power. The governor’s unallotment authority was originally enacted into law by the legislature in 1939, at the request of Governor Harold Stassen. Yet the first recorded use of unallotment didn’t occur until 41 years later, in 1980 under Governor Al Quie.[13]

In the 70 years the unallotment statute has been in place, there have only been five recorded uses of unallotment authority prior to the 2009 Legislative Session:

- Governor Al Quie unalloted $195 million in 1980.

- Governor Al Quie unalloted local government aid payments in late 1981, but repaid them early the following year.

- Governor Rudy Perpich unalloted $109 million in 1986.

- Governor Tim Pawlenty unalloted $281 million in 2003.

- Governor Tim Pawlenty unalloted $269 million in 2008.[14]

Governor Pawlenty’s decision to unallot $2.7 billion for the FY 2010-11 biennium represents the first time a governor has used the unallotment power at the beginning of a budget biennium to balance the budget. In the past, governors have exercised the authority when an unexpected budget shortfall occurred midway through the budget year.

The statute governing unallotment does not spell out many specifics, giving the executive branch broad authority to reduce spending. A few key components include:

- It is the Commissioner of Finance (now known as the Commissioner of Minnesota Management and Budget) that actually oversees the unallotment process, although the governor must approve the actions.

- In order to trigger the unallotment authority, the Commissioner must determine that the state’s revenue collections are lower than expected, and that the amount that is available will be less than is needed for the biennium.

- Before unalloting, the Commissioner must first use any available balance in the state’s budget reserve account.

- the amount in the budget reserve is not sufficient, then the remaining deficit can be resolved by “reducing unexpended allotments of any prior appropriation or transfer”.[15]

There are few checks and balances built into the unallotment process. Before implementing any unallotment plan, the Commissioner must consult with the Legislative Advisory Committee (LAC). The LAC has four permanent members: the majority leader of the Senate, the speaker of the House, the chair of the Senate Finance Committee and the chair of the House Ways and Means Committee. Budget committee chairs will sit on the LAC depending on which budget areas are being discussed. Although the Commissioner is required present the unallotment plan to the LAC prior to implementation, the committee has no authority to approve, amend or reject the plan.

The Commissioner is also required to provide written notification of the unallotment decisions to the Senate Finance and Tax Committees and the House Ways and Means and Tax Committees 15 days prior to any unallotment action. Once again, however, these committees have no authority to approve, amend or reject the plan.

There are few limitations on the Governor’s unallotment authority. While unemployment benefits and the legislative and judicial branches are exempt from unallotment, there are no limits on how much any other area of the budget can be cut to resolve the budget deficit.

The unallotment statute applies not only to the state’s general fund – which accounts for about 60 percent of the state’s operating funds – but to any state fund that may be facing a deficit. However, the Commissioner cannot unallot from a fund that is not in deficit in order to help solve a deficit in a different fund.

State Faces $4.4 to $7.2 Billion Deficit in Future

Although the Governor’s unprecedented unallotment actions closed the remaining deficit for the FY 2010-11 biennium, there is still more red ink in Minnesota’s fiscal future. Minnesota Management and Budget estimates the FY 2012-13 biennium deficit at $4.4 billion. However, this estimate makes some controversial assumptions about not fully paying off the school payment shift and not restoring General Assistance Medical Care.[16]

In contrast, Senate Fiscal Analysis estimates a $5.9 billion deficit in FY 2012-13. This figure assumes the $600 million property tax shift from school districts is paid off and that funding for General Assistance Medical Care would be fully restored. After including the impact of inflation, the deficit rises to $7.2 billion in FY 2012-13.[17]

Next Steps in the Process

Later this year, the state’s next economic forecast will be released, most likely early December. The economic forecast is a critical step in the state’s budgeting process and will help provide an updated picture of the state’s financial situation.

When the state legislature reconvenes in February 2010, on the agenda will be the passage of a capital budget (or bonding bill), as well as a supplemental budget to resolve any new deficits that are revealed by the next economic forecast. Although the legislature will have the opportunity to attempt to reallot funding to areas cut by the Governor’s unallotments and restore line-item vetoes, these efforts will be complicated by timing issues and the near certainty of additional budget deficits.

[1] Minnesota Management and Budget, February 2009 Economic Forecast, March 2009.

[2] For a complete list of approved unallotments, see Minnesota Management and Budget, Approved Unallotments & Administrative Actions, July 1, 2009.

[3] Governor’s 2010-11 Biennial Budget, Human Services Department, January 2009.

[4] Senate Fiscal Analysis, Enacted General Fund Budget Prior to Unallotments, June 18, 2009.

[5] Minnesota Management and Budget, June 25 Letter to Legislative Advisory Commission.

[6] Minnesota Department of Revenue.

[7] In December 2008, higher education received additional funding cuts when Governor Pawlenty unalloted $40 million from this budget area. During 2009 Legislative Session, however, the state had to restore $30.5 million of those unalloted resources in order to meet federal requirements for receiving the federal fiscal stabilization funds as part of the American Recovery and Reinvestment Act.

[8] The payment shift has two components: a payment deferral ($1.2 billion) and a change in when property tax receipts are recognized ($600 million).

[9] Minnesota Management and Budget, Approved Unallotments & Administrative Actions, June 2009.

[10] Minnesota Management and Budget, June 25 Letter to Legislative Advisory Commission.

[11] Minnesota Management and Budget, July 28 Letter to the Legislative Advisory Commission and August 14 Letter to the Advisory Commission.

[12] Minnesota Management and Budget, July 17 Letter to Legislative Advisory Commission.

[13] Minnesota Legislative Reference Library, Resources on Minnesota Issues: Unallotment, June 2009.

[14] Minnesota Legislative Reference Library, Historical Use of Unallotment, June 2009.

[15] Minnesota Statutes, section 16A.152.

[16] The $4.4 billion deficit figure assumes that the $1.2 billion school aid payment deferral is paid off in FY 2012-13, but the $600 million property tax recognition portion of the shift is not. This figure also assumes General Assistance Medical Care, which was line-item vetoed by the Governor in May and further unalloted in July, is not fully or even partially restored during the next legislative session. Minnesota Management and Budget, General Fund: Fund Balance Analysis, July 2009 Executive Actions, July 17, 2009.

[17] Senate Fiscal, Governor’s Proposed FY 2010-11 Unallotments – Revised July 20, 2009.