Minnesota’s property taxes are regressive, which means low- and middle-income Minnesotans pay a larger share of their income in property taxes than higher-income Minnesotans do. The Property Tax Refund, or PTR, reduces the regressivity of property taxes by providing a tax credit to households whose property taxes are high in relation to their income. The PTR is commonly called the Circuit Breaker when it applies to homeowners and the Renters’ Credit when it applies to renters.

Who Participates in the PTR?

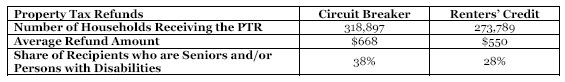

Nearly 600,000 Minnesota households received the PTR in 2007, with just over half receiving the Circuit Breaker and the remainder receiving the Renters’ Credit.[1] The average amount of credit is $668 for the Circuit Breaker and $550 for the Renters’ Credit. Seniors and persons with disabilities make up a significant portion of PTR recipients, as shown in the table below.[2]

Eligibility Rules for the PTR

- For PTR claims filed in 2009, renters must have household incomes less than $52,299 and homeowners must have incomes less than $96,939.[3] The income ceilings are adjusted each year for inflation.

- The taxpayer must have been a resident of Minnesota for at least part of the year.

- The taxpayer could not have been claimed as a dependent for income tax purposes.

- Renters are ineligible if they live in buildings that do not pay property taxes, a portion of the rent receipts in place of property tax, or payments in lieu of taxes to a local government.

- Homeowners must not owe delinquent property taxes, and the home must be their homestead.

Taxpayers are eligible for the PTR when their property taxes reach a certain percentage of income, called the threshold. The PTR is calculated based on a percentage of the amount of tax that exceeds the threshold.[4] The Renters’ Credit recognizes that, although the owners of rental properties are legally responsible for paying the taxes on that property, a portion of this cost is passed on to renters in the form of higher rents. For renters, 19 percent of total rent paid is considered their share of property taxes. The PTR cannot exceed a maximum amount, which is adjusted each year for inflation. For claims filed in 2009, the maximum amount of Property Tax Refund is $2,310 for homeowners and $1,490 for renters.

The PTR is received as a refund from the State of Minnesota, not as a reduction in property taxes owed to local government.

[1] The data in this fact sheet comes from House Research, Homeowner’s Property Tax Refund Program and Renter’s Property Tax Refund Program. The data refers to PTRs filed in 2007.

[2] For more information, including information by county, see Minnesota Budget Project, Who Receives the Renters’ Credit?

[3] Household income is a comprehensive measure of income that includes wages, nontaxable social security and railroad retirement benefits, payments to retirement plans, government assistance, worker’s compensation and other nontaxable income sources. In determining household income, taxpayers are allowed a subtraction from their income based on the number of dependents and whether the taxpayer and/or the taxpayer’s spouse is over 65 and/or disabled.

[4] For a step-by-step example of how the credit is calculated, see House Research, Homeowner’s Property Tax Refund Program and Renter’s Property Tax Refund Program.