The full version of this issue brief includes a table with data on the importance of the Working Family Credit to each Minnesota county and the state as a whole. A related map shows what percentage of filers in each Minnesota county receive the Working Family Credit.

Minnesota’s Working Family Tax Credit encourages and supports work, makes the tax system more equitable, and helps working people across the state to meet their basic needs and support their families. In 2017, more than 315,000 households received the Working Family Credit, which is 10.8 percent of all households who file Minnesota income taxes.[1] Minnesotans claiming the Working Family Credit live all across the state: 48 percent in Greater Minnesota and 52 percent in the Twin Cities metro area.

More than half of all states, including Minnesota, have tax credits like the Working Family Credit that are based on the federal Earned Income Tax Credit (EITC), and build on the EITC’s documented success in supporting work, reducing poverty, and improving the health and education of children.[2] Children in households receiving the EITC are also more likely to attend college and earn more as adults.[3] Because these tax credits are received once a year, after workers and families file their taxes, many people use their credits to secure a stronger financial future by building their savings or reducing debt.

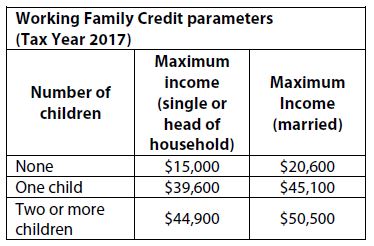

Minnesota’s Working Family Credit is calculated based on a family’s earnings and family size, and it requires that people have earnings from work. Families with two or more children qualify for larger credits on average, and workers with no dependent children qualify for much less. The Working Family Credit offsets a portion of the significant state and local taxes, such as sales taxes, that low- and moderate-income people pay.

In the 2019 tax year, Minnesotans will see a $30 million expansion of the Working Family Credit, which is expected to increase the amount of credit received by 275,000 households, 33,000 of whom did not previously qualify for the credit. 2019 is also the first year that workers without children can qualify for the credit if they are at least 21 years old, rather than 25.

By Nan Madden and Abimael Chavez-Hernandez

[1] Minnesota Department of Revenue, Tax Year 2017 Minnesota Income Tax Statistics by County. In this analysis, the number of households refers to the number of tax returns.

[2] Center on Budget and Policy Priorities, Policy Basics: State Earned Income Tax Credits, August 2017.

[3] Center on Budget and Policy Priorities, EITC and Child Tax Credit Promote Work, Reduce Poverty, and Support Children’s Development, Research Finds, October 2015.