In 2023, Minnesota passed a nation-leading Child Tax Credit (CTC). About one-third of Minnesota families with children are expected to qualify and, as a result, be better able to afford the basic expenses of raising thriving children. [1] The Minnesota Child Tax Credit has huge potential to reduce hardship and child poverty, narrow disparities by race and geography, and improve the lifetime prospects of Minnesota children.

This new process could be in place when families file their Minnesota income taxes in 2025. Additional legislation needs to be passed in the 2024 session, and final implementation decisions made, in order to launch a family-centered process that empowers families to choose what works best for them and that minimizes potential negative consequences.

How advance periodic payments could work

The Minnesota Department of Revenue is developing plans to implement advance periodic payments beginning with tax-filing in the 2025 calendar year. Their preliminary design for that first year of implementation includes:[4]

- Families who qualify for the 2024 Child Tax Credit could choose to receive advance payments of their 2025 Child Tax Credit.

- Advance payments would equal 50 percent of the family’s 2024 Child Tax Credit.

- Advance payments would be received in the second half of the 2025 calendar year. Whether payments would be made monthly, quarterly, or some other frequency is yet to be determined.

- The next year, when families file their income taxes, they will reconcile their 2025 Child Tax Credit amount. They will receive the remainder of their 2025 Child Tax Credit that they did not receive in advance payments.

- Families who saw a significant change during the year that impacted their Child Tax Credit amount would be protected from repayment burdens, as long as their incomes are below certain limits. This component needs legislative change in order to implement.[5]

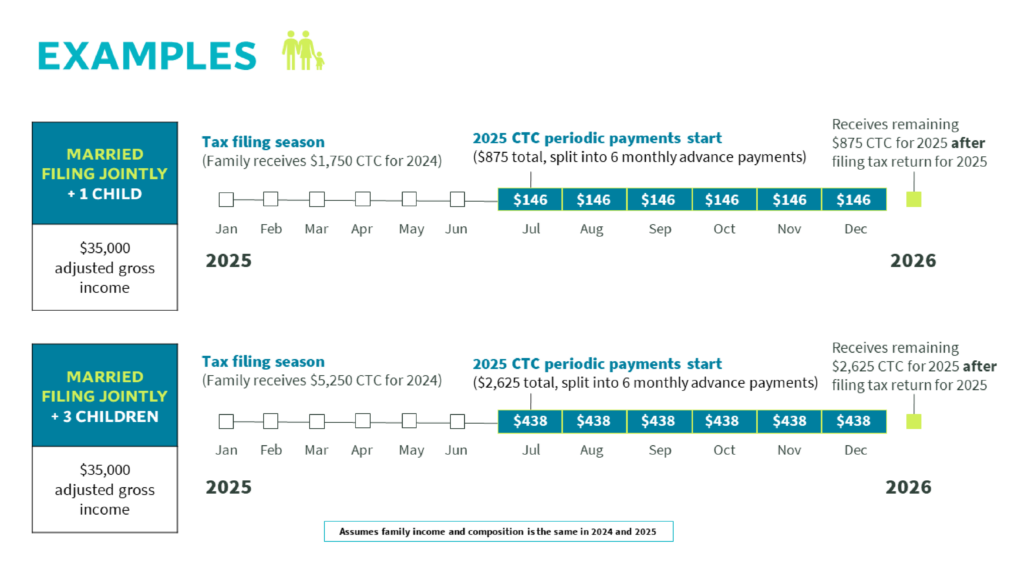

While the exact implementation of advance periodic payments is still to be determined, we can envision what the experience could be like for families. The examples below assume that periodic payments are offered as monthly payments, and the example family’s income and composition is the same in 2024 and 2025.

Say a family is headed by a married couple, has one child, and adjusted gross income of $35,000. When they file their 2024 Minnesota income taxes in early 2025, they qualify for and receive a 2024 Child Tax Credit of $1,750. In addition, they could choose to receive $875 in advance payments of their 2025 Child Tax Credit, which would be $146 each month from July to December 2024. When the family files their taxes in early 2026, they qualify for a 2025 Child Tax Credit of $1,750. They have already received $875 in advance payments, and the remaining $875 would go toward taxes they owe or be added to their tax refund.

A similar family with three children would qualify for a $5,250 Child Tax Credit for 2024. They could receive advance payments of $438 a month and receive the remaining $2,625 after filing their 2025 tax return. This illustrates how advance payments could work; it is not guaranteed that periodic payments will be offered on a monthly basis.

Design principles for advance periodic payments

Based on feedback from Minnesota families, the experiences of organizations that serve families, and national policy research and tax preparation experts,[6] an advance periodic payment process should have the following design principles:

- Families are the decision-makers about whether to opt in to receive advance periodic payments, and should be able to later opt out if advance payments do not meet their needs. Families should be able to opt out through an easy-to-navigate online portal and other methods.

- Families are provided with sound, specific information to inform their choice whether to receive advance payments and to successfully interact with the tax-filing system, regardless of their method of tax-filing. This includes information about how advance payments could impact other assistance and their annual tax refund; and how their Child Tax Credit could be impacted by changes in their family’s income, marriage status, or number of children living in the home.

- Eliminate or limit negative impacts on families’ access to other assistance.

- Protect families from repayment burdens who in good faith choose to receive advance periodic payments.

- Provide resources for successful implementation. Volunteer tax preparation services, direct service organizations, and government entities that work directly with potentially eligible families should have financial and information resources to provide support and guidance to families in making their decisions about periodic payments.

An advance periodic payment process with all of the above design principles would create a positive opportunity for families and build a strong foundation for future improvements. Legislation is needed to create stronger repayment protections and providing funding for infrastructure, education, and support for families to make informed choices about whether to participate in periodic payments and can opt out in response to changing family circumstances.

Challenges and policy responses to them

For many families, receiving advance payments would make it easier to afford their everyday expenses. Unfortunately, there are some potential trade-offs for families that the policy design and implementation must take into account.

- Potential negative impacts on other assistance that families may rely on. Tax credits usually do not count against other kinds of assistance. But unfortunately, under current interpretations of federal laws, simply changing the frequency in which families receive state tax credits – from a once-a-year payment to periodic payments – could impact families’ access to some federal assistance. For example, families who receive advance periodic payments of their Child Tax Credit may see a reduction in their food assistance through SNAP.

- Risk of having to pay back advance payments or incur tax debt. Tax policy usually looks to the past: a family’s Child Tax Credit is based on how much income a family had in the prior year, and what their family composition was like. To decide whether advance payments are good for them, a family needs to look forward and predict what their income and family configuration will be for the current year. Things working out differently than expected – a family member getting a new job, or a child leaving part-way through the year to live with another family member – could mean a family ultimately qualifies for a different amount of CTC than they expected when they chose to receive advance periodic payments.

Federal policy action is needed to ensure that families can participate in advance payments of state tax credits without harming their ability to access federal assistance. In the meantime, Minnesota families must have good information about how federal benefits may be impacted to inform their choices about participating in advance periodic payments.

Similarly, families must have good information about how a change in their incomes or family composition could impact the amount of Child Tax Credit they are eligible for, and be able to make changes in their periodic payments in response to changes that occur during the year.

For successful implementation of advance payments, Minnesota policymakers should enact legislation this year to provide payback protections for families who in good faith choose to participate in advance payments. The benefits of such protections go beyond the relatively small share of families that could face payback scenarios if no safeguards are put in place. A primary deterrent to choosing advance payments identified by Minnesota families is concerns that they may have to pay back their advance payments or end up owing taxes.

Learning from the success of the federal expanded Child Tax Credit

Advance payments are a successful approach that has been proven on the federal level. In 2021, federal policymakers temporarily made powerful changes to the federal Child Tax Credit that contributed to bringing child poverty down to record lows.[7] It increased the size of the CTC that families could receive and made policy changes so that the lowest-income families received the full value of the credit.

For the first time, a portion of the federal Child Tax Credit was delivered through advance periodic payments. Families received 50 percent of the value of their expanded CTC through monthly payments during part of the year. Families used these payments to pay for food, clothing, housing, and other basic expenses.[8] Families were better off and faced less hardship in the months they received those advanced CTC payments.[9]

It’s time for Minnesota to lead with advance periodic payments

A body of research demonstrates that boosting family incomes – through tools like income-targeted tax credits – expands opportunities for children and is associated with better school performance, better health outcomes, and higher earnings as adults.[10]

Minnesota can be a leader among states by implementing a sound system for periodic payments, informed by Minnesota families and the success of federal advance payments, and continue to learn and improve the process in the years ahead.

By Nan Madden

[1] Office of Governor Tim Walz & Lt. Governor Peggy Flanagan, One Minnesota Budget: Minnesota Child Tax Credit.

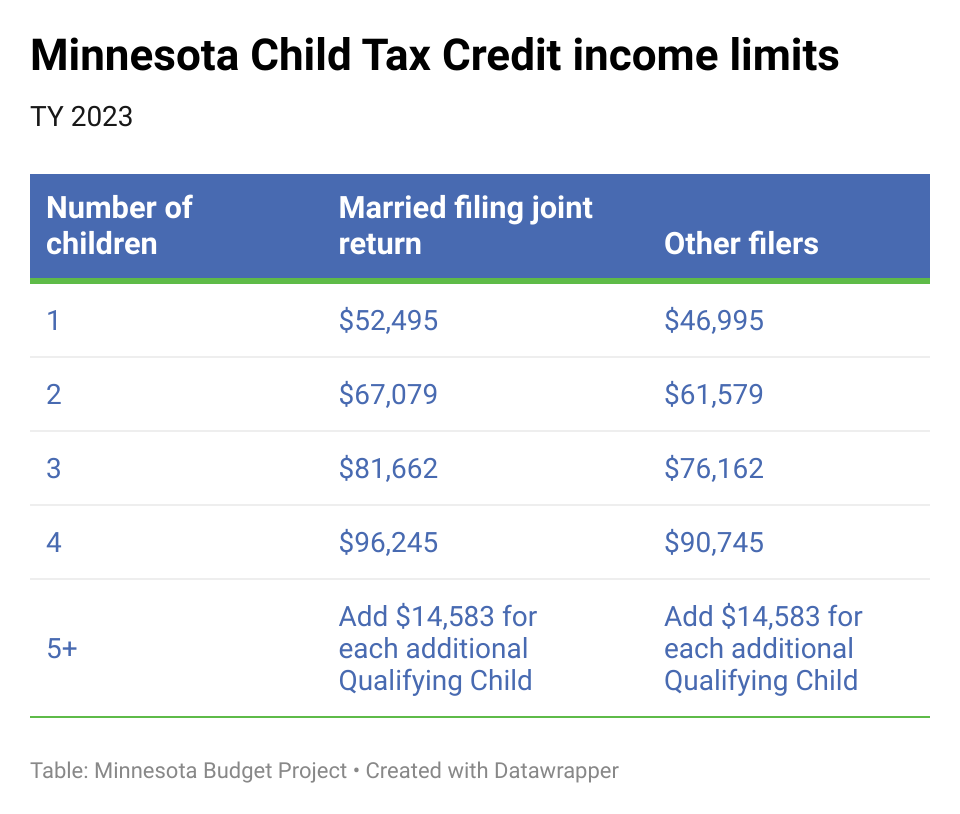

[2] These income limits are for Tax Year 2023. The income limits assume that families also qualify for the Minnesota Working Family Credit.

[3] National Conference of State Legislatures, Child Tax Credit Overview, January 26, 2024.

[4] Minnesota Department of Revenue, The Big Idea: An Advanced Child Tax Credit presentation, February 8, 2024.

[5] 2024 Governor’s Supplemental Budget Recommendations, All Funds by Agency, Marcy 18, 2024.

[6] Resources informing these principles include: focus groups, surveys, and other feedback methods involving Minnesota families conducted by Children’s Defense Fund-Minnesota; Georgetown Center on Poverty and Inequality, Matching Timing to Need: Refundable Tax Credit Disbursement Options, November 2020; and Center on Budget and Policy Priorities. The opinions expressed are those of the authors.

[7] Center on Budget and Policy Priorities, Policy Basics: The Child Tax Credit, December 2022.

[8] Center on Budget and Policy Priorities, 9 in 10 Families With Low Incomes Are Using Child Tax Credits to Pay for Necessities, Education, October 2021.

[9] Center on Poverty and Social Policy, Columbia University, Research Roundup of the Expanded Child Tax Credit: One Year On, November 2022.

[10] Center on Budget and Policy Priorities, Policy Basics: The Child Tax Credit.