What is the Estate Tax?

The estate tax can best be described as an inheritance tax on very wealthy estates — it taxes the transfer of large amounts of wealth from one generation to the next. If the total value of an estate is large enough, an estate tax is imposed on the estate before the assets are distributed to the heirs.

Over 99 percent of Americans who die will pass on their estates without ever coming into contact with the estate tax.[1] In Minnesota, just 230 estates owed any federal estate taxes in 2006 – less than one percent of all estates.[2]

So few estates are subject to the estate tax because currently no estate taxes are due on the first $2 million in value of an individual’s estate, or $4 million for a couple. This amount is called the exemption. If a married person dies, their entire estate goes to their surviving spouse with no estate tax liability at all.

A large package of tax cuts became law in 2001, often referred to as the Bush tax cuts, which included the gradual elimination of the federal estate tax. Under this legislation, the amount of an estate exempted from tax was gradually increased, and simultaneously the top estate tax rate was lowered. In 2009, the exemption will rise to $3.5 million ($7 million per couple) and the top tax rate will be 45 percent. In 2010, the estate tax is eliminated completely – for one year only.

These changes to the estate tax, along with the rest of the Bush tax cuts, will expire in 2011. Without Congressional action, the estate tax will then revert back to 2001 law in which the top estate tax rate would return to 55 percent and the exemption level would be back at $1 million for an individual.[3] While it is unlikely that lawmakers will allow this outcome, the situation has generated numerous proposals that go beyond a reasonable solution and instead would radically reform or completely eliminate the estate tax.

Radical reform or repeal of the estate tax is poor policy for several reasons:

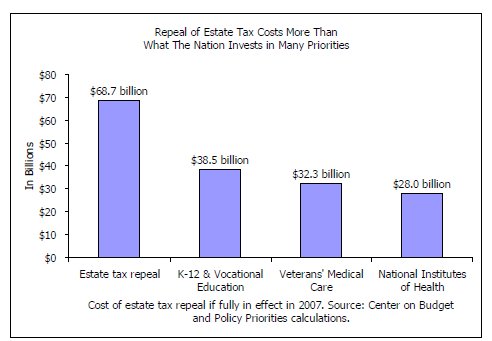

- Repeal or radical reform of the estate tax is simply unaffordable, costing up to $1 trillion over ten years. Such a loss of revenue would hamstring the nation’s ability to address the problems facing the country today – such as health care, energy and the economy — and add billions of dollars to our national debt.

- Repeal or radical reform of the estate tax is unfair, as it would shift responsibility for funding our national priorities away from those with the greatest ability to pay to those with more modest means.

Radical Reform or Repeal of the Estate Tax is Unaffordable

The $69 billion raised by the estate tax is used to support a broad range of programs and services that benefit all Americans. Complete repeal of the federal estate tax would cost over $1 trillion over the first ten years, including increased interest payments on the national debt. Repeal of the estate tax would cost more in one year than what the federal government currently invests annually in K-12 and vocational education, veterans’ medical care, or the National Institutes of Health.

Many reform proposals are almost as costly as repeal, especially those that include a dramatic reduction in the tax rate. For example, a proposal to cut the top estate tax rate from 45 percent to 15 percent would eliminate almost 80 percent of the money collected by the estate tax.[4]

Such proposals fail to recognize that the actual share of an estate that is paid in taxes paid is much lower than the top estate tax rate. Americans subject to the estate tax can shield much of their estate from taxation through various tax deductions and exemptions. As a result, those few estates paying any estate tax in 2006 paid, on average, 20 percent in taxes and this figure is declining over time.

If the goal of estate tax reformers is to reduce the number of estates subject to the estate tax, this can be addressed through reasonable changes to the exemption level. For example, in 2009, the estate tax exemption will be $7 million per couple, and only three in 1,000 estates would owe any estate tax. It is not necessary to reduce the tax rate.

The Estate Tax is a Critical Part of a Fair Federal Tax System

The estate tax is the most progressive component of the federal tax code. A progressive tax is one in which those with a greater ability to pay contribute a larger share of their incomes in taxes than do those with lower incomes. This is a fair and widely accepted principle that has served as the foundation of the federal tax system since its inception.

In the case of the estate tax, only the wealthiest Americans are affected by the tax. In tax year 2009, approximately 7,000 estates nationwide will be subject to the estate tax, or 0.3 percent of all estates. In other words, 99.7 percent of all Americans will be able to pass on 100 percent of their assets free of any federal estate tax.

The estate tax is the only means to tax certain kinds of capital gains income that would otherwise never be taxed. For example, a house or art work bought and kept until the owner dies will almost certainly have increased in value, but the increase in value will never be taxed unless the estate tax is applied.

We need tax policies that meet our nation’s needs in a fair and equitable manner. If repeal or radical reform of the estate tax is to be accomplished without a significant loss of federal revenue, the result is a shift in responsibility in paying taxes from those taxpayers with greatest ability to pay to less well-off taxpayers.

The Estate Tax is a Critical Incentive for Charitable Giving

Radical reform or repeal of the estate tax would have a devastating impact on foundations and nonprofit organizations that do important work in our communities. Under current law, any part of an estate that goes to a charitable donation is exempt from the estate tax, providing a valuable incentive for charitable giving. A Congressional Budget Office study found that charitable donations would have been $13 billion to $25 billion lower in 2000, had the estate tax not existed.[5]

A Common-Sense Approach to Estate Tax Reform

Proposals to repeal or radically reform the estate tax have a great cost that can only lead to unacceptable outcomes.

- Decreased tax fairness. The lost revenue could be made up through other changes in the tax system. Since the estate tax is the nation’s most progressive tax, such a tax swap would inevitably result in a shift in responsibility in paying taxes from those taxpayers with greatest ability to pay to less well-off taxpayers.

- Damaging cuts. The lost revenue would be offset through damaging cuts to critical services. As noted above, the one-year cost of estate tax repeal is much more than the federal government invests annually in K-12 education, veterans benefits and medical care, or the National Institutes of Health. What’s more, our ability to address emerging concerns, such as energy independence or health care reform, would be severely hampered.

- Increased debt. If the cost is not offset in any way, repeal or radical reform of the estate tax would saddle the American public with large amounts of debt and harm long-term economic growth. Already nearly one-tenth of the federal budget goes just towards paying the interest on our national debt.[6]

And under any circumstances, repeal or radical reform of the estate tax would be damaging to charitable giving by reducing or removing a significant incentive for larger gifts.

A more common-sense approach would be to maintain an exemption level that ensures that the estate tax continues to exempt small businesses and family farms, but maintain reasonable tax rates so that a significant portion of estate tax revenues are not lost. Any other approach is unaffordable and unfair.

[1] Except where otherwise noted, data in this analysis comes from Center on Budget and Policy Priorities, The Estate Tax: Myths and Realities, and Issues Surrounding the Federal Estate Tax.

[2] Citizens for Tax Justice, Fewer than One Percent of Estates are Taxed.

[3] Center on Budget and Policy Priorities, House to Vote on Permanent Repeal of Estate Tax.

[4] 45 percent will be the top estate tax rate in 2009.

[5] Center on Budget and Policy Priorities, Estate Tax Repeal – Or Slashing the Estate Tax Rate – Would Substantially Reduce Charitable Giving.

[6] Center on Budget and Policy Priorities, Federal Budget Outlook.