Minnesota is continuing its slow recovery from the Great Recession, but the state still faces deficits. The continuing deficits underscore the fact that Minnesota has not found a sustainable way to meet the state’s needs and make investments that are critical for our future economic success.

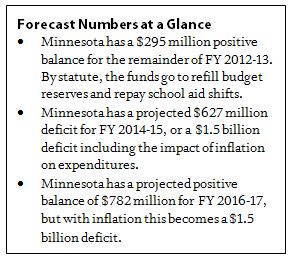

The February 2013 Economic Forecast shows that Minnesota’s economy continues to outperform the national economy, thanks to an improving labor market that results in higher-than-expected state revenue collections. This additional revenue, along with lower-than-expected spending, has resulted in a $295 million positive balance in the current budget cycle, the FY 2012-13 biennium. These resources will automatically go toward refilling the state budget reserve and buying back the school payment shift.[1]

The outlook for FY 2014-15 has improved since the November forecast; however, the state continues to face deficits. The February forecast projects a $627 million deficit for the FY 2014-15 budget cycle, or $1.5 billion after the impact of inflation on expenditures is taken into account. And there is a $1.5 billion deficit in FY 2016-17 when inflation is included.

The Forecast is the Official Measure of the State’s Fiscal Health

Minnesota’s constitution requires the state to have a balanced budget. The forecast is a critical tool for the Governor and Legislature to measure the state’s fiscal health and assess spending and tax proposals. Minnesota Management and Budget (MMB) prepares forecasts each November and February. MMB considers state, national and global economic trends, and uses them to estimate future revenues and expenditures based on current laws.

Improved Budget Outlook Reflects Higher Revenues, Lower Spending

The last three state economic forecasts provided Minnesota with short-term good news in the form of positive balances. The February 2013 forecast continues that trend with a $295 million positive balance for the current biennium, FY 2012-13. The additional revenues come primarily from increased income tax collections. On the spending side, expenses were lower than expected, primarily due to lower state health care costs from negotiating savings in Medical Assistance payments to health plans and lower enrollment.

For the upcoming budget cycle, the FY-2014-15 biennium, the November forecast predicted a $1.1 billion deficit. As a result of improved revenues and lower-than-anticipated spending, that deficit has been reduced to $627 million. This still leaves policymakers with the challenge of addressing the deficit during the 2013 Legislative Session without cutting vital services and undermining future economic growth.

If a positive balance appears in a biennium, state law has clear rules for how the funds must be used. First, the positive balance must be used to bring the state’s budget reserve balance to $653 million, which requires $9 million of the current balance. Then, the remainder of the balance is available to continue repaying the school payment shifts to the nearest tenth of a percent. This allows $282 million to go toward the school shifts, with the residual $3 million also going into the budget reserve. With this payment, $808 million of the school shifts remain.[2]

Reserves give policymakers the ability to soften the shock of a future large and unexpected budget shortfall. However, the state’s current reserves fall short. The state’s Council of Economic Advisors has long recommended reserves equal to five percent of the state’s general fund biennial budget, or nearly $1.8 billion for the FY 2014-15 biennium.

Future Structural Imbalance Underscores Importance of Counting Inflation

In 2002, the general impact of inflation on expenditures was taken out of the forecast. This means that while revenues are shown to grow with inflation, most expenditures stay at the current biennium levels without acknowledging that inflation increases the cost of providing the same level of services.

The February forecast highlights how failing to account for inflation can create a misleading picture. Although the forecast predicts a $782 million positive balance in the FY 2016-17 biennium, it becomes a $1.5 billion shortfall when the impact of inflation is included. The state’s macroeconomists continue to urge that inflation be added back into the forecast. This gives policymakers a more accurate picture of the state’s financial situation and provides a better guide to whether budget choices are sustainable.

Sequestration will Put Drag on Minnesota’s Economy

When making predictions about Minnesota’s economy, the forecast takes into account the effects of decisions made by federal policymakers. This forecast assumes that sequestration, the set of scheduled dramatic across-the-board federal spending cuts, will be in place for only a few months, and then federal policymakers will reach a deal comprising a mix of revenues and spending cuts. Minnesota’s economy would receive a “modest shock” under this scenario. There is also a 20 percent probability assigned to a more optimistic scenario, where the economy performs better than expected and sequestration is ended with a “credible” long-term debt reduction plan; and a 20 percent chance that sequestration cuts continue the whole year and slow economic growth. No scenario includes a serious risk of a recession.

Policymakers Should Put Minnesota on a Sustainable Track

The positive balance in the February forecast means the state can continue to reverse the school funding shift, one of the budget gimmicks used to create short-term balanced budgets in past years. However, the state is not on solid financial footing. The deficits in upcoming budget cycles indicate that policymakers have not yet found a way to sustainably fund education, health care and other critical investments in our future economic success. This legislative session presents an important opportunity to put the state on a sustainable track. The Governor’s budget focuses on investing in education, workforce development, health care and other areas that suffered cuts in the past few years, as well as raising revenues fairly to end the cycle of deficits and deep cuts in services. The Legislature should pursue these goals and invest in stronger, healthier and more educated communities.

By Clark Goldenrod

[1] Data in this analysis come from Minnesota Management and Budget’s February 2013 Economic Forecast.

[2] Of this $808 million, $257 million is needed to return to the original 90-10 payment schedule and $551 million is needed to repay the property tax recognition shift.