The path to a stronger, more equitable recovery is through strengthening public services so that all Minnesotans, their families, and communities can thrive. But some policymakers want instead to enact billions of dollars in poorly targeted tax cuts that leave out the most struggling Minnesotans while giving the largest tax cuts to those with the most resources.

In a press conference in late February, the Minnesota Senate Republican caucus laid out two major tax cut priorities – expanding Minnesota’s tax exemption for Social Security benefits and cutting the income tax rate in the first bracket – with a total cost of $8.5 billion over three years.[1] These tax cuts are tilted toward those with the most resources and would prevent making strong investments in schools, health care, child care, housing, and other public services that would create a brighter future for us all.

This issue brief looks at how and why higher-income Minnesotans are more likely to benefit from a first bracket rate cut and get larger tax cuts than those of modest means.

First bracket rate cut is not focused on lower-income Minnesotans

The Senate Republican caucus has proposed cutting the state income tax rate in the first bracket from 5.35 percent to 2.8 percent. Despite being described as being for all taxpayers, this proposal provides no benefit for about 1 in 5 Minnesota households.[2]

Those who are struggling the most to get by are the most likely to be left out. About two-thirds of Minnesota households with incomes below $30,000 would receive no tax cut from the proposed rate reduction, and 3 out of 10 Minnesotans with incomes $30,000 to $51,000 would receive no tax cut. These Minnesotans do their part paying taxes to fund state and local services in Minnesota, they just happen to pay their taxes more through the sales tax and property tax, and less through the state’s income tax, which is based on ability to pay.

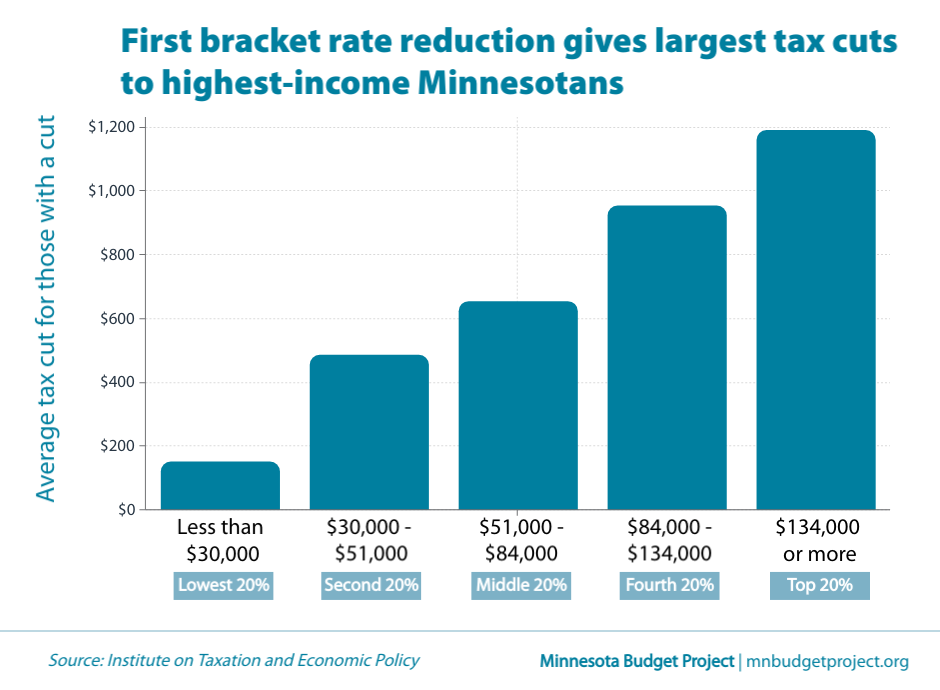

First bracket rate reduction gives largest tax cuts to higher-income Minnesotans

The 20 percent of Minnesotans with the highest incomes (above $134,000) would receive average annual tax cuts of nearly $1,200 from the proposed rate reduction. That’s more than seven times the average tax cut a household with income under $30,000 would receive ($153), and more than twice the average tax cut that households with incomes $30,000 to $51,000 would receive ($488). And as noted above, a substantial number of folks in these lower income groups would not get any tax cut at all.

Why are lower-income Minnesotans more likely to be left out and get less?

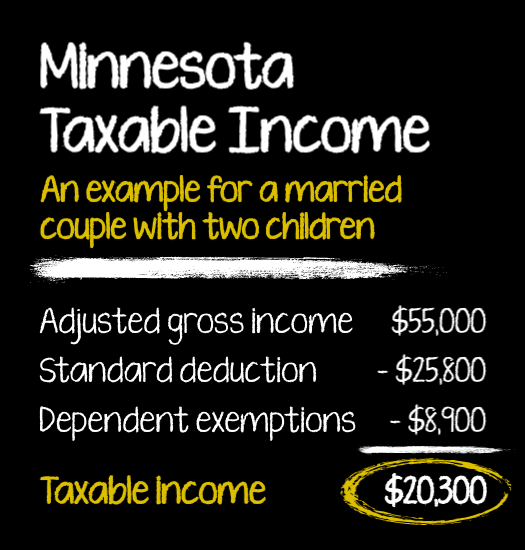

To understand why so many folks don’t get any benefit or only a partial tax cut from the proposed rate reduction, we have to keep in mind the difference between adjusted gross income and taxable income. Adjusted gross income (AGI) is the starting point for calculating state income taxes, but taxable income is a smaller amount of income that income tax rates actually apply to.

Adjusted gross income includes wages, dividends, capital gains, business income, retirement distributions, and other kinds of income, minus some adjustments like retirement contributions. To calculate their Minnesota taxable income, a household starts with their adjusted gross income and then subtracts their standard deduction based on their filing status (or itemized deductions). If they have dependents, they can subtract additional dependent exemptions as well.[3] For example, a family of four may have adjusted gross income of $55,000 and taxable income of $20,300.

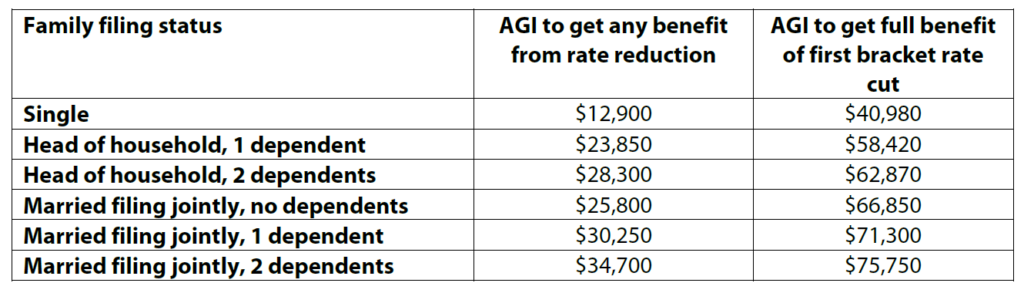

To get any benefit from a first bracket rate cut, a household has to have taxable income after subtracting adjustments, deductions, and exemptions. To get the full benefit of the rate reduction, a household has to have enough taxable income to get to the top of the first bracket.

For example, a married couple with two children has to have adjusted gross income close to $35,000 before they would begin to see any benefit from this proposal. They would need to have adjusted gross income of nearly $76,000 to get to the top of the first bracket and get the full value of the rate reduction. How this math plays out for various kinds of families is demonstrated in the table below.[4]

In addition, some married couples receive a Marriage Credit on their Minnesota income taxes. Some of them would receive even larger marriage credits as a result of this proposal, on top of the tax cut they receive from lowering the income tax rate. This is another factor contributing to larger average tax cuts among higher-income taxpayers.

A 5.35 percent rate doesn’t mean Minnesota income taxes are high on everyday folks

The examples above remind us that how much income is subject to tax is an important factor in how much taxes people pay, not just the tax rate. The Minnesota Center for Fiscal Excellence (MCFE) notes that Minnesota’s standard deductions are higher than in many other states, and Minnesota is one of only four states that also provide dependent exemptions.[5] The size of brackets and other elements of the tax code are also important when comparing Minnesota to other states. The fact that Minnesota has a higher tax rate (5.35 percent) in our first income tax bracket doesn’t necessarily mean that Minnesotans pay more in state income taxes than folks with similar incomes living in other states. MCFE finds that married joint filers with incomes of $100,000 pay lower state income taxes in Minnesota than they would in several other states with lower income tax rates.

Large tax cuts threaten essential public services

The Senate Republican caucus reports their full tax cut package would total $8.5 billion over three years. Enacting tax cuts of this magnitude would mean failing to invest in things from schools to child care to housing to infrastructure that Minnesotans, their families, and communities need to recover from the pandemic and its economic disruption.

Large tax cuts also would undermine the state’s ability to fund public services in the future. Permanent tax cuts of this size are irresponsible when we know that some of the current large projected budget surpluses are being driven by short-term factors, including the positive effects that federal legislation have had on the economy, household incomes, and state budgets. For example, the additional federal aid to states is coming to an end, and families across the nation have already seen their buying power drop because Congress allowed the federal Child Tax Credit expansion to expire.

While some middle-income Minnesotans would receive some benefit from this tax cut, a better way forward would be through tax policies focused on low- and middle-income families that bring down the costs of raising a family and maintaining a home, such as expanding property tax refunds for renters and homeowners and other income-targeted tax credits. Targeted tax policies don’t give large tax cuts to the highest-income Minnesotans, and instead leave more resources to fund the building blocks of a broader prosperity.

By Nan Madden

[1] Minnesota Senate Republican Caucus, Senate Republicans Propose Biggest Tax Cut Ever, February 24, 2022.

[2] The data in this brief on the distribution of tax cuts by income group and average tax cut amounts are from Institute on Taxation and Economic Policy, March 2022, and model the impact on state residents.

[3] This description describes the basic process for getting from adjusted gross income to taxable income in a fairly simple case. There are other kinds of adjustments to adjusted gross income, and other additions and subtractions that may apply to individual taxpayers in that calculation.

[4] These calculations are based on the income tax brackets, deductions, and dependent exemption amounts in place for 2022.

[5] Minnesota Center for Fiscal Excellence, February Forecast: Whatever Goes Up Must Come Down…But Not Yet, March 2, 2022.