Expanding economic opportunity in Minnesota should be a top priority of the 2017 Legislative Session, and two effective strategies to do so are the Working Family Tax Credit and Child and Dependent Care Tax Credit. These two tax credits are targeted to Minnesotans who, despite working hard, struggle to pay for child care, education and training, reliable transportation and other things they need to succeed in the workplace.

These two credits are centerpieces of the 2017 tax plan that Governor Mark Dayton released today. We’ll see more details when the governor’s comprehensive budget proposal comes out later this month, but it’s clear the plan outlined today focuses on supporting the work efforts of everyday Minnesotans.

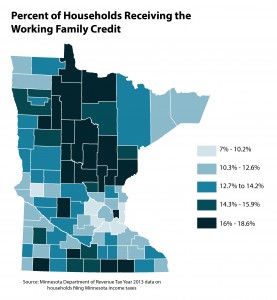

The Working Family Credit expansion seeks to make Minnesota a place where working people can better support themselves and their families. The Working Family Credit reaches all across the state; its impact is especially strong in parts of Greater Minnesota where wages tend to be lower and good jobs are harder to find. Similarly, the Working Family Credit can help boost the wages of people of color, who are more likely to be earning lower wages, and begin to narrow racial income disparities.

Dayton’s Working Family Credit plan boosts the size of the credit that eligible families and workers can receive, makes more Minnesotans eligible for the credit, and allows independent workers ages 21 to 24 to qualify for the credit.

In addition, Dayton continues to prioritize expanding the state’s Child and Dependent Care Credit, which offsets a portion of the considerable costs that Minnesota families pay for child care. The proposal would update the credit, which hasn’t kept up with the rising costs of child care, and allow more working parents to qualify.

The Working Family Credit and Child and Dependent Care Credit were both priorities in the 2016 tax bill. In addition, Dayton’s plan includes other components of the 2016 tax bill, including increased funding to Minnesota cities and counties, and a new tax credit on agricultural land and buildings that proponents say will help rural school districts that currently have difficulty passing local referenda to build or improve school facilities. The plan also includes provisions that Dayton has previously proposed, such as a package of corporate tax changes meant to create a more level playing field among businesses.

Making everyday Minnesotans the priority in our tax and budget decisions addresses the economic insecurity that so many Minnesotans are facing, and the governor has done that today by including strong expansions of the Working Family Credit and Child and Dependent Care Credit in his tax plan.

By Nan Madden

This blog is part of a series on Governor Mark Dayton’s FY 2018-19 budget proposal, including his HHS budget.