The Minnesota Legislature passed some investments in Minnesota families’ economic well-being and improving their tax-filing experience in this year’s final tax legislation, including essential provisions for successful implementation of advance payments of the Child Tax Credit.

Here’s a look at how our priorities for the tax bill fared this session.

Child Tax Credit advance periodic payments improvements

The bill includes an important policy for successful implementation of advance periodic payments of Minnesota’s Child Tax Credit. Advance periodic payments is a system by which families can choose to receive some of their Child Tax Credit in advance through multiple payments, instead of waiting to receive the full amount in one lump sum after they have filed their state income taxes. Advance payments better match how families pay their bills and strengthen the CTC’s ability to reduce child poverty and hardship.

The 2024 tax legislation creates a “minimum credit” for the Child Tax Credit aimed at limiting the circumstances under which families would later have to pay back some or all of their advance payments. Without this provision, families who experience significant increases in their incomes over the course of the year could face such payback scenarios. While a relatively small number of families would likely be in this situation adopting this policy reduces stress and concerns for all eligible families. Minnesota families have identified payback concerns as a potential deterrent that could keep them from choosing advance payments.

The bill protects families from paying back advance payments, as long as they continue to meet income limits for the Child Tax Credit and the number of eligible children in the family remains the same as in the prior year. This provision expands funding for the Child Tax Credit by about $5.5 million per year.

Protecting families from repayment burdens was a key family-centered design principle advanced by the Minnesota Budget Project and our partners this session, and Governor Tim Walz, the House, and Senate all had various versions of these protections in their tax proposals this year.

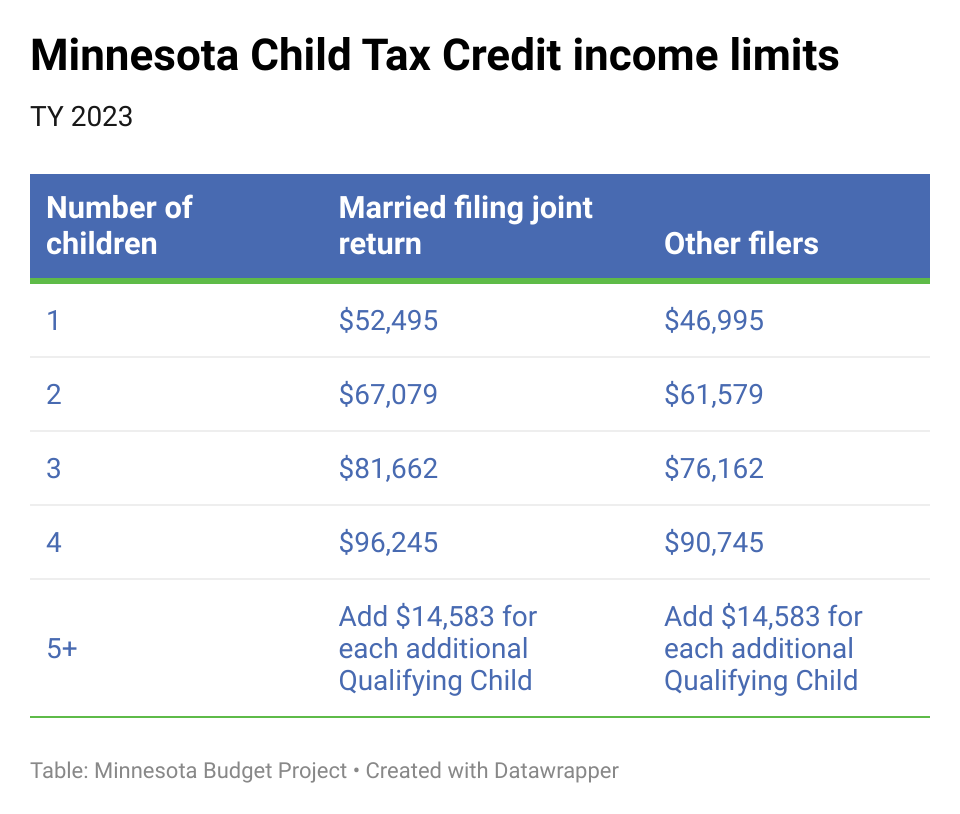

This policy builds on the legislation passed in 2023 that created Minnesota’s nation-leading Child Tax Credit. Families can qualify for up to $1,750 for each of their eligible children ages 17 or under, as long as their family incomes are below certain limits. (See table.) The 2023 tax bill gave the Minnesota Department of Revenue (DOR) the option to implement advance periodic payments; this year’s tax bill requires them to do so. DOR is developing plans to launch advance periodic payments in 2025. (Learn more about CTC advance payments in our issue brief.)

The final tax bill did not include the House’s provision to expand the Child Tax Credit to include eligible children who are age 18. The current eligibility criteria will stay in place, which is that children must be 17 or under to qualify for the Child Tax Credit.

Tax-filing improvements

The bill puts additional dollars into efforts to make sure Minnesotans learn about and apply for the income-boosting tax credits for which they are eligible. It allocates an additional $1 million in FY 2025 and $500,000 per year in FY 2026 and FY 2027 for grants to organizations that do free tax preparation for lower-income Minnesotans. It also provides an additional $1 million in FY 2025 and $500,000 per year in FY 2026 and FY 2027 to nonprofits and tribal nations for outreach and education about tax credits. Both the House and Senate had proposed increasing funding for these essential infrastructure investments in their tax bills.

The bill does not include any additional policy provisions regarding establishing a free and easy public method for filing income taxes, often called Direct File. Paying taxes is how we come together to fund public services that Minnesotans value and count on, but with our current system, the majority of folks pay to meet their tax-filing responsibilities. A free public income tax-filing option would be a better choice for many Minnesotans, especially if connected to the successful federal Direct File system launched this year. (Learn more about Direct File on our blog.) Last year’s tax bill gave the Department of Revenue the option to develop a free state tax-filing option and coordinate with the federal Direct File process; the House’s bill would have required that a free filing program be established and encouraged integrating with the federal Direct File.

Scope of final tax legislation smaller than anticipated

In all, a fairly small number of tax provisions were enacted this year, which had a net general fund impact of under $8 million in FY 2024-25 and $13 million in FY 2026-27. This was less than what the House and Senate had originally allocated in their tax bills; those bills reflected the budget target of $53 million in FY 2024-25 and $5.2 million in FY 2026-27 that legislative leaders and Walz allotted for this year’s tax bill earlier this session. That was the net amount of general fund changes that policymakers could put into their original supplemental tax bills from expanded tax credits, other tax reductions or increases, funding for local governments, and tax implementation.

Some of the issues that were brought into the final tax negotiations but not addressed in the final tax bill included expanding local governments’ authority to raise sales taxes, requiring disclosure of certain corporate tax information, and sales tax exemptions for various local construction projects.