The state’s new budget projections give the latest on the continuing impact of the pandemic, and a preliminary sense of the positive effects from the federal government likely passing COVID relief legislation at the scale this moment demands.

The good news is that Minnesota is expecting more resources than was projected in the last forecast, despite the ongoing economic disruption caused by COVID-19.

But an improving state budget situation is not a sign that everyone is doing well. This winter, hundreds of thousands of Minnesotans said they didn’t have enough to eat, were behind on rent, and had difficulty covering basic expenses. And because of long-standing structural inequities, our Black and Brown neighbors are being disproportionately harmed by the virus and its economic impact.

The forecast highlights the uneven nature of this recession, noting that low-wage workers have been much more likely to lose their jobs than high-wage workers. While some sectors of the economy and high-income workers have already recovered, the service economy’s recovery will be dependent on widespread COVID-19 vaccinations.

It’s important to keep in context what the forecast does and does not include. The forecast measures projected state revenues against a baseline budget that does not include the full cost of tackling the pandemic or even existing services keeping up with the cost of inflation over time.

What these new numbers do tell us is that Minnesota has more resources than was previously thought. However, state revenues still are down compared to what was expected in February 2020. Revenues for FY 2020-21 are $1.2 billion lower than expected a year ago and revenues for FY 2022-23 are $461 million lower.

It will be essential that policymakers deploy resources in ways that focus on those who have been hardest hit by the pandemic, and address the need for long-term, sustainable investments to build a more prosperous and equitable state.

Some of the key data in the forecast include:

1. The state is projecting a $940 million positive balance for the FY 2020-21 budget cycle, which ends on June 30, 2021.

2. The forecast predicts a $1.6 billion positive balance for FY 2022-23, which shrinks to $529 million when including what it would take for most current public services to keep up with inflation. For scale, $529 million is about one percent of the total general fund budget. The $1.6 billion includes the $940 million positive balance carried forward from FY 2020-21.

3. The forecast gives somewhat improved numbers for FY 2024-25. Forecasters predict a structural balance of $845 million, which becomes a deficit of $1.7 billion when the impact of inflation is included.

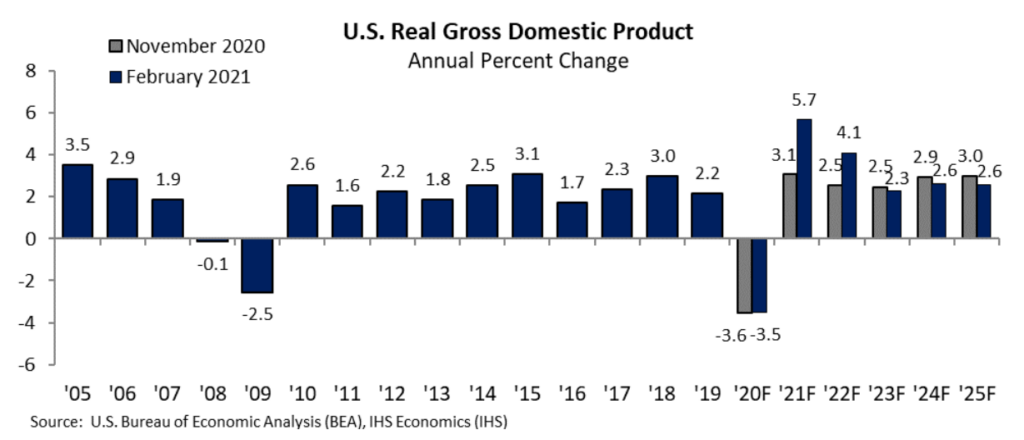

4. After a sharp decline last year, the national economy is expected to see 5.7 percent growth this year. Forecasters project that the economy will continue to grow over the next few years, albeit at a slower pace, with annual growth hovering around 2.5 percent from 2023 to 2025.

5. Unemployment during this economic downturn has disproportionately hit lower-wage workers – more than half of all initial unemployment claims since mid-March were from workers in lower-paid occupations. Additionally, many workers have left the labor force. As of January, the national labor force participation rate (the proportion of folks who are working or looking for work) had dropped to 61.4 percent, which is the lowest since 1976.

6. Forecasters are only somewhat confident in their projections. The nation’s economic performance is dependent on the severity of the pandemic and the effectiveness of efforts to bring it under control. Uncertainty about the course of the pandemic is reflected in forecasters’ uncertainty about their economic projections. They assign a 50 percent chance that their baseline economic scenario is correct. They give a 25 percent chance for a more pessimistic scenario in which the pandemic causes greater economic harm. They assign a 25 percent probability to a more optimistic scenario in which the impact of COVID-19 is less severe and federal policymakers pass a larger stimulus bill.

Smart federal and state policy decisions are contributing to improved state budget numbers. The forecast includes the effects of state legislation passed in December to support unemployed workers and struggling businesses. Some of the improved forecast picture is due to the additional federal COVID relief bill that’s expected to come out of Congress soon. While the U.S. House recently passed a $1.9 trillion federal relief bill, the forecast assumes Congress will pass a compromise $1.5 trillion bill that includes another round of stimulus checks, extended unemployment insurance, funding for COVID-19 mitigation efforts, and “significant aid” to state, local, and tribal governments. About 1.5 percentage points of the increase in GDP growth this year is due to this expected federal legislation. The forecast numbers do not include additional federal aid directly to state government that is expected in the COVID legislation.

It is good news that the state can expect more resources to take action to advance Minnesotans’ health and economic well-being during COVID.

However, when looking at the next biennium, the state has a small structural balance that turns into a deficit when inflationary costs are included in the picture. This highlights the gap between what the state’s current revenue system brings in and what is needed for all Minnesotans to thrive. The federal funding likely coming to Minnesota is temporary and doesn’t solve this problem.

And we can’t divert our attention from the ways deep divides in opportunity and well-being across race and income are being highlighted and widened right now. Passing a “status quo” budget that leaves these barriers in place is not acceptable.

Instead, Minnesota must take bold steps to address the pandemic and build a more equitable future through investments in things like our schools, health care, and BIPOC-owned businesses and communities. The individuals and businesses with the most resources can contribute a bit more to build a new, equitable vision for the state.