In Washington, D.C., the House and Senate have passed budget frameworks that demonstrate they are moving forward with plans to extend trillions of dollars of tax cuts that give the biggest benefits to the wealthy, and spend billions more on anti-immigrant actions. These policies would be paid for by drastically cutting health care, nutrition, and other public services that Minnesotans count on to get by.

Congress plans to fill in the details and enact these changes through an expedited process known as budget reconciliation. This blog takes a look at that process, what is outlined in the recently passed Congressional budget resolutions, and the harm these plans would cause.

What is a budget resolution?

A federal budget resolution is a plan that sets the guidelines for what actions will be taken on federal spending and revenue. It lays out broad targets for the budget and does not include program-level specifics. Budget resolutions do not become laws but instead are rules that guide the work of Congress. Typically to get a bill through the Senate, 60 votes are required, but budget resolutions only need a majority of votes to pass.

A congressional budget resolution can start a “budget reconciliation” process to make major budget changes

Congress may use budget resolutions as the first step of a budget reconciliation process. Two key features of budget reconciliation are:

- Tax and budget changes can pass the Senate with a majority of votes, rather than the 60 votes needed to pass most legislation.

- They generally focus on changes to mandatory or entitlement spending, which includes things like Medicaid, Medicare, and SNAP, rather than discretionary spending, which are services whose funding levels are set through the annual budgeting process.

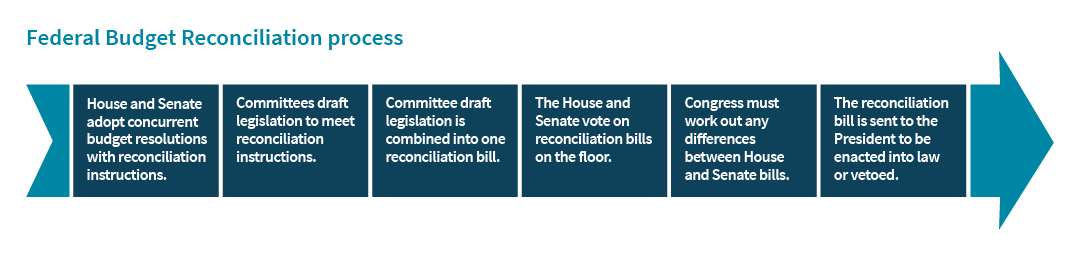

The House and Senate vote on budget resolutions on the floor, which include instructions, called reconciliation directives, that tell certain committees to create legislation that changes spending or revenues within their area of jurisdiction by a specific amount. These changes can be increases or decreases. The instructions can also call for modifying the public debt limit. These instructions will set a deadline for those committees to complete that work.

Working separately in the House and Senate, each committee that has received a reconciliation instruction will draft legislation that details specific funding and/or policy changes in order to meet the revenue, spending, or debt changes laid out in the budget resolution. Once all relevant committees complete and pass their reconciliation legislation, all the pieces are combined in one reconciliation bill.

If the House and Senate reconciliation bills are not identical, they will need to negotiate until they reach agreement. Once both the House and Senate have passed matching reconciliation bills, it is passed to the President to sign into law or veto.

Congress’ recent budget resolutions would fund tax cuts that favor the wealthy and large-scale anti-immigrant operations while gutting vital services

The House passed their budget resolution on February 25 and the Senate passed theirs on February 20. While there are important differences, both plans outline cuts to services that families rely on for health care, food assistance, and other crucial needs in order to fund expensive, unfair tax cuts.

The House budget resolution requires at least $1.5 trillion in spending cuts. While it does not lay out the details, it’s clear from which committees are targeted, as well as other materials that lay out the Republican majority’s priorities, where we can expect those cuts to land.

The House Energy and Commerce Committee must cut at least $880 billion over 10 years, which will come primarily from Medicaid. These cuts put the health and financial well-being of more than one million Minnesotans in danger. Medicaid is a crucial source of affordable health care for people with disabilities, older adults, children, families, and low-income individuals in our communities. For example, cutting Medicaid by enacting work reporting requirements could put 36 million people nationwide at risk of losing health care coverage.

More Minnesotans would go hungry under proposed cuts to nutrition services like SNAP and school meals. The House Agriculture Committee is directed to cut $230 billion over 10 years, which is likely to come primarily from cuts to SNAP, formerly known as food stamps. More than 40 million people across the country could see increased food costs with proposed cuts to SNAP.

Support for student loans and many other areas of federal funding are threatened by other portions of the House budget resolution.

At the same time that the House budget plan would require these painful cuts in services, it would allow the Ways & Means Committee to increase the deficit by $4.5 trillion through 2034. That would likely come from extending the expiring provisions of the 2017 tax bill. According to the Institute on Taxation and Economic Policy, the 20 percent of American households that make $28,600 or less per year would see an average tax cut of $110 from extensions of expiring provisions of the TCJA, and those making $28,600 to $55,100 would see an average tax cut of $510. Meanwhile, the 1 percent highest income earners, making $914,900 or more, would see annual tax cuts averaging $80,680. And that $4.5 trillion target gives room for the House to pass additional corporate tax cuts as well.

The Senate’s budget resolution includes a $325 billion spending increase for committees related to military and homeland security, which appears to be for the border wall, detention centers, and deportation operations. This dollar amount indicates an intent to support a mass deportation program, which targets our neighbors who have had the courage and tenacity to move to this country for a better life for themselves and their families. These mass deportations will also harm the economy.

The spending increases would likely be funded by cuts to Medicaid, SNAP, student loans, and energy resilience efforts. The four committees in the Senate that make decisions about these important services have been directed to each cut at least $1 billion.

While not included in their initial budget resolution, other related materials show Senate support for extending the expiring Tax Cuts and Jobs Act provisions.

Where federal cuts are made, states, local, territorial, and tribal governments are expected to pick up the slack. For example, cuts to services like Medicaid and SNAP from the federal level would force states to cover the balance or reduce services to compensate. Given the tough fiscal conditions states are already facing, the funding required for services everyday folks rely on for health care coverage and food assistance will not all be covered.

Minnesota would be better served by a budget resolution that puts everyday people first by protecting and strengthening essential public services that our families and neighbors count on to get by, and ensuring the country has the revenues needed to fund services that contribute to thriving communities in every corner of our state.