Federal policymakers are in the midst of an essential and high stakes debate about the future of our country. More than a year and a half after the pandemic began, we have seen the dramatic hardship that people and families face when we don’t have robust systems in place so they can get by when illness or job loss strikes. We’ve also seen how bold, smart policy actions can ensure everyday people and their families have food on the table and a roof over their heads. At the same time, from big city streets to rural Main Streets, from statehouses to the nation’s capital, more Americans are reckoning with our nation’s deep racial disparities and calling for justice.

The key question: will policymakers take bold action to build a stronger, more equitable future, or will we go back to an unacceptable status quo characterized by concentrations of income, wealth, and power, that wastes the potential of so many of our neighbors and harms us all?

Specifically, policymakers are working on the details of what’s often called the Build Back Better plan. Based on a framework from President Joe Biden and a budget outline passed by Congress, policymakers are crafting legislation that would invest in reducing child poverty, expand access to health care, address climate change, and promote economic security for everyday Americans.

The tax and revenue components of the recovery legislation should:

- Use the power of the tax code to promote greater economic security and reduce poverty;

- Raise revenues to fund crucial investments in a more equitable economy, robust communities, and confronting the climate crisis;

- Make the tax code more fair by taxing income from wealth more like work, and end ineffective and inequitable elements of the corporate tax code.

Let’s take a look at some of the key tax decisions before policymakers.

Permanently expand the Child Tax Credit to promote family economic security and reduce child poverty

The federal Child Tax Credit is a powerful tool to ensure families can afford the costs of raising healthy and thriving children.

Policy improvements put in place on a temporary basis through the American Rescue Plan are expected to result in a 40 percent drop in child poverty – that’s more than 4 million fewer children living in poverty in a typical year. That’s a historic outcome that reduces hardship today and promotes better futures for kids all across the country. This is achieved through a combination of changes: providing larger tax credit amounts, making older children eligible, and, most importantly, making the full value of the credit available to lower-income families (through what’s called “full refundability”).

Because of those changes, more families have been able to afford the basics of food, shelter, and security after receiving a portion of their Child Tax Credit as monthly payments starting in July. For example, the number of folks caring for children who reported their household did not have enough to eat has significantly dropped.

The expanded Child Tax Credit can also reduce racial and ethnic gaps in child poverty, which are unacceptably large because of the range of past policy choices and current barriers that reduce opportunity for communities of color.

Policymakers should build on this success by making these high-impact strategies permanent. The full refundability component is the largest contributor to the expanded CTC’s poverty reduction impact, and is especially important for Black and Brown families, and families living in rural areas. They should also ensure the credit reaches all children by reversing a decision in the 2017 tax law; that provision excluded some families because they use ITINs instead of Social Security Numbers when they file their income taxes because of their immigration status. Ensuring the tax credit is available in all U.S. territories is another important step to make sure all children are included.

In Minnesota, 322,000 children previously left out of the full Child Tax Credit would benefit from a permanent expansion, including 74,000 Black children, 57,000 Latinx children, and 23,000 Asian children.

Support workers earning lower wages through permanent improvements to the Earned Income Tax Credit

The federal Earned Income Tax Credit (EITC) fights poverty and boosts incomes for families. But it has had a weaker track record for workers earning lower wages but are not raising children in their home. This is the only group of poor Americans who became poorer through the federal tax code before the American Rescue Plan took effect. Their EITC credit amounts have been far too low, and younger and older low-paid workers have been shut out. The American Rescue Plan enacted long-overdue but temporary improvements to increase the size of the credit, reach more lower-income workers, and end arbitrary age restrictions (following the lead of states like Minnesota that have been expanding their tax credits for these workers to make them more effective and inclusive).

These policies should be made permanent. Some 276,300 workers in Minnesota would benefit each year from a permanent EITC expansion, including 23,100 Black workers, 17,900 Latinx workers, and 11,700 Asian workers. As with the Child Tax Credit, EITC expansion can contribute to reducing our nation’s racial income gaps, a product of obstacles to economic opportunity that mean that today, people of color are over-represented in low-paid work. The pandemic reminded us all how important these essential workers are to keeping our economy going; it’s time to make sure their hard work translates into decent living standards.

Build Back Better tax plan reduces taxes on most income groups, raises taxes on the wealthiest

These tax reforms that promote economic security and prioritize getting all children off to a strong start in life, and the Build Back Better plan’s essential investments in child care, health care, housing, nutrition, addressing climate change, and more, would be funded by raising revenues from those with the most resources. Revenues would be raised from high-income and wealthy households, from profitable corporations, and better enforcement of the nation’s tax laws (again with an emphasis on high-income filers and profitable corporations.) The U.S. House Ways and Means’ tax proposal would also raise taxes on tobacco and nicotine.

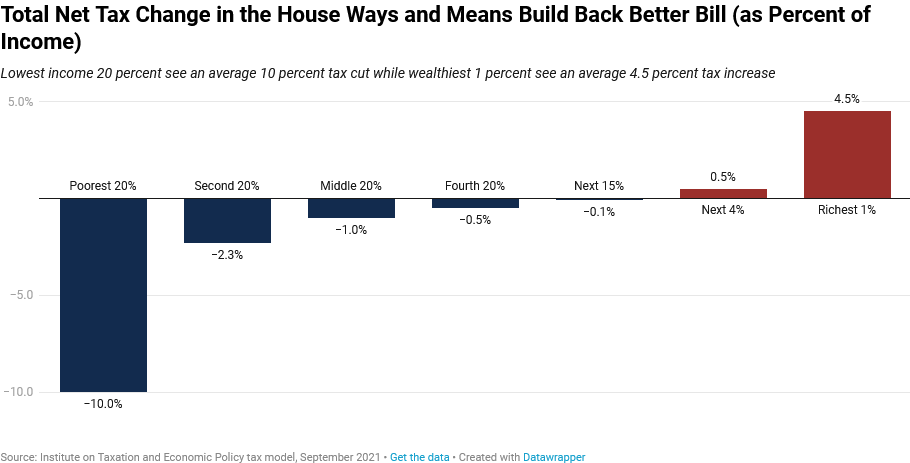

The Institute on Taxation and Economic Policy finds that overall, the House Ways and Means revenue package “would make our tax system more progressive, raising taxes overall on the richest 5 percent of Americans and foreign investors, while cutting taxes overall for other income groups, although the effects on specific taxpayers depend on their individual circumstances.”

Income from wealth should be taxed more like income from work

Recent reporting from ProPublica demonstrates the shocking results of tax policy that gives special treatment to income from investments and ownership that is not available to everyday folks who earn their incomes from wages and salaries.

Tax experts at the Center on Budget and Policy Priorities (CBPP) report that the House Ways and Means Committee’s tax legislation would raise the top tax rates on “realized capital gains, dividends, pass-through business income, and carried interest, all of which are heavily concentrated among wealthy people and are taxed at rates far below the rate on wages and salaries.” As a result, income from wealth would be taxed more like income from work, and these policies would reduce the distorting economic effects when wealthy people make investment decisions in order to achieve tax savings.

CBPP notes that the Ways and Means bill would have an even stronger effect on tax fairness if it addressed “stepped-up basis”. This is a current policy that means when investors pass assets onto their heirs, there is no income tax paid on the capital gains on that asset that grew during the investor’s lifetime. In other words, this growth in wealth is shielded from the income tax. The President has proposed ending this special treatment while providing protections for family farms, small businesses, and homes.

In addition, the House Ways and Means proposal includes other revenue-raising provisions focused on the highest-income individuals, such as restoring the top income tax rate on regular income to 39.6 percent (up from 37 percent), putting the rate back to where it was before the 2017 tax law; and creating a new 3 percent surcharge on adjusted gross income above $5 million.

Reverse ineffective corporate tax breaks

The 2017 tax bill cut corporate taxes substantially, reducing the corporate tax rate from 35 percent to 21 percent. Proponents of this “Tax Cuts and Jobs Act” said it would spur economic growth that would benefit shareholders and workers alike. But that stronger economic growth did not materialize, and the benefits primarily went to wealthy shareholders.

The House Ways and Means proposal would partially restore the corporate tax rate to 26.5 percent, Biden has proposed setting it at 28 percent. It also includes provisions to reduce tax incentives to shift profits and operations overseas to low-tax “tax havens”.

To understand how increases in corporate taxes ultimately impact people, the Institute on Taxation and Economic Policy notes that, “most analysts believe that the bulk of the corporate tax is borne by the owners of corporate stocks and other business assets, which are mostly (but not entirely) owned by well-off individuals. The Joint Committee on Taxation (JCT) assumes that working people eventually bear a quarter of the impact of a corporate tax hike (in the form of a wage reduction), but also assumes that it takes several years for this to happen.” The takeaways? The impact of a corporate tax increase falls on owners of stocks and business assets in the short term. To the extent that some of the increase eventually may impact working class people, it is potentially offset by increases in the EITC and Child Tax Credit, as well as the improvements in living standards coming from federal investments in affordable child care, health care, housing, and other investments in the Build Back Better plan.

Invest in IRS enforcement to close the tax gap

In addition to changing our tax laws to make them more equitable, our country needs the tools to enforce the laws that are on the books. It’s estimated that about $600 billion of taxes go uncollected each year, of which $160 billion is attributed to the top 1 percent of filers.

To close this “tax gap”, policymakers should reverse a long trend of cutting funding to the IRS, and allow it to have the qualified staff needed for oversight of the complex returns of large corporations and the highest-income taxfilers. Biden also calls for information reporting requirements on financial institutions to tackle the problem of underreporting of income and improve compliance with our tax laws.

A brighter, more equitable future – or back to the unacceptable status quo?

The decisions before policymakers could not be clearer. The pandemic has starkly demonstrated the hardships in store for everyday folks when there aren’t robust systems in place to ensure that everyone can stay healthy and make ends meet when the unexpected strikes. More voices are echoing what many in our communities have long known: past policy choices and current obstacles to opportunity mean that our Black and Brown neighbors especially bear the brunt of hard times, and that cannot continue.

A better, more equitable future is possible. The expanded Child Tax Credit is bringing about a historic drop in child poverty – we must maintain that, not go back to where we were. Our tax policy can’t continue to prop up growing income inequality and concentration of wealth, but instead should be made more equitable and fund investments in child care, housing, health care, and more, that build a country where all can thrive.

To contact your elected officials to demonstrate your support for transformational tax and budget policy changes to build a more equitable future, visit our action center.