The state of Minnesota’s revenue picture continues to improve, and the national economic recovery is expected to be a little stronger in the near term, according to the January Revenue and Economic Update from Minnesota Management and Budget.

The new Update suggests a slightly improved picture compared to the recent November forecast, and affirms the state’s historic opportunity to build a more equitable recovery in which all Minnesotans are healthy, safe, and economically secure.

Some of the top takeaways from the Update include:

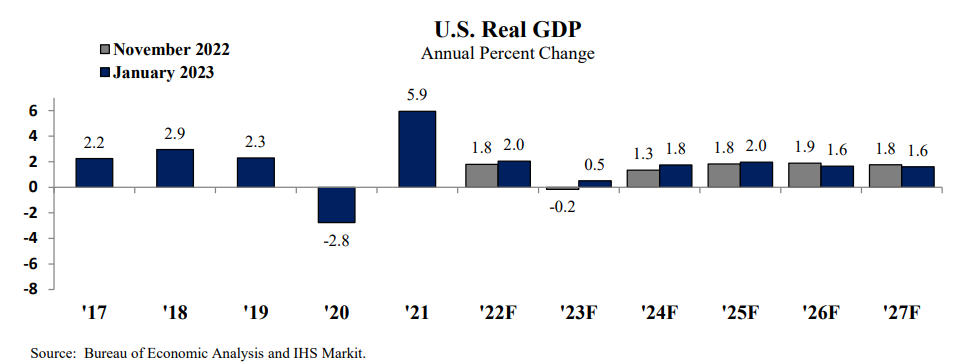

1. The national economy is expected to grow in 2023, and looks stronger than in the November Forecast. Forecasters now predict 0.5 percent GDP growth in 2023, whereas in November they expected the economy to contract with –0.2 percent GDP growth. Economic growth in 2024 and 2025 is also expected to be higher than earlier predicted, due to stronger national trade and business investments. Forecasters still expect a mild recession, but now expect it to start early this year (rather than the late 2022 start date they earlier predicted).

2. Recent state revenues came in higher compared to the November forecast. Revenues for November and December 2022 came in $217 million, or 4.4 percent higher than the forecast’s projections. Corporate tax revenues were 52 percent higher than expected in the forecast and are the largest source of this increase.

3. The official unemployment rate remains low for now. In December, the national unemployment rate was 3.5 percent, which was roughly at pre-pandemic levels. However, with a recession predicted, forecasters assume unemployment will rise to 5.1 percent late this year.

What does this suggest for Minnesota’s tax and budget decisions ahead?

These latest numbers suggest that when the new February Forecast is released later this month, we will continue to see historic levels of general fund surpluses. The February Forecast will be used as the baseline for the decisions made this year to build the FY 2024-25 biennium budget.

Projected budget surpluses are not a measure of whether the state is successfully addressing the challenges Minnesotans face or investing in the future they want. The forecast and economic updates simply compare projected revenues to the expected spending under prior budget decisions.

Our state has the resources to build a stronger, more equitable future for all of us through transformational investments in affordable health care, child care, paid family and medical leave, housing, a quality education from the earliest years through college and training, clean air and water, and other building blocks of a high-quality standard of living.

The ability to make and sustain those crucial investments will be squandered, however, if policymakers enact large tax cuts for those who are already doing very well – such as by replacing our state’s existing targeted Social Security income tax exemption that prioritizes modest-income seniors with an unlimited exemption that would give the biggest tax cuts to high-income seniors. A better approach is to enact high-impact tax policies focusing on everyday Minnesotans, such as by creating a state Child Tax Credit (CTC) that builds on the federal CTC’s historic success in reducing child poverty.